30-Day Progression Plan: From Demo to First Live Account

When I first opened a demo account, it felt exciting. I could take huge positions, double down when I was wrong, and even reset my balance after blowing up. It was entertaining but it didn’t prepare me for live trading. I realized I was learning nothing about discipline, risk, or patience.

This is the 30-day progression plan I followed to move from a messy demo account to placing my first live trades with real money. I’ve written it in a journal style, day by day, with the trades I took, the lessons I learned, and the shifts that made the difference.

If you’re already considering starting your own trading journey, you can begin today with a small live account through our trusted partner broker.

Why I Needed a 30-Day Plan

The biggest trap in demo trading is comfort. You can lose thousands of “virtual dollars” without any emotional sting. You can wipe out your balance and hit the reset button as if nothing happened. This cycle destroys discipline.

I needed to create a window where I could stop treating the demo like a game and start simulating the emotional weight of real trading. Thirty days gave me just enough time to build habits without losing focus.

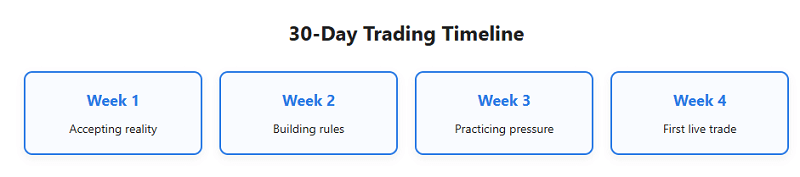

Week 1: Accepting Reality and Starting a Journal

Day 1–2: Facing the Mess

When I logged in, my demo balance was already down by 20%. In the past, I would have reset. This time, I refused. Watching a damaged account forced me to confront the fact that my decisions mattered.

Day 3–4: Building a Trade Journal

I created a simple spreadsheet with the following columns:

| Date | Asset | Direction | Entry | Exit | Size | P/L | Notes |

| Jan 3 | EUR/USD | Long | 1.0820 | 1.0860 | 0.1 lot | +$40 | Breakout trade, London open |

| Jan 4 | Gold | Short | 1898 | 1901 | 0.1 lot | -$30 | Chased move, bad entry |

Writing “bad entry” in the notes stung. But that sting was the point. It made me pause before placing the next trade.

Day 5–7: Learning from Early Pain

That first week, I lost more than I won. The old me would have reset and pretended it never happened. Instead, I stared at my equity curve dipping lower. By the weekend, I understood something powerful: the pain was teaching me discipline.

Lesson from Week 1: Stop hiding behind resets. Track trades, learn from mistakes, and accept the balance as it is.

Week 2: Building Rules and Focusing on One Strategy

Defining My Risk Boundaries

On Day 8, I gave myself a strict rule: never risk more than 1% on a single trade. That meant smaller lot sizes and tighter calculations. Overnight, my trading looked less chaotic.

Day 9–10: Sticking to One Setup

I picked a single strategy to test—London session breakouts on EUR/USD. For two days, I waited for that one signal instead of chasing everything.

Day 11–14: Results Start to Show

Across four days, I had:

- 2 wins (+2.5% total)

- 1 loss (-1%)

- 1 breakeven

It wasn’t spectacular, but it was structured. For the first time, I was trading like I had a system.

Lesson from Week 2: Rules give structure, and structure removes guesswork. The journal started to show patterns that I could refine.

If you’re following along, this is the perfect time to test under real conditions. Open a micro live account here and start small.

Week 3: Practicing With Realistic Pressure

Day 15–16: Identifying Bad Habits

I noticed most of my losses came late in the New York session. By recognizing this, I cut those hours from my trading plan. That single change stopped a string of impulsive trades.

Day 17–18: Trusting My Stop-Loss

I had always dragged stops wider when I felt uncomfortable. Now, I forced myself to leave them untouched. The first time a stop got hit, I felt frustrated. The second time, I accepted it as part of the process. By the third, I felt lighter—it was proof of discipline.

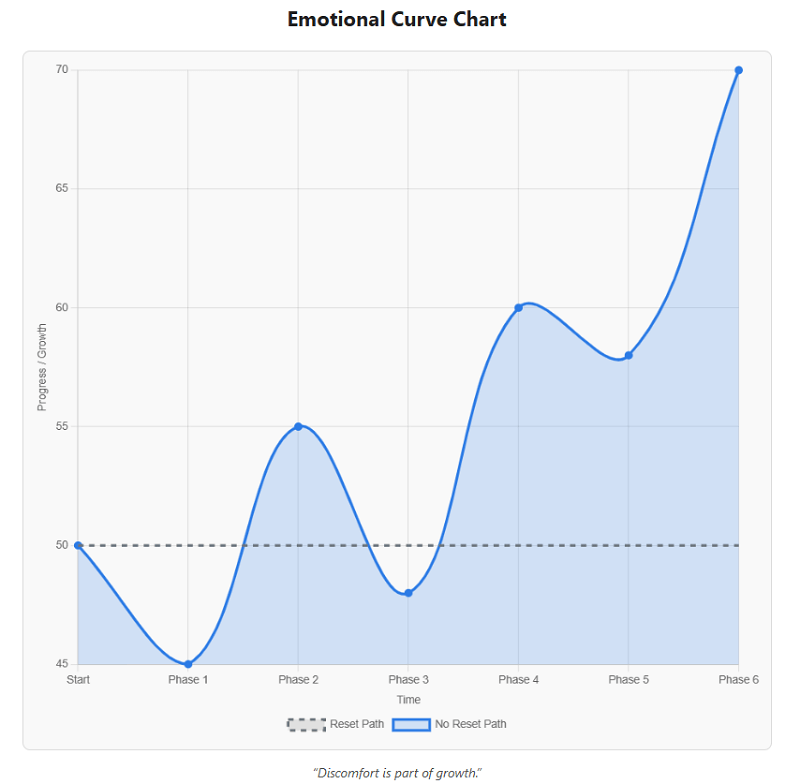

Day 19–21: The “No Reset” Breakthrough

Three full weeks had passed and I still hadn’t reset my demo account. My balance wasn’t high, but my equity curve showed a story: steep drawdowns at first, then gradual stability. That chart meant more to me than any profit number.

Lesson from Week 3: Treat demo like live. If you wouldn’t reset a live account, don’t reset your demo. The discipline carries over.

Week 4: Moving Into Live Trading

Day 22: Funding a Small Account

I deposited $100 into a live account. Small enough to accept losses, but large enough to feel real. My very first trade lost $2.80, and it hit me harder than any demo loss ever had. That emotion was the real difference.

Day 23–24: Parallel Journaling

I traded both demo and live at the same time. In the demo, I felt freer and sometimes sloppy. On live, I tightened my discipline. The trades weren’t better because of the setup—they were better because money was real.

Day 25–27: Adjusting Strategy Under Pressure

I realized I was cutting winners too early in live trades. Fear of losing profit made me exit before my target. I started forcing myself to let winners breathe. When I watched one trade hit my full take-profit instead of bailing early, it felt like growth.

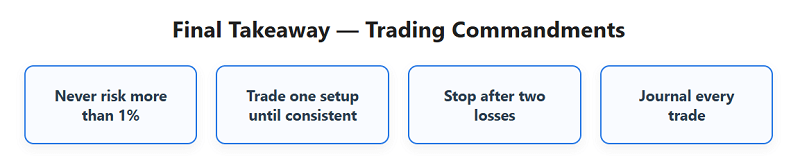

Day 28–30: Writing My Commandments

Before finishing the 30 days, I wrote down my rules:

- Never risk more than 1% on a trade

- Trade only one proven setup until consistent

- No trading after two consecutive losses in a day

- Journal every trade without exception

Those rules became my bridge from demo practice to live trading discipline.

Lesson from Week 4: The transition isn’t about profit. It’s about proving that you can respect your own rules when money is real.

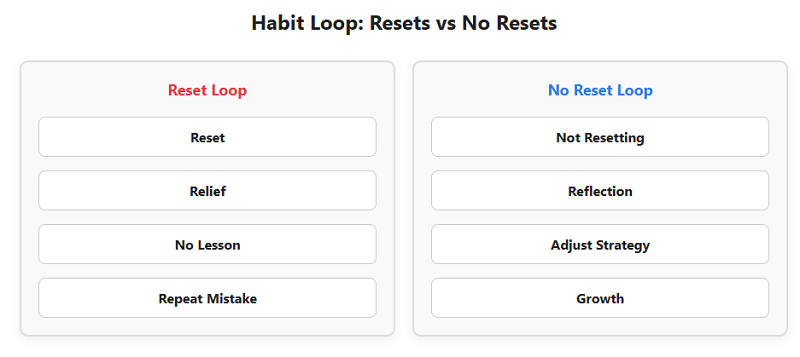

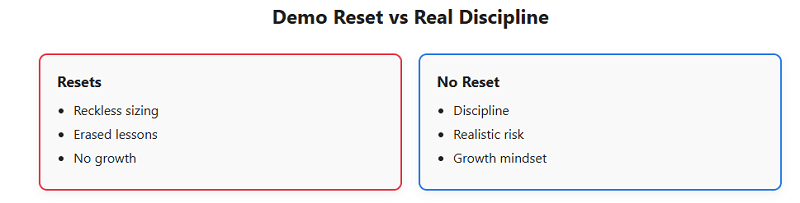

Demo Resets vs Real Discipline

I compared the two paths I had lived:

The contrast was clear. Resets felt comfortable but taught me nothing. Sticking with losses and learning from them built real habits.

My Biggest Takeaways From 30 Days

- The first step is painful: watching your balance drop without resetting.

- Journaling every trade is the single most valuable habit.

- One strategy, tested consistently, teaches you more than chasing many.

- Live trading changes everything. Even a $3 loss feels real.

- Discipline matters more than strategy.

Why This Journey Changed My Trading

This 30-day plan didn’t turn me into a professional trader, but it gave me a foundation. I no longer saw the demo as a game. I understood the difference between reckless resets and real discipline. And when I opened my first live account, I wasn’t shocked by the emotions—I was ready for them.

If you’re ready to take the same step, don’t wait for the “perfect” moment. Start your own 30-day progression today with our partner broker.