Pocket Option vs Quotex Demo Account Comparison: Which Is Better for Practice?

I didn’t lose my first live account because of a bad strategy. I lost it because my demo account taught me the wrong habits.

At the time, I didn’t understand that. I thought demo trading was just practice, something informal before the “real game” started. I treated virtual money casually, reset balances without hesitation, and judged my readiness based on how confident I felt, not how disciplined I behaved.

That mistake forced me to slow down and reassess everything, including the platforms I practiced on. This is what led me to a serious Pocket Option vs Quotex demo account comparison, approached not as a review, but as a trading journal.

If you want to replicate the same testing environment I used, you can open a demo account using my affiliate link here. I strongly recommend opening both platforms at the same time and running them in parallel.

Why Demo Accounts Shape Traders More Than Strategies

Most traders think demo accounts exist to test strategies. That’s only partially true.

In reality, demo accounts shape behavior first and strategy second.

They influence:

- How often you trade

- How quickly you enter positions

- Whether you respect risk rules

- How you emotionally process losses

Those behaviors don’t magically change when you switch to live trading. They transfer almost intact.

That’s why this Pocket Option vs Quotex demo account comparison focused less on features and more on how each platform quietly trained me to think, react, and decide.

My Rules for a Fair Demo Comparison

I knew that if I treated this casually, the results would be meaningless. So I set strict rules.

- Same assets on both platforms

- Same trading sessions

- Same strategies and indicators

- Same risk logic per trade

- No demo balance resets

That last rule was non-negotiable.

Resetting a demo balance erases accountability. It creates the illusion that mistakes don’t matter. I explain this in detail in my article on why resetting your demo balance hurts real trading discipline, and I lived that lesson here.

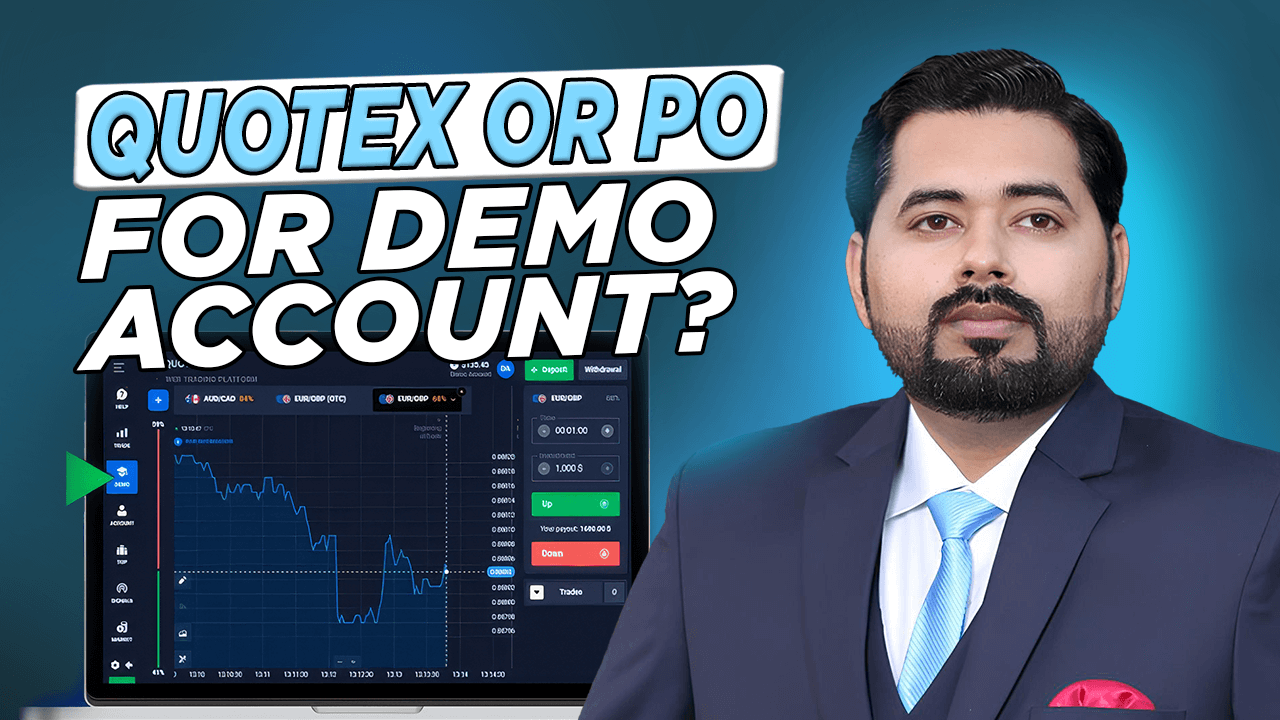

First Login Experience: Comfort vs Awareness

Pocket Option’s demo account feels welcoming. The balance is generous. The interface is colorful and responsive. From the first trade, everything feels smooth.

Quotex feels quieter. The interface is cleaner, almost restrained. The demo balance feels more realistic, less forgiving.

This difference affected me immediately.

On Pocket Option, I felt relaxed. Too relaxed.

On Quotex, I felt alert. More cautious.

Neither reaction was accidental. Demo environments shape emotional posture from the first click.

The Illusion of Safety in Demo Trading

One of the biggest traps I noticed, especially on Pocket Option, was the illusion of safety.

Losses didn’t sting. Wins felt inevitable. I caught myself entering trades simply because setups looked “interesting,” not because they met my rules.

On Quotex, losses registered more clearly. Even though the money was virtual, the environment didn’t encourage careless behavior.

This reinforced something I later explored in common demo account mistakes traders make, where emotional detachment becomes a hidden enemy.

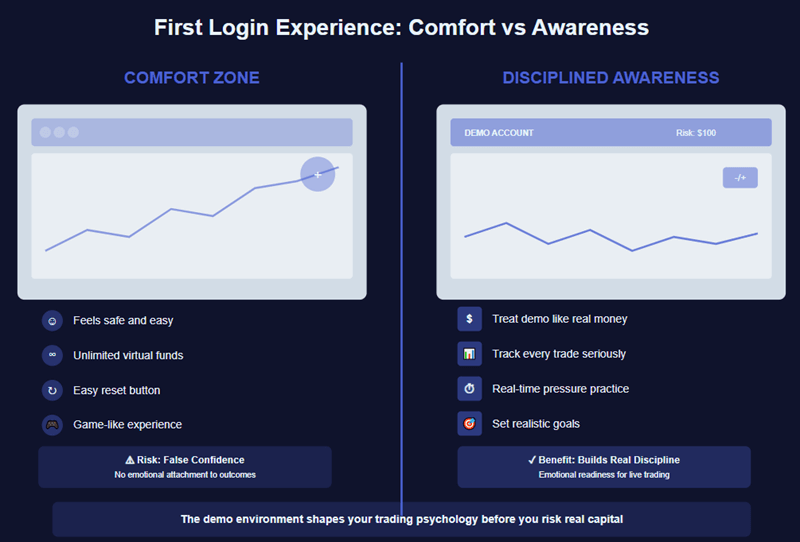

Execution Speed: Why Demo Realism Matters

Many traders ignore execution quality in demo trading. That’s a mistake.

Pocket Option’s demo execution felt extremely fast. Entries snapped into place. Outcomes felt clean and decisive.

Quotex’s demo execution felt closer to live conditions. Slight delays. Candles behaved less predictably.

At first, Pocket Option felt better. Over time, Quotex felt more honest.

When I transitioned to live trading later, that honesty mattered more than comfort.

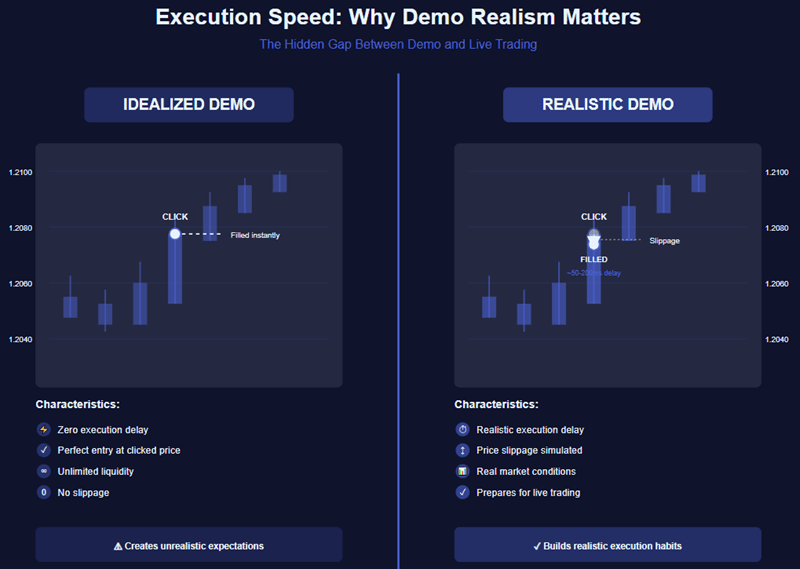

Week One: Trade Frequency Shock

I kept a detailed journal during the first week.

By day three, the difference was impossible to ignore.

On Pocket Option, my trade count was nearly double.

On Quotex, my sessions were shorter and quieter.

Nothing in my strategy changed. Only the environment did.

This aligns perfectly with what I explain in how many trades you should take in a day, where overtrading often starts in demo accounts, not live ones.

Indicators in Demo Mode: Exploration vs Refinement

Both platforms offer strong indicator access in demo mode, but they encourage very different behaviors.

Pocket Option made it easy to experiment. Adding, removing, and stacking indicators felt frictionless. I tested ideas freely.

Quotex made me selective. Fewer tools meant clearer charts. I spent more time watching the price and less time adjusting settings.

Over time, I realized:

- Pocket Option helped me discover ideas

- Quotex helped me refine them

If you’re still learning how demo accounts should be used properly, my guide on the best way to use binary options demo accounts fits naturally here.

Demo Balance Psychology

Pocket Option allows easy demo balance resets. That convenience slowly became dangerous.

Every time I reset, I erased responsibility.

Quotex also allows resets, but the platform doesn’t encourage it. I found myself resetting far less often.

Once I stopped resetting balances on both platforms, everything changed.

Losses felt heavier.

Wins felt earned.

Rules mattered again.

That single adjustment improved my live performance more than any technical change I’ve ever made.

If you want to experience these differences firsthand, open a demo account using my affiliate link here. Run the same strategy on both platforms for at least two weeks without resetting balances. The lesson will be unavoidable.

Transitioning From Demo to Live Trading

This is where demo accounts reveal their true value.

When I moved from Pocket Option demo to live, the interface felt identical. That familiarity reduced friction, but it also encouraged overconfidence.

When I moved from Quotex demo to live, the emotional shift was smaller. My habits transferred more cleanly.

This transition mirrors what I describe in demo vs live binary options trading, especially around emotional carryover and expectation gaps.

Discipline Transfer: What Actually Carried Over

From Pocket Option demo:

- Confidence

- Speed

- Tool familiarity

From Quotex demo:

- Patience

- Risk awareness

- Session discipline

Neither was perfect alone. Together, they showed me what demo accounts are really for.

A Journal Snapshot

| Category | Pocket Option Demo | Quotex Demo |

| Emotional comfort | High | Moderate |

| Realism | Moderate | High |

| Trade frequency | Higher | Lower |

| Discipline training | Weaker | Stronger |

| Best use case | Learning & testing | Preparation & control |

This table sits in my trading notebook because it captures weeks of observation in seconds.

Which Demo Account Is Better for You

Pocket Option’s demo account is better if:

- You are new

- You need confidence

- You want to explore tools and ideas

Quotex’s demo account is better if:

- You know the basics

- You want realistic conditions

- You are preparing for live trading

Understanding this distinction stopped me from asking which platform was “better” and helped me choose intentionally.

The Real Purpose of Demo Trading

Demo trading isn’t about winning.

It’s about exposing weaknesses safely.

That’s why I later built a structured 30-day progression plan to bridge demo and live trading. Without structure, demo accounts create illusions instead of skills.

Final Verdict: Pocket Option vs Quotex Demo Account Comparison

After weeks of side-by-side testing, here’s the honest conclusion.

Pocket Option’s demo account builds confidence and familiarity.

Quotex’s demo account builds discipline and realism.

Neither one guarantees success.

Both can quietly sabotage you if misused.

Demo accounts don’t teach trading.

They teach behavior.

If you want your demo trading to actually prepare you for live markets, open a demo account using my affiliate link here. Treat virtual money like it’s real, because your habits don’t know the difference.