Get 50% Bonus

Boost your trading capital instantly

Terms and conditions apply

It started like any other session. I brewed my coffee, set up my charts, and opened the trading platform. The goal was simple: stick to my rules, follow my setups, and record everything in my trading journal. But that day, I didn’t realize just how much I would need every ounce of discipline I had been trying to cultivate.

Even before entering my first trade, I could feel tension in my shoulders. My breathing was shallow, and my mind wandered between confidence and doubt. I had read countless articles about the psychology of binary options and thought I understood the theory. But theory and reality are different. That first loss of the day was going to teach me that lesson the hard way.

I started the session by reviewing my journal from the previous week. There were notes on trades that went wrong not because of strategy, but because of emotional mismanagement. I reminded myself of two things:

I also opened the platform I use to start trading, which helps me execute trades quickly without distraction. Having a stable environment is surprisingly important when emotions are running high.

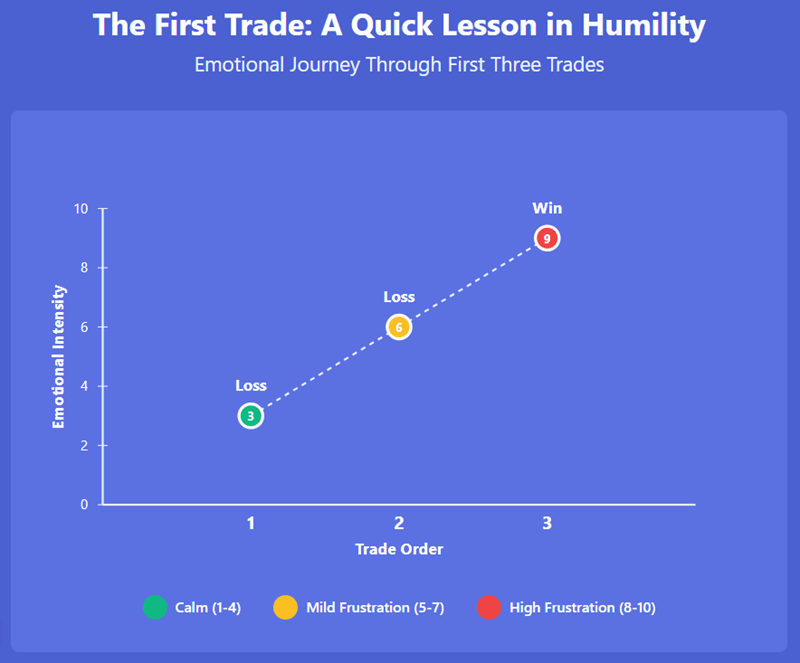

The first trade was a simple call on EUR/USD after a clear support bounce. My analysis matched my plan perfectly. But as the candle closed, the trade lost by mere seconds. I stared at the red payout flash and felt that familiar pang of frustration.

Instead of immediately trying to win it back, I paused. I wrote in my journal:

“The first loss is the easiest to recover from if I don’t chase it.”

At that moment, I realized that coping with losses isn’t about shaking off disappointment. It’s about observing how your mind reacts to the sting.

The second trade appeared on GBP/USD. I had a setup that normally warranted a high level of confidence. But my mind whispered, “You need this win to feel better.”

I could feel the pull of emotion. My heartbeat accelerated, my hands tightened on the mouse, and I almost entered too quickly. I stopped, took a deep breath, and recorded my thoughts in the journal:

“Notice the rush. Entry must wait for clear conditions.”

By consciously acknowledging the emotional bias, I prevented what could have been a revenge trade. Later, I would link this lesson to why greed destroys more binary accounts than strategy mistakes. Emotion often masquerades as strategy, and learning to separate the two is crucial.

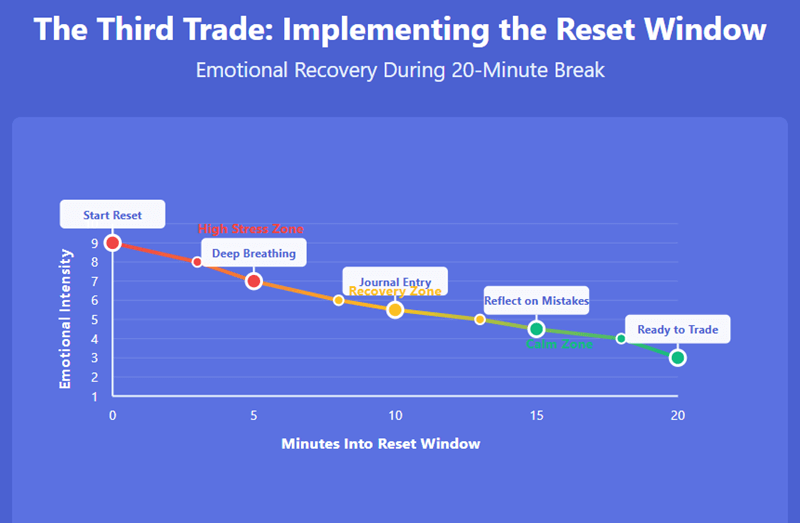

After the second loss, I realized I was on a losing streak within the session. I decided to implement my reset window: a twenty-minute break away from the charts. During this time, I walked, drank water, and reviewed my prior trades objectively.

I noted patterns:

This reinforced what I had learned from surviving losing streaks: stepping away and resetting mentally is often more powerful than immediately trying to recover losses.

Returning from the reset, I spotted a clean setup on USD/JPY. My mind was calmer, my breathing steadier, and I could follow my rules without deviation. This trade won. I recorded in my journal:

“Clarity beats urgency. One calm trade is better than three rushed ones.”

This was a turning point in the session. I realized that coping with losses was not about forcing wins but about regaining control. Observing my emotional state became as important as reading the charts.

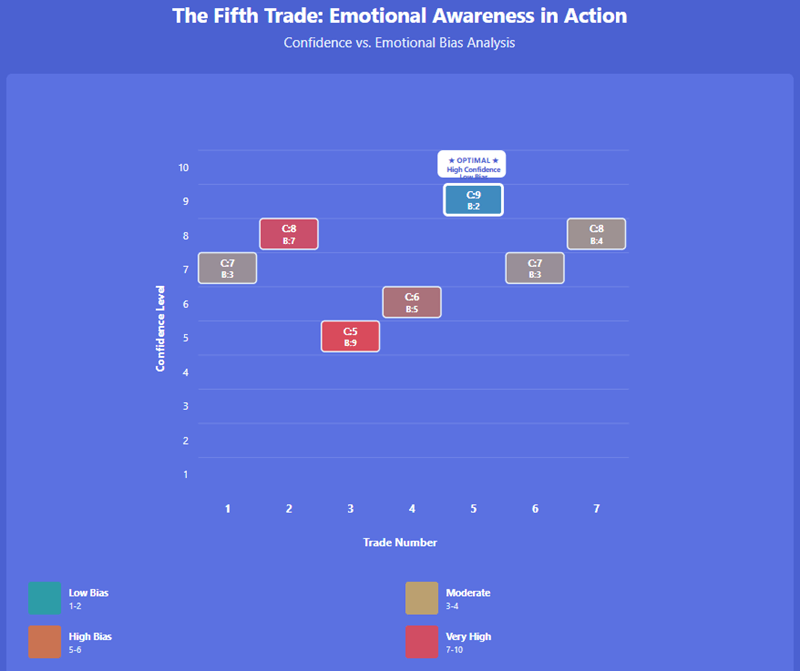

The next trade was EUR/JPY, and the setup was strong. However, I noticed subtle signs of overconfidence creeping in: slightly faster entries, reduced patience for confirmations, and a tiny urge to increase the stake.

I paused and wrote in my journal: “Confidence is not permission to bypass rules.” This reflection prevented what could have been a disastrous trade. I later connected this insight to lessons from how I built true trading discipline.

The trade went in my favor, but more importantly, the session taught me how to balance confidence without letting it turn into recklessness.

Throughout the session, my trading journal was my anchor. I recorded every trade, every thought, and every emotional reaction. This is not about logging entries mechanically; it’s about understanding your internal state and how it affects decisions.

Here’s an excerpt from my journal:

| Time | Instrument | Outcome | Emotional Note |

| 09:15 | EUR/USD | Loss | First sting, mild frustration |

| 09:35 | GBP/USD | Loss | Impulse to “fix it now” avoided |

| 10:00 | USD/JPY | Win | Calm, clear reasoning |

| 10:25 | EUR/JPY | Win | Confidence present but rules followed |

By visually capturing emotions alongside trades, I could analyze patterns objectively. It’s a technique that relates to the broader topic of the psychology of binary options.

By the end of the session, I had internalized several critical lessons about coping with losses:

I applied for these lessons immediately. Later sessions confirmed that this approach significantly reduced impulsive trades and preserved capital.

A natural step for anyone who wants to replicate this process is to open a reliable platform and start trading with a structured approach. A stable execution environment makes these mental strategies effective.

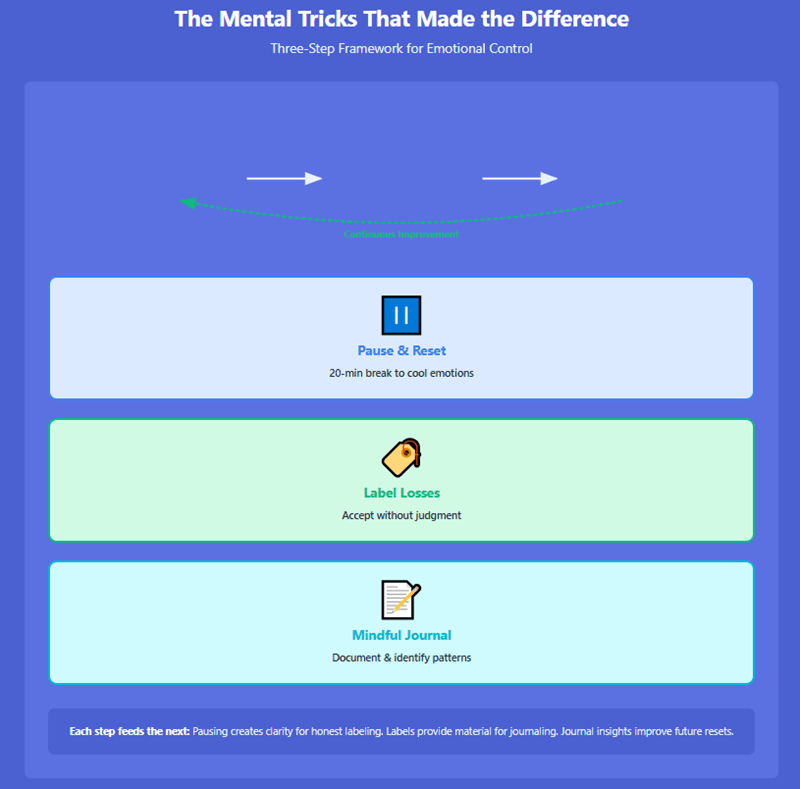

From this single session, three mental tricks became the foundation for surviving losses:

These techniques are interconnected. Practicing one without the others only gives partial protection. Using all three together is what ultimately saved my account that day.

By the session’s end, I wasn’t celebrating the wins. I was reflecting on the growth. I had learned to watch my emotional patterns, apply mental tricks in real-time, and use my journal as a mirror for my own behavior.

If you want to start trading with a focus on discipline and emotional awareness, doing so on a stable platform allows you to implement these lessons practically. This subtle step can dramatically improve your ability to manage stress, maintain clarity, and ultimately survive the inevitable losses.

By treating losses as signals and applying mental tricks consistently, this single session became a blueprint for future trading. Coping with losses is not just a mindset, it’s a skill you can develop systematically.