Quotex Trading Secrets: Insider Tips for More Wins

If you’ve been trading on Quotex for a while but still feel like you’re stuck in the same cycle; win, lose, win, lose, it’s not just you. I was in the same spot. But then I started digging deeper, far beyond what typical YouTube videos or Google guides show. And what I found changed everything. In this guide, I’ll walk you through the lesser-known tricks, the hidden indicators, insights from seasoned Quotex traders, and my own checklist that helped me turn my trades around.

How I Discovered the Hidden Side of Quotex

Most people use Quotex like a coin toss. They open a chart, slap on RSI, and make a call. I used to do the same. But I got tired of guessing. So I started asking questions. What are pro traders doing that I’m not? Are there tools buried in the platform that I haven’t noticed? The short answer, yes. And once I started using them, my win rate improved dramatically.

Let me share everything with you.

Lesser-Known Quotex Trading Hacks

These aren’t your average “use RSI + MACD” kind of tips. These are things most people either overlook or have no idea about.

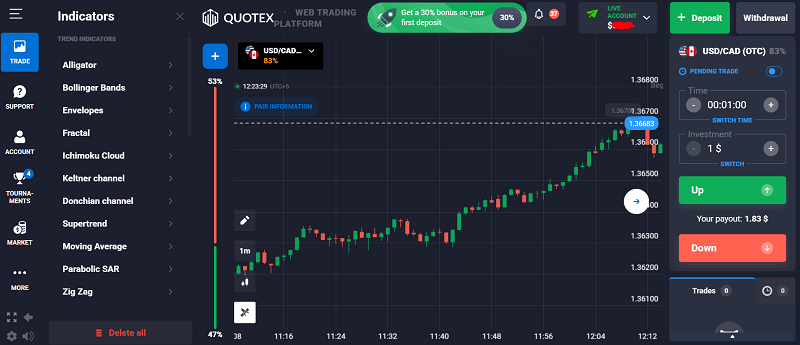

Hidden indicators most traders miss

Quotex offers more indicators than most traders use. Some of the most overlooked ones are actually powerful.

- Alligator: It’s not just a trend-following tool. When the lines tighten and cross, it often signals the end of a range and the start of a breakout.

- Parabolic SAR: Not just for trailing stops. Use it as a reversal signal when paired with Bollinger Bands.

- CCI (Commodity Channel Index): It’s better than RSI for detecting momentum in short bursts. Ideal for turbo trades.

- Fractals: Spotting local highs and lows becomes easier. Combine with Alligator for a strategy Bill Williams himself would be proud of.

I didn’t even know half of these existed until I spent an entire weekend just clicking through every option on the platform.

Want to try these indicators in action? Open a free Quotex demo account and start testing them now.

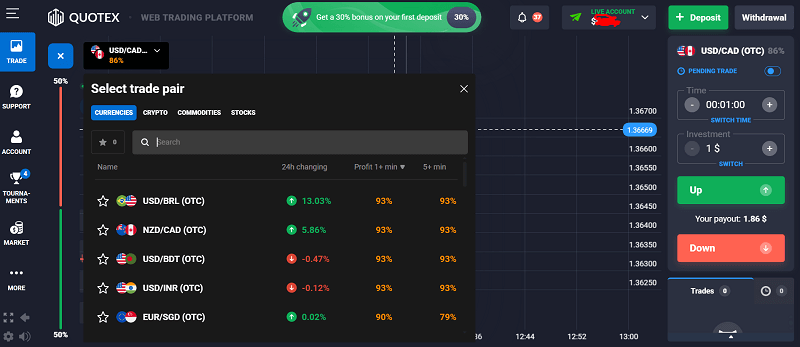

Payout boosts that happen at specific times

Quotex payouts are dynamic. I started tracking them. I noticed that payouts on EUR/USD would shoot from 80% to 93% between 2 PM and 4 PM (GMT). Why? Because that’s when the London and New York markets overlap.

Here’s what I learned:

- Asset-specific spikes: Some assets consistently pay more at specific hours.

- Low volatility = lower payout: Avoid trading in the Asian session unless you’re working with JPY pairs.

- Fridays before market close: Payouts can drop fast due to thinning liquidity.

Use demo mode to track payout behavior over 3–5 days. You’ll start spotting a pattern.

Time your trades right. Sign up on Quotex and watch how payouts vary through the day.

Custom timeframes – yes, you can do that

Most traders stick to 1m, 5m, 15m charts. But Quotex lets you enter custom timeframes like 33 seconds or 75 seconds. You just click on the timer and type in the number.

Why does this matter?

Because news events or scalping setups don’t always align perfectly with 60 seconds. I found that 45s entries often gave me better confirmation on fakeouts.

Shortcut keys no one talks about

Few people know this, but:

- Press R to refresh assets instantly

- Use ← and → keys to scan past price action faster

- Double-click on chart to switch color themes (dark vs light)

Not game-changing alone, but when you’re trying to make snap decisions, even small efficiency gains help.

Insights from Top Quotex Traders

I connected with a small community of serious Quotex traders on Discord and Telegram. These aren’t your typical “signal sellers.” These are people who’ve been quietly making consistent profits for over a year. Here’s what they shared with me.

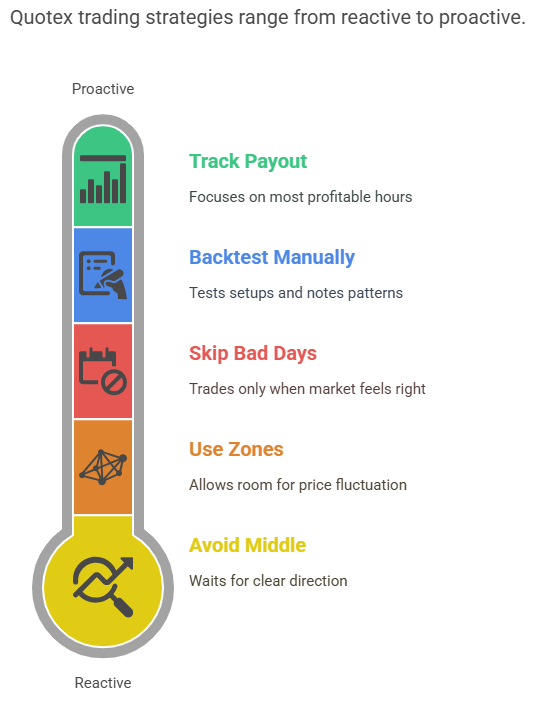

1. They use zones, not lines

Instead of drawing perfect support/resistance lines, they draw zones, areas where price reacted multiple times. It gives breathing room for the trade to play out.

2. They avoid the middle

One trader told me this, and it stuck: “Never enter when price is in the middle of the range.” Why? Because direction is unclear. They only enter at the edges, breakouts or bounces.

3. They don’t trade every day

This one shocked me. The best traders skip bad days. If the market feels off, they walk away. One guy said he only trades Tuesdays to Thursdays. Mondays and Fridays are for review.

4. They backtest manually

Instead of relying on bots or tools, they manually test setups on the Quotex demo. They take screenshots, note results, and look for patterns. It’s slow, but it works.

5. They track payout history

Several traders keep a log of payout variations for their top 3 assets. This helps them avoid low-payout hours and focus when it’s most profitable.

My Winning Trade Execution Checklist

After months of trial and error, I came up with a checklist that forces me to stay disciplined. This is what I use before every trade:

Pre-Trade Checklist

- Is there a clear trend or range?

- Are we near support/resistance zones, not just lines?

- Are 2 or more indicators confirming the move?

- Is the payout above 80%?

- Is this an edge or middle of the range?

- What session is it? (Avoid low-volatility hours)

- News event nearby? (Check forexfactory or investing.com)

- Is the timeframe clean? (No overlapping candles or noise)

During the Trade

- Timer set with margin (avoid cutting it close to expiry)

- Stay off the mouse, no mid-trade panic

- Breathe, don’t check profit until after expiry

Post-Trade

- Screenshot the setup

- Note outcome: win/loss, why

- Move on, don’t revenge trade

If I skip any step, I usually lose. Discipline is 70% of the game.

Most Asked Questions

How do I increase my win rate on Quotex?

Focus on zone trading, avoid low-payout hours, and use CCI or Parabolic SAR instead of standard RSI.

What is the best time to trade on Quotex?

London–New York overlap (2 PM–4 PM GMT) gives best payouts and volatility. Avoid late Fridays and early Mondays.

Are Quotex signals reliable?

Use them for inspiration, not confirmation. They don’t account for market context.

Can I trade with $10 and still win?

Yes, but focus on learning and compounding. Don’t expect to double your account in a day.

Is Quotex manipulation real?

If you feel price behaves strangely, it’s often due to low-liquidity hours. Stick to major pairs and overlap sessions.

Why do I lose more on weekends?

Weekend OTC markets are synthetic. They don’t follow live price action and can be riskier. Trade them only with tested setups.

Secret Setup That Works (Don’t Tell Everyone)

Here’s one setup I use that wins more than 70% of the time:

- Asset: EUR/USD

- Time: 2 PM GMT

- Indicator: Bollinger Bands + CCI (14)

- Entry: When price hits upper band AND CCI > +100 → Enter put

- Expiry: 60 seconds

- Only enter at London/NY overlap

Test it on demo first. You’ll be surprised.

Final Thoughts

Winning on Quotex isn’t about gambling or using 5 signals from Telegram. It’s about understanding what the platform offers beneath the surface. Once I started tracking payouts, testing non-standard indicators, and following strict entry rules, everything changed. It’s not about luck. It’s about leverage, the kind you get from information others ignore.

If you’re still trading with guesswork, it’s time to level up.

Start Trading Smarter

Quotex offers a powerful platform if you know how to use it. Use the tricks and strategies I’ve shared here to step up your game. Don’t just trade, trade smart.