From Gambler to Data‑Driven Trader: Arjun’s Binary Options Turnaround

Arjun stared at the EUR/USD chart on his second monitor, the hum of Bangalore traffic drifting through the open window. It was 3:25 p.m., and a five‑minute binary option was setting up, exactly the kind of pattern he had spent months testing. Two years earlier, he would have clicked “Call” on impulse, chasing the rush. Now he did something very different: he opened his trading journal and a small web dashboard he had come to rely on.

On his spreadsheet, 426 rows told the story of his last three months: win rate 58.2%, maximum drawdown 8.5%, account growth around 41%. On his browser, a short‑term forecast dashboard showed live signals for multiple assets. Between his own rules and that external signal feed, Arjun had built a decision process he could finally trust.

This is his journey from emotional, gambling‑like binary trading to disciplined, statistics‑driven execution, and how he used tools like Becoin to find his edge.

1. The Painful Beginning: Losing Like Almost Everyone Else

Arjun’s first contact with binary options came through aggressive online ads promising “Earn 80% in minutes!” Intrigued, he deposited 500 USD with a popular broker. The first week felt like a dream: he doubled his account through a mixture of luck, over‑sizing, and impulsive entries.

Then reality hit. A streak of losses arrived, he raised his stakes to “win it back,” used martingale position sizing, and within two days most of his gains, and much of his starting capital, were gone. He felt scammed and assumed the game was rigged.

Later, he came across regulatory warnings that sounded uncomfortably familiar. A joint CFTC/SEC Investor Alert on Binary Options described how many binary options platforms operate outside proper oversight and how even when the platform is honest, payoff structures often result in a negative expected return for customers.

He also discovered academic work on retail derivatives and options trading showing that most individual traders lose money overall, with only a small minority consistently profitable. A good example is the paper “Retail Trading in Options and the Rise of the Big Loser” on SSRN, which documents how concentrated and persistent retail losses can be.

Arjun recognized himself in those statistics. If he kept approaching trading the same way, he would stay part of that losing majority.

2. Turning Point: Treating Trading Like Engineering

By profession, Arjun was an engineer. At work, he trusted data, iteration, and version control; in trading, he had been operating on pure emotion. One evening, staring at his depleted account, he wrote a simple line on a sticky note and attached it to his monitor:

“No more thrill. Only tested edges and controlled risk.”

He stopped trading live for a month and reshaped his approach around three pillars.

1. Understand the product and the math.

He studied how binary options are structured how brokers set their payouts and how to compute expected value per trade. Research on using expected profit and loss metrics for binary options, such as “Trading Binary Options Using an Expected Profit and Loss Metric” on SSRN, helped him think in terms of long‑run averages rather than single trades.

2. Define one clear setup.

Arjun focused on EUR/USD with 5‑minute expiries during the London–New York overlap. His pattern:

- A clear short‑term trend (measured by moving‑average slope).

- A brief pullback against that trend.

- Re‑alignment with the trend before expiry.

If any of these conditions weren’t present, he simply didn’t trade.

3. Build a robust information and journaling workflow.

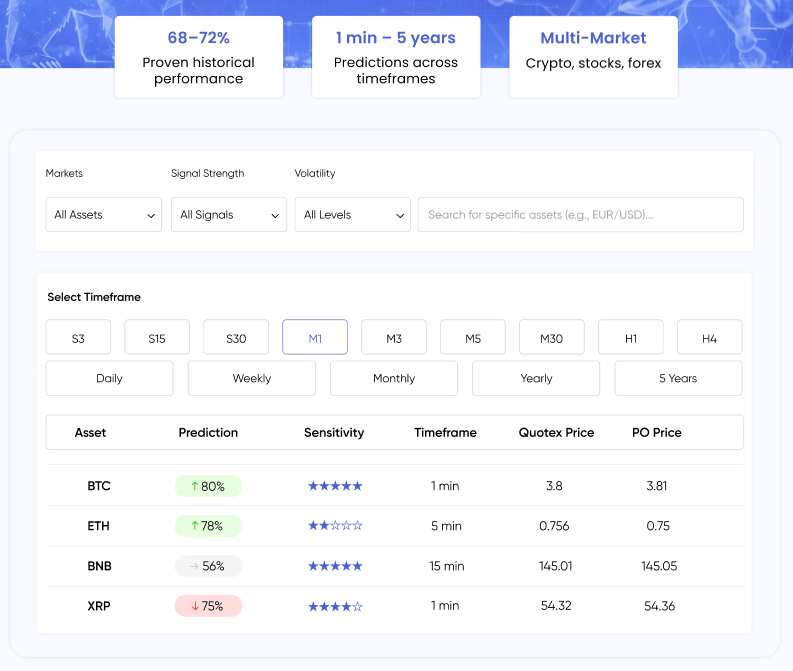

Alongside his own charts, Arjun began using a short‑term forecast dashboard to cross‑check market conditions. Alongside his own charts, Arjun began using a short‑term forecast dashboard to cross‑check market conditions. Becoin.net offers similar live short forecasts with 360 signals and 74.36% proven accuracy that is even more accurate that Ajrun used.

He didn’t blindly follow those signals; instead, he logged in his journal whether a trade he took aligned or conflicted with the external forecasts. Over time this helped him see patterns: his best trades tended to occur when his own setup and a strong forecast signal pointed in the same direction.

3. The Strategy in Numbers: How Arjun Crafted His Edge

After refining his rules and practicing on demo, Arjun funded a fresh 1,000 USD account with strict money‑management rules:

- Risk per trade: 1% of account

- Typical payout: 80% on wins, 100% loss on losses

- Max trades per day: 5

- Stop rule: After 3 losing trades in a day, stop trading

Over three months, his trading log looked roughly like this:

| Metric | Value |

| Number of trading days | 60 |

| Total trades | 426 |

| Average trades per day | 7.1 |

| Win rate | 58.2% |

| Average payout on wins | 80% |

| Loss on losing trades | 100% of stake |

| Risk per trade | 1% of account |

| Initial account balance | 1,000 USD |

| Final account balance (approx.) | 1,410 USD |

| Maximum drawdown | 8.5% |

3.1 Expected Value: The Quiet Core

Using his observed win rate and the fixed payout structure, he computed the expected value per trade:

- Probability of win:

p = 0.582 - Probability of loss:

1 – p = 0.418 - Profit on a win (per 1 unit risk):

+0.80 - Loss on a loss:

-1.00

E=p⋅0.80+(1−p)

E=0.582⋅0.80+0.418⋅(−1.00)≈0.0656

So his strategy’s expected return per trade was about +6.6% of the amount risked. With 1% risk per trade, that meant about 0.066% of account growth per trade in expectation.

Individually, that’s tiny. Across 426 trades, applied consistently and with tight drawdown limits, it added up to roughly 41% growth in three months while keeping risk contained.

With Becoin’s forecast tool, the winning probability is even higher

4. How External Forecasts Fit in (Without Taking Over)

The forecast dashboard at becoin.net could enhance the trading performance. The site offers a Trading Analytics Dashboard where he could filter signals by:

- Timeframe: 1M, 5M, 15M

- Asset class: Crypto, Forex, Stocks, Commodities

- Signal strength: High, Medium, Low

Before the trading session, he would:

- Check which assets currently had high‑confidence short‑term signals.

- Narrow his focus mostly to EUR/USD but note if multiple Forex pairs showed aligned direction (e.g., several USD pairs signalling strength or weakness).

- Log, for each trade he took, whether the external forecasts agreed with his direction, disagreed, or was neutral.

Over weeks, his journal started to show clusters: many of his best trades were those where (a) his own setup was valid, and (b) the external forecast showed high confidence in the same direction on the same timeframe. Conversely, when he overrode either his setup rules or ignored conflicting signals, his notes often included “forced trade” or “felt uneasy.”

In other words, the forecast tool became a confirmation and filtering layer that helped him stay selective and data‑driven, without replacing his own clearly defined rules.

5. A Day in His Trading Life: What It Actually Feels Like

By month three, a typical session looked like this:

- 1:00 p.m. – Arjun opens his charting platform, and his trading journal. He checks the economic calendar for high‑impact news.

- 1:15 p.m. – EUR/USD is in a clean uptrend with a pullback forming. On the becoin dashboard, EUR/USD shows a high‑confidence upward forecast on the 5M horizon. His checklist is satisfied on both his own system and the external tool. He risks 1% on a Call; the trade wins. He records not just the result, but also: “Setup = valid, becoin = aligned (high).”

- 1:40 p.m. – Another pullback appears, but now the forecast shows only a low‑confidence, noisy picture. Combined with an upcoming news release, he passes on the trade and writes “Setup borderline + low external confidence, no trade.”

- 2:10 p.m. – A clean post‑news trend emerges; both his criteria and the forecast align again. He takes two more trades, one win and one loss. After a third loss later in the day, his stop rule triggers. Even if fresh high‑confidence signals pop up on the dashboard, he stops, because his plan says: no trading after three losses.

The important part is not that he “follows a website.” It’s that every decision he makes is anchored in rules and data, whether from his own testing or from structured external information.

6. Key Lessons Readers Can Relate To

Arjun’s story is fictional but designed to be realistic and responsible. It doesn’t claim that tools or dashboards magically make you profitable. It shows how a trader can integrate them into a disciplined framework.

In Summary

Arjun doesn’t become a millionaire overnight. His real victory is moving from chaos to clarity: from gambling on “up or down” to running a structured experiment where every trade, every statistic, and every external signal has a defined role. Tools like becoin.net enter the story not as magic bullets, but as part of a broader, disciplined workflow, exactly how serious traders treat any outside information.