Best Way to Use Binary Options Demo Accounts Without Wasting Time

When I opened my first binary options demo account, I felt like I was doing everything right. The broker gave me $10,000 in virtual funds, and I went wild with it. Within a week, I doubled the account. That gave me the illusion of being ready. So when I switched to live with $250 of my own money, I expected the same magic. Instead, I lost it all in less than a month. That’s when I realized something important. I hadn’t actually learned how to trade. I had only learned how to play with demo money.

👉 If you’re curious to practice the right way, you can open a free demo account with this trusted broker.

The Casino Stage of Demo Trading

In the beginning, I treated the demo like a game. I clicked trades without thinking, sometimes on 30-second expiries just to test my reflexes. I piled on every indicator the platform offered, even if I didn’t understand them. And since the balance was so large, I sometimes bet $500 per trade without hesitation.

Of course, I won more than I lost. My demo balance skyrocketed. But that didn’t mean I was a trader. What I had really learned was that with fake money and an unlimited reset button, there are no consequences. And without consequences, there is no growth.

It hit me that if I wanted a demo to prepare me for live trading, I had to make it mirror reality as closely as possible.

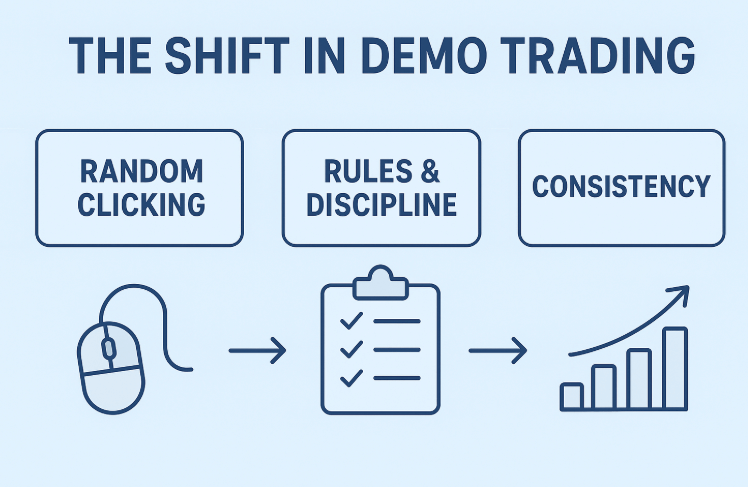

The First Change: Making Demo Feel Real

The very first change I made was shrinking the demo balance. Instead of $10,000, I gave myself just $1,000. That number felt closer to the deposits I could realistically make. Suddenly, each $20 trade mattered.

The second shift was in how I sized my trades. I decided that no single trade would ever be more than 2 percent of my account. It wasn’t about money. It was about discipline. With that rule, the numbers on the screen finally carried weight.

I also cut down on the number of trades. Instead of clicking endlessly out of boredom, I gave myself three trades per session. If I wanted more, I had to write down my reasons first. That pause between impulse and action changed everything.

And when I blew up a demo balance, I didn’t hit reset right away. I forced myself to sit with the loss, analyze where I went wrong, and only restart after I had a clearer plan. Those pauses hurt, but they stopped me from treating the demo like a free arcade game.

My Trade Journal: The Turning Point

I realized I couldn’t rely on memory alone. I needed a record of every trade — the good, the bad, and especially the careless ones. So I started keeping a journal. It didn’t just track results. It tracked my state of mind, my reasons, and my mistakes.

Here’s an example of how one week looked in my journal. Notice that I didn’t hide losses. Losses were the entries that actually taught me something.

| Date | Asset | Direction | Expiry | Stake | Entry Price | Exit Price | Result | Balance After Trade | Notes |

| 02/10/2025 | EUR/USD | Call | 1 min | $20 | 1.0650 | 1.0658 | Win | $1,020 | Clean bounce off support |

| 02/10/2025 | GBP/USD | Put | 2 min | $20 | 1.2270 | 1.2276 | Loss | $1,000 | Entered too early, ignored confirmation |

| 03/10/2025 | USD/JPY | Call | 5 min | $20 | 148.20 | 148.33 | Win | $1,020 | Breakout worked, RSI confirmed |

| 04/10/2025 | AUD/USD | Put | 1 min | $20 | 0.6425 | 0.6429 | Loss | $1,000 | Traded during news spike, poor timing |

| 05/10/2025 | EUR/USD | Call | 3 min | $20 | 1.0685 | 1.0695 | Win | $1,020 | Nice moving average bounce |

| 06/10/2025 | GBP/USD | Put | 2 min | $20 | 1.2250 | 1.2259 | Loss | $1,000 | Chased trade after previous loss |

Looking back at this table, it’s easy to see where my weak spots were. Twice I entered too early. Once I ignored upcoming news. Another time I chased a loss. Writing these down forced me to face my habits.

The journal became my mirror. Without it, I would have fooled myself into thinking I was improving.

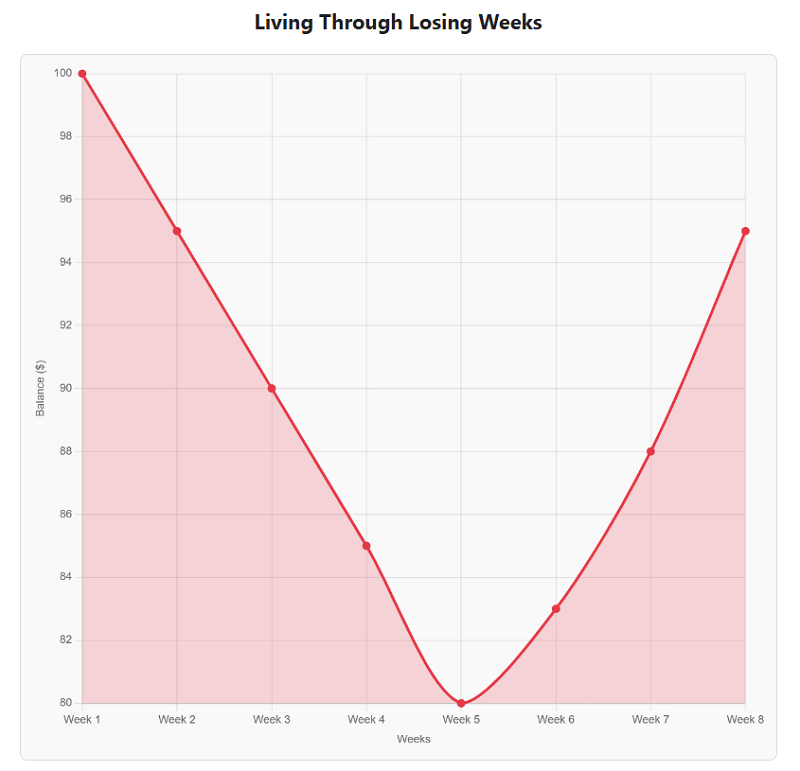

Living Through Losing Weeks

Some of the hardest but most important lessons came from weeks where I couldn’t catch a break.

There was one stretch where I lost three trades in a row. On demo, it was only sixty dollars gone. On live, that same streak would have hurt deeply. I forced myself to stop trading that day, write down exactly what went wrong, and review my charts. I realized I was entering trades right before news events. That single discovery saved me from repeating the same mistake later with real money.

Another time, I had a week of slow, grinding results: win one, lose one, win another, lose two. The balance barely moved. But by the end of that week, I had proved something to myself — I could keep my head steady even without big wins. That steadiness was more valuable than any single profitable trade.

The Problem of Overconfidence

Even with these lessons, a demo can trick you. A few good weeks can make you feel invincible. I fell into that trap too. After a streak of wins, I thought I had cracked the code and was ready to live again.

That’s why I set a rule: thirty disciplined demo sessions in a row before I would go live. No exceptions. And “disciplined” didn’t mean profitable. It meant following my own rules — trade sizing, journaling, patience.

👉 If you want to bridge that same gap, try running a small live account alongside demo with this broker. That’s what helped me transition without shock.

My Way of Resetting

Whenever I caught myself slipping back into bad habits, I had a personal reset system. If I traded recklessly, I shut down for a full day. If I blew the balance, I wasn’t allowed to restart until I wrote down the exact reasons why. If I won too easily, I made my rules stricter.

The reset wasn’t punishment. It was training. It taught me that careless trading had consequences, even on demo.

What Demo Finally Taught Me

By the time I had spent months on demo with discipline, here’s what I discovered:

- Patience made all the difference. The trades I waited for were the ones that worked.

- Risk management stopped being a rule and became instinct. Capping stakes on demo made it natural when I went live.

- Losing streaks carried the best lessons. Every loss showed me a habit I needed to fix.

- Market conditions mattered more than I thought. Practicing in ranging and trending markets gave me confidence later.

- Consistency became the true measure. A steady upward line was more important than occasional big wins.

Moving Back to Live

When I finally deposited $100 again, the difference was night and day. Losses still stung, but they didn’t throw me into panic. I traded with calm focus. The habits I had built on demo carried over. That time, I didn’t blow up my account in weeks. I grew it slowly instead.

Why Demo Still Has a Place in My Trading

Even now, I still use demos, but with a very different purpose. I use it as a lab. Whenever I want to test a new idea or when the market feels strange, I go back to demo. It’s not a playground anymore. It’s my practice field.

👉 If you want to turn demo into a real training tool, open your demo and live account with this broker.

Related Reads

You might also like:

- Binary Options Risk Management Strategies That Actually Work

- Top Candlestick Patterns Every Beginner Should Master

- Copy Trading in Binary Options: Shortcut or Trap?

Final Thoughts

Demo trading almost fooled me into thinking I was already a good trader. I kept doubling my account, but it was meaningless because I wasn’t trading realistically. The best way to use binary options demo accounts without wasting time is to treat them like they’re real from the start, keep a journal, respect the numbers, and know when to move on.

Demo is a stepping stone. Not a hiding place. Use it to prepare for the real challenge, not to pretend you’ve already mastered it.