Pocket Option Trading Psychology: How to Stay Profitable

When I first started trading on Pocket Option, I thought the biggest challenge would be finding the right indicators or mastering price action. I was wrong. The hardest part was mastering my mind.

If you are serious about making consistent profits, you must understand that your mindset is the real weapon. Technical skills are important, but psychology separates winners from those who blow their accounts.

In this guide, I’ll share real trader stories, practical exercises, and insights you won’t find just by searching “how to control emotions in trading.”

Let’s dive deep into the real side of Pocket Option trading psychology.

The Invisible Enemies: Psychological Mistakes I Learned the Hard Way

You must know what’s wrong before you can fix your mindset. Here are the psychological mistakes that almost every trader falls into, including me at one point.

Overtrading:

Feeling like you must always be in a trade. Even when there’s no good setup.

Revenge trading:

Losing a trade and immediately trying to “win it back” with another impulsive trade.

Fear of missing out (FOMO):

Jumping into trades because you see a big candle or someone else posted profits.

Greed:

You should not close trades when you’re ahead; you should be hoping for just a little more.

Fear:

Being too scared to take a trade, even when the setup is perfect.

Lack of discipline:

Ignoring your strategy because you “feel” like the market is different today.

Confirmation bias:

Only see the signs that agree with your trade and ignore the warnings.

I made all these mistakes—not once, but over and over—until I realized that I wasn’t losing because of the market—I was losing because of myself.

Pro tip: You can try a demo account before going with the real money. Test waters, then dive deeper.

My Turning Point: How I Rebuilt My Pocket Option Mindset

After blowing my third account, I took a step back. I spent weeks not trading. Instead, I studied trader psychology, journaled my thoughts, and created exercises to fix my discipline.

Here’s what helped me.

Take a look at the detailed article on using Pocket Option step by step.

Exercises to Build Discipline and Focus

Trading psychology isn’t something you fix by reading a motivational quote. It’s something you train like a muscle. Here are the exercises that changed my trading life.

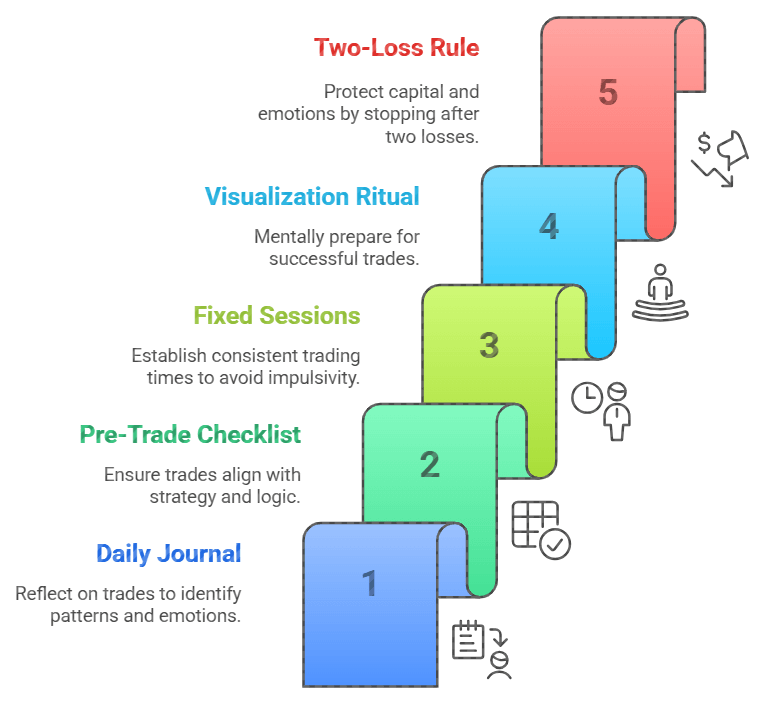

1. Daily Trading Journal

Every trade I take, I write:

- Why I took it

- How I felt before and after

- Did I follow my plan?

At first, it felt tedious. But within two weeks, I started seeing patterns. I realized I was trading best when I felt bored, and worst when I felt excited. The journal became my mirror.

2. Pre-Trade Checklist

Before entering any trade, I must answer these:

- Is this trade based on my tested strategy?

- Is the risk-reward ratio acceptable?

- Am I acting emotionally or logically?

If I can’t answer YES to all three, I don’t trade. Simple but powerful.

3. Fixed Trading Sessions

I set a fixed time to trade: 2 hours max. There were no random late-night sessions, and there was no revenge trading after dinner. This alone saved me from so many impulsive losses.

4. Visualization Ritual

Before I open Pocket Option, I spend 3 minutes closing my eyes and visualizing:

- Seeing a perfect setup

- Feeling calm when entering

- Closing trades exactly according to my plan

Sounds silly? Maybe. But it primes your brain for success.

Want to build emotional discipline without risking real money? Open a Pocket Option demo account and start training your mindset today, no deposit needed.

5. Two-Loss Rule

I stop for the day if I lose two trades in a row. No exceptions. It protects my capital and my emotions.

Here, you can find how to avoid getting banned with Pocket Option.

Real Trader Stories: Lessons That Hurt But Healed

I’m not the only one who struggled. Here are some real stories from traders I met in forums and coaching groups.

Jason’s Revenge Trading Nightmare

Jason once lost $300 in a single trade. Furious, he opened another bigger trade without thinking, and then another. By the end of the day, he was down $2,000.

He said, “I thought I was fighting the market. Really, I was fighting myself.”

Jason recovered only after adopting a strict “cooling-off” rule: after any loss, he must step away from the screen for at least 30 minutes.

Linda’s Overtrading Addiction

Linda loved action. She felt uncomfortable sitting out. She traded every small signal she saw.

Her win rate wasn’t bad, but fees and small losses ate her account slowly.

Her breakthrough? Limiting herself to a maximum of two trades a day. If she didn’t find good setups, she stayed out completely.

Arman’s Discipline Contract

Arman backtested a solid scalping method but kept breaking his rules live. Fear made him skip good entries.

One day, he printed a “Discipline Contract” and signed it:

“I will follow my system 100% for 30 days without adjustments. If I break the rules once, I restart.”

He said sticking to that contract gave him the first profitable month he ever had.

Every winning trader has a turning point, make this yours. Upgrade to a Pro or VIP Pocket Option account and unlock smarter tools for strategy discipline and trade control.

Advanced Insights: What Most People Don’t Tell You About Trading Mindset

Most articles say “control your emotions” or “be disciplined.” That’s useless advice without showing how.

Here’s what rarely gets discussed:

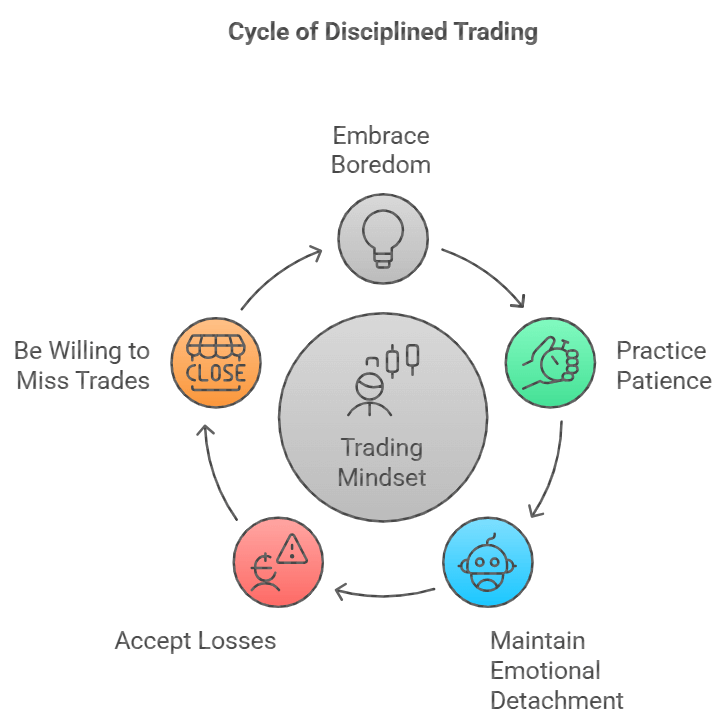

1. Boredom Is Your Friend

When you feel bored, it often means you are thinking properly. No impulsive clicks. No chasing. Real trading is waiting.

2. The Real Skill Is Sitting Out

Anyone can click BUY or SELL. Very few can sit on their hands for 2 hours because no setup appeared. That’s professional behavior.

3. Good Trading Feels Anti-Emotional

Your best trades won’t feel exciting. They’ll feel almost mechanical. When a trade feels thrilling, it’s probably wrong.

4. Your Brain Hates Losses

Studies show that losing $100 hurts twice as much as the pleasure of winning $100. Your brain is wired to act irrationally after a loss. Accept that. Prepare for it.

5. You Must Be Willing to Miss Trades

Missing a good trade hurts. But it’s better than taking a bad one. Pocket Option is open almost 24/7. Opportunities are endless. Missing one doesn’t matter.

FAQs on Pocket Option Trading Mindset and Emotional Trading

What is the best mindset for trading on Pocket Option?

The best mindset is calm, detached, and disciplined. Focus on executing your plan perfectly, not on making money fast.

How do I stop emotional trading on Pocket Option?

Use pre-trade checklists, daily journals, and a two-loss daily limit. Also, practice visualization and set clear trading hours.

How can I control greed when trading?

Set take-profit targets before entering the trade and stick to them. Remind yourself that “small profits consistently” beats “one big win rarely.”

Is trading on Pocket Option stressful?

It can happen if you trade without a plan or discipline. With proper risk management and a strong mindset, trading becomes boring—and that’s a good thing.

How do professional traders manage losses?

They expect losses. They control their risk size so no trade damages their account or emotions.

Why do I always lose after a winning trade?

This usually happens after a win because of overconfidence or greed. Stick to your plan and treat every trade independently.

How many trades should I take per day on Pocket Option?

Quality over quantity. One to three high-quality trades a day are enough. More trades usually mean more emotional mistakes.

What is revenge trading, and how do I avoid it?

Revenge trading involves trying to regain losses immediately. To avoid this, establish a two-loss rule: stop trading for the day if you lose two trades.

Final Thoughts: Trading Success Starts in Your Mind

Pocket Option trading is not about outsmarting the market. It’s about outsmarting your emotional brain.

I learned that discipline, patience, and self-control matter more than any indicator or strategy.

The truth is, anyone can master these psychological skills. But most won’t because it’s not glamorous. It feels boring and slow.

Your trading results will transform if you can embrace that boring, patient, disciplined mindset.

- Start today

- Track your emotions

- Use your checklist

- Accept boredom

- Control yourself before trying to control the market.

That’s the real Pocket Option trading mindset. And that’s how you stay profitable.

Ready to master your mindset and start trading like a pro? Open your Pocket Option account now, get up to 50% bonus and apply what you’ve learned today with full control.