PocketOption Profit Playbook: From 5K to Consistent Wins with Smart Forecasts

Many new PocketOption traders lose money not because the market is unbeatable, but because they trade without a repeatable process. Here, we ground a real PocketOption success story in peer-reviewed research and show how a tool like Becoin.net can be used to pursue similar, more disciplined results.

The PocketOption Success Story in Brief

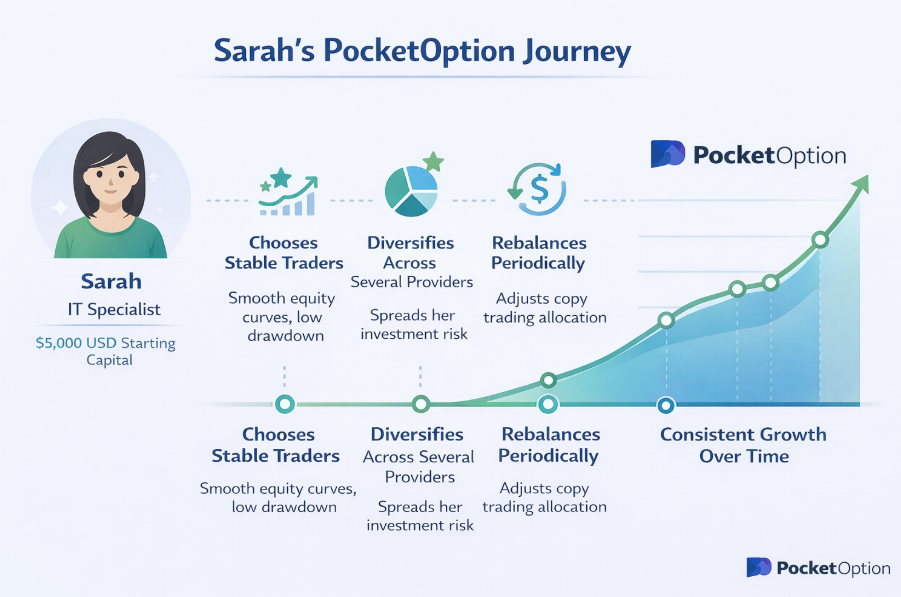

PocketOption’s educational content profiles Sarah Chen, a former IT specialist who started with 5,000 USD and used copy trading rather than guessing every trade herself.

What she did differently was focus on traders with smoother equity curves, controlled drawdowns, and sensible risk per trade. She diversified across several providers instead of betting everything on one “star” trader, and she rebalanced slowly, adding more to stable performers and cutting back on highly volatile ones.

Most importantly, she treated it as a process, avoiding emotional interference. Over time, her 5,000 USD grew into a much larger account, and PocketOption presented her as a real success story emphasizing consistency and risk management rather than luck.

What Credible Research Says About This Approach

Sarah’s behavior lines up closely with what academic work on social and copy trading has found.

A peer-reviewed study in the Journal of Business Research titled “Imitation-related performance outcomes in social trading” examined how imitation affects outcomes on social trading platforms. The research shows that copying can be beneficial when followers select leaders based on longer-term, risk-adjusted performance, not just short bursts of returns. Followers who chase top short-term performers often undermine their own results, while more stable imitation relationships and attention to drawdown improve long-term outcomes.

Additionally, research published by INFORMS titled “Social Audience Size as a Reference Point” shows that social comparisons and leaderboards can push traders to take more risk and overtrade, often without better returns. Traders who rely on clearer rules and decision support rather than emotion and comparison show more stable performance over time.

In short, Sarah’s success reflects exactly the kind of behavior these peer-reviewed journals suggest is rational: focus on consistency over hype, use transparent performance data, and keep risk and diversification front and center.

From Copying Traders to Copying Signals: Enter Becoin.net

Sarah outsourced forecasting to human traders. Today, you can also outsource forecasting to algorithmic signals. According to the Becoin.net website, the platform provides “Up or Down? Live Binary Forecasts for Quotex & Pocket Option” with around 360 live signals and a reported 75.77% proven accuracy on historical data.

Through its Trading Analytics Dashboard, you can choose timeframes (1-minute, 5-minute, 15-minute), asset types (Crypto, Forex, Stocks, Commodities), and signal strength (High, Medium, Low). Instead of copying a person, you are effectively “copying” a signal engine already optimized for PocketOption-style up/down decisions.

A Compact Case Study: Applying Sarah’s Logic with becoin.net

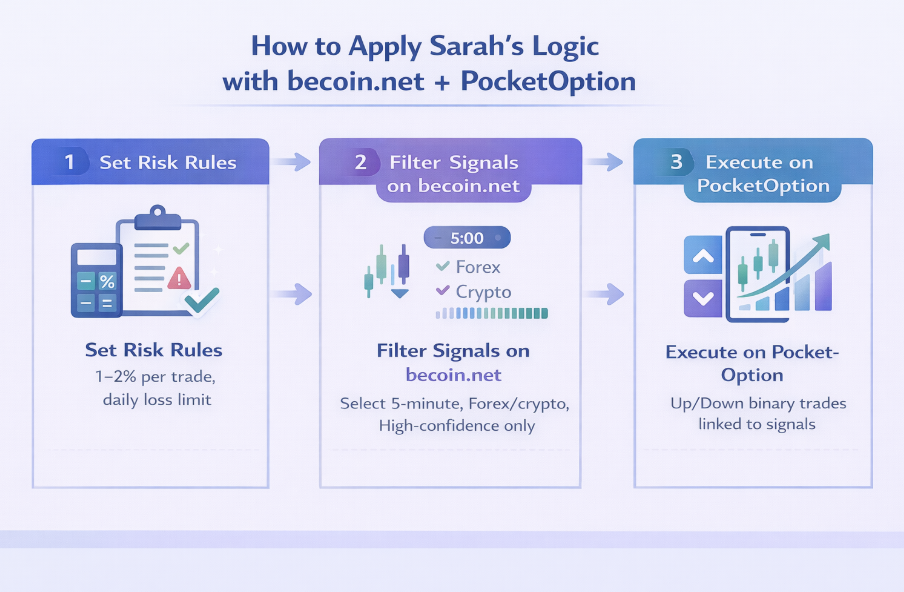

Consider Alex, a non-professional trader with 5,000 USD on PocketOption who wants structured, controlled growth. Based on research on copy trading and behavioral finance, Alex would establish clear risk rules: risking 1–2% of his account per trade, setting a daily loss limit of 5%, and capping the number of trades per day to prevent overtrading.

On Becoin.net, Alex filters for 5-minute signals on major Forex and crypto pairs at High confidence only, focusing on combinations that show consistent strength over time, just as Sarah did with copy-trading providers. When a High-confidence Up/Down signal appears, he opens the matching binary trade on PocketOption using his 1–2% risk rule. If his daily loss cap is hit, he stops for the day. Weekly or monthly, Alex checks which asset/timeframe combinations worked best and whether actual accuracy matches historical figures, shifting focus toward the most stable signal “streams” and dropping weaker ones.

This approach works because Alex is following structured imitation backed by research rather than gut feeling, using a forecast dashboard to reduce emotional reactions and social comparison that research links to poor decisions. No tool can guarantee profit, but this aligns both with Sarah’s real-world success and with what credible journals suggest improves the odds.

Key Takeaways

The PocketOption story of Sarah Chen shows that non-professionals can succeed by following structured, risk-aware strategies rather than guessing. Peer-reviewed research on copy trading and social trading behavior consistently validates that disciplined imitation, focus on risk-adjusted performance, and reduced overtrading matter. Becoin.net’s binary forecast and analytics dashboard gives today’s traders a way to apply the same philosophy by copying signal streams designed for PocketOption, filtered by timeframe and confidence.