Binary Options Addiction Warning Signs Traders Should Notice: My Personal Journey

I never imagined I would be writing about binary options addiction warning signs. When I first started trading, I thought this was a problem for others, people who chased losses recklessly or burned accounts repeatedly. I convinced myself I was too disciplined to fall into that trap.

But addiction doesn’t always start loudly. Mine crept in through small, subtle behaviors that seemed harmless. Only later did I realize these were warning signs I needed to take seriously.

Before I dive deeper, I want to mention something practical that helped me when I finally decided to rebuild healthy trading habits. Using a structured platform made a huge difference. If you want to start trading with a more deliberate, mindful approach, consider starting trading with a platform that lets you focus on disciplined, intentional trades. It gave me the space to apply rules without emotional pressure.

The First Subtle Signs: When Trading Starts Running the Routine

One evening, I reviewed my logs and realized I had taken twenty-three trades in a day when my plan allowed only five. I hadn’t blown money, but I barely remembered half of the trades. My hand moved automatically, almost unconsciously.

That was the first whisper of a problem. Small, quiet behaviors, like checking charts during breakfast or refreshing prices mid-conversation, were creeping in. I didn’t feel out of control yet, but I was slowly letting trading dictate my schedule.

Reading about the psychology of binary options confirmed what I suspected: early addiction often begins with subtle patterns that are easy to ignore.

When Wins Feel Too Good and Losses Too Personal

A few weeks later, I noticed a troubling emotional pattern. I had a winning streak of four trades. Nothing large, just routine payouts. But after the fourth win, I felt a sense of entitlement, a desire to chase the feeling of success.

I opened another trade without proper confirmation. It lost. I opened another immediately. Another loss. My brain was trying to regain the emotional high, not the money.

That’s when I realized one of the most overlooked binary options addiction warning signs: trading for emotion, not logic.

Later, I came across a detailed guide on why greed destroys more binary accounts than strategy mistakes. I saw myself in it, the subtle pull of emotional highs, the urge to overtrade, the impatience with rules. Recognizing this pattern early was crucial.

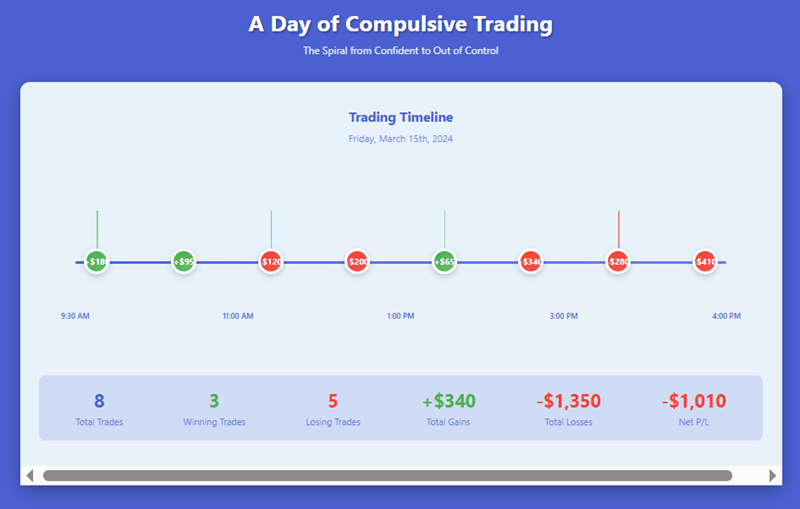

The Day I Took My First Compulsive Trade

It was a weekday session with minimal market movement. I knew there were no strong setups. I knew I should step away. Yet I placed a position anyway.

Not because of strategy. Not because of analysis. Simply because doing nothing felt uncomfortable. The trade lost, and I felt an immediate urge to “fix it” with another impulsive trade.

Compulsion isn’t always obvious. Sometimes it whispers quietly. And that whisper was one of the clearest binary options addiction warning signs I ever experienced.

Behavior Patterns That Made the Problem Visible

I created a table comparing my healthy trading patterns with the unhealthy ones. Seeing it visually made the truth undeniable.

My Real Behavior Patterns Over Time

| Pattern | Healthy Phase | Unhealthy Phase |

| Number of Trades | 4–6 per day | 15–25 without awareness |

| Session Duration | Fixed, predictable | Open-ended, impulsive |

| Emotional State | Calm, patient | Restless, urgency-driven |

| Entry Reason | Confirmed setup | Impulse or boredom |

| Response to Loss | Pause and analyze | Immediate continuation |

| Chart Checking | Only during sessions | All day, off-hours |

This wasn’t about judgment, it was about awareness. Seeing patterns side by side forced me to confront my habits objectively.

Social Withdrawal as a Quiet Warning Sign

Another subtle indicator surprised me: social withdrawal. Not dramatic isolation, just tiny shifts. Declining weekend plans because of “possible market movement,” staying glued to charts even when volatility was low.

Reading about surviving losing streaks helped me recognize that emotional fatigue and withdrawal are connected, even when you’re still profitable.

Charts became a safe space. Conversations felt unpredictable. Slowly, trading became more about comfort than strategy. Recognizing that shift was another critical early warning.

Mid-Session Reflection: Rebuilding Awareness

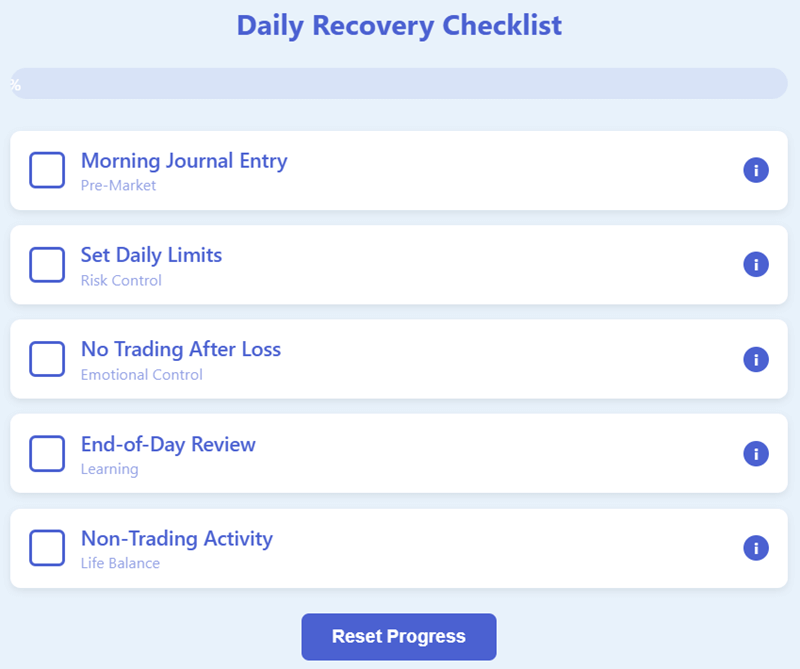

At that point, I paused deliberately and started journaling every trade with emotional notes. I documented:

- Why I entered

- How I felt

- What my reactions were after a win or loss

The clarity from journaling allowed me to see patterns I had ignored. Over time, I could identify impulsive urges before acting on them.

If you’re noticing similar early patterns, you might consider practicing structured trading through a reliable platform. It’s not about preventing losses. It’s about giving yourself space to follow rules intentionally.

How I Regained Control and Built Discipline

The real turning point came when I committed to boundaries:

- Limiting session lengths

- Mandatory breaks between trades

- Journaling every decision

- Strict pre-trade checklists

Revisiting lessons from how I built true trading discipline helped me anchor these routines. I wasn’t trying to fight the market. I was trying to manage myself.

Gradually, the compulsive urges diminished. Wins and losses felt neutral, predictable. Trading returned to being part of my life, not the center of it.

Recognizing the Mental Shifts That Indicate Risk

Looking back, the main warning signs I experienced were:

- Trading for stimulation rather than analysis

- Obsessive chart checking, even off-hours

- Emotional highs driving overtrading

- Avoiding social interactions to stay near the market

- Impulsive trades when bored

These are the subtle binary options addiction warning signs most guides overlook. Recognizing them early can prevent serious issues.

A Calm Reminder for Every Trader

Trading itself is not dangerous. The danger comes from our thoughts and behaviors surrounding it. Watching for early warning signs allows you to intervene before habits become destructive.

If you feel a shift in your routines or emotions, take action immediately. Pause. Reflect. Review your patterns.

For anyone looking to rebuild their habits safely, consider starting trading with a structured platform that prioritizes discipline and clear rules. It allows you to practice intentional trading without emotional pressure.