Confidence vs Overconfidence in Binary Options Trading: What I Learned the Hard Way

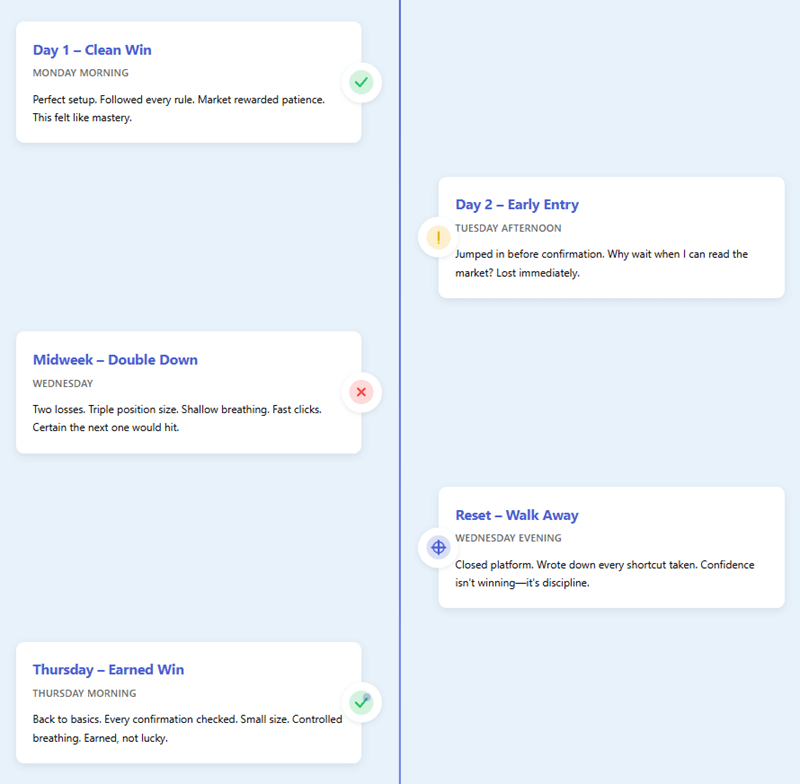

I didn’t plan to write about confidence vs overconfidence in binary options trading today. I only planned to document a few trades, review the charts, and log the usual notes. But something happened this week that shifted the way I see myself as a trader. It started with a single win, one of those clean, smooth entries where everything aligns and you feel like you’re finally getting it.

That moment is where the trap usually begins. And it’s also where I now tell new traders to start fresh with a proper, dedicated account, because separating ego from execution becomes much easier when everything is clean and structured. If you want to build that separation early on, this is the right place to open one.

The Day My Confidence Slipped Into Something Else

The first trade of the week wasn’t supposed to be special. EUR/USD had pulled back into a familiar zone near the London open. Volume was rising steadily, the wick rejections looked convincing, and the correlation with DXY matched the reversal idea. I entered a five-minute PUT with a simple, calm conviction.

It won.

But the win itself wasn’t the problem. The problem was the way it made me feel. My breathing slowed. My shoulders loosened. My posture shifted slightly forward, as if I suddenly had permission to take space on the chart. It was the kind of confidence that feels earned, not borrowed.

Yet just a few trades later, I realized that this confidence had quietly transformed into something heavier. Something louder. Something impatient.

That’s where the week took a turn, and where I learned the real difference between confidence and overconfidence in binary options trading.

How Winning Blinds You Faster Than Losing

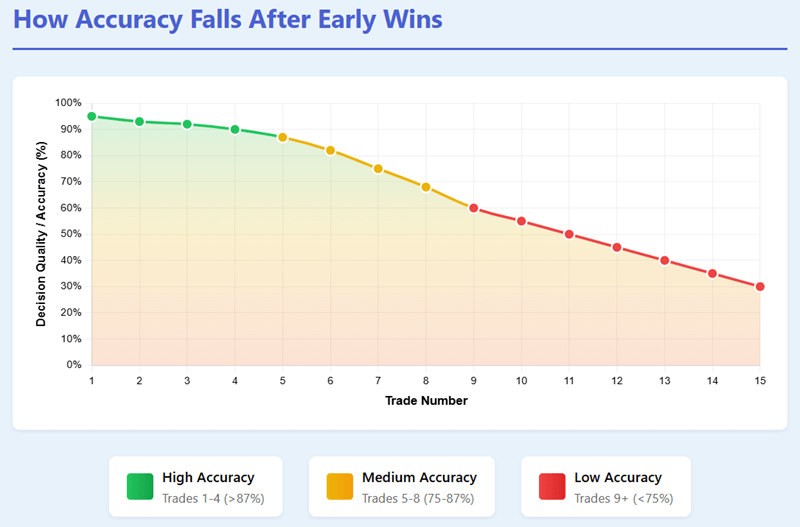

People assume losing makes you emotional. For me, winning is what distorts my judgment first. A win acts like a warm spotlight, and before I notice it, I’m standing right under it, enjoying a moment that shouldn’t even matter.

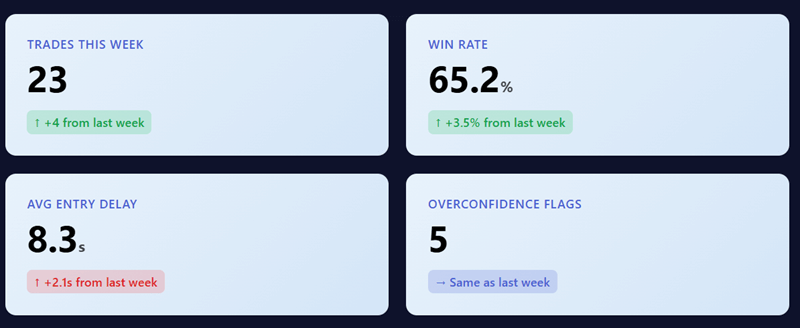

I tracked the shifts carefully this week. Here’s exactly how the transition happened in my own behavior.

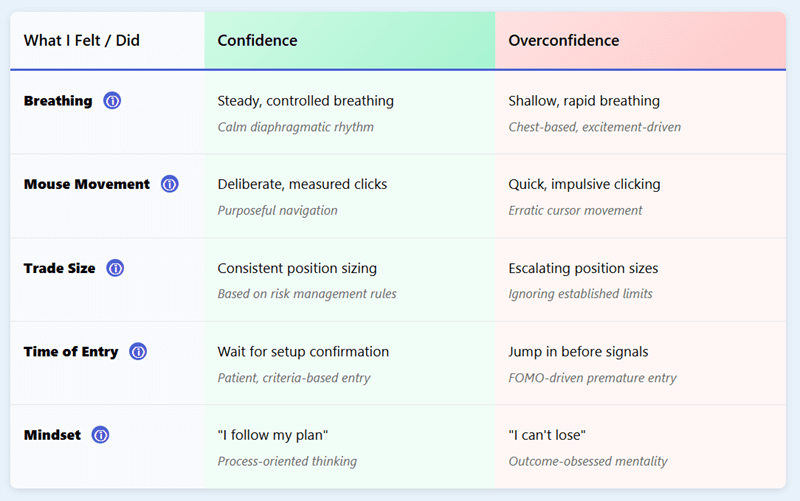

How the Feel Changed Inside My Body

Confidence was the slow inhale just before entering a trade I understood. It was my cursor hovering patiently as I double-checked the levels. It was quiet, grounded, steady.

Overconfidence felt different. The warmth from winning a previous trade spilled into the next one. My finger clicked earlier than my brain completed the thought. My speed increased. My reasoning was shortened.

To put it in a clearer format, here’s what I mean.

Table: Confidence vs Overconfidence in My Own Trades

| What I Felt / Did | Confidence | Overconfidence |

| Breathing | Calm, slow, observational | Slightly faster, subtle pressure on chest |

| Mouse movement | Deliberate, reviewing levels twice | Quick, jumpy, entering mid-candle |

| Trade size | Consistent, fixed plan | Quiet urge to increase the next position |

| Time of entry | Near confirmations | Early entries without confirmation |

| Mindset | “This setup makes sense” | “I can read the market today” |

Every trader knows the second column. It’s honest, controlled trading.

But the third column, the overconfidence column, is where most blowups begin.

And I didn’t recognize the shift until it already cost me two trades.

The Trade I Entered Without Checking the Chart Twice

This was Tuesday.

USD/JPY was consolidating just above a zone I had marked hours earlier. My plan was simple: wait for a breakout, then enter on the retest if rejection confirmed it. I had written this clearly in my notes. I even set alerts.

But when the breakout candle happened, something changed. I felt “ready.” Too ready.

Instead of waiting for the retest, I jumped in a mid-impulse candle for a CALL. My reasoning? “Momentum is strong… It’s fine.” That was the first time in months I dismissed my own rules mid-trade.

Five minutes later, the market cooled, rejected, and pushed down just enough to invalidate my entry.

If I had followed my usual rules, I would’ve avoided this loss completely.

The setup wasn’t the problem. The entry behavior was.

I later remembered a pattern I had documented in another one of my posts on market timing, where I wrote about the exact same type of impulse traps. It’s funny how we forget our own lessons the moment we feel “in control.”

That’s the part top articles rarely talk about. They explain the technical side but ignore the emotional shift that happens after a win. That’s the content gap I felt myself falling through this week.

The Midweek Shock That Reset My Thinking

When Wednesday came, I was already carrying that misplaced confidence into the new session. I told myself I was calm, but the truth is that a single win had inflated the way I saw myself more than the market justified.

I made two back-to-back mistakes that snapped me out of it.

The first mistake was sizing up slightly, just a small increase, nothing dramatic. But the intention behind it was wrong. I did it to accelerate gains, not to execute a higher-conviction setup.

The second mistake was entering without looking at the higher timeframe. This is something I never skip when I’m grounded. But overconfidence makes shortcuts look harmless.

Both trades were lost.

The losses weren’t catastrophic, but the psychological effect was immediate. I didn’t feel upset, I felt exposed. I saw how easily confidence turns into overconfidence when I begin trusting my feelings more than my system.

This is the moment I realized I needed a reset.

And just to be completely transparent: if I were starting fresh today, I would open a clean, dedicated trading account right here. It removes the baggage, the noise, and the impulsive temptation to “fix” a mistake in the same messy environment. A fresh space helps keep emotions contained.

That midweek shock forced me to return to my rules. Not because I lost money, but because I saw myself becoming someone I didn’t want to be: a trader who thinks he knows more than the market.

The System I Now Use to Filter Out Overconfidence

When I stepped away from the charts after those losses, I opened my notebook and started rewriting the rules that keep me grounded. Not new rules, just a refined version of the habits that were already working before I let ego interfere.

Here are the filters I now use to detect overconfidence before it destroys my session.

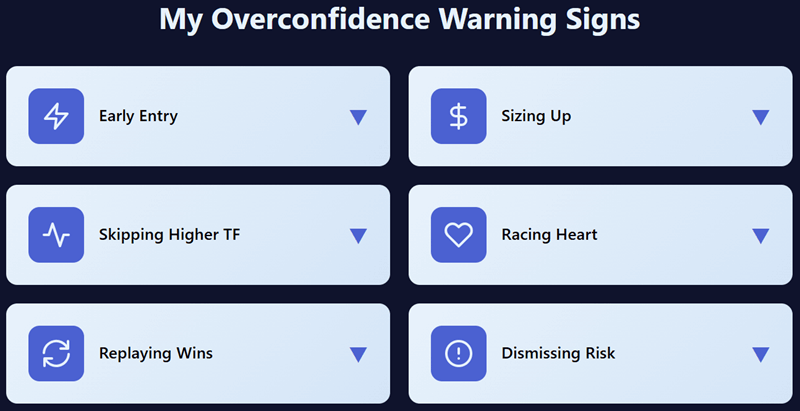

My Overconfidence Warning Signs

- I feel ready to enter early before confirmation.

- I catch myself increasing trade size out of excitement.

- I skip the higher timeframe analysis.

- I feel a subtle pressure in my chest or arms.

- The last winning trade is still replaying in my head.

- I enter within seconds of seeing a setup instead of waiting.

- I trust the last candle too much.

- I justify risks instead of measuring them.

Every time at least two of these appear, I stop trading for ten minutes.

This is what online articles usually miss. They list theories about psychology but ignore the quiet internal signals, tiny physical sensations, small behavioral shortcuts, slight shifts in how the chart looks through your eyes.

If you want another example of how I break down setups more rationally, my article on spotting reversal timing patterns covers that part in detail. That process is what confidence looks like for me on good days.

The Trade That Brought My Balance And Mindset Back To Zero

Thursday gave me a clean setup again. Not perfect, not a textbook, but clean.

GBP/USD tapped into a fresh liquidity pocket near a previous rejection area. Price slowed, created a small fake breakout, and then gave me a clear exhaustion wick. It was not dramatic. It was not fast. It was controlled.

This is where I felt something new, or rather, something old that I had forgotten.

Real confidence doesn’t feel exciting. It feels quiet.

When I entered that trade, I didn’t feel a rush. I felt a slight pause. I reviewed everything twice. I looked at the correlation with DXY. I checked the session timing. I waited for the right moment, not the first moment.

The trade won.

But the win didn’t make me smile. It didn’t raise my heart rate. It didn’t inflate anything. It simply brought my balance back to neutral and reminded me that the right way to trade feels boring in the best possible way.

This is when I finally understood the real distinction between confidence vs overconfidence in binary options trading.

Confidence is slow.

Overconfidence is fast.

Confidence is silent.

Overconfidence is loud.

Confidence respects the chart.

Overconfidence argues with it.

I wrote that in big letters at the top of my journal page.

Lessons I Wish Someone Had Told Me Earlier

If I could go back five years and give myself a note, it would be a simple one: stop assuming your mind is stable after a win. That’s where most hidden risk lies.

Here are the lessons that came out of this week, raw, unpolished, and honest.

- A win changes your behavior more quickly than a loss.

- Overconfidence shows up as speed, not aggression.

- The chart looks easier only when your mind is biased.

- You don’t notice shortcuts until they cost you.

- Confidence grows from process; overconfidence grows from memory.

- The best traders are the quietest after a win.

- If a trade feels “easy,” step back and recheck it.

- Every win should be reviewed slower than every loss.

When I cross-checked these lessons with some notes from my article about market conditions, I noticed how often I had ignored my own advice. That’s the vulnerability most traders don’t admit. And that’s why I wanted to write this entire journal-style reflection, so I don’t forget what overconfidence feels like from the inside.

Why I Trade Differently Now

By the time Friday arrived, I wasn’t trying to “make back” anything. I wasn’t trying to end the week green. I wasn’t trying to prove anything to the market or myself.

I was simply back to trading the way I should’ve been trading all along.

The irony is that confidence isn’t something you chase. It’s something that appears when you stop forcing outcomes. And overconfidence isn’t a dramatic emotional spike, it’s a quiet drift away from structure.

If there’s one thing I want anyone reading this to take away, it’s this:

The market doesn’t punish your skills. It punishes your attitude.

If you’re serious about trading with discipline and you want a clean space where your setups, not your excitement, control your entries, then open a focused account here and treat it like your trading journal’s first new page.

That’s how I’m approaching things from now on.

One page at a time. One trade at a time.

With confidence, and without the noise that almost pulled me under this week.