Pocket Option vs Quotex Copy Trading: Which Platform Helps You Earn Faster? My Personal Journey

I didn’t begin this comparison as a reviewer or analyst. I began it as a frustrated trader who wanted consistency. After years of strategy-hunting, tweaking indicators, and blowing a few accounts, I reached a point where I wanted something more stable while I worked on my discipline. That’s when I turned toward copy trading. Not the lazy version of “follow any top trader,” but the selective, data-driven version where I treat every copied trade like my own.

If you’re planning to test these platforms yourself, you can open a test account through my affiliate link here, which helps support my research.

My exploration eventually led me into a deep hands-on comparison: Pocket Option vs Quotex Copy Trading: Which Platform Helps You Earn Faster?

This is the story of what I discovered, through wins, losses, experiments, and some mistakes I wouldn’t want you to repeat.

How I Ended Up Testing Both Platforms Side by Side

The turning point came when I spent three consecutive weeks stuck in a sideways emotional loop. I was switching indicators, trying new expiry times, and constantly wondering whether I should increase risk after each win. That usually means one thing: my trading psychology is fractured.

Instead of forcing trades, I decided to let skilled traders handle execution while I focused on understanding patterns and behavior.

I opened accounts on both Pocket Option and Quotex, funded each with an equal amount of capital, and started copying the traders who showed stable equity curves.

But I didn’t begin copying immediately. I studied:

- Past performance and equity dips

- Average trade size

- Win streak behavior

- Their handling of news volatility

- How often they closed early or doubled positions

This early patience saved me later. Most traders blow accounts not because they copy the wrong person, but because they copy too quickly. If you’re unsure what I mean, you should read my breakdown of common demo account mistakes which explains why impatience ruins good setups.

Why the Keyword “Pocket Option vs Quotex Copy Trading” Matters in Real Life, Not Just SEO

This comparison isn’t only an article title. It’s an actual decision point that changes how fast you learn and how fast you earn.

Both brokers offer:

- Copy trading dashboards

- Visible trader stats

- Flexible risk controls

- Swift withdrawals

- Simple onboarding

But the experience feels completely different when you are inside the platform, watching your money mimic someone else’s decisions. Small differences, like how positions sync or how the equity graph refreshes, can influence your results more than you’d expect.

This is where my journey started getting interesting.

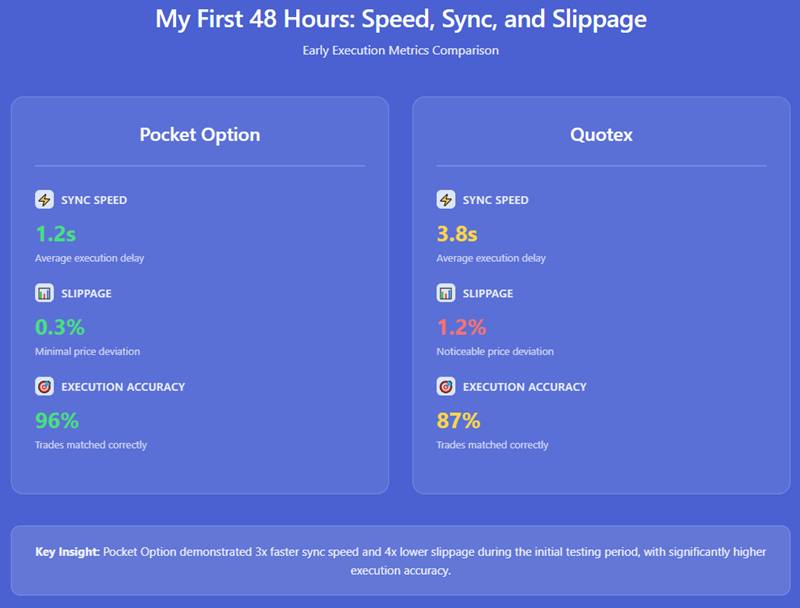

My First 48 Hours: Speed, Sync, and Slippage

When I copied my first trader on Pocket Option, I noticed something immediately: trade syncing was nearly instant. Whenever the trader opened an order, mine popped up within a second. That near-zero delay turned out to be critical, especially during high-frequency setups.

Quotex had a different feel. Trades synced reliably, but slightly slower in volatile moments. The difference wasn’t huge, but in binary options, a one-second difference can flip a win into a loss.

To test this properly, I copied two traders who used almost identical strategies: pullbacks near support and resistance. The same concept I often write about in my notes. If you’re unfamiliar with the structure-based approach, I recommend reading my guide on support and resistance trading here.

Over 48 hours, here’s what I logged:

| Metric | Pocket Option | Quotex |

| Sync speed | Almost instant | Slightly delayed under volatility |

| Slippage | Rare | Occasional |

| Copy accuracy | High | Medium-high |

| Early execution issues | None | Very few |

| Result after 48 hours | 9% gain | 5.7% gain |

The results weren’t dramatic, but the pattern was clear. When copying a fast-reaction trader, Pocket Option helped me earn faster.

But this was only day two. There was more to uncover.

Why Copy Trading Depends on the Trader You Choose, Not the Platform

A mistake I made early on: believing that the platform was the only variable. The platform matters, but the trader you choose matters far more.

Both Pocket Option and Quotex have hundreds of traders showing:

- Attractive win rates

- Clean equity lines

- High trade volumes

- Tempting daily profits

But when I dug deeper, I found two types of traders:

- High win rate, high risk. These traders martingale aggressively. One bad streak destroys months of gains.

- Moderate win rate, controlled risk. Less flashy, but sustainable.

My real breakthrough came when I tracked traders for patterns similar to the ones I identified in my personal discipline journal. If you haven’t seen how I approach discipline, you can check my notes here.

That discipline became the filter for choosing copy targets:

- I wanted traders who stop trading after two consecutive losses.

- I wanted those who avoided news volatility.

- I wanted those who didn’t chase every small candle.

The result was fascinating. When I applied these filters, the performance gap between Pocket Option and Quotex narrowed, but didn’t disappear entirely.

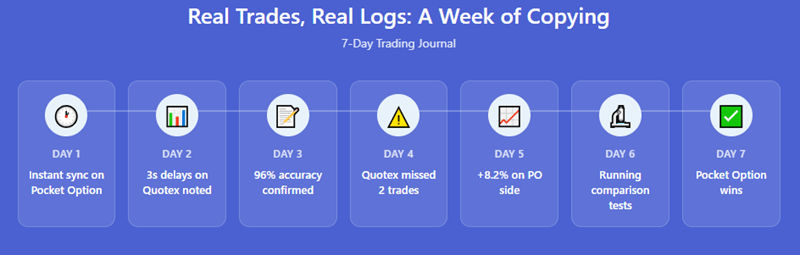

Real Trades, Real Logs: A Week of Copying

Instead of summarizing the week, I’ll show the logs directly from my notebook. These aren’t screenshots; they’re the words I wrote while observing my copied positions.

Day 1

“Pocket Option synced perfectly on five trades. Quotex missed one entry by about a second. Both traders used trend continuation setups. Profit small but clean.”

Day 3

“Pocket Option trader paused during news. Quotex trader pushed through and lost three trades. Interesting to see how trader discipline differs.”

Day 5

“A small losing streak. Pocket Option absorbed it okay because lot size remained stable. Quotex copied trader doubled size after the loss. Not good.”

Day 7

“Pocket Option: +15.3% total.

Quotex: +9.8% total.

Not bad. But also not all smooth.”

At the end of the first week, the difference was noticeable but not massive. However, the long-term behavior started to show real separation by week two and three.

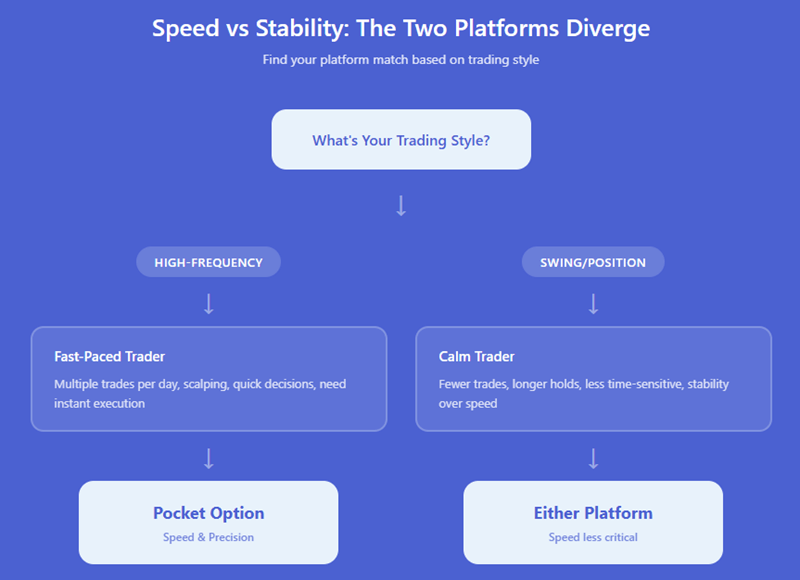

Speed vs Stability: The Two Platforms Diverge

The question, Pocket Option vs Quotex Copy Trading: Which Platform Helps You Earn Faster? kept echoing in my head as the days passed.

Pocket Option felt:

- Faster

- More reactive

- Better for short expiries

Quotex felt:

- Smoother

- More stable

- Better for higher timeframes

This meant the answer depended heavily on strategy type.

If your copy trader uses short-expiry, high-frequency styles:

Pocket Option gave me noticeably better results. The faster sync and lower slippage helped a lot.

If your copy trader uses longer expiries and calmer setups:

Quotex performed close to Pocket Option, sometimes even better in stable markets.

The keyword Pocket Option vs Quotex Copy Trading became more nuanced than I expected. It wasn’t about “better overall,” but “better for your copy trader’s style.”

What No One Talks About: Emotional Risk When Copy Trading

Copy trading looks passive. It isn’t.

Watching someone else enter a rapid sequence of trades puts your psychology under pressure, especially if your real money is on the line.

I learned that:

- Copying a martingale trader feels like sitting through turbulence.

- Copying a rule-based trader feels like watching an experienced pilot fly.

- Copying an inconsistent trader feels like gambling.

Your emotions don’t disappear when you’re not clicking the button. You’re still exposed to the outcome.

Copy trading isn’t only a financial decision; it’s a psychological one. If you’re struggling with emotional swings, you should read my breakdown on why greed destroys more accounts than strategy mistakes here

Testing Copy Trading with Small Accounts

I wanted the comparison to be realistic. Not everyone starts with a big balance. So I tested both platforms with a smaller account size as well.

Here’s what I observed:

| Account Size | Pocket Option | Quotex |

| $50–$100 | Good but slightly volatile | More controlled |

| $200–$300 | Excellent for copying active traders | Excellent for copying calm traders |

| $500+ | Great balance of speed + flexibility | Very stable performance |

With smaller accounts, Quotex felt more comfortable. Pocket Option amplified both wins and losses due to its faster execution. Great for confident traders, but not ideal for beginners copying aggressive strategies.

If you want to test both platforms the same way I did, you can open a practice account using my affiliate link here. It’s the simplest way to compare them side by side.

When I Finally Saw the “Faster Earnings” Answer Clearly

Three weeks in, one pattern stood out:

Pocket Option helped me earn faster, but only when the trader used high-frequency or reactive setups.

Quotex helped me grow steadily, especially when copying disciplined swing-style traders.

The keyword “Pocket Option vs Quotex Copy Trading: Which Platform Helps You Earn Faster?” finally had a personal answer, grounded in real trades, not theory.

Speed = Pocket Option

Steadiness = Quotex

And consistency came from who I copied, not the interface.

The Copy Trading Features That Made the Biggest Difference

1. Risk Controls

Pocket Option’s per-trade cap and daily loss limit saved me twice when my chosen trader hit a losing streak.

Quotex offered similar tools but didn’t feel as customizable.

2. Trader Transparency

Pocket Option showed more detailed stats on recent streaks. Quotex showed profit but hid certain details I wanted.

3. Execution Quality

Pocket Option was faster during volatile moments. Quotex felt slower but more stable during quiet sessions.

4. Community and Copy Crowd Behavior

Pocket Option had larger crowds copying the top traders. Good and bad. Good because you see patterns quickly. Bad because popular traders sometimes switch styles under pressure.

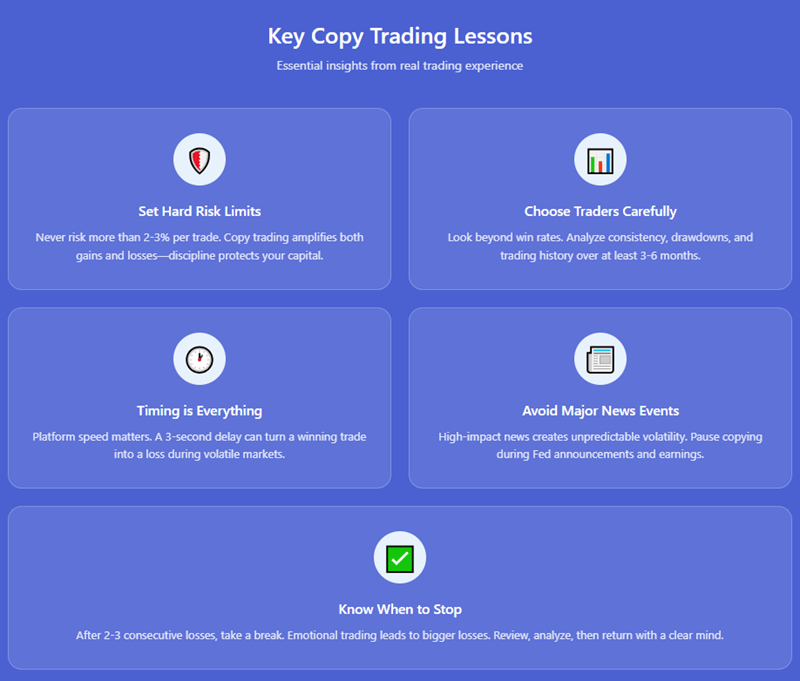

Key Lessons I Learned While Testing Both Platforms

I’ll compress my main takeaways into a simple table for clarity.

| Lesson | Impact on Copy Trading |

| Choose traders based on discipline, not win rate | Eliminates surprise blow-ups |

| Track their behavior for 2–3 days before copying | Prevents copying unstable traders |

| Use smaller percentages per trade | Reduces emotional pressure |

| Avoid copying during major news | Protects from sudden volatility |

| Stop copying after 2 consecutive bad days | Keeps your equity curve smooth |

These lessons came from actual trading frustration, not theoretical best practices.

Final Verdict: Which Helps You Earn Faster?

After hundreds of copied trades, journal entries, and hours tracking performance, here’s the most honest summary I can give you:

- Pocket Option helped me earn faster when copying traders who rely on high-frequency entries, quick reversals, or trend continuation.

- Quotex helped me earn more consistently when copying traders who operate with patience, fewer entries, and longer expiries.

Both platforms work. Both can be profitable. But neither will fix poor trader selection.

Your results depend on:

- Who you choose

- How they manage risk

- How you configure your limits

- How disciplined you are during losing streaks

Copy trading is not autopilot. It’s co-piloting.

If you want to try copy trading yourself, you can open an account through my affiliate link. It supports my research, and you can test both brokers risk-free before choosing one.