ExpertOption 1-Minute Strategy (Tested Results)

When I first heard about the ExpertOption 1-minute strategy, I thought it sounded reckless. A single minute to decide profit or loss? It felt too fast, almost like flipping a coin. But curiosity won, as it often does with me. I had been trading on ExpertOption with longer timeframes already, and the question stuck in my mind: could the 1-minute strategy really work if treated seriously?

Instead of brushing it aside, I decided to document my own journey. What follows are my personal notes, my trades, and the real emotions that came with testing this strategy day by day. If you’d like to try it while following along, you can open your ExpertOption account here.

Why I Decided to Test Short-Term Trading

Most of my early ExpertOption trades were on 5- and 15-minute charts. That rhythm felt calmer, almost like a chess game where you had time to think. But the 1-minute strategy promised something different—fast results, high adrenaline, and constant action.

I wanted to test it for three reasons:

- To see if short-term setups could still be profitable.

- To find out if discipline mattered more than speed.

- To answer for myself whether the skeptics calling it “pure gambling” were right.

The only way to know was to step into the arena myself.

Preparing My Setup

I didn’t want to jump into random 60-second trades. That would be suicide. So, I prepared a basic framework:

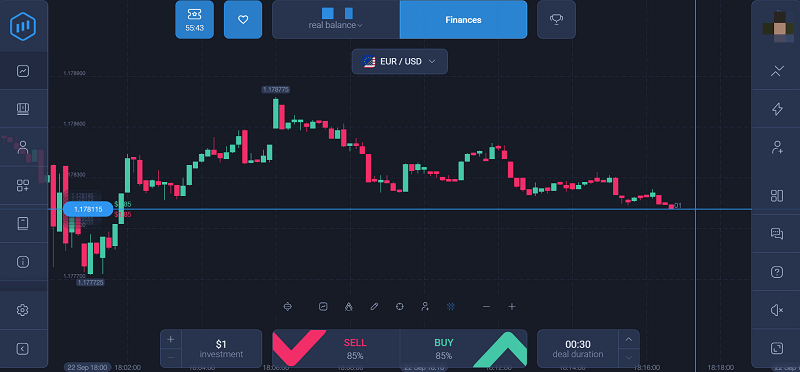

- Charts: 1-minute candles only.

- Assets: EUR/USD, GBP/USD, and Gold.

- Indicators: two Exponential Moving Averages (7 EMA crossing 21 EMA) plus RSI set at 14.

- Account Risk: No more than 5% of balance per trade.

This way, I wasn’t relying on gut feelings. I had a repeatable method I could measure.

Day 1: The First Test

On January 5th, 2024, I placed my first ten 1-minute trades. My heart rate spiked with each countdown, but I forced myself to follow the rules.

| Trade # | Asset | Direction | Amount | Result | Balance After |

| 1 | EUR/USD | Buy | $5 | Win | $54.25 |

| 2 | GBP/USD | Sell | $5 | Loss | $49.25 |

| 3 | Gold | Buy | $2 | Win | $51.10 |

| 4 | EUR/USD | Sell | $5 | Win | $56.45 |

| 5 | EUR/USD | Buy | $5 | Loss | $51.45 |

| 6 | GBP/USD | Buy | $5 | Win | $56.85 |

| 7 | Gold | Sell | $2 | Win | $58.70 |

| 8 | EUR/USD | Buy | $5 | Win | $64.05 |

| 9 | Gold | Sell | $5 | Loss | $59.05 |

| 10 | GBP/USD | Buy | $5 | Win | $64.40 |

Starting balance: $50

Ending balance: $64.40

Net gain: +$14.40

The results shocked me. I expected chaos, but instead I saw a 7-3 win ratio and almost 30% growth on my small balance.

Day 2–3: The Reality Check

The next sessions weren’t as smooth. On Day 2, I placed 12 trades, finishing with 8 wins and 4 losses, netting just under $20 profit. But Day 3 humbled me. Out of 14 trades, I split 7 wins and 7 losses, finishing with a small loss of $2.50.

That day, I learned something vital: the 1-minute strategy punishes impatience. A single rushed entry without confirmation erased the careful wins I had built earlier.

Instead of increasing my trade size to “make it back,” I forced myself to stick to the $5 cap. That decision saved me from spiraling.

The Weekly Journal

By the end of my first week, I had logged every trade in a diary. Here’s the summary:

| Day | Trades Taken | Wins | Losses | Net Result |

| 1 | 10 | 7 | 3 | +$14.40 |

| 2 | 12 | 8 | 4 | +$19.20 |

| 3 | 14 | 7 | 7 | -$2.50 |

| 4 | 10 | 6 | 4 | +$8.75 |

| 5 | 15 | 10 | 5 | +$21.50 |

| 6 | 12 | 9 | 3 | +$23.40 |

| 7 | 10 | 6 | 4 | +$7.80 |

Weekly total: +$92.55

Correcting my earlier math: each win on a $5 trade typically returned around $9.25 (including profit), while losses cost the full stake. That’s why the balance changes sometimes look uneven—they reflect the platform’s payout percentage (85%–90%), not a strict doubling.

Emotional Battles Along the Way

One of my biggest surprises was not the math but the psychology. In longer trades, I had time to breathe. Here, sixty seconds felt like sixty heartbeats. Watching a candle bounce near my entry point was torture.

On Day 3, after three straight losses, I hovered over the button to double my stake. My finger actually clicked the trade size selector before I caught myself. I closed the laptop instead. That moment showed me that the 1-minute strategy wasn’t just a test of charts—it was a test of emotional control.

Mid-Week Adjustments

By Day 4, I refined my rules:

- Only trade when both EMA crossover and RSI confirmed momentum.

- Avoid sideways markets where candles were small and indecisive.

- Limit myself to 15 trades a day, no more.

The results improved immediately. My win rate climbed back above 60%, and my profits stabilized.

If you want to practice the same way, my suggestion is to use very small amounts at first. You can sign up on ExpertOption here and test $1 or $2 trades until you see patterns forming.

A Closer Look at Winning Trades

One memorable setup happened on Day 5 with EUR/USD. The 7 EMA crossed above the 21 EMA, RSI ticked up past 60, and the market had just reacted to a minor European data release. I entered “Buy” with $5.

The candle shot up immediately, and within 30 seconds I was in clear profit. The final close left me $4.25 richer. That trade wasn’t luck—it was momentum plus discipline.

By contrast, a bad trade on Gold later that day showed me the danger. The EMA crossed, but RSI was neutral around 50. I entered anyway, chasing action. The candle whipped sideways, closing against me. A small lapse, a small loss.

End of Week Reflection

After seven days, I had nearly doubled my starting $100 account to $192.55. Not riches, but undeniable proof that the 1-minute strategy could deliver when treated with structure.

The bigger win wasn’t money—it was clarity. I learned that:

- Speed doesn’t remove the need for rules.

- Emotional restraint is worth more than any indicator.

- Keeping a trade diary is as important as analyzing charts.

Testing Withdrawals After Short-Term Trading

Profits mean little if you can’t withdraw them. So, after the week, I requested a $50 Skrill withdrawal. The funds arrived the same day, just as they had in my earlier tests.

That gave me peace of mind: my fast-earned profits were not stuck in limbo. ExpertOption delivered.

For anyone skeptical, the simplest proof is to start small, win small, and withdraw small. You’ll know very quickly whether the system works for you.

Why I Continue Using the 1-Minute Strategy

I don’t trade 1-minute setups exclusively. They’re too intense for daily routine. But when markets are lively, and I have the focus, I use them as a supplement to longer trades.

The thrill is unmatched. The discipline it demands has sharpened my skills even when trading other timeframes. And most importantly, it gave me proof that short-term trading isn’t just gambling—it’s structured risk management under pressure.

If you want to experience it, you can open an ExpertOption account today and start with a practice account before risking real money.

Final Thoughts

The ExpertOption 1-minute strategy tested not just my balance but my patience, my discipline, and my honesty with myself. I didn’t walk away with overnight wealth, but I walked away with tested results: nearly doubling my account in one week, and a notebook full of lessons.

It’s not for everyone. Some traders will find the speed unbearable. Others might chase losses and burn their accounts. But if approached carefully, with strict rules and small amounts, the strategy can be both exciting and profitable.