Pocket Option Copy Trading: How to Profit from Experts

I still remember the first time I opened the copy trading page on Pocket Option. My heart raced a little. The idea that I could just click a button and have a pro trader make money sounded almost too good to be true. But like most things in trading, the reality was a little deeper than just “click and get rich.”

Over time, I learned how to use copy trading the right way. I also saw mistakes that cost me and others a lot of money. Today, I’ll share everything; the good, the bad, and the ugly. So, you can use Pocket Option copy trading like a real pro.

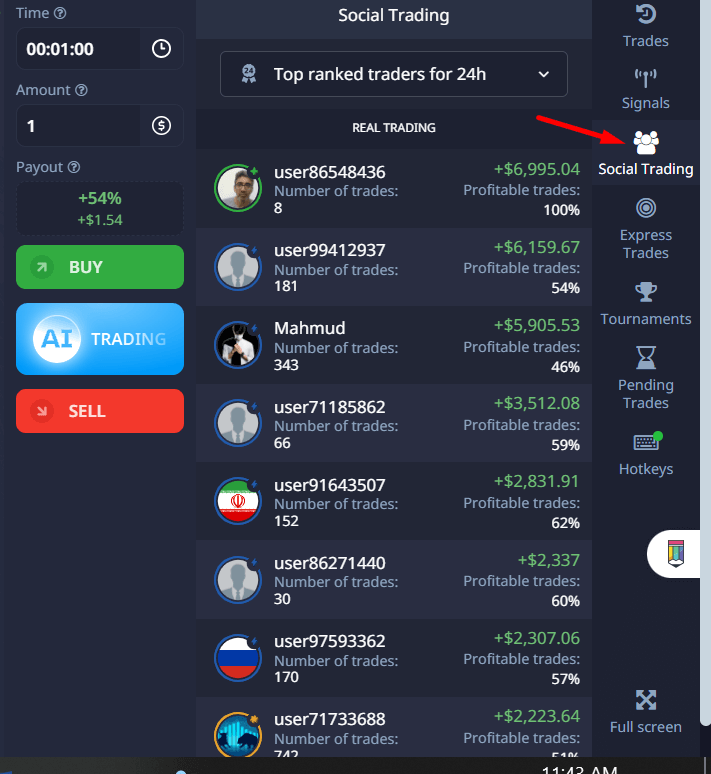

How Copy Trading on Pocket Option Works

At its core, copy trading is very simple. Instead of making trades yourself, you pick a trader on Pocket Option’s leaderboard and automatically copy their trades into your account.

When they open a trade, your account opens the same trade. When they close a trade, your account closes it too. You can choose how much money to allocate per trade or day. You can stop copying anytime you want.

It feels like hiring someone to trade for you. But you still control the risk, the trader selection, and when you start or stop.

There are two main ways you can start:

- Browse the Top Traders section inside Pocket Option.

- Use filters like profit% %, number of followers, total trades, or risk level.

- Click “Copy” next to a trader you like.

- Set your copying amount and risk settings.

But this is where most beginners make their first mistake: they pick the guy with the highest profit percentage.

That’s dangerous.

New to Pocket Option? Start with $5, copy safely, and grow from there. Sign up through our link and unlock a bonus to test copy trading without extra risk.

What No One Tells You About Picking the Best Traders to Copy

Let me tell you a quick story. In my first week on Pocket Option copy trading, I found a trader who had made 800% profit in one week. I thought, “This guy is a genius!” I immediately copied him.

In two days, he blew half my balance.

I learned the hard way that the highest return does not mean the best trader. Some traders go all-in on risky trades, win big for a while, then crash and burn.

Here’s what I learned to look for instead:

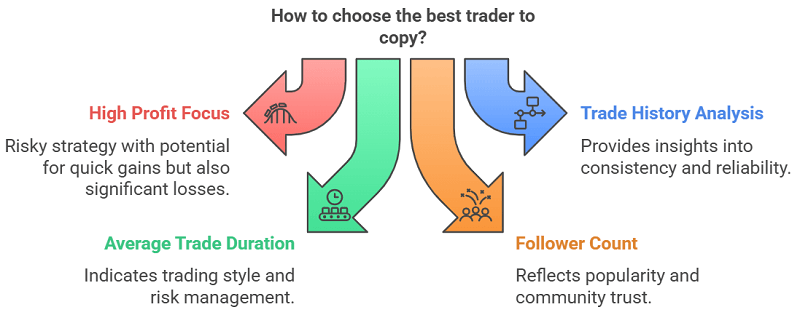

1. Look at Their Trade History, Not Just Their Profit

Don’t just stare at the % gain. Open their profile. Check:

- How many trades have they made? (More is better for judging skill.)

- How long have they been trading? (Weeks or months matter.)

- Are their profits steady or up and down wildly?

Consistency beats lucky streaks every time. Keep an eye on the performance through broker’s mobile app.

2. Watch Their Average Trade Duration

If a trader holds trades for only a few seconds or minutes, they are scalping. Scalping can be exciting, but it’s very risky, especially with high leverage. Look for traders with trade durations that match your risk appetite.

3. See How Many Followers They Have

Traders with many followers tend to be more stable. If a trader is copied by hundreds of people, it’s a small vote of trust. But don’t rely only on this. Some new but skilled traders might have fewer followers.

4. Check Their Maximum Drawdown

Drawdown means how much money the trader lost at their worst moment. A high drawdown shows risky behavior. I prefer traders whose maximum drawdown is below 30%.

5. Study Their Risk Level

Pocket Option sometimes labels traders with risk levels. Low-risk traders are safer to copy long-term. High-risk traders may get you fast profits, but can also cause fast losses.

6. Trust But Verify

Even after picking a trader, watch their performance every day, especially at the start. Don’t be afraid to stop copying if you notice strange behavior. It’s better if a master trader mentions what indicators or strategies he applies.

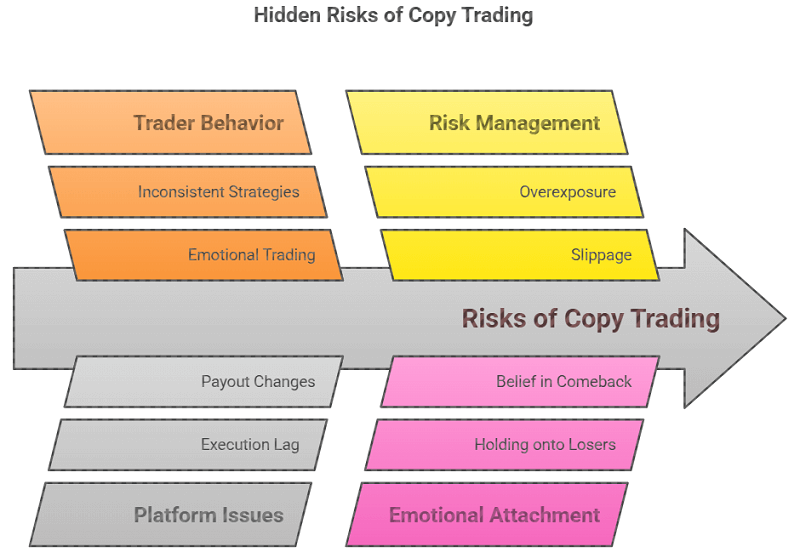

Risks of Copy Trading That No One Warns You About

Most platforms will tell you, “Copy trading is easy and profitable.” But I want to be real with you. Here are the hidden risks that I personally experienced:

1. Traders Can Change

A trader who was conservative yesterday might get emotional tomorrow and start gambling. Copying is not “set and forget.” You need to check regularly.

2. Pocket Option Platform Risks

Sometimes, execution might lag by a few seconds. Especially in high volatility moments, your copied trade might not enter at exactly the same price.

3. Overexposure

If you copy several traders who trade the same asset (like EUR/USD), your risk gets concentrated. If EUR/USD has a bad day, you lose double or triple.

4. Slippage and Payout Differences

The payout rates change frequently on Pocket Option. If a copied trader opens a trade when payouts are high but yours are low, your final profit might be different.

5. Emotional Attachment

It’s easy to get emotionally attached to a trader. I once held onto a losing trader for weeks because I believed “he’ll come back.” He didn’t. Don’t marry a trader.

Want to reduce copy trading risks? Use our vetted list of steady traders with low drawdown and consistent returns, get it free with your Pocket Option account setup.

How I Built a Safer Copy Trading Strategy

After losing some money and learning these lessons, I built a small system for myself. Here’s how I copy trade now:

- Start small (like $10-$20) with a new trader.

- Copy a maximum of 3 traders at a time.

- Diversify between different asset types (Forex, Crypto, Commodities).

- Use Stop Loss settings if available (to cut losses early).

- Review every 2-3 days and adjust.

- Accept that even the best trader can have bad days.

It’s not about winning every trade. It’s about surviving and growing steadily.

FAQs About Pocket Option Copy Trading

How much money do you need to start copy trading on pocket option?

You can start with as little as $5. But I recommend starting with at least $50-$100 so you can properly spread your risk across multiple trades.

Is copy trading on pocket option safe?

It’s safer than random trading, but it still carries risks. You can lose money if the trader you copy performs poorly. Always monitor your account. Contact customer support for any technical issues.

Who are the best traders to copy on pocket option?

It changes often. Look for traders with steady profits, low drawdowns, and a decent following. Avoid chasing traders with very recent high profits.

Can you lose money copy trading?

Yes. There’s no guarantee of profits. Copy trading reduces your effort but not your risk.

How to stop copy trading?

Go to your Copy Trading Dashboard inside Pocket Option and click “Unfollow” or “Stop Copying” on any trader you want to disconnect from.

Final Thoughts: Is Pocket Option Copy Trading Worth It?

If you do it smartly, copy trading on Pocket Option can be a fantastic way to grow your account while learning from better traders. It’s like having a shortcut while still being in the driver’s seat.

But you must treat it seriously. You must manage risk. You must watch your traders regularly.

There is no such thing as a 100% guaranteed trader. Even the best have losing days. Your real power is choosing who to trust, setting smart limits, and adapting quickly.

I use Pocket Option copy trading almost every week now, but with discipline. Not with blind hope. And that’s the big secret no one tells you.

If you follow this guide, you’ll be ahead of 90% of beginners who jump in blind.

Good luck, and trade smart.

Ready to try copy trading with a smarter strategy? Open your Pocket Option account today and start copying like a pro, bonus included for first-time users