ExpertOption Copy Trading: Does It Really Work?

When I first came across ExpertOption copy trading, I felt both excitement and doubt. The idea of earning by mirroring experienced traders sounded like a shortcut I had been waiting for. Yet, a voice in my head warned me not to fall for something that looked too easy. Still, curiosity won. I deposited funds, picked my first trader to copy, and decided to see if this system actually worked in practice.

👉 Ready to try it yourself? You can open your ExpertOption account here and follow along as I share my real experiences.

How I Discovered Copy Trading on ExpertOption

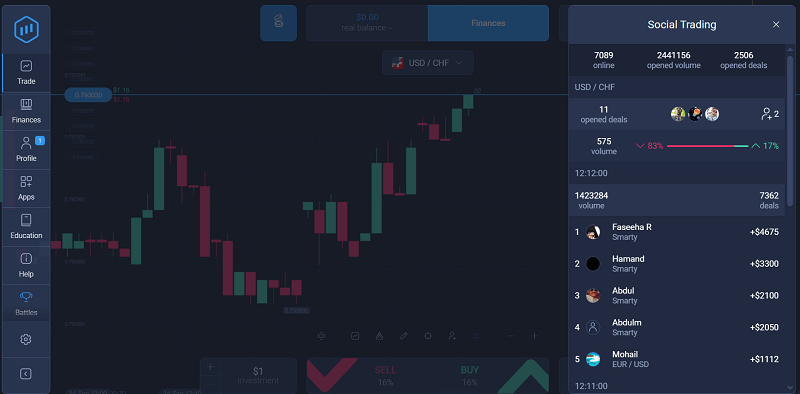

I had been exploring different strategies on ExpertOption, from reading candlestick charts to experimenting with trend lines. But one evening, while browsing the platform, a feature caught my eye. It was the “Top Traders” leaderboard.

The leaderboard displayed profiles of traders who had performed well recently. Their stats were shown in neat numbers: win rates, daily profits, and total followers. It felt like scrolling through a list of “market celebrities.” And the best part? With one click, I could start copying any of them.

At that moment, I thought to myself, “If these traders are already making money, why not just follow their lead instead of guessing?”

My First Steps into Copy Trading

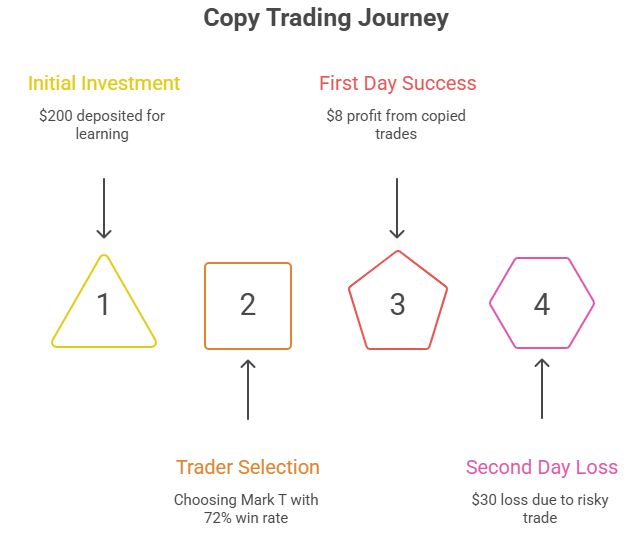

I decided to start small. I deposited $200 into my ExpertOption account, telling myself that this money was my tuition fee for learning. If I lost it, so be it.

I picked a trader named “Mark T” who had a 72% win rate over the past week. His chart showed a steady upward curve, and he had hundreds of copiers already. That gave me confidence. I clicked “Copy” and allocated $50 of my balance to mirror his trades.

The First Day

- Three trades were copied.

- Two ended in profit, one in loss.

- My balance grew by $8.

It felt like magic. I did nothing, yet my account grew.

The Second Day

- Mark T placed a risky trade during a volatile session.

- The trade went south quickly.

- I lost $30 in minutes.

That sinking feeling in my stomach reminded me that there was no such thing as a free ride in trading. Even top traders lose.

This was my first big lesson: copy trading exposes you to someone else’s risk tolerance.

Observing Trader Styles

Instead of quitting, I started to track patterns. Over the next few weeks, I copied different traders and noted how each approached the market.

Here is a simplified version of the notes I kept:

| Trader Style | Win Rate | Risk Level | My Experience |

| Aggressive scalper | 65% | High | Huge swings, stressful, occasional large profits but frequent losses |

| Steady strategist | 70% | Medium | Consistent returns, fewer trades, balanced risk |

| Conservative player | 60% | Low | Very small gains, almost no drama, but growth was slow |

I realized something important: copy trading is not about picking the “best” trader but picking the one whose style matches your personality. If you are impatient, you might chase aggressive traders and burn out. If you want stability, you may prefer steady strategists.

Mistakes I Made in the Beginning

I do not want to sugarcoat this. I made mistakes that cost me money in the early weeks.

1. Switching too quickly

Whenever a trader had a bad day, I abandoned them and jumped to another. Many times, I left just before they recovered. Impatience was my enemy.

2. Over-allocating funds

At one point, I allocated nearly half my balance to a single trader. When he had a bad streak, my account took a hit. I learned to diversify and only allocate small percentages.

3. Ignoring context

Some traders excelled during stable markets but struggled during volatile news releases. Copying blindly without paying attention to the market environment was another mistake.

👉 If you want to avoid the mistakes I made, start small with ExpertOption copy trading and treat it as a learning process first.

My Day-by-Day Journal

To give you a clearer idea, here is a sample log from my second week of copy trading.

| Day | Copied Trader | Trades Taken | Profit/Loss | Notes |

| Monday | Mark T | 4 | +$12 | Solid day, no surprises |

| Tuesday | Mark T | 3 | -$18 | Risky entry, lost quickly |

| Wednesday | Anna P | 5 | +$9 | More consistent, low risk |

| Thursday | Anna P | 2 | +$4 | Slow but safe |

| Friday | Anna P + Mark T | 6 | -$7 | Diversified but still ended slightly down |

This log shows how unpredictable copy trading can feel day to day. A good streak is often followed by a loss.

What Copy Trading Taught Me

After about three months of experimenting, here are the lessons that stuck with me:

- Copy trading is not passive income. You cannot just copy and forget. You need to monitor performance.

- Trader psychology matters. Some chase risky trades, others wait patiently. Choose wisely.

- Patience pays. Leaving a trader after one loss is often a mistake. Look at their overall history.

- Risk management is in your hands. Allocate funds wisely and never commit more than you can afford to lose.

Does ExpertOption Copy Trading Work?

So, after months of testing, does it really work?

Yes, but not in the way many beginners imagine. I did not become rich overnight. My account did not skyrocket in weeks. Instead, I ended my three-month experiment slightly in profit—around 12 percent up. That may not sound exciting, but it was meaningful to me because I stayed profitable while learning.

Copy trading worked for me as a bridge between being a beginner and becoming a more thoughtful trader. I learned by watching how experienced traders made decisions in real time.

Tips for Beginners Who Want to Try Copy Trading

If you are just starting out, here are the rules I would give my younger self:

- Start with a small deposit. Treat it like tuition.

- Study traders’ past performance, not just their recent wins.

- Diversify by copying more than one trader.

- Do not copy during major market news events unless you understand the risks.

- Keep notes on what you observe. This will teach you faster than blind copying.

Combining Copy Trading with Learning

One of the best decisions I made was not to rely solely on copy trading. While copying, I also studied basic trading skills. I practiced reading candlestick patterns (you can read my full notes on that here) and explored strategies for managing emotions.

The combination made me stronger. Copy trading gave me exposure, while learning gave me independence.

Final Thoughts: My Honest Take

Does ExpertOption copy trading really work? For me, it worked as an educational tool that happened to make me some money along the way. I would not call it a magic solution. I would call it a stepping stone.

If you treat copy trading as a shortcut, you may be disappointed. But if you treat it as a training ground, it can accelerate your learning and possibly help you grow your account carefully.

👉 If you are ready to test it yourself, you can sign up for ExpertOption here and start exploring the copy trading feature today.