Common Demo Account Mistakes That Cost You Later on Live

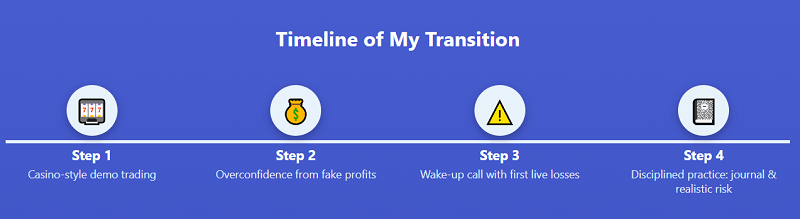

I still remember the first time I opened a demo account. The charts moved exactly like the real market, the buttons clicked just the same, and after my first few trades in profit, I started believing I had cracked trading. But the truth was, I wasn’t really trading at all. I was practicing without consequence, and that lack of consequence came back to haunt me when I eventually went live.

If you are in your demo phase right now, understand this: the mistakes you overlook in practice don’t disappear later. They resurface when real money is at stake, and that’s when they become expensive. I learned that lesson through trial, error, and a painful first live account. You must treat your demo account as real from the start to avoid my mistakes. Open your account here and give yourself the discipline edge early. Remember, it’s not about the safety of the demo, but the sense of control and discipline it can instill in your trading.

The Comfort Trap of Unrealistic Sizing

In the beginning, I didn’t think about position size. Why would I? On demo, I could open a massive trade, and if it went against me, nothing happened. I could reset the account with a few clicks and start again. That habit built a false sense of confidence because there was always an escape button in the back of my mind.

When I finally switched to a live account, I took the same casual sizing approach. Suddenly, a move of just 20 or 30 pips wasn’t a number on a screen—it was a noticeable dent in my balance. The stress of watching half a paycheck evaporate in minutes made me realize how unrealistic my demo sizing had been.

The lesson was simple but critical: always practice with the size you’ll realistically trade live. If your future live account will be $5,000, don’t demo with $100,000. The behavior you build with larger virtual numbers doesn’t translate well when every dollar becomes real. This caution and mindfulness in your trading decisions can significantly impact your trading journey.

Ignoring Stop Losses Because “It’s Just Demo”

Another mistake was ignoring stop losses. On demo, why bother closing early? Trades usually “come back,” and if they didn’t, no harm done. That thinking made me feel patient, even disciplined.

But when I went live, that habit backfired instantly. I remember holding a EUR/USD trade that went 60 pips against me. Instead of cutting it, I kept waiting, telling myself the same story: “It will recover.” It didn’t. A week’s worth of careful small wins was gone in a single position.

After that, I rewired my process. Today, a trade isn’t valid until I know exactly where my stop goes. The stop loss isn’t just protection—it’s part of the entry itself.

Treating Demo Like a Casino

Some of my demo sessions looked more like roulette nights than trading practice. I would chase sudden spikes, jump into random pairs, and celebrate when I guessed correctly. It felt exciting, and because no money was on the line, I convinced myself I was “learning.”

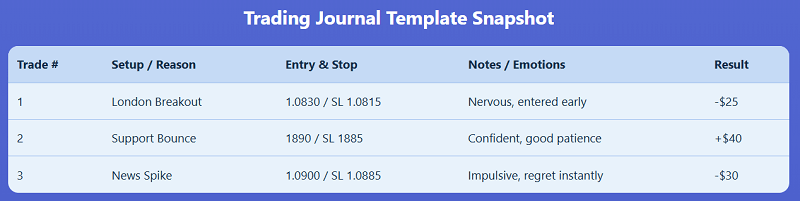

The problem is that this behavior taught me to mistake luck for skill. I realized how fragile it was when I started keeping a trading journal. After reviewing 30 demo trades, I saw no strategy, no repeatable setup—just random bets. That realization stung, but it saved me before I threw away more live capital.

Once I started journaling, I began to see patterns in my behavior. The trades I labeled as “guesses” had no consistency. The ones I placed with a defined entry and stop actually had logic behind them. That awareness shifted how I practiced.

The Hidden Danger of Overconfidence

Demo wins gave me a dangerous kind of confidence. Seeing thousands of dollars of profit in a virtual account felt like proof that I was ready. I even told a friend, “This is easy, I’ll be profitable immediately.”

But live trading humbled me fast. In my first month, I gave back nearly everything I had made on demo—because the confidence wasn’t built on discipline. It was built on conditions where failure didn’t cost anything. What I should have been measuring wasn’t the size of my demo profits, but the quality of my decisions.

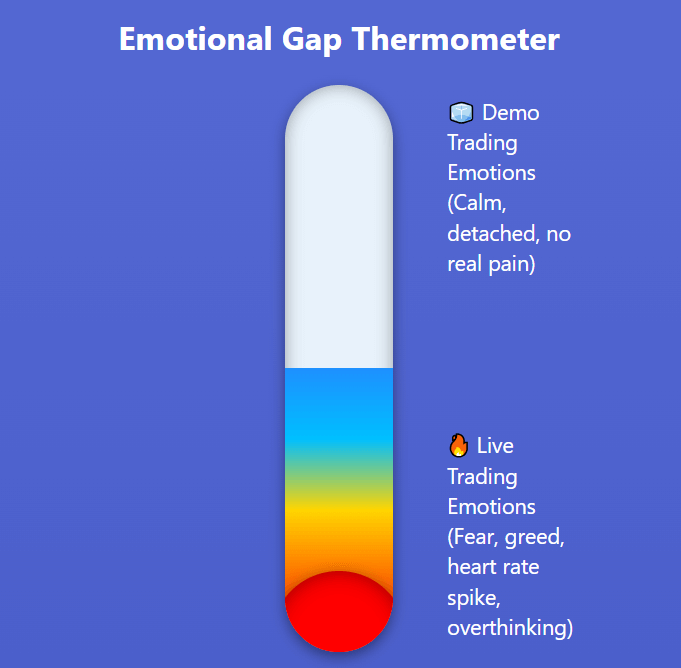

Emotional Detachment vs. Emotional Reality

One of the most deceptive parts of the demo is how emotionless it feels. Losses don’t sting, wins don’t thrill you much, and it’s easy to believe you’re disciplined. I thought I had mastered my psychology because demo losses didn’t bother me.

Then I went live. Suddenly, a $50 drawdown made my heart race. Every tick mattered, every candle felt personal. The emotional gap between demo and live was massive, hitting me harder than expected.

The mistake wasn’t practicing on a demo but failing to simulate the emotional weight of real trades. To fix that, I started treating demo trades as if money was truly on the line: I tracked them in detail, reviewed them, and gave myself consequences for breaking rules.

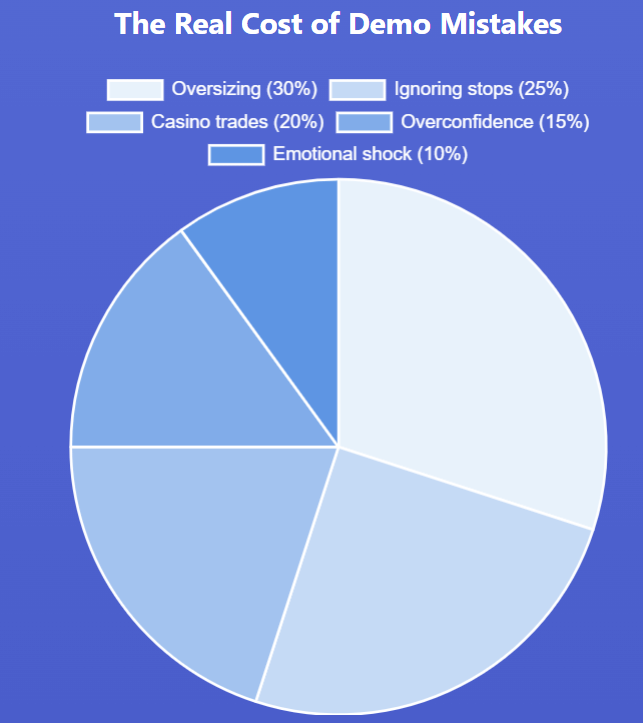

The Core Demo Account Mistakes in Perspective

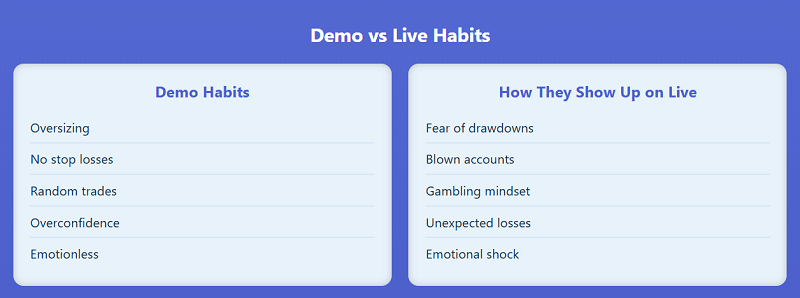

When I look back, the biggest issues can be summed up like this:

- Oversizing trades created panic when real drawdowns happened.

- Skipping stop losses taught me to hope instead of act.

- Random entries turned trading into gambling.

- Overconfidence from fake profits blinded me to risk.

- Emotional detachment left me unprepared for real pressure.

Each might seem harmless in practice, but they form habits that can wreck your first live account.

My Midway Wake-Up Call

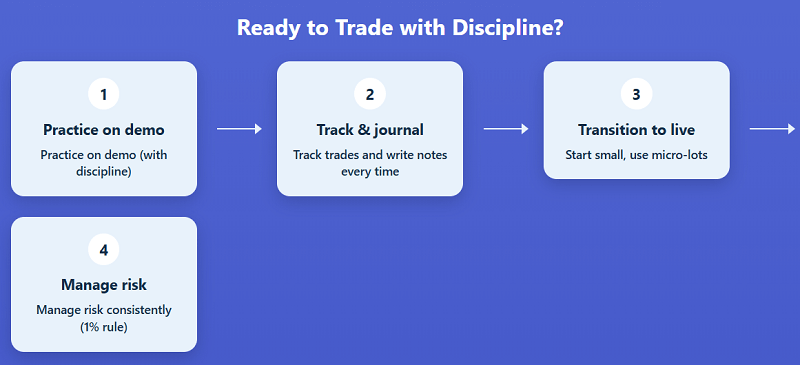

Halfway through my journey, I realized the demo wasn’t preparing me—it was sabotaging me. That’s when I changed my approach. I gave myself rules that mirrored live conditions:

- A fixed balance equal to my intended live account.

- A 2% risk cap on every trade.

- A journal that measured discipline, not profit.

That structure changed the way I treated practice. When I went live again, losses still hurt, but they didn’t shock me. I was prepared because I had trained realistically. If you’re in the demo right now, don’t wait for losses to teach you the lesson. Start with a real account now and practice discipline early. Remember, it’s not about the profit, but the discipline in your trading that can make the difference.

Journaling: The Habit That Made the Difference

The single practice that bridged the gap between demo and live for me was journaling. My notes weren’t polished, but they were honest: why I entered, where I stopped, how I felt, and what I did after.

Looking back, I could see precisely where my habits were reckless. That reflection shortened my learning curve because I could correct myself before money was at risk. Without the journal, I would still be repeating old mistakes on autopilot.

Why Many Traders Stay Stuck in Demo

I’ve met plenty of traders who spend years in demo, convinced they are “practicing.” They’re avoiding the real test: handling emotions when money is at risk. Demo is excellent for learning mechanics—how to use the platform and place orders—but it doesn’t prepare you for the psychological side.

The solution isn’t to skip the demo. The solution is to respect it. Use it as a training ground for discipline, not entertainment. If you use it right, the leap to live will be smoother, and your habits will already be in place.

Final Reflection: How Demo Cost Me More Than I Realized

I don’t blame the market when I calculate the money I lost in my first live account. I blame myself for wasting my demo time by treating it like a game. The habits I built there made the live experience harder than it had to be.

If I could give you one piece of advice: Don’t waste your demo. Trade it like it’s live, or don’t trade it at all. The shortcuts you take now will cost you later, and the sooner you respect that, the sooner you’ll give yourself a real chance at consistency.

I’m sharing this so you don’t repeat my path. If you’re ready to avoid these common demo account mistakes and build discipline from day one, open your live account here and take the step with intention.