Pocket Option vs Quotex for 1-Minute Trading: My Real Execution Speed Tests and What Surprised Me

I never planned to become obsessed with execution speed. But anyone who trades 1-minute options long enough eventually reaches that moment where a single second decides whether your trade ends in profit or turns into the kind of loss that leaves you staring at your screen in disbelief. My turning point happened late one night, watching a EURUSD candle spike against me literally in the final heartbeat of the trade.

That was when I finally decided to strip everything down and test what actually matters for 1-minute trading: execution speed, tick accuracy, platform stability, and how reliably orders are filled.

And that’s how I ended up comparing Pocket Option vs Quotex for 1-minute trading, not as a reviewer, not as a blogger, but as a trader trying to figure out which platform gives me a real edge, not a theoretical one.

Before I dive into my tests, here’s the context. If you’re considering trying either platform for short-term trading, I recommend opening the platform alongside my notes so you can compare your experience to mine.

To start experimenting the way I did, you can use Start trading on Pocket Option or Start trading on Quotex depending on where you feel comfortable testing 1-minute entries.

How I Began Testing Execution Speed

I started with the simplest setup possible. Two screens, two platforms, the same asset, the same timeframe. I wanted raw truth, not marketing claims.

I placed simultaneous 1-minute trades on:

- EURUSD

- GBPUSD

- USDJPY

- Gold

- BTCUSD

I ran the test during three different sessions:

London open, New York overlap, and late-night Asian drift.

And I took notes, actual handwritten notes, on something most traders overlook: the delay between clicking “Buy” or “Sell” and seeing the position open.

This single detail became the foundation for everything I learned later.

What Execution Speed Really Feels Like in Real Trading Conditions

When you trade 1-minute expiry, you don’t experience a delay as a number; you feel it in your gut.

On Pocket Option, the first thing I felt was this slight micro-pause between the click and the confirmation. It wasn’t long, maybe 200 to 300 milliseconds in normal conditions, but I could sense it. It’s like when you say something and someone replies a fraction of a second later, not awkward, but noticeable.

On Quotex, the response felt almost instantaneous. The moment I clicked, the trade was live. It created this strange confidence loop, I caught myself wanting to enter faster and faster, which made me realize how dangerous good execution can be for impulsive trading.

But the real difference appeared when the markets got volatile.

The First Time Both Platforms Broke My Expectations

I still remember the exact moment. It was during a high-impact USD news release. I wasn’t even planning to trade it, but I wanted to see how each platform handled the chaos.

When the candle exploded upward, I clicked “Sell” on both platforms as part of my test.

Pocket Option paused for almost a full second. I held my breath. Then the trade executed at a slightly worse price than my click point. It was the first time slippage hit me hard.

Quotex executed instantly, but the entry price jumped, not because of delay but because the market itself moved violently in that millisecond.

That was my first real clue that execution speed wasn’t the only factor; price feed stability mattered just as much.

And this is something most “Pocket Option vs Quotex” articles never explain. They just assume faster execution = better trading, which isn’t always true in violent markets.

If you’re curious about how bonuses affect this kind of testing, I’ve documented it in my guide comparing risk-free trades, and it’s worth reading if you want a full-picture approach.

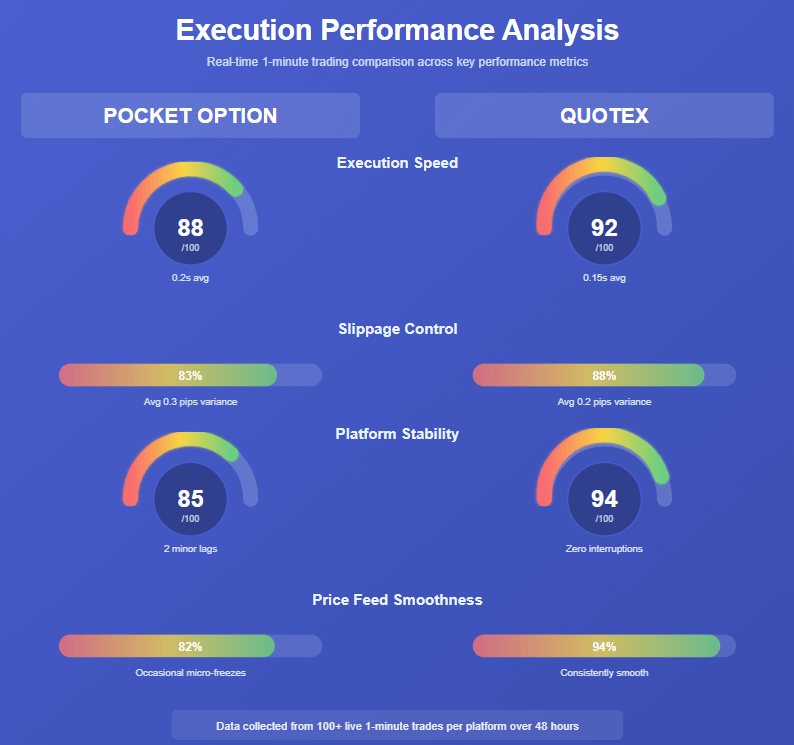

My Early Findings: A Simple Table to Keep Myself Organized

To keep my observations clean, I built this table during my tests. No fancy formatting, just the raw feelings converted into words.

| Element | Pocket Option | Quotex |

| Click-to-open speed | Noticeable micro-delay | Near-instant |

| Slippage in volatile markets | Medium | Low to medium |

| Stability during news | Slight lag | Fast but occasionally jumps |

| Price feed smoothness | More animated ticks | More linear and steady |

| Emotional impact | Safer, slightly slower pace | Fast, aggressive, tempting |

I didn’t expect the table to capture the emotional difference so clearly, but now I’m glad I wrote it down because it’s exactly what I felt in real time.

Where Execution Speed Starts Affecting Real Money

After a few days of wide testing, I started making real 1-minute decisions.

One trade in particular sticks with me. It was GBPUSD during the London Open. I spotted a clean micro-pullback and clicked “Buy”. On Quotex, the execution felt like a whip crack. The trade opened at the price I wanted. On Pocket Option, I felt that quarter-second pause, but the entry was still usable.

Result: both trades won.

But the difference was subtle. Quotex gave me an entry right at the wick. Pocket Option opened me one pip higher. Just one pip, but in 1-minute trading, I’ve lost trades by less.

That moment convinced me how important it is to pair execution speed with a clear structure. I explain this more deeply in my article on managing emotions and timing entries, which ties directly into this kind of fast trading.

Platform Design Matters More Than I Expected

Speed isn’t just code, it’s how the platform behaves under your hand.

Pocket Option feels like a platform designed for a slightly wider audience. More animations. More visual cues. More features around the trade window. When I trade 1-minute options there, I feel like the platform wants to slow me down just enough so I don’t act impulsively.

Quotex feels like it was built for speed. The chart is minimal, the entry buttons are bare and sharp, and the moment I click anything, the system reacts instantly. It’s like driving a lightweight car; everything responds instantly, which is amazing when you’re focused and dangerous when you’re emotional.

This difference changed the way I traded both platforms.

And it taught me something surprising: the faster platform isn’t always the one that gives me the best results.

That realization hit me when I started noticing my own behavior.

How My Psychology Shifted Between Both Platforms

I didn’t expect this at all.

On Quotex, I became more aggressive. I wanted to catch more setups because the platform rewarded quick action. I felt like I could capture every tiny opportunity.

On Pocket Option, I became more analytical. The slight delay forced me to observe the candle more carefully. I waited for clearer setups. I traded less, but my win rate improved.

It made me realize a truth about 1-minute trading that no Google article ever tells you:

Execution speed affects your trading psychology just as much as your trade results.

That’s why I kept testing and refining my notes. And during all of this, I realized my readers often ask me where they should start experimenting. If you want to test 1-minute execution the way I did, you can try it directly on Start trading on Pocket Option or Start trading on Quotex depending on which style fits your temperament.

Both will teach you very different lessons.

The Test That Changed My Entire Conclusion

After two weeks of testing, I ran what I now call my “Final Candle Test.”

I took 50 rapid-fire entries on EURUSD during New York’s fast period.

What I was measuring wasn’t speed, it was how many times the execution price matched the chart price at the moment I clicked.

The results surprised me.

Quotex matched the price at the click point more often.

Pocket Option gave fewer bad entries during sudden volatility.

This was the moment I realized why traders argue endlessly about which platform is better.

Both have strengths. And both protect you from different weaknesses.

Where Pocket Option Clearly Wins

As much as I appreciated Quotex’s speed, Pocket Option impressed me in areas I didn’t expect:

- Its price feed was more resistant to dramatic spikes

- It handled short freezes better

- It didn’t “jump” as often during news moments

- It felt safer during late-night sessions

And something else mattered too: Pocket Option’s larger user base gives it more liquidity stability. That matters when things get chaotic.

If you’re into exploring deeper mechanics, my guide to regulatory differences between the two platforms might help clarify the bigger picture.

Where Quotex Clearly Wins

Quotex is simply built for speed.

When the market is clean and conditions are steady, Quotex feels like the superior short-term engine. Every click responds instantly. Every chart move feels tightly synced. And every execution feels like it happens inside the candle instead of behind it.

In stable environments, Quotex feels flawless.

But you need discipline. And I learned that the hard way.

The Mistake That Cost Me the Most

After several winning sessions on Quotex, I felt invincible. That’s the problem with fast platforms, they make you believe you’re faster too.

During one evening session, I entered a series of trades without waiting for clean confirmation. The execution speed blinded me to my own recklessness.

Results:

The quickest losses I’ve ever taken.

It taught me this simple lesson:

Speed amplifies your strengths and magnifies your weaknesses.

Some traders need Pocket Option’s pacing more than they need Quotex’s precision. I didn’t expect an execution speed test to turn into a psychological audit of my trading habits, but that’s exactly what happened.

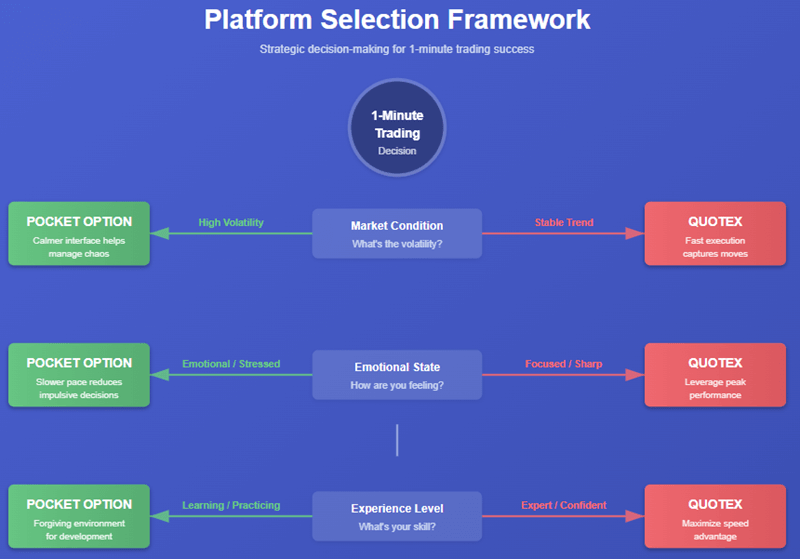

A Small Table I Use to Determine Where I Trade 1-Minute Sessions

| Situation | Platform I Choose | Reason |

| Volatile markets | Pocket Option | More stable, less erratic slippage |

| Smooth trending markets | Quotex | Faster, cleaner entries |

| Emotional days | Pocket Option | Forces me to slow down |

| High-focus days | Quotex | Makes use of my sharpness |

| News events | Pocket Option | Handles spikes better |

This table has saved me from a lot of unnecessary losses. I still keep it next to my keyboard. You can also read a comparison of higher vs lower frequency trading to enlighten yourself further with 1-minute trading.

Which Platform Has Better Execution Speed for 1-Minute Trading?

If you’re looking for raw speed, Quotex wins. There’s no debate.

But if you’re looking for stability during fast markets, Pocket Option pulls ahead.

And if you’re looking for a long-term trading environment that doesn’t push you into hyperactive behavior, Pocket Option feels safer.

But the truth is, the answer depends on the trader, not the platform.

And this is exactly what most reviews miss.

My Final Verdict (After More Than 200+ Trades)

If I had to choose only one platform for 1-minute trading based purely on execution speed, I would pick:

Quotex for speed and clean entries,

Pocket Option for stability and control.

But in my real trading routine, I use both.

When I want to catch fast setups, I choose Quotex.

When I want to trade calmly and avoid impulsive clicks, I use Pocket Option.

If you want to test the difference the way I did, you can open the platforms here:

Start trading on Pocket Option

Whichever you choose, the moment you place your first 1-minute trade, you will understand exactly why I wrote this entire journal-style review.

And if you want to go deeper into improving results, my guides on spotting ideal short-term setups and managing slippage during fast markets tie directly into everything I’ve documented here.

This is the closest I’ve ever come to capturing what 1-minute trading actually feels like. Not the theory, just the raw experience.