Underrated IQ Option Tools No One Talks About

How I Discovered Hidden IQ Option Tools in My Trading Journey?

I still remember the night I stumbled on one of IQ Option’s lesser-known features. I wasn’t looking for a new setup, I was simply frustrated. My main strategy had just delivered three losing trades in a row, and instead of logging off, I started exploring the platform menus out of curiosity. That’s when I noticed tools like “Market Analysis” tabs, “Pending Orders” with unusual conditions, and even asset volatility filters. None of these were part of the typical discussions around the platform, yet they sat there quietly, waiting to be tested.

At that moment, I thought: if I’ve been ignoring these, most traders probably have too. So I decided to document my experience, testing each underrated IQ Option tool in live conditions. Before diving in, if you haven’t opened an account yet, you can sign up with IQ Option here and explore the tools as you follow along with my story.

Step-by-Step Setup: Testing IQ Option Tools and Features in Real Conditions

To make the test structured, I listed the features I wanted to try. The three that stood out were:

- Pending Orders with Expiration – Letting me pre-set trades with conditions, not just price levels.

- Market Analysis Calendar – An integrated news feed and sentiment indicator I had never used seriously.

- Volatility Alerts – Price notifications tied to specific thresholds.

I set aside a $500 test balance just for these experiments. My idea was to trade small ($5–$10 per position), so the focus stayed on learning, not profits.

Here’s how I structured my tests:

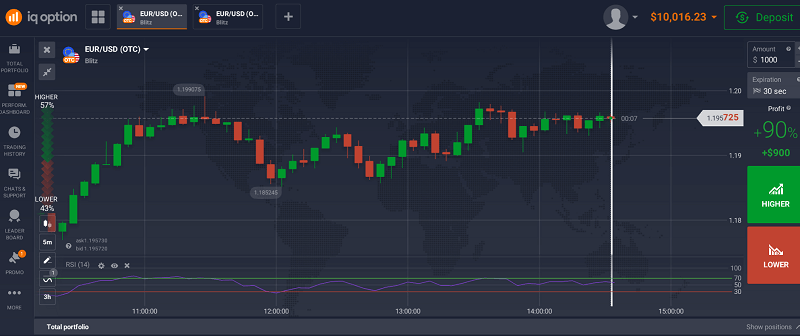

| IQ Option Tool | Setup | Expectation |

| Pending Orders | Pre-set EUR/USD buy at 1.0950 with expiry 2 hours | Trade triggers only if market respects level |

| Market Analysis | Used economic calendar to trade USD events | Catch short bursts of volatility |

| Volatility Alerts | Alerts for BTC and gold when 1%+ moves occur | React faster, avoid staring at charts |

I went in with low expectations, assuming most of these would be gimmicks.

Real Trade Examples Using IQ Option Tools and Strategies

The first surprise came with pending orders. I placed a buy order on EUR/USD, 5 pips above a resistance level, with a two-hour expiry. Price tapped that level 90 minutes later, triggering the trade. Within 12 minutes, I hit my 1.5x risk target. Out of five similar setups across different pairs, three worked perfectly, one scratched at break-even, and one hit stop loss. Win rate: 60%.

The market analysis calendar was less smooth. I decided to trade the Non-Farm Payrolls release. Using IQ Option’s news tab, I positioned short on USD/JPY minutes before the release. The initial spike went my way, but spreads widened, and my entry slipped. I still closed green, but out of four event-driven trades, two were messy losses. Win rate: 50%.

The volatility alerts worked better than I expected. One afternoon, I was away from the desk when I got an alert that gold had surged 1.2%. I rushed in, spotted a pullback, and shorted. That trade alone netted 2R. Over two weeks, I took eight trades triggered by alerts, with five winners and three losers. Freelancers rely on hidden tools that most traders miss.

In numbers:

| IQ Option Tool | Trades | Wins | Losses | Win % | Notes |

| Pending Orders | 5 | 3 | 2 | 60% | Clear rules, less stress |

| Market Analysis | 4 | 2 | 2 | 50% | Slippage a big issue |

| Volatility Alerts | 8 | 5 | 3 | 62.5% | Great for intraday setups |

Analysing IQ Option Trade Results: Wins, Losses, and Lessons Learned

Looking back, pending orders were the biggest revelation. They gave me structure, forcing me to define entries before emotion kicked in. I compared this with the IQ Option 1-minute strategy I tested earlier, and realised pending orders added discipline that short-term setups lacked.

The market analysis tool, though informative, showed me the risk of trading purely off economic events. Slippage, spreads, and unpredictable reactions cut into profitability. It reminded me of lessons I noted when studying IQ Option technical indicators, price action often gives cleaner signals than news-driven chaos.

Volatility alerts, however, gave me flexibility. Instead of staring at charts for hours, I let the platform ping me when action began. It made me more selective, much like when I used multi-chart layouts in IQ Option to avoid overtrading by spreading my focus.

Practical IQ Option Trading Tips From My Testing Experience

If you want to test these underrated IQ Option tools yourself, here’s what I recommend:

Pending Orders

- Define entry levels well in advance.

- Always set expiry to avoid accidental overnight triggers.

- Works best with support/resistance zones.

Market Analysis Calendar

- Avoid trading right at the news release; wait for 2–5 minutes of reaction.

- Use it as confirmation, not your only signal.

- Expect slippage, size positions smaller.

Volatility Alerts

- Pick 1–2 assets you know well.

- Set % thresholds, not random prices.

- Use alerts to catch reversals, not chase spikes.

These small shifts can make a real difference. If you haven’t yet, create an IQ Option account here and try one of these setups with a demo balance before risking real funds.

Final Thoughts: How These IQ Option Tools Fit Into My Strategy Going Forward

What I learned is that the most valuable IQ Option tools are often the ones no one talks about. They don’t get flashy mentions in YouTube tutorials, yet they can quietly reshape how you trade. Pending orders taught me discipline, volatility alerts saved me time, and even the market calendar, though unreliable, gave me context I hadn’t been using. You can also boost your efficiency with shortcut combinations.

I don’t see these tools as a magic IQ Option strategy, but as small edges that, combined with experience, tilt the game slightly in my favour. Next on my radar is testing custom risk management rules within the platform, documenting whether scaling in and partial exits are worth the effort.

If you’re curious to see what IQ Option can really offer beyond the basics, sign up here and start experimenting. Just like me, you might find your best trades come from the tools hidden in plain sight.