Candlestick Patterns Every Binary Options Trader Should Know: My Trading Journal from 2025

I still remember one quiet evening in late 2024 when I entered what looked like a perfect hammer setup on EUR/USD. I placed a five-minute Call, convinced I had spotted a textbook reversal. Two minutes later, the price plunged and the trade expired out of the money. That single moment changed how I viewed candlestick patterns for binary options.

It wasn’t the pattern that failed me, it was my lack of context. From that loss, I began to document every trade and analyze why certain patterns work better than others in short expiry markets. By mid-2025, I had built a small collection of setups that consistently delivered clarity and control.

If you want to follow along with real setups as I describe them, you can open your Pocket Option account today and get a 50% deposit bonus. It’s where I test every pattern you’ll read about here.

Why Most Candlestick Guides Don’t Help Binary Traders

When I first searched online for reliable candlestick strategies, I found countless lists and diagrams, morning stars, haramis, three crows, and more. They looked useful, but they ignored the reality of short expiries.

In binary trading, timing is ruthless. Candles form and vanish in minutes. Patterns that work on daily charts often collapse when reduced to five-minute frames. That’s the gap I’m addressing here. Every pattern you’ll see is one I’ve actually traded live, tested repeatedly, and filtered by results rather than reputation.

How I Analyze Candlestick Patterns in Binary Options

Candlestick patterns are only reliable when they fit into a larger story of price movement. Over the years, I developed a few habits that help me filter good setups from noise.

Context Is Everything

A hammer near a strong support line carries weight. A hammer floating in the middle of a random range means nothing.

Wait for Confirmation

I always require the next candle to confirm direction either by closing beyond a key level or aligning with volume momentum.

Timeframe Precision

My focus is on one-minute and five-minute charts. These are where I’ve found candlestick signals most responsive for binaries.

Keep a Trading Journal

After every trade, I log the pattern, entry time, expiry result, and notes about context. Patterns that repeatedly fail get cut from my list.

5 Candlestick Patterns That Still Work for Me in 2025

After hundreds of trades, I narrowed my list to five candlestick patterns that remain consistent in binary conditions. Each one tells a story and comes with a lesson I learned the hard way.

Hammer and Inverted Hammer

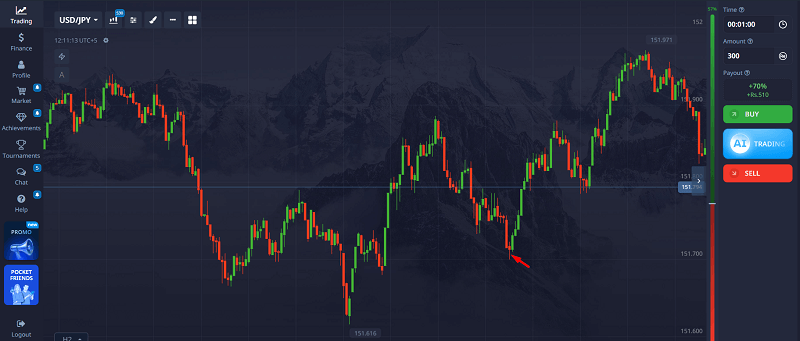

A hammer suggests that sellers pushed prices down, but buyers managed to recover by the close. I treat this as a potential reversal signal. In April 2025, I spotted a hammer on USD/JPY sitting directly on a strong support line. I waited for the next candle to confirm upward momentum and entered a Call. The trade expired profitably.

I’ve also lost trades when I entered too early, especially when the hammer formed mid-range with no support nearby. My rule now is simple: only act when the lower wick is at least twice the body and context supports a bounce.

Engulfing Pattern

The engulfing candle remains one of the strongest candlestick patterns for binary options. It shows a complete takeover of momentum from one side of the market to the other.

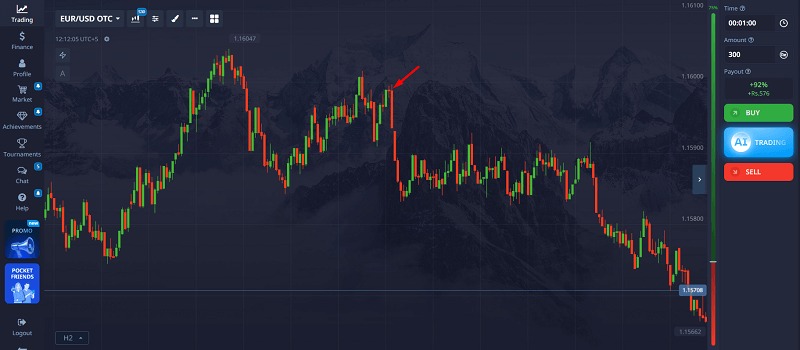

One afternoon on EUR/USD, I saw a bearish engulfing pattern right after a small pullback. The next candle confirmed weakness, and I entered a Put. It worked. But on another day, a weak engulfing near resistance failed within seconds. I’ve since learned to only trust full engulfings that align with the broader trend.

Doji and Spinning Top

Doji candles fascinated me early on, but they caused as many losses as wins. A doji represents indecision, which means I treat it as a warning, not an entry signal.

I now use it as a potential turning point marker. For example, a doji near strong resistance after a long uptrend often hints at reversal potential. Once a confirming bearish candle forms, I’ll enter a Put. But I completely ignore dojis that appear mid-trend or in flat markets.

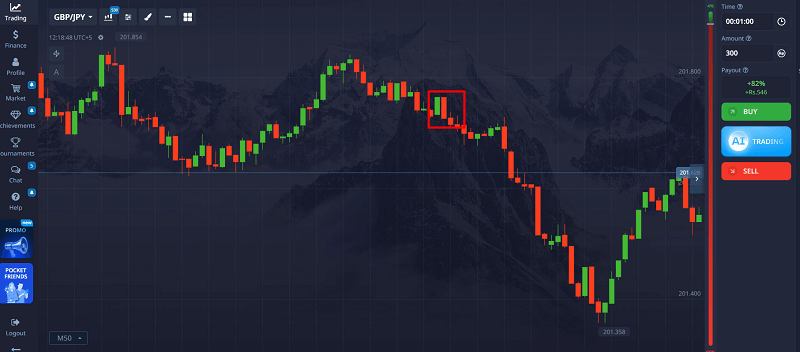

Three Inside Up and Three Inside Down

This pattern combines a smaller inside candle followed by a strong confirmation candle. I like it because it forces patience.

During a GBP/JPY session, I spotted a bullish three inside up pattern after a steep decline. When the third candle closed above the first, I took a Call and won the trade. The multi-candle structure gives this setup built-in confirmation, making it more dependable in fast-moving binary conditions.

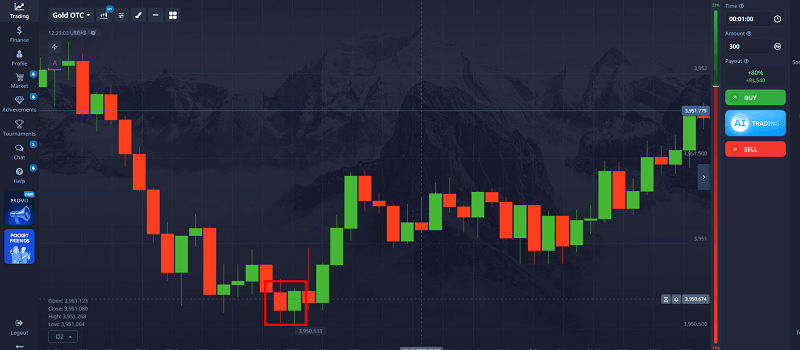

Tweezer Top and Bottom

Tweezer setups appear as twin candles with matching highs or lows. They’re subtle but powerful around clear price levels. In March 2025, I noticed a tweezer bottom at a tested support zone on gold. After the second candle confirmed strength, I took a Call and the trade succeeded.

However, I’ve also been trapped by false tweezers during volatile sessions. Now I only trust them when both candle wicks align neatly and volume suggests genuine rejection.

Patterns I’ve Stopped Using

Over time, I eliminated several classic candlestick formations from my binary toolkit.

Morning and Evening Stars

These patterns look great on daily charts but rarely form clearly on shorter timeframes. By the time they confirm, the move is already over.

Harami Without Confirmation

A standalone harami is too weak to trade. Unless it appears as part of a Three Inside pattern, I ignore it.

Rare or Complex Setups

Patterns like the Abandoned Baby or Kicker appear so infrequently that they’re not worth monitoring in binaries.

How I Execute Pattern-Based Binary Trades

Whenever I spot a potential pattern, I move through a clear decision path. First, I check whether it aligns with support or resistance. Then I wait for confirmation and confirm that market momentum matches the signal. Only then do I take a position with a defined stake and expiry.

After each trade, I review the outcome and note what worked or failed. This habit has improved my consistency more than any new strategy ever could.

If you want to build your own structured testing process, create your Pocket Option account today and use the 50% bonus to practice these same setups in real market conditions.

A Trade From My Journal: June 12, 2025

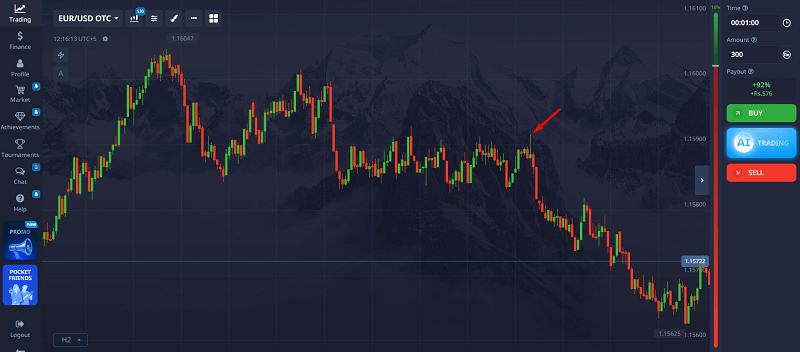

Asset: EUR/USD

Timeframe: 5-minute expiry

Pattern: Bullish Engulfing

Context: Short-term uptrend, pattern at local support

Entry: After confirming candle close

Outcome: Trade expired in profit

That trade reminded me of the power of patience. Just an hour earlier, I skipped a weak hammer setup that looked tempting. Price collapsed moments later. Discipline, not prediction, saved that session.

Lessons From My Wins and Losses

Trading candlestick patterns taught me lessons that go far beyond charts.

Patterns Are Probabilities, Not Promises

Every candle offers information, not certainty. Accepting this mindset helped me trade more calmly.

Timing Is Crucial

Even a perfect pattern can fail if entered too early. Waiting for proper confirmation improved my win rate dramatically.

Less Is More

I used to clutter my charts with indicators and filters. Simplicity works better. Now I focus only on price, context, and momentum.

Avoid Emotional Trading

Losing trades used to make me chase revenge setups. I now treat every trade as a data point, not a test of confidence.

Practicing and Refining Your Own Method

Here’s what worked best for me when developing consistency with candlestick patterns for binary options.

- Backtest visually and take screenshots of patterns that succeed or fail

- Start in demo mode until you have data-backed confidence

- Limit yourself to three to five patterns at a time

- Keep a trading journal to measure long-term performance

Once you’re ready to move from demo to live, open your Pocket Option account and claim your 50% welcome bonus. It gives you a comfortable margin to test small, controlled trades under live pressure.

Final Thoughts

Candlestick trading in binary options isn’t about memorizing shapes, it’s about understanding the story behind each one. These five core setups have earned their place in my playbook through years of testing, mistakes, and adjustments.

If you treat them as clues rather than predictions, combine them with structure, and document everything, you’ll eventually build a personal system that fits your style.

When you’re ready to see these patterns in action, start on Pocket Option and claim your 50% deposit bonus to explore real setups under live market pressure. That’s exactly how my trading confidence grew—one candle at a time.