Pocket Option vs Quotex: Which Broker Has Better Market Signals & Indicators?

There was a point in my trading journey when I stopped blaming my strategy and started questioning my tools. I wasn’t losing because I misunderstood price action. I was losing because my indicators were late, noisy, or giving conflicting signals at the worst possible moments.

That realization pushed me into this deep comparison of Pocket Option vs Quotex: Which Broker Has Better Market Signals & Indicators? Not as a feature checklist, but as a personal trading journal where I documented real trades, watched signals fail and succeed, and learned how much the platform itself shapes decisions.

If you want to test what I describe in real time, you can open a trading account using my affiliate link here. I recommend opening both platforms side by side, exactly the way I did.

Why Signals and Indicators Became My Focus

Early on, I believed indicators were meant to predict the market. That belief cost me money. Over time, I learned indicators don’t predict. They organize information, and the quality of that organization depends heavily on how the broker implements them.

Once my entries became technically correct but poorly timed, I stopped asking which indicator was best and started asking which platform delivered the cleanest signals.

That question led directly to Pocket Option and Quotex.

My Trading Setup for a Fair Comparison

To keep the test clean, I controlled every variable:

- Same assets

- Same timeframes

- Same strategies

- Same risk per trade

The indicators I focused on were the ones traders actually rely on:

- RSI

- Moving averages

- Bollinger Bands

- Support and resistance tools

- Built-in market signals

If you want a foundation on how these indicators work individually, my breakdown of the most effective binary options indicators explains the mechanics clearly.

This comparison, however, is about how they behave in live conditions.

First Impressions: Quantity vs Clarity

Pocket Option impressed me immediately with variety. Indicators were easy to access, stacking was smooth, and performance stayed stable even with multiple tools active.

Quotex felt more restrained. Fewer indicators, cleaner charts, less visual noise.

At first, I assumed Pocket Option would win by default. More tools usually feel powerful. That assumption didn’t last long.

Within a few sessions, it became clear that more indicators don’t automatically create better signals.

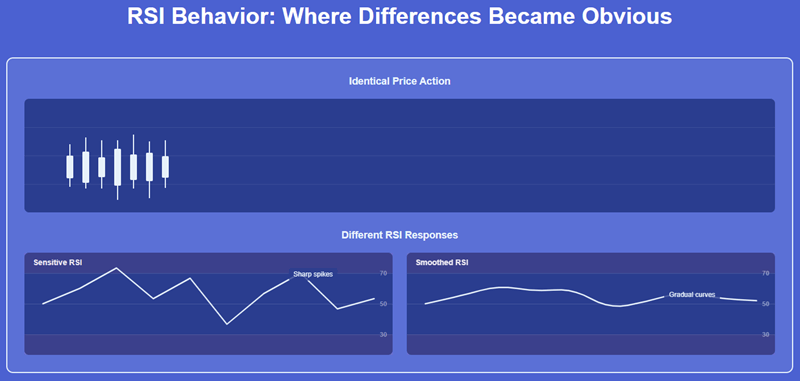

RSI Behavior: Where Differences Became Obvious

RSI is simple but unforgiving. Any delay or calculation inconsistency shows up immediately.

On Pocket Option, RSI reacted quickly, sometimes too quickly. During volatile candles, it spiked and dipped aggressively, often tempting me into early entries.

On Quotex, RSI moved more smoothly. It lagged slightly but filtered noise better.

Pocket Option’s RSI suited aggressive traders. Quotex’s RSI rewarded patience.

This aligned closely with what I explain in my guide on using RSI with Bollinger Bands in binary options, where signal timing matters more than signal frequency.

Moving Averages: Speed vs Reliability

Moving averages revealed the clearest contrast.

Pocket Option’s moving averages responded fast. Crossovers appeared early, which helped catch momentum trades but also increased false signals in choppy markets.

Quotex’s moving averages lagged slightly but produced cleaner crossover structures.

How That Played Out in Real Trades

| Market Condition | Pocket Option | Quotex |

| Fast reversals | Early entries, mixed results | Later entries, higher accuracy |

| Ranging markets | Frequent false signals | Fewer but cleaner signals |

| Strong trends | Excellent timing | Slight confirmation delay |

If you want a deeper understanding of crossover interpretation, my guide on moving averages in binary options provides helpful context.

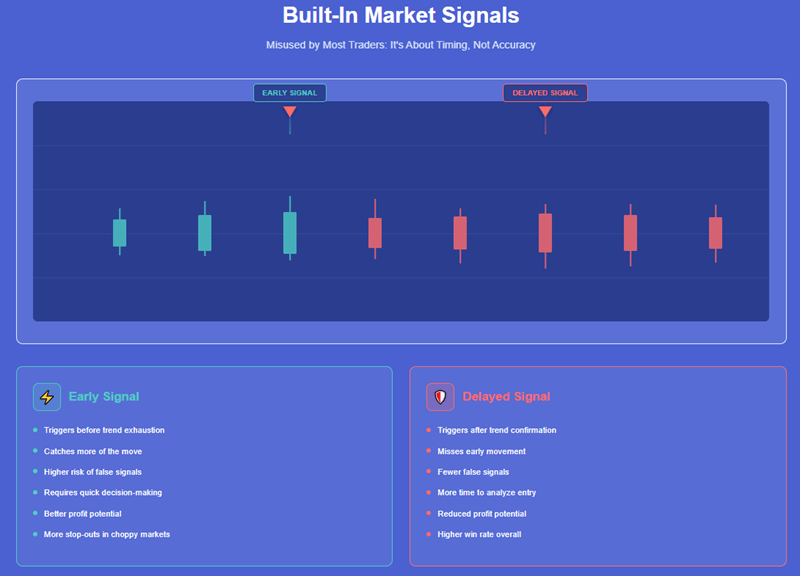

Built-In Market Signals: Misused by Most Traders

Market signals are either overused or ignored completely. I treated them as a timing reference, not instructions.

Pocket Option’s signals appeared frequently and aggressively. They worked best as filters, helping me identify when to stay out.

Quotex’s signals appeared less often and felt more conservative. When they appeared, they aligned better with structure.

The Trade That Changed My Perspective

EUR/USD, one-minute chart.

Pocket Option signaled CALL. RSI was oversold. A crossover had just formed. I entered early and lost.

Two candles later, Quotex signaled CALL on the same setup. I entered and won.

That moment reinforced a hard truth. Signals don’t decide trades. Timing does.

This experience aligns with what I explain in my article on high-frequency vs longer expiry trading strategies, where execution timing outweighs signal volume.

Indicator Stacking and Trader Psychology

Pocket Option made stacking indicators tempting. The interface encouraged experimentation, but it also increased confirmation bias.

Quotex forced simplicity. Fewer indicators meant fewer excuses.

That difference affected my mindset more than my strategy.

Pocket Option rewarded confidence and decisiveness.

Quotex rewarded restraint and patience.

If overloading charts sounds familiar, my breakdown of why too many trades reduce accuracy explains the psychological trap behind it.

Support and Resistance Tools

Both platforms handled support and resistance well, but with different strengths.

Pocket Option offered more drawing flexibility, ideal for fast scalping adjustments.

Quotex focused on stability and clarity, which suited structured level-based trades.

This directly connects with my guide on support and resistance trading in binary options, where execution discipline matters more than tool variety.

If you want to see how these signals behave under real market pressure, open an account using my affiliate link here. Testing both platforms side by side reveals more in a week than reviews reveal in months.

Noise Handling: Where Signals Are Truly Tested

Low-liquidity sessions exposed the biggest differences.

Pocket Option’s indicators reacted aggressively to noise. Quotex filtered more noise but sometimes delayed entries.

Neither approach is universally better.

When I was focused and alert, Pocket Option gave me sharper timing.

When I was emotionally tired, Quotex protected me from bad decisions.

This ties directly into trading psychology, which I explore in my guide on the psychology of binary options trading.

A Summary From My Trading Journal

| Feature | Pocket Option | Quotex |

| Indicator speed | Fast | Moderate |

| Signal frequency | High | Low |

| Noise filtering | Medium | High |

| Best suited for | Active traders | Disciplined traders |

| Learning curve | Steeper | Smoother |

This table reflects weeks of observation, not theory.

What Actually Improved My Results

Not better indicators. Better alignment.

Pocket Option helped when I trusted my system and acted decisively.

Quotex helped when I needed discipline and fewer impulses.

The broker doesn’t create profits. It amplifies behavior.

Final Verdict: Pocket Option vs Quotex Market Signals & Indicators

After documenting hundreds of trades, my conclusion is simple.

Pocket Option delivers faster, more reactive signals suited to aggressive traders.

Quotex delivers calmer, cleaner signals that reduce noise and improve discipline.

Neither replaces skill. Both expose weaknesses.

If you want to understand how market signals actually behave, not how they’re marketed, open an account using my affiliate link here. Trade small, observe carefully, and let the platform show its true character.