Pocket Option vs Quotex for Traders in Pakistan, India, and the Philippines — Which Is Better?

I didn’t start trading with a laptop, dual monitors, or fast funding options. I started with unreliable internet, payment restrictions, and a constant fear that my withdrawal might get stuck.

If you trade from Pakistan, India, or the Philippines, you already know the reality. The broker you choose isn’t just about payouts or indicators. It’s about whether you can even fund your account, place trades smoothly, and withdraw without stress.

That’s why this Pocket Option vs Quotex for traders in Pakistan, India, and the Philippines comparison is personal. I tested both brokers under the same constraints most traders here face. Small deposits. Local payment methods. Real money. Real pressure.

If you want to explore either platform yourself, you can open an account using my affiliate link here. Just remember, the broker won’t save you from bad discipline, but the wrong broker can absolutely amplify your problems.

Why Regional Reality Matters More Than Broker Marketing

Most reviews are written from Europe or regions with smooth banking access. They don’t talk about failed deposits, blocked cards, or support tickets that never get answered.

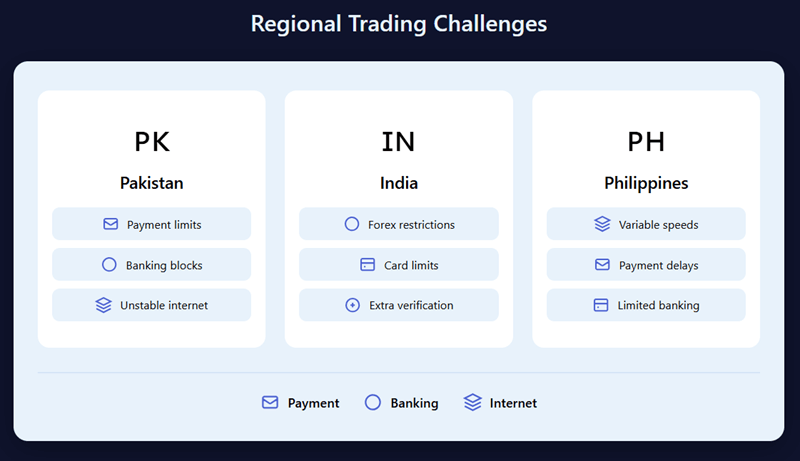

From South Asia and Southeast Asia, trading is layered with friction.

- Payment gateways change

- Banks flag transactions

- Internet stability varies

- Support response time matters more

This is where the Pocket Option vs Quotex for traders in Pakistan, India, and the Philippines debate becomes less about features and more about survival.

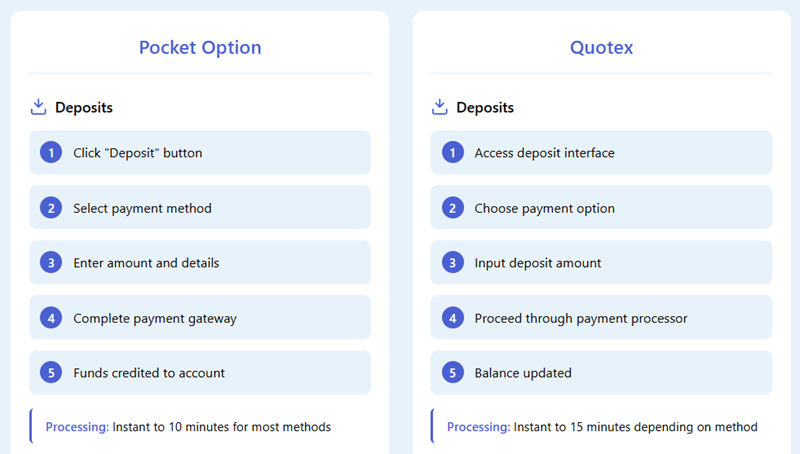

My First Deposits From South Asia

I deposited the same amount on both platforms.

Pocket Option accepted my payment smoothly. No delays. No unnecessary verification loops. The balance reflected almost immediately.

Quotex worked, but not as seamlessly. The process felt more rigid. It wasn’t broken, just less forgiving.

That difference seems small until you’re staring at a pending transaction with limited funds and no clear timeline.

Local Payment Experience: The Make-or-Break Factor

For traders in Pakistan, India, and the Philippines, payment access is not a luxury. It’s the entry point.

Pocket Option felt more adaptable. It supported a wider range of funding routes that actually worked from my region.

Quotex was functional, but narrower. If your preferred method failed, alternatives were limited.

| Criteria | Pocket Option | Quotex |

| Regional accessibility | Strong | Moderate |

| Deposit reliability | High | Stable but selective |

| Withdrawal confidence | Higher | Cautious |

This is rarely discussed in global reviews, yet it defines the real experience.

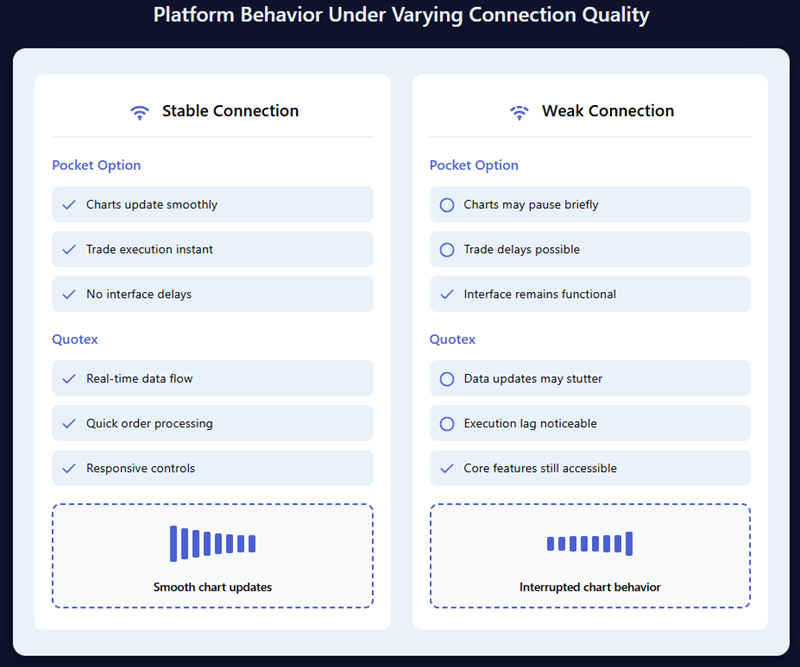

Platform Performance on Slower Internet

This surprised me.

Pocket Option handled unstable connections better. Charts loaded faster, trades executed with fewer freezes, and re-logins were smoother.

Quotex required more stability. When the connection dipped, I hesitated before entering trades. That hesitation changes outcomes, especially on short expiries.

If you’ve ever lost a trade because the platform lagged, you know how damaging that feels.

Trading Sessions That Match Local Time Zones

Another overlooked factor.

Pocket Option’s asset activity felt more consistent during Asian sessions. I didn’t feel forced to trade awkward hours.

Quotex worked well too, but I noticed better alignment with European volatility windows.

For traders balancing jobs, studies, or family schedules, this matters more than fancy tools.

Psychology of Trading From Developing Markets

Trading from these regions carries a unique mental load.

Every dollar matters more.

Every withdrawal feels heavier.

Every mistake feels amplified.

Pocket Option’s environment felt less intimidating. I stayed calmer, traded longer, and made fewer emotional decisions.

Quotex felt stricter. Cleaner. But also heavier psychologically. I became more cautious, sometimes to the point of hesitation.

This ties closely to the lessons I documented in my piece on the psychology of binary options trading, where platform design subtly shapes behavior.

Support Response When Things Go Wrong

At some point, something always goes wrong.

Pocket Option’s support responded faster and with clearer answers. Not perfect, but responsive.

Quotex support felt slower and more formal. Issues eventually resolved, but the waiting period tested patience.

When you’re trading from Pakistan, India, or the Philippines, delayed support can mean missed opportunities or frozen capital.

If you want to test which platform fits your regional reality, open an account using my affiliate link here. Start small. Test deposits and withdrawals before scaling anything.

Withdrawal Reality: The Moment of Truth

Withdrawals tell the real story.

Pocket Option processed my withdrawal with fewer questions. The funds arrived without extended delays.

Quotex required more patience. Nothing alarming, but enough to keep me checking my account repeatedly.

That emotional drain is rarely mentioned, but it’s real.

This mirrors what I discussed in surviving losing streaks, where emotional capital matters as much as financial capital.

Regulatory Awareness for Regional Traders

Let’s be honest. Neither broker is locally regulated in Pakistan, India, or the Philippines.

That means personal responsibility matters more.

Pocket Option felt more transparent in its processes.

Quotex felt more procedural and rule-bound.

Neither is inherently safer, but clarity reduces anxiety.

Learning Curve for Beginners in These Regions

For newer traders, Pocket Option feels easier to approach. The interface is intuitive, and mistakes feel less punishing.

Quotex demands structure early. It rewards discipline but punishes impulsiveness faster.

This aligns closely with what I wrote about how many trades you should take in a day, especially when capital and confidence are limited.

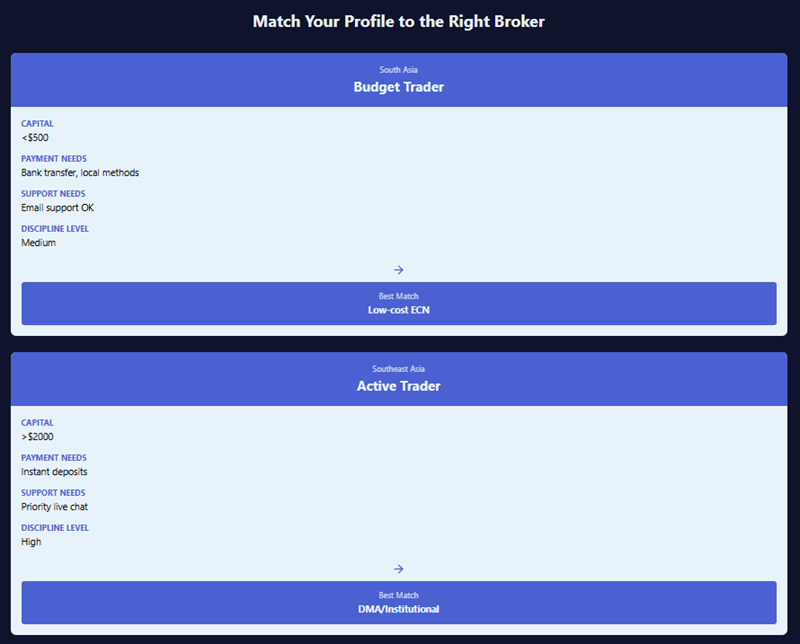

Who Each Broker Actually Suits Regionally

Pocket Option suits traders who:

- Need flexible payments

- Trade on unstable connections

- Prefer smoother onboarding

- Learn through repetition

Quotex suits traders who:

- Already have discipline

- Prefer structured environments

- Trade fewer, higher-quality setups

- Can handle stricter processes

This is the nuance missing from most Pocket Option vs Quotex for traders in Pakistan, India, and the Philippines reviews.

My Personal Verdict After Months of Use

I didn’t abandon either broker.

I used Pocket Option for testing, learning, and adapting.

I used Quotex for focused sessions when I wanted discipline enforced.

Your broker doesn’t make you profitable.

But the wrong broker can make you quit early.

Final Thoughts on Pocket Option vs Quotex for Traders in Pakistan, India, and the Philippines

Trading from these regions isn’t harder because of skill. It’s harder because of friction.

Pocket Option reduces friction.

Quotex increases structure.

Both can work.

Both can fail you if misunderstood.

The real edge comes from choosing the platform that matches your environment, not someone else’s success story.

If you’re trading from Pakistan, India, or the Philippines and want to experience these differences firsthand, open an account using my affiliate link here. Trade small, withdraw early, and let the platform reveal itself before you commit.