Pocket Option vs Quotex Minimum Deposit: Which Broker Gives More Value for $10?

I remember staring at the deposit screen longer than I should have. Ten dollars doesn’t sound like much, but when it’s your first live trade, it feels heavier than any demo balance you’ve ever touched.

I wasn’t expecting profits. I wasn’t chasing a win streak. I just wanted to answer a very personal question: would my trading behavior change the moment real money entered the equation?

That question is what led me into this Pocket Option vs Quotex minimum deposit comparison. Not as a marketing exercise, but as a private experiment. Same amount. Same strategy. Same mindset. Two very different experiences.

If you want to follow the same path and test this yourself, you can open an account using my affiliate link here. Start with $10. That’s where trading habits are exposed most honestly.

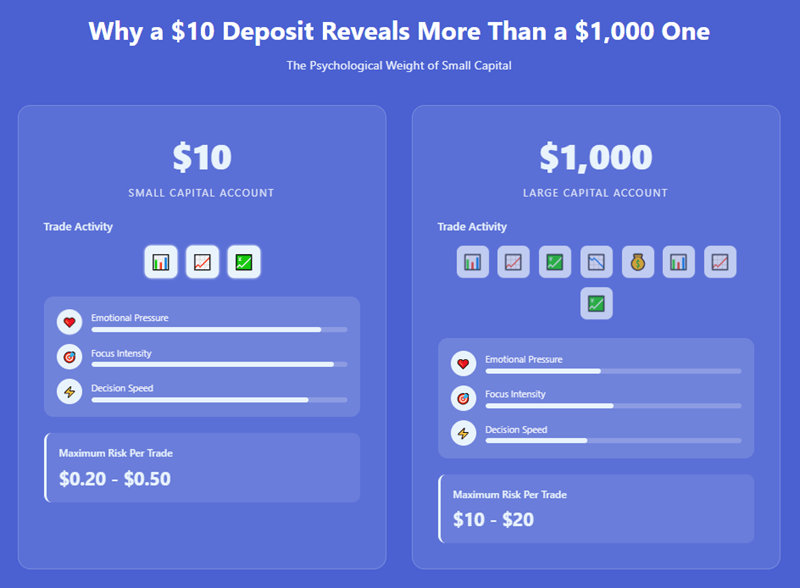

Why a $10 Deposit Reveals More Than a $1,000 One

Large deposits hide mistakes. Small deposits amplify them.

With $10, every decision carries weight. You don’t have the luxury of revenge trading. You don’t have space for sloppy entries. One bad habit can wipe out days of patience.

That’s why the minimum deposit isn’t just a number. It’s a stress test.

Most reviews talk about low deposits as accessibility. What they don’t talk about is what kind of trader survives inside that constraint. This Pocket Option vs Quotex minimum deposit comparison exists to fill that gap.

My Ground Rules Before Depositing

I wanted clean data, not emotional excuses.

So I set non-negotiable rules:

- Exactly $10 deposited on each broker

- No bonuses activated

- Fixed stake sizing

- Same assets and sessions

- No top-ups

- No martingale or recovery systems

I treated this as a discipline test, not a growth challenge. If you’re wondering why I avoided recovery strategies, my breakdown of martingale vs fixed stake trading explains why small balances collapse under pressure systems.

The Moment the Deposit Cleared

Pocket Option made the $10 deposit feel normal. No warnings. No upsell pressure. The platform treated me like any other trader.

That mattered more than I expected.

Quotex accepted the deposit just as smoothly, but the interface subtly reminded me of my balance size. Not aggressively, just enough to keep me aware.

That difference set the tone for everything that followed.

On Pocket Option, I felt welcomed.

On Quotex, I felt accountable.

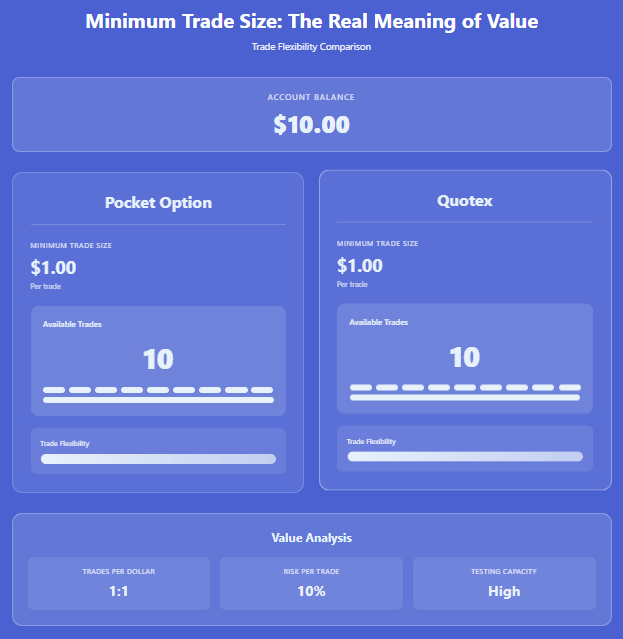

Minimum Trade Size: The Real Meaning of Value

Minimum deposit means nothing without minimum trade size.

Pocket Option allowed $1 trades comfortably. That gave me ten attempts to learn, adjust, and absorb losses without panic.

Quotex also allowed small trades, but psychologically each trade felt heavier. The balance moved slower, but the impact felt sharper.

That difference shaped how I behaved more than any payout percentage.

| Aspect | Pocket Option | Quotex |

| Trade size flexibility | High | Moderate |

| Emotional weight per trade | Lower | Higher |

| Recovery room | Wider | Narrower |

With $10, emotional friction matters more than features.

My First Live Session With $10

I still remember the first hour.

Same setup I had practiced on demo. Same indicators. Same rules.

On Pocket Option, I placed my first $1 trade calmly. Lost. Placed another. Won. Balance hovered just below the starting level.

On Quotex, after two trades, I paused. Same outcomes, but my pulse was higher. I rechecked my rules before placing the third trade.

That pause mattered.

It reminded me of what I later articulated in demo vs live binary options trading, where the first real loss rewires your decision-making.

Payout Percentages and Small Balances

When you trade with $10, payout differences aren’t abstract. They are survival mechanisms.

Pocket Option often offered slightly higher payouts on common assets. That meant a single win recovered more ground.

Quotex payouts were consistent, but less forgiving. Losses took longer to recover from.

Neither approach is wrong, but they reward different behaviors.

Pocket Option rewards activity.

Quotex rewards precision.

The Overtrading Trap With Low Deposits

Here’s something most traders don’t admit.

Small balances invite overtrading.

On Pocket Option, the platform’s smoothness made it easy to click again. I had to consciously stop myself.

On Quotex, the environment slowed me down. I waited more. I skipped marginal setups.

This perfectly mirrored what I later wrote in why too many trades kill your accuracy. The broker doesn’t force overtrading, but it can make it easier or harder to resist

If you want to see how $10 really behaves under pressure, open an account using my affiliate link here. Don’t add funds. Don’t chase losses. Let the balance expose your habits.

Execution Quality When Capital Is Limited

Execution errors feel different when capital is tight.

Pocket Option execution felt fast and clean. Entries triggered smoothly. Results felt decisive.

Quotex execution felt slightly slower, but that delay forced confirmation. I waited for the candle to close more often.

With $10, speed can be dangerous. Precision becomes safety.

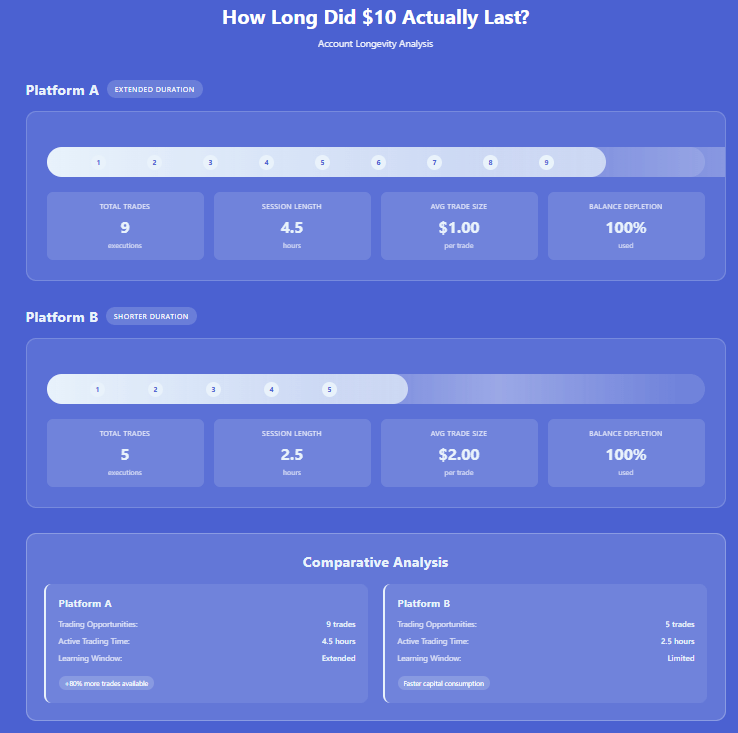

How Long Did $10 Actually Last?

This is the question no review answers honestly.

Pocket Option let my $10 last longer. More trades. More room to recover. More chances to adjust.

Quotex forced a shorter learning window. Fewer trades. Less margin for error. But cleaner behavior.

Neither outcome is inherently better. They serve different stages of a trader’s growth.

Psychological Fatigue With a Small Balance

Another thing I noticed was fatigue.

On Pocket Option, I felt mentally fresher longer. The environment reduces stress.

On Quotex, sessions were shorter but heavier. I stopped trading earlier, even when setups appeared.

That difference mattered. Fatigue leads to mistakes, and mistakes end small accounts.

This ties closely into what I explored in binary options money management rules beginners ignore, especially when capital is limited.

A Deeper Look at My Trading Journal

| Metric | Pocket Option | Quotex |

| Average trades per session | Higher | Lower |

| Emotional strain | Lower | Higher |

| Discipline pressure | Moderate | High |

| Learning repetitions | More | Fewer |

| Account longevity | Longer | Shorter |

This table doesn’t crown a winner. It clarifies trade-offs.

The Hidden Cost of a $10 Deposit

The real cost isn’t losing ten dollars.

It’s internalizing the wrong lesson.

Pocket Option risks teaching comfort too early.

Quotex risks teaching fear too early.

The trader’s job is to extract the lesson without absorbing the damage.

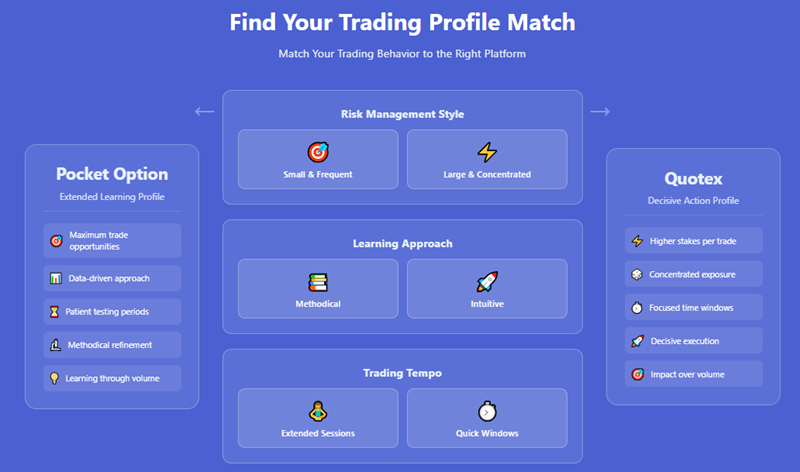

Who Truly Gets More Value From $10

Pocket Option gives more time.

Quotex gives more structure.

Time helps beginners learn.

Structure helps beginners survive.

Your value depends on which one you lack most.

Which Broker I’d Recommend at $10

If you asked me to choose blindly, I wouldn’t.

I’d ask you one question instead.

Do you struggle more with fear or with impulse?

Fear points toward Pocket Option.

Impulse points toward Quotex.

Understanding that saved me far more than $10.

Final Verdict: Pocket Option vs Quotex Minimum Deposit

Minimum deposits don’t exist to make trading accessible. They exist to reveal weaknesses early.

Pocket Option stretches $10 further.

Quotex sharpens $10 faster.

Neither turns $10 into profits.

Both turn $10 into feedback.

That’s the real value.

If you want to learn what a small balance teaches before risking more, open an account using my affiliate link here. Trade slow. Trade small. Let $10 do its job.