ExpertOption Withdrawal Proof (2025 Guide)

Trading online has always been an emotional rollercoaster for me. From the first time I placed a $1 trade to the moment I withdrew my first real profit, every step felt like a test of patience, strategy, and trust. ExpertOption wasn’t my first platform, but it’s the one where I finally gained the clarity I had been searching for: proof that a broker would actually let me withdraw without endless excuses.

In this guide, I’ll walk you through my personal trading journey with ExpertOption, focusing specifically on withdrawals. No big promises, no flashy screenshots—just the raw experience of how I tested the system, the lessons I learned, and why I now trust the platform in 2025. If you’re curious to experience it for yourself, you can open your own account here.

Why I Decided to Test ExpertOption

When I first looked at ExpertOption, I wasn’t drawn to the design or the bonuses. I was drawn by a simple question: would they pay me if I win?

I had tried other brokers before. Some delayed payouts, others threw compliance hurdles at me when I finally tried to withdraw. That left me cautious—almost skeptical. I didn’t want to invest energy in another platform only to be told “please wait, we are processing your request” for weeks.

So, instead of rushing, I planned a personal test. My approach was simple:

- Deposit a small amount.

- Trade carefully.

- Withdraw early.

- Document everything.

That way, I could judge the platform not by what it promised but by what it actually delivered.

Making My First Deposit with ExpertOption

On a quiet January morning in 2024, I deposited $50 into my ExpertOption account. The process was straightforward. I used Skrill because I had heard withdrawals were faster through e-wallets. The money appeared instantly, and suddenly, I wasn’t just a visitor—I was in the game.

The emotions surprised me. Even though it was only $50, I felt the weight of every trade. My mindset was not “let’s make money fast,” but “let’s test whether this works.”

Early Trades: Testing the Waters

My first trades were cautious, almost surgical. I didn’t want to gamble my balance away. Instead, I chose assets I understood—EUR/USD, gold, and tech stocks like Tesla and Apple.

Here’s a glimpse of how those first days looked:

| Date | Asset | Trade Size | Direction | Outcome | Balance After |

| Jan 5, 2024 | EUR/USD | $5 | Buy | Win | $56.75 |

| Jan 6, 2024 | Gold | $10 | Sell | Loss | $46.75 |

| Jan 7, 2024 | Tesla | $5 | Buy | Win | $51.25 |

| Jan 9, 2024 | Apple | $10 | Buy | Win | $59.50 |

These weren’t life-changing trades. But that wasn’t the point. I was watching how orders were executed. Were there lags? Did payouts reflect instantly? The answer was yes—execution was smooth, results updated quickly, and I felt more confident with each trade.

The Moment of Truth: First Withdrawal

On January 15, with $72 in my account, I decided to request my first withdrawal. I remember pausing for a few seconds before hitting “confirm.” This was the real test.

- Requested: $50 at 11:30 AM

- Email confirmation: 11:32 AM

- Funds received in Skrill: 3:48 PM

The money landed in my wallet the same day. No hidden fees, no excuses. That $50 felt like more than just money—it was validation. Proof that ExpertOption actually paid.

(If you want to replicate my test, start small and try withdrawing early. You’ll feel a lot more secure once you see funds arriving in your account.)

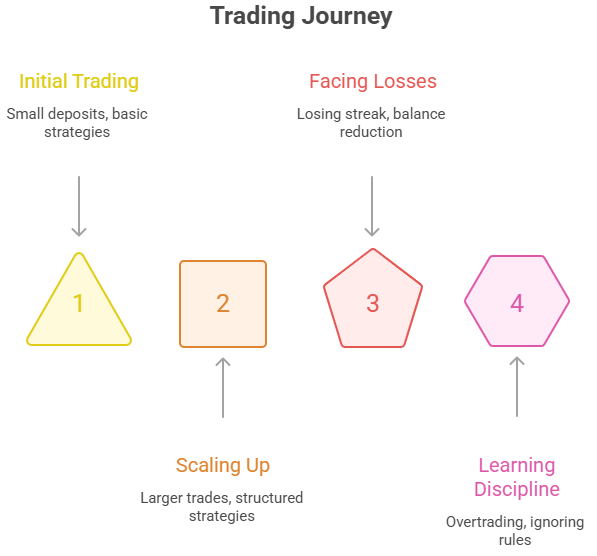

Scaling Up and Facing Losses

With the first withdrawal successful, I grew more comfortable. By March 2024, I deposited $500. My trades also grew larger, and I began experimenting with structured strategies.

But this is where reality hit: I wasn’t always winning. In April, I went through a losing streak that cut my balance down by nearly 30%. That month taught me that trading wasn’t just about strategy—it was about discipline.

I made two mistakes:

- Overtrading after losses.

- Ignoring my own rules when emotions ran high.

Despite the losses, I stuck to my original principle: always withdraw profits when available. By doing so, I never faced the stress of seeing all my earnings vanish during a bad week.

Withdrawal Speed in Real Life

Over the months, I tested multiple payment methods. My goal was to see whether ExpertOption was consistent. Here’s what I found:

| Method | Average Time | My Experience |

| Skrill | 4–6 hours | Always reliable, fastest option |

| Neteller | Same day | Slightly slower than Skrill but smooth |

| Visa/Mastercard | 2–3 days | Worked fine but slower |

| Crypto (BTC/USDT) | 1–24 hours | Depended on blockchain traffic |

My conclusion was simple: if you want peace of mind, e-wallets like Skrill or Neteller are the best options. Crypto was quick too, but sometimes network fees ate into the profits.

Verification: The Gatekeeper Step

One thing I quickly learned was that verification matters. Before you can withdraw smoothly, your account needs to be verified. Here’s what ExpertOption asked from me:

- Passport photo.

- Selfie holding the ID.

- Utility bill for address proof.

I uploaded the documents in the morning and got verified within 24 hours. Since then, I’ve never had a withdrawal blocked or delayed for compliance.

(Tip: do this step right after signing up. Don’t wait until you’ve made profits—you’ll thank yourself later.)

My Withdrawal Records

To keep myself accountable, I documented every withdrawal in a simple spreadsheet. Here’s a trimmed version of my 2024 records:

| Date | Amount | Method | Status | Notes |

| Jan 15 | $50 | Skrill | Success | Arrived in 4 hrs |

| Feb 2 | $120 | Neteller | Success | Same-day |

| Mar 20 | $200 | Visa | Success | Took 3 days |

| Apr 12 | $75 | Skrill | Success | Smooth process |

| Jun 9 | $350 | BTC | Success | 12 hours |

Looking back, these records remind me why I trust ExpertOption today. Every payout arrived—sometimes faster, sometimes slower, but always without excuses.

What ExpertOption Taught Me About Money

Beyond the withdrawals themselves, this journey taught me a few important lessons:

- Withdraw profits, not promises. Don’t leave everything in the account—secure some gains.

- Stay calm during losses. Emotions are expensive. Discipline pays.

- Keep records. A simple table can save you from confusion and build trust.

- Trade small, withdraw often. Confidence grows in steps, not leaps.

These lessons reshaped not only how I trade but how I view financial risk.

Why 2025 Still Matters

By now, it’s been over a year since my first withdrawal, and I’ve repeated the process dozens of times. ExpertOption hasn’t changed its core promise—they still pay. That’s important in 2025, when skepticism around online brokers is higher than ever.

The internet is full of bold claims and flashy screenshots. But my own journey proves something simpler: if you approach trading carefully, verify your account, and test withdrawals early, you’ll know for yourself whether a platform is reliable.

If you’re ready to take that step, you can create your account here and test your own withdrawal.

Final Thoughts

Trading on ExpertOption hasn’t been a fairy tale. I’ve had winning streaks and painful losses. But the constant through it all has been withdrawals that worked—real proof that my efforts weren’t trapped in a digital account.

I don’t trade for dreams of instant wealth. I trade for clarity, for lessons, and for steady progress. And with ExpertOption, I’ve found a platform that lets me do exactly that.

If you’re still undecided, my advice is simple: don’t take my word for it. Deposit a small amount, make a few trades, and request your own withdrawal. The truth becomes clear when you see the money hit your account.

Start your journey today by opening an ExpertOption account.