Why Resetting Your Demo Balance Can Hurt Real Discipline

When I first started trading binary options, the reset button on my demo account felt like a gift. I could blow up my balance in the morning and be back at ten thousand dollars by the afternoon. No consequences, no scars.

At the time, I thought it was just practice. But later, when I went live, I realized something harsh: resetting my demo balance had trained me to ignore loss. It taught me the exact opposite of what real trading demands discipline.

👉 If you’re looking for a broker that offers both demo and live accounts to practice responsibly, check out this platform here.

The Hidden Illusion Behind the Reset Button

The first time I blew up my demo balance, I felt nothing. I clicked reset, watched the screen refresh, and there it was: a fresh ten thousand. That moment shaped my psychology. Instead of analyzing why I had lost, I skipped to the comfort of a clean slate. Over time, I realized that this habit built a dangerous mindset: mistakes could simply be erased.

In live trading, nothing erases your mistakes. A hundred-dollar loss is gone forever. Treating a demo like a video game only made the transition harder.

The Turning Point When I Stopped Resetting

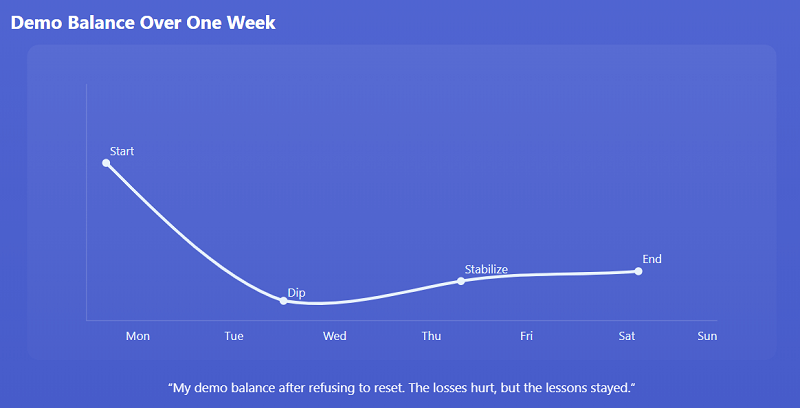

One particular week, I blew up my demo balance three times. Each time, I hit reset. By Friday, it hit me. If that had been real money, I would have lost a thousand dollars. Instead of laughing it off, I decided to test myself: no more resets.

I lowered my demo balance to $500 to match what I could realistically deposit live. If I lost it, I had to sit with the loss. No magic button. That one small change completely transformed the way I treated every trade.

Suddenly, the numbers on the screen mattered.

How Real Losses Started Teaching Me Valuable Lessons

Here’s a snapshot of what my trading looked like when I stopped resetting:

| Date | Asset | Direction | Expiry | Stake | Entry | Exit | Result | Balance After | Notes |

| 10/05/2025 | EUR/USD | Call | 1 min | $10 | 1.0650 | 1.0648 | Loss | $490 | Entered too early, ignored candle close |

| 10/05/2025 | GBP/USD | Put | 3 min | $10 | 1.2275 | 1.2266 | Win | $500 | Waited for confirmation, patient entry |

| 10/06/2025 | USD/JPY | Call | 2 min | $20 | 148.20 | 148.12 | Loss | $480 | News volatility killed the trade |

| 10/06/2025 | AUD/USD | Put | 5 min | $10 | 0.6430 | 0.6422 | Win | $490 | Better timing, slow move in favor |

| 10/07/2025 | EUR/USD | Call | 1 min | $10 | 1.0680 | 1.0686 | Win | $500 | Clean bounce, trusted my setup |

Before, I would have erased this entire streak. But forcing myself to look at these numbers, I saw patterns: rushing into trades, ignoring news, winning when I waited. Without the reset button, each mistake became a note in my diary rather than a forgotten click.

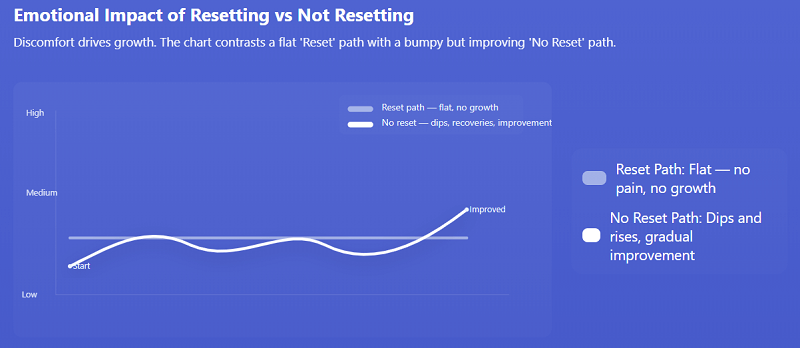

Why Emotional Discipline Matters More Than Technical Skill

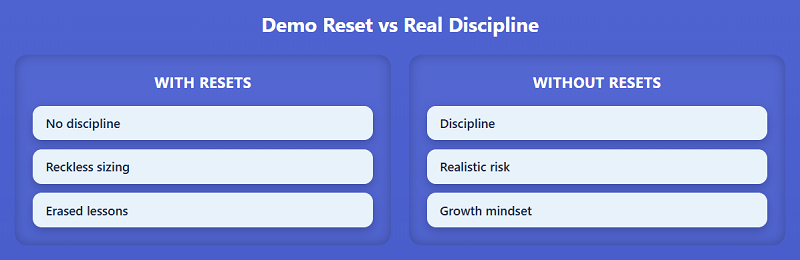

People think the demo is about testing strategies. In truth, it is just as much about testing emotions. Resetting the account numbs you to loss. And once you are numb to loss, you carry that same recklessness into live trading.

The weeks I refused to reset, I noticed my trading sessions felt heavier, almost like I had real money at stake. That tension was valuable. It forced me to double-check setups and avoid trading out of boredom.

👉 If you want to test your emotional discipline, start with a small live account alongside your demo with this broker. That was my bridge between fake and real.

How Constant Resets Quietly Build the Wrong Habits

Looking back, here is how constant resets quietly hurt me:

- They taught me that losses did not matter.

- They encouraged reckless trade sizes since I knew I could start over.

- They erased valuable data. Journals only work if you let the numbers accumulate, not restart every time you feel uncomfortable.

- They made the transition to live a shock. Suddenly, I could not press a button to fix my mistakes.

This was a content gap I noticed online. Many guides mention using demo accounts, but few talk about the psychological trap of resets. It is not just wasted time. It is training the wrong reflexes.

The Simple Rules I Created to Avoid Reset Addiction

I set personal ground rules:

- Once the demo balance was gone, I had to take a 48-hour break and review my journal.

- I could only reset after writing down the exact mistakes that led to the blow-up.

- Each reset required stricter conditions the next time, such as smaller stakes and fewer trades.

These were not glamorous rules, but they turned demos into training, not entertainment.

The Week That Tested My Resolve to Its Limit

There was one week I went on a terrible streak. I lost six trades in two days and watched my demo balance sink. Normally I would have hit reset. Instead, I let it ride. By the end of the week, I had clawed back only half the losses. My balance was still lower, but my journal was full of lessons about overtrading, fatigue, and ignoring market sessions.

That week did more for my trading discipline than any reset ever could.

The Difference I Felt When Moving Back to Live Trading

When I finally switched to live with $100, I felt different. Losses stung, but they did not paralyze me. The habit of sitting with discomfort had prepared me. The reset button was gone, but I did not miss it anymore.

Final Thoughts: Why Resetting Your Demo Balance Hurts Real Discipline

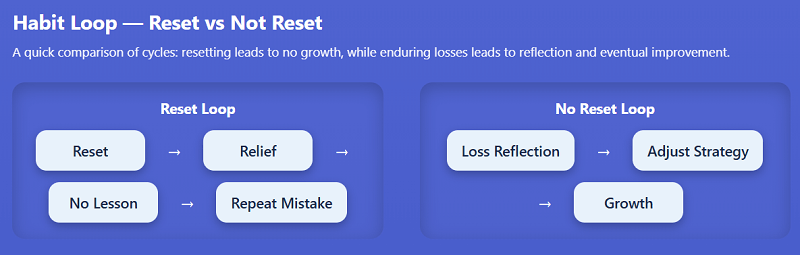

If I could sum up the lesson, it is this: the reset button is not your friend. It trains your brain to erase mistakes instead of learning from them. Real trading is about carrying those scars, adjusting your behavior, and growing discipline with each setback.

👉 Ready to start practicing without bad habits? Open your demo and live account with this broker.

Related Reads for Deeper Learning

You might also like: