Pocket Option Risk Management: How to Protect Your Capital

I didn’t learn risk management the easy way. My first week on Pocket Option, I turned $50 into $120, then lost it all by Friday. I had no strategy or plan, just blind confidence and a lot of guessing. I thought winning a few trades made me a genius. I was wrong, painfully wrong.

Fast-forward a few months, and I started approaching trading differently. I stopped thinking like a gambler and started thinking like a risk manager. That’s when I saw real, consistent results.

This guide will walk you through how I protect my capital while trading on Pocket Option. I’ll explain simple but powerful techniques like stop-loss, bankroll management, and ideal risk-reward setups. Plus, I’ll share real examples of trades where I followed (and broke) these rules, so you can see the difference they make.

Don’t wait for a painful lesson like I did.Before you place another live trade, open a free Pocket Option demo account and practice your strategy with real risk rules in place. It’s the fastest way to learn without burning your bankroll.

The Problem Most Pocket Option Traders Have

Here’s what I’ve noticed with myself and others. Most traders on Pocket Option don’t have a risk plan. They just:

- Open the platform

- Click “Call” or “Put” based on a feeling

- Hope for a payout

That’s not trading. That’s just expensive guessing.

The real difference between long-term winners and short-term lucky traders is this: risk management. If you don’t protect your capital, you wait for your account to blow. And trust me, it happens faster than you think.

Here, you can find how to avoid getting banned with Pocket Option.

What is Risk Management on Pocket Option?

Risk management means having rules that stop you from making emotional, reckless trades. It’s the foundation of safe trading on Pocket Option. It involves:

- Managing how much you risk per trade

- Setting daily loss limits

- Avoiding overtrading

- Using proper trade sizing

- Knowing when to stop

This isn’t about avoiding risk; all trading has risk. It’s about controlling it so one bad day doesn’t wipe out your whole account.

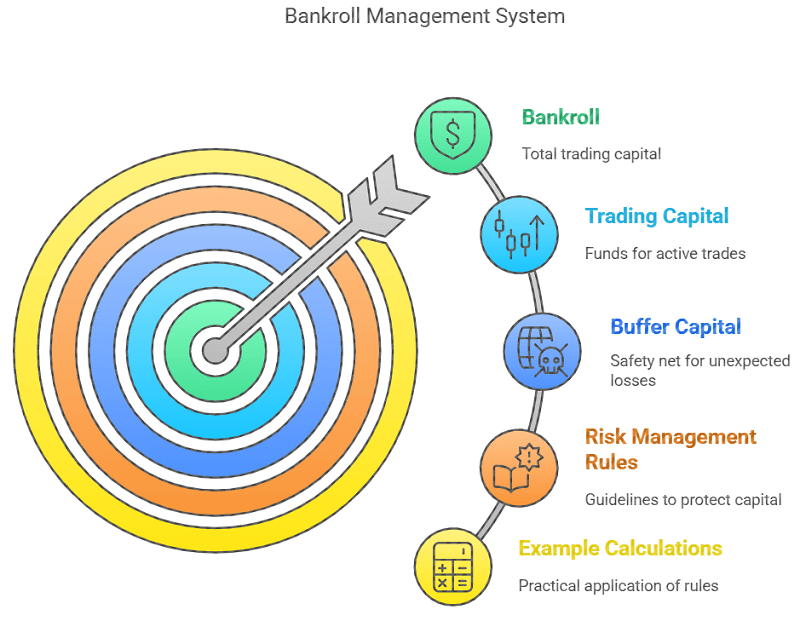

My Bankroll Management System

Let’s start with bankroll. Your bankroll is your total trading capital. When I first started, I treated every dollar the same. But I quickly realized that I needed to split my funds into two things:

- Trading Capital (used for active trades)

- Buffer Capital (just in case things go wrong)

So if I deposit $500, I’ll only allow myself to trade with $350 actively. The remaining $150 is off-limits to my safety net.

Here are the bankroll rules I follow:

- Never risk more than 5% of your total balance per trade

- Set a daily stop-loss (mine is 15%)

- Set a daily win goal (mine is 20%)

- Walk away after hitting either one

Let me break it down with an example. If my account has $500:

- 5% per trade = $25 max risk per trade

- 15% daily stop-loss = $75 loss limit

- 20% daily target = $100 win cap

This means I’ll stop trading if I lose $75 or win $100 in a day, no matter what, even if the market looks “perfect.”

Trading psychology is also important to manage your risk.

Stop-Loss on Pocket Option: Is It Even Possible?

Unlike forex platforms or MT5, Pocket Option doesn’t have a built-in stop-loss feature for binary trades. You can’t just say, “Close my position if it goes against me.” But that doesn’t mean you can’t set one mentally and stick to it.

I call it a “soft stop-loss.” Here’s how I do it:

- Before I open a trade, I decide how many trades I’m willing to take today

- If I lose three trades in a row, I stop trading for the day

- If I lose two trades and start feeling emotional, I walk away

- I track every trade in a spreadsheet, including why I took it and how I felt

This form of discipline saved me countless times. One day, I remember losing two trades on GBP/JPY. I was tempted to double down and make it back. But I forced myself to stop. The next day, the market reversed, and I would’ve lost everything had I stayed.

Discipline starts before you hit ‘Trade’.

Pocket Option’s Pending Trades feature lets you pre-plan your entries — perfect for sticking to a mental stop-loss strategy. Try it now with a small real-money account or demo.

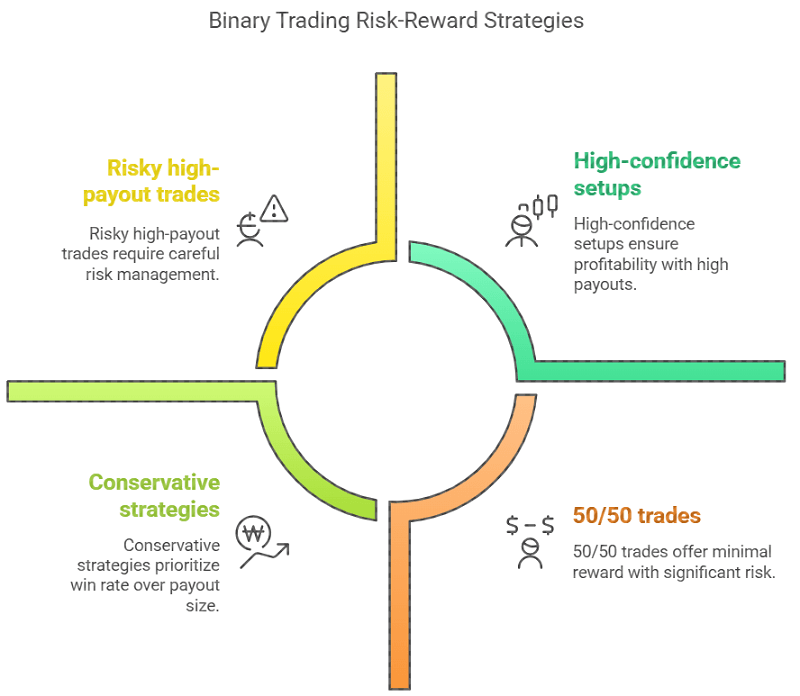

Ideal Risk-Reward Ratios for Binary Trading

Now let’s talk about the part most traders ignore: the risk-reward ratio.

Binary options are a bit different because payouts are fixed. You either win a set percentage or lose the trade amount. But there’s still a way to manage risk-reward smartly.

If a trade offers an 80% payout, that means:

- You risk $100 to win $80

- If you lose, you lose $100

- Your reward is smaller than your risk

This doesn’t sound good, but you can still make it work by:

- Picking only high-confidence setups

- Avoiding 50/50 trades

- Limiting the number of trades per session

I aim for at least 2 wins for every one loss, which is a 66% win rate. This ensures that I stay profitable even with payouts under 90%.

Real Trade Example: Controlled Risk

Let me share a real trade I made last month.

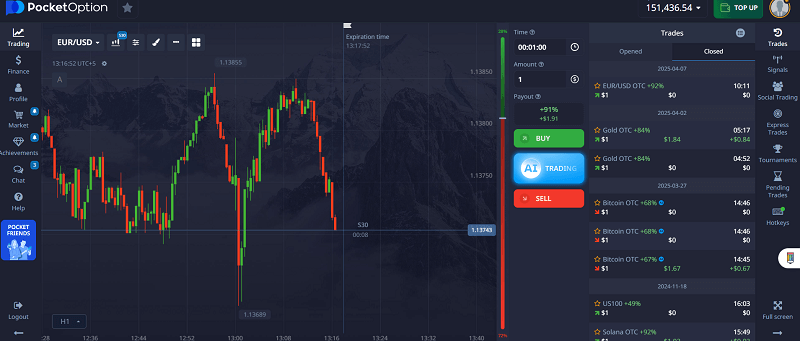

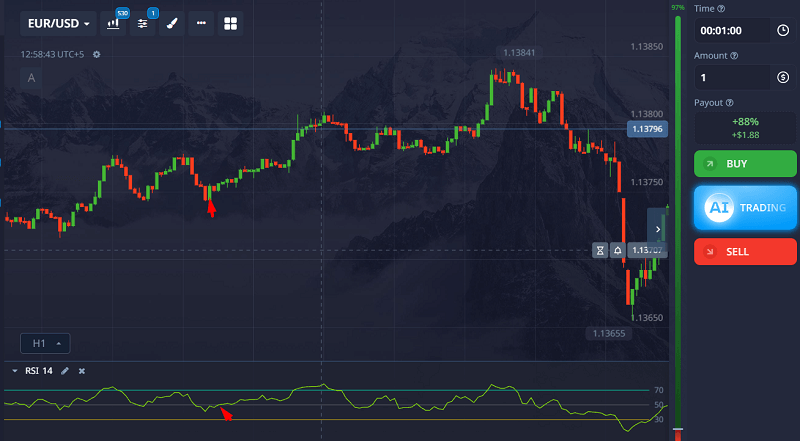

Asset: EUR/USD

Time: 3-minute expiry

Signal: RSI was oversold + bullish engulfing candle

Trade size: $25

Payout: 88% ($21.75 profit)

I had already lost one trade earlier, so this was my second for the day. I waited for all my confirmations, including the RSI, candlestick pattern, and news check, and placed the trade only after getting full alignment.

Result: Win

I made a $21.75 profit. I didn’t immediately go back for another trade. I took a break, reviewed the trade, and then placed another trade later that day. That second one was a win, too.

I ended the day up $43.50 on a $50 total risk, with zero stress. That’s the kind of trading that adds up.

What Happens When You Don’t Follow Your Rules

Let me be honest. I’ve broken my own rules. Once, I went into a trade with no signal, just revenge after losing two trades. I doubled my trade size to “make it back.” Lost again. Then doubled again. Lost again.

That day, I lost over $200 in under 10 minutes.

That one day took me a week to recover from, mentally and financially. I now use phone alarms to remind me when I hit my daily limits. It may sound silly, but it works.

Don’t repeat my mistake of revenge trading.

Use Pocket Option’s risk tools and set a daily stop-loss goal. Start small, trade clean, and protect your future wins by protecting your capital today.

Safe Trading on Pocket Option: Habits That Help

Here are a few habits I use to stay consistent:

- I journal every trade with screenshots and reasons

- I never trade during emotional stress or when tired

- I use the 80/20 rule: 80% watching, 20% trading

- I practice on a demo once a week to test new ideas

- I use Pocket Option’s pending trades feature to avoid impulse trades

Also, I never chase losses. If I hit my stop for the day, I stop. No exceptions.

FAQs About Pocket Option Risk Management

How much should I risk per trade on Pocket Option?

No more than 5% of your total account balance per trade. Many traders do better with just 1–3% risk per trade.

What’s the safest way to trade on Pocket Option?

Use strict bankroll limits, avoid emotional trading, and never risk more than you can afford to lose. High payout trades aren’t always the best if the setup is weak.

Can I use a stop-loss on Pocket Option?

There’s no built-in stop-loss, but you can use mental stop-loss limits or time-based trading caps to control losses.

How do I recover after a losing streak?

Stop trading for the day. Review your journal. Trade demo until your confidence returns. Don’t try to win it all back quickly.

Are there any risk management tools on Pocket Option?

Yes, some VIP features, like cashback, help cushion losses, such as pending trades, trade expiry control, and the demo account.

The Truth Most Traders Won’t Tell You

Trading isn’t about finding the perfect strategy. It’s about surviving the bad days. And those bad days come, no matter how skilled you are.

I’ve learned that the key isn’t to win every trade, but never to lose so much that you can’t return.

Risk management is your best friend if you want to trade full-time or profit consistently. It’s not flashy. It’s not exciting. But it works.

And when everyone else is blowing accounts chasing one big win, you’ll be quietly compounding your balance, one smart, low-risk trade at a time.