Decision Fatigue: Why Too Many Trades Kill Your Accuracy

I didn’t learn about decision fatigue from a book or a psychology blog. I learned it on the charts, the hard way, on days when I walked in feeling sharp and walked out confused about how my accuracy fell apart without warning. It wasn’t the market. It wasn’t the strategy. It was me reaching a mental limit I didn’t know existed.

In my early stages of trading, I believed discipline was just about rules, not mental energy. I carried the same confidence most beginners have: I thought I could make endless decisions without it affecting performance. I also believed more trades meant more opportunities. That mindset cost me entire weeks of progress.

If you want to experience cleaner charting and faster execution while reading through this journey, you can check out the platform I use daily, which helps me structure sessions more tightly and avoid unnecessary decisions.

How I First Noticed My Accuracy Dropping Long Before My Emotions Did

There was a session where I started strong. Three wins in a row, all clean setups. I felt in control. The structure was smooth, the retests were clear, and I executed them the way I had practiced for weeks. Nothing unusual at first.

Then something odd happened.

Around the fifth trade, my patience cracked a little. I didn’t notice it consciously, but when I reviewed my journal later, the shift was impossible to miss. My entries became slightly rushed. I reacted to candles rather than anticipating them. It wasn’t emotional trading. It was something quieter, a slow erosion of the attention I didn’t even realize I was losing.

That’s the problem with decision fatigue. It doesn’t announce itself. It simply takes away your sharpness a little at a time.

This was also when I revisited some of my earlier technical foundations. Clean levels matter more when the mind is tired, so I reread my own notes and resources on how high-probability zones form, especially from my work on support and resistance clarity. You can see a similar approach here: support-resistance-trading-in-binary-options. It helped me realize how many of my late-trade decisions were happening on messy, low-quality levels.

The more I analyzed my behavior, the clearer it became: I wasn’t losing because my strategy suddenly stopped working. I was losing because my mind wasn’t capable of maintaining the same quality of decisions beyond the first few trades.

The Hidden Cost of Each Micro-Decision We Make on the Charts

One thing I underestimated early in my journey was how many tiny decisions trading actually requires. Even when you don’t take a trade, your mind is processing information constantly.

A typical setup requires evaluating:

- Whether the level is valid.

- Whether the candle structure confirms it.

- Whether momentum is aligned.

- Whether to wait for one more pullback.

- Whether a nearby spike invalidates the idea.

- Whether the session conditions still favor your strategy.

Each one seems minor. Together, they drain you. Decision fatigue builds from these micro-decisions long before you feel any physical tiredness. The problem is that binary options demand extremely precise decisions in very short time windows. The moment mental energy dips, accuracy drops with it.

Understanding this made me view my trading sessions differently. I didn’t need more setups. I needed fewer, better decisions.

This insight helped me connect the dots with something I had studied earlier, Fibonacci retracement behavior. Clean retracements require patience and selectiveness, concepts I had almost forgotten. Revisiting that framework here: fibonacci-retracements-in-binary-options reminded me how often I took “almost setups” later in the session, which were exactly the trades where decision fatigue had the most influence.

The Session That Finally Made Me Accept the Truth About Decision Fatigue

There was a day that forced me to confront this problem fully. I started strong, just like many of my earlier sessions. A simple continuation setup on EUR/JPY, two clean retest confirmations, and a smooth win.

My next two trades were also high-quality. My accuracy was near perfect.

Then I made a small mistake.

I convinced myself that I could “maximize the session.” I kept trading.

Fourth trade: Slightly rushed confirmation. A loss.

Fifth trade: Incomplete retest. Another loss.

Sixth trade: Complete impulse, taken out of frustration. Loss again.

By the seventh trade, I wasn’t trading my system anymore. I was trading noise. Looking back at my journal entries later that night, the progression was painfully clear. The early entries showed structure and patience. The later ones showed fatigue masquerading as urgency.

The market didn’t change.

My ability to make decisions did.

That was the moment I realized decision fatigue was silently destroying my accuracy.

Why Decision Fatigue Feels Invisible While It’s Happening

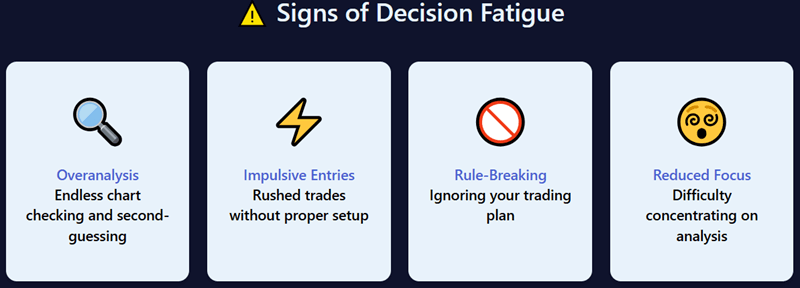

Decision fatigue is not like emotional trading. With emotions, you usually feel the shift. With fatigue, you don’t. You still think you’re sharp. You still feel in control. But your decisions say otherwise.

These were the signs I identified over time:

- I began reacting to the price rather than reading it.

- I justified weak setups more easily.

- My entry timing became inconsistent.

- I lost the patience to wait for the candle closes.

- I assessed far too many non-setups as potential trades.

None of these felt dramatic while they were happening. They crept in slowly over the session.

This is exactly why I started limiting my exposure. I wanted my best decisions made while my mind was still fresh, not after I had already spent half of my mental energy on early trades.

How I Rebuilt My Accuracy by Limiting Trades Instead of Finding New Strategies

When I finally started limiting the number of trades I took per session, everything changed. I didn’t reduce trades to be “disciplined.” I reduced them to protect decision quality.

I made three adjustments:

- Set a strict maximum number of trades.

- Shortened my session length dramatically.

- Only traded the highest clarity levels.

These three changes alone increased my accuracy more than any new indicator or strategy ever did.

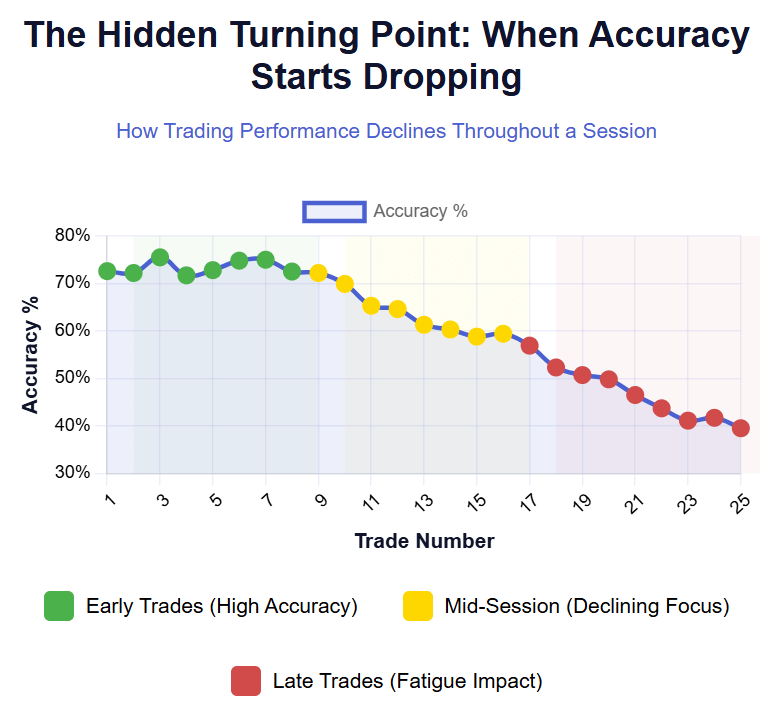

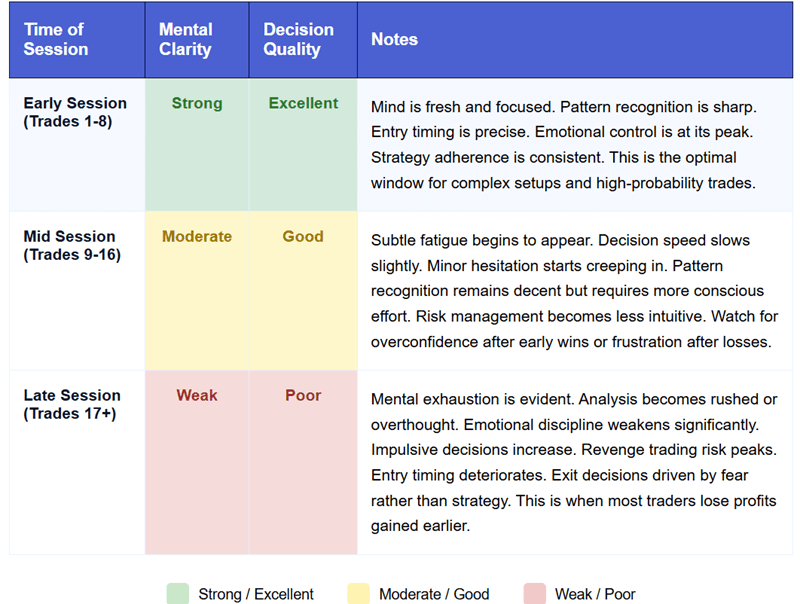

Below is the improved table I use to track decision quality. It helped me visualize the mental decline that once ruined my sessions:

| Time of Session | Mental Clarity | Decision Quality | Notes |

| Early Session | Strong | High | Best setups appear here |

| Mid Session | Moderate | Mixed | Small rush signs appear |

| Late Session | Weak | Poor | Fatigue leads to errors |

It became clear that my worst decisions always happened after the mid-session point. Once I saw this pattern repeat for several weeks, the solution became obvious. I didn’t need to strengthen my motivation. I needed a structure that protected me from reaching the late-session weaknesses at all.

This also made me revisit money management. Overtrading was directly connected to risk mismanagement. Reviewing my earlier reference notes on binary options risk, particularly the lessons highlighted here: binary-options-money-management-rules-beginners-ignore, reinforced how important it is to protect both mental and financial capital simultaneously.

The Mid-Article Window Where I Made My Biggest Breakthrough

The turning point didn’t come from a winning streak. It came from a losing one. But this time, the losing streak was different. It wasn’t caused by the market. It was caused by the same mistake repeated: too many decisions.

Once I realized the pattern, I changed my approach. I built a decision budget instead of a trade budget.

A decision budget meant I was only allowed a certain amount of mental analysis in a session. Once I felt myself nearing that limit, I ended the session regardless of the number of trades taken. Some days that meant two trades. Other days it meant four. It didn’t matter. What mattered was preserving mental clarity.

To help me stay disciplined, I relied on clean charting and quick execution. It was easier to keep my sessions tight once I switched to the platform I use daily, which helped reduce clutter and unnecessary decisions.

How Decision Fatigue Shows Up Clearly in a Trade Journal

One of the biggest advantages of journaling is that fatigue becomes obvious on paper even when it’s invisible in real time. When I reviewed my journal weeks later, I noticed a consistent pattern in my notes:

- “Waited for a full retest. Good entry.”

- “Structure decent but rushed confirmation.”

- “Not sure why I took this one.”

- “Entered too fast again.”

This was one of the clearest signals that decision fatigue had been a recurring problem. The early entries reflected good discipline. The later ones reflected mental wear.

Seeing this pattern taught me something important:

I didn’t have a strategy issue. I had a decision quality issue.

What Professional Traders Understand That Most Beginners Don’t

Professionals know something that took me years to understand:

Your accuracy peaks early in the session.

Your decision quality drops with each additional trade.

Your last trades are usually your weakest trades.

Your mind, not your strategy, determines your results.

Beginners keep pushing through the fatigue and believe they can maintain peak focus for hours. I used to be one of them. Now I understand that the mind has limits, and trading success requires respecting them.

The Personal Rule Set That Changed Everything for Me

After months of tracking my habits and studying my journal, I built a simple rule set that I still follow today:

- Maximum of three to five high-quality trades per session.

- Stop immediately after two consecutive losses.

- Trade only clean trend or clean range levels.

- Pre-mark all levels before the session to reduce decision load.

- Use moving averages only as confluence, not as primary decision makers.

If you want an approach to moving averages similar to what I use, you can see the breakdown here: moving-averages.

These rules protect my decision quality and keep me from slipping into late-session weakness.

Bringing It All Together: Decision Fatigue as the Silent Accuracy Killer

When I look back now, decision fatigue was the invisible force behind most of my losses. It disguised itself as impatience, slight overconfidence, minor rushes, forced trades, and subtle emotional swings. All the while, I believed I was trading normally.

But accuracy doesn’t collapse suddenly. It erodes in small steps as the mind tires.

The truth I discovered is simple:

You don’t need more trades. You need better decisions.

And you can only make better decisions when your mental clarity is protected.

Trading fewer, higher-quality setups didn’t just improve my accuracy. It brought back the calmness I had lost during long sessions. It removed the frustration of late-session mistakes. And it helped me grow consistently instead of chasing every candle.

If you want a clean, minimal setup that lets you focus on the decisions that truly matter, you can explore the platform I use daily. It’s the same one I rely on to keep my sessions short, structured, and sharp.