Quotex Trend Trading: The Easiest Way to Win More Trades

I remember the first time I discovered the power of trading with the trend on Quotex. I was frustrated, hopping between different strategies, such as reversals, breakout scalps, and even martingale systems. But nothing gave me consistent results. Then one day, I stumbled across an old trading book that repeated a simple truth: “The trend is your friend… until it ends.” I initially ignored it, but after a string of losing trades, I decided to test this “trend-following” idea. What happened next changed everything.

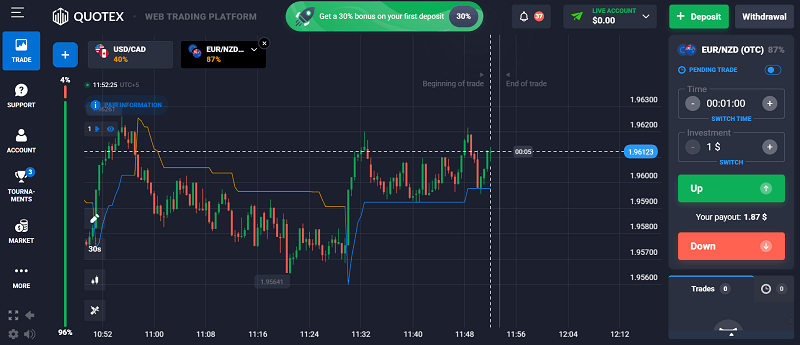

Trading trends on Quotex is one of the easiest ways to boost your win rate. Suppose you know how to confirm a genuine trend and distinguish it from false ones. In this guide, I’ll share how I built a trend-following strategy that consistently wins, the indicators that confirm trends, real trade examples, and when to stay out of the market.

If you’re struggling to stay profitable or feeling lost in the noise of all the strategies out there, this might be the reset you need.

What is a Trend in Quotex Trading?

In the simplest terms, a trend is the general direction the market is moving. If prices are mostly moving up, it’s an uptrend. If they’re driving down, it’s a downtrend. Sideways? That’s a ranging or consolidating market.

Quotex makes it super easy to spot trends visually. Open any chart, switch to the 1-minute or 5-minute timeframe, and you’ll usually see clear waves up or down. But relying on your eyes alone can be misleading. The market often deceives us. That’s why trend indicators matter.

Why Trend Trading Works So Well on Quotex

Quotex is a binary options platform. You’re betting on whether the price will be higher or lower after a specific time. In a trending market, the price often continues moving in the same direction. This makes trend trading ideal for trades with expiries ranging from 1 minute to 15 minutes.

Most new traders on Quotex try to catch reversals. But reversals fail more often than trends. That’s the trap. Once I started following the existing direction instead of fighting it, my win rate jumped from 40% to over 70%.

Best Trend Confirmation Indicators for Quotex

You don’t need 10 indicators. Just 2 or 3 good ones are enough. Here are my go-to tools for trend confirmation:

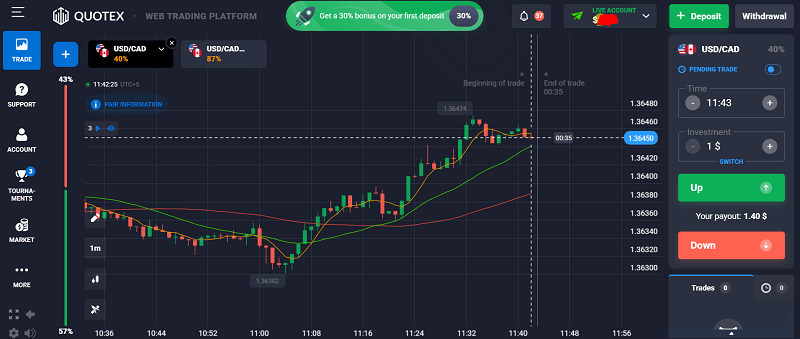

Moving Averages (MA)

Moving averages smooth out price action, helping you see the overall direction. I use:

- EMA 50: Long-term trend direction

- EMA 20: Short-term momentum

- EMA 5: Entry trigger

If the 5 EMA is above 20, and 20 is above 50, we’re in a strong uptrend. The reverse is true for downtrends. It’s clean, visual, and reliable.

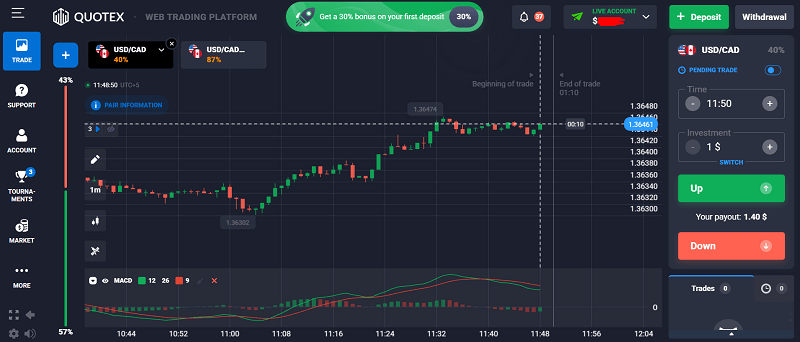

MACD (Moving Average Convergence Divergence)

MACD helps confirm if the trend has momentum. I use the standard 12, 26, 9 settings.

- When the MACD line crosses above the signal line, it confirms a bullish trend.

- When it crosses below, it confirms a bearish trend.

Use MACD to avoid getting in too late. It shows whether momentum is still alive or fading.

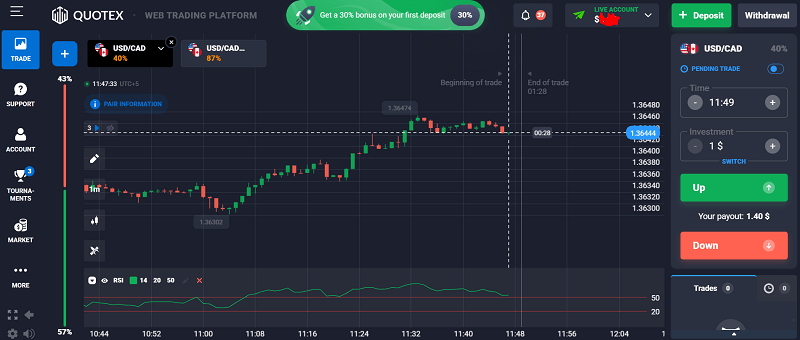

RSI (Relative Strength Index)

RSI isn’t strictly a trend indicator, but it helps confirm the strength of a trend.

- RSI above 50 in an uptrend = solid confirmation

- RSI below 50 in a downtrend = more confidence

Avoid trades when RSI is too close to 50. That’s when markets go sideways.

Supertrend

This one is underrated. It plots a dynamic trend-following line right on the chart. When the price is above it, the trend is up. Below it? Down.

Use Supertrend with EMAs and MACD, and you’ve got a powerful trio.

Real Examples of Trend Trading on Quotex

Let me walk you through a recent EUR/USD trade I took.

- Timeframe: 1-minute chart

- Expiry: 3 minutes

- Indicators: EMA 5, EMA 20, MACD

Around 10:35 AM, I saw the EMA 5 cross above the EMA 20. MACD also flipped bullish. I entered a “Higher” trade and set my expiry for 3 minutes. The price kept climbing, and the trade ended in a profit. I repeated this three more times that session. 3 wins, one loss.

Another trade: GBP/JPY. The price was falling hard. EMA 5 below 20, 20 below 50. MACD red, RSI below 40. I entered “Lower” trades every time the price pulled back to the 5 EMA. 4 wins in a row.

This works because trends tend to continue more than they reverse, especially in the short term.

How to Know When NOT to Trade Trends

This is where most people typically make mistakes. They see indicators aligned and jump in… but the market is flat.

Here’s when I avoid trend trades:

- RSI between 45-55: No clear direction

- MACD flat or showing low histogram bars: No momentum

- EMAs squeezed together or crossing frequently: Choppy market

- Price stuck between support and resistance: Consolidation zone

Additionally, avoid trading trends during high-impact news events (such as NFP or interest rate decisions). The price can whip both ways and kill your setup.

How to Build Your Own Quotex Trend Strategy

Let me share the exact framework I follow every day:

Step 1: Identify the Trend

Use the EMA 50 and EMA 20 to identify the overall trend. Price above = uptrend. Price below = downtrend.

Step 2: Confirm Momentum

Check MACD and RSI. Ensure momentum aligns with the prevailing trend.

Step 3: Wait for Pullbacks

Don’t buy or sell right away. Wait for the price to pull back to EMA 5 or EMA 20. That’s your best entry point.

Step 4: Time the Entry

When MACD turns again in trend direction, or when price bounces off EMA 20 with a strong candle, take the trade.

Step 5: Choose the Right Expiry

Use 2x the pullback candle’s timeframe. For 1-minute candles, use a 2–3-minute expiry. For 5-minute charts, try 10–15 minutes.

Common Mistakes in Trend Trading

I made all of these. You don’t have to.

- Entering too late after the trend is exhausted

- Using trend indicators during consolidation

- Adding too many indicators

- Chasing price after a big candle

- Trading trends in news volatility

Avoid these, and you’ll instantly level up.

Advanced Tip: Use Multi-Timeframe Confirmation

This is something that not many Quotex traders discuss. If you’re trading on the 1-minute chart, check the 5-minute first. If the 5-minute chart shows the same trend, your 1-minute setup is stronger.

When I started doing this, I avoided a lot of fakeouts.

How to Practice This Strategy

Quotex has a free demo account. Use it. Don’t test this on real money right away.

- Open demo

- Set the chart to 1-minute

- Add EMA 5, 20, 50

- Add MACD

- Add RSI

Then trade for a week. Track your results. Only go live when you achieve a win rate of at least 60% in the demo.

Quotex Makes Trend Trading Easy

Honestly, I’ve tried many brokers. Quotex stands out for its smooth charting, fast order execution, and responsive platform. If you’re not already using Quotex, this strategy won’t be as effective elsewhere.

Ready to try trend trading on a platform built for speed and clarity?

Sign up on Quotex now and get a deposit bonus. Test this strategy risk-free and see the results for yourself.

Start Trend Trading on Quotex Now

FAQs

What is the best time to trade trends on Quotex?

Early sessions, such as the London Open (9 AM PKT) or New York Open (6 PM PKT), exhibit stronger trends due to higher volume. Avoid weekends and late nights.

How do I know a trend is ending?

Watch for RSI divergence, MACD weakening, and price breaking below EMA 20 or 50. A strong candle in the opposite direction can also signal a reversal.

Can I use Bollinger bands for trend trading?

Yes. When bands widen and prices hug one side, it’s a strong trend. But combine with EMA or MACD for better confirmation.

How many trend trades should I take daily?

Two to five high-quality setups are sufficient. Don’t overtrade. Wait for clean trends and strong pullbacks.

Should I follow trends on higher timeframes?

Yes, for confirmation. Use 5-minute or 15-minute charts to validate your 1-minute entries. Multi-timeframe trend alignment improves accuracy.

Final Thoughts

I wasted months chasing reversals and complicated systems. But once I focused on trend trading, things changed. Fewer trades. Higher win rate. More confidence. Quotex is the perfect platform for this approach, fast, simple, and reliable.

If you want to stop guessing and start growing, trend trading is the way. Master it, and you’ll never look at the charts the same way again.

Create your free Quotex account today and get started with this trend strategy. The earlier you start, the faster you learn.