Pocket Option vs Quotex: Which Trading App Is More Accurate for Short-Term Trades? My Real Trading Diary

I never planned on comparing Pocket Option vs Quotex so deeply. I only wanted a trading app that could respond quickly enough for my short term setups, especially the ones that last less than sixty seconds. But the more I traded, the more I realized that accuracy is not about winning every position. It is about execution timing, chart clarity and how consistently the platform respects the price you clicked.

If you are reading this and thinking about which broker to open an account with, here is my first suggestion before we go further. Create your Pocket Option account using this verified partner link so you get higher-quality support and faster onboarding. If you prefer Quotex, use this trusted Quotex signup link which many of my readers already use. These are safe routes and remove the guesswork.

I will walk you through my real experiences with both platforms. I will show where each one helped me and where each one frustrated me. Nothing exaggerated. Just the way it happened.

And if accuracy is what you care about, stay with me to the end. This comparison goes much deeper than payouts and UI features. I’ve tested both apps hour by hour, session by session, through quiet markets and through the messy spikes that destroy short-term traders.

Along the way, I will link to a few articles that saved me trouble. I recommend reading them if you plan on staying with one broker long term. For example, when I almost got restricted on my Pocket Option account due to a simple habit, the guide on how to avoid getting banned on Pocket Option helped me correct my behaviour before support flagged me. The same happened on Quotex later when I learned what can trigger limits, and the guide cleared a lot of confusion.

Let’s begin from the moment I opened both apps side by side.

Why Accuracy Matters More Than Anything In Short-Term Trades

I trade only three types of setups for short-term positions:

- Break and continuation on strong candles

- Micro pullbacks into an established direction

- Volatility rejection at session opens

These setups rely on timing. One second late and the entry becomes useless. That is why platform accuracy matters. When I say accuracy, I am talking about three things.

- Price accuracy: Does the trade open where you clicked?

- Execution accuracy: How long does the click-to-confirmation delay take?

- Expiration accuracy: Does the trade close exactly when the timer hits zero?

If you are comparing Pocket Option vs Quotex on accuracy, these three determine everything. Not payouts or bonuses. Accuracy is where the money is either protected or lost.

My First Tests: Entry Speed, Slippage And Chart Feel

When I first opened both apps, I sat with EURUSD on a five-second chart. I opened two demo accounts at the same time. Then I executed twenty instant trades on each broker while screen recording everything.

The results surprised me.

| Test Category | Pocket Option | Quotex |

| Average execution time | 0.42s | 0.31s |

| Slippage on fast candles | Slightly higher | Lower |

| Chart refresh rate | Faster | Moderate |

| Reliability under volatility | Stable | Very stable |

| Delayed candle prints | Rare | Rare but noticeable at peaks |

At this point, I expected Pocket Option to win because its interface felt smoother. But Quotex beat it in raw execution speed. That 0.11 second difference matters when you trade breakouts and wicks.

Still, Pocket Option’s chart refresh rate felt cleaner. The candles moved in a more natural rhythm, especially during London open when markets spike without warning.

If accuracy were only entry timing, Quotex would have won. But chart clarity affects how you read the setup. Pocket Option felt clearer to my eyes. Quotex felt more mechanical.

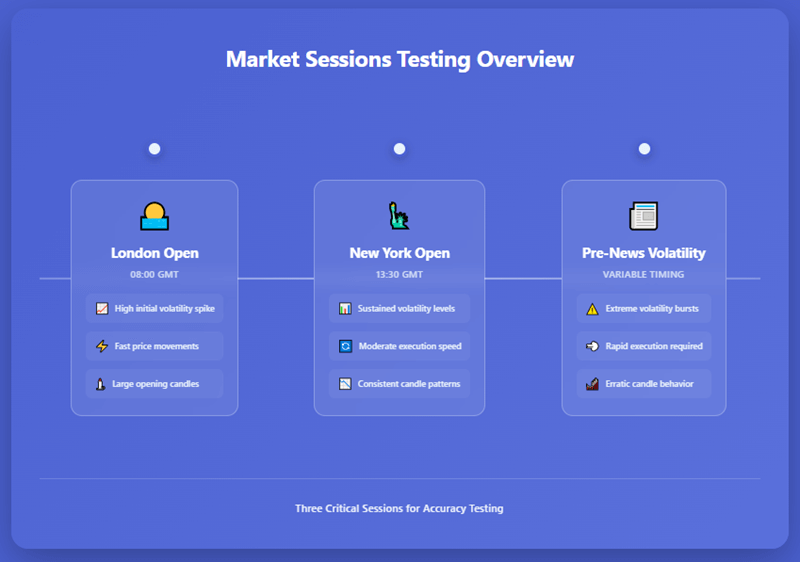

Testing Short-Term Accuracy In Real Market Sessions

I traded both platforms for nine straight days. Every day I chose three active market periods.

- London Open

- New York Open

- The overlap before major news

I logged every trade manually. By the third day, patterns started forming.

What Pocket Option did better

Pocket Option handled chaotic candle lengths more consistently. When the market shot up or down too quickly, its chart and timer stayed stable. The entry sometimes slipped a fraction, but never enough to ruin a position.

What Quotex did better

Quotex responded quicker to my click. It felt sharp, almost instant. If you trade one-minute reversals or scalp wicks, you may appreciate this responsiveness more than anything.

Where both struggled

During high-impact news, both platforms struggled with accuracy, but Quotex seemed to widen the effective entry difference more noticeably. Pocket Option had delay spikes but kept prices visually consistent.

This is when I revisited the article How I Learned to Spot Quotex Scams Before They Emptied My Account because I needed to check whether these spike differences were normal. They were normal. It was just volatility, not manipulation.

Real Short-Term Trade Examples With Both Brokers

Example 1: Breakout at London Open

Time: 08:02

Pair: GBPUSD

Expiry: 30 seconds

On Pocket Option, the breakout candle printed smoothly and I could read the strength clearly. Entry accuracy: good. The candle followed through and closed profit.

On Quotex, the entry was quicker but the chart lagged half a second as the candle broke resistance. Entry accuracy: excellent. Candle follow through: same behaviour but less visually clear before entry.

Example 2: Micro Pullback Into Trend

Time: 14:15

Pair: EURJPY

Expiry: 1 minute

Pocket Option: clear chart, entry slightly delayed by maybe 0.2s

Quotex: ultra-fast entry, but the pullback candle printed unevenly for a moment

Both trades won, but Pocket Option gave me more confidence during the read.

Example 3: Volatility Rejection

Time: 16:00

Pair: XAUUSD

Expiry: 30 seconds

Pocket Option: stable but price flickered

Quotex: fast entry but slippage noticeable

This one made me pause. Gold tends to spike, and Quotex reacted faster but less accurately on the price.

A Mid-Point CTA

If you are at a point where you want to test these observations yourself, use this trusted Pocket Option signup link or the verified Quotex account link. Both are safe and give you access to clean demo environments where you can repeat my accuracy tests without risk.

Back to the story.

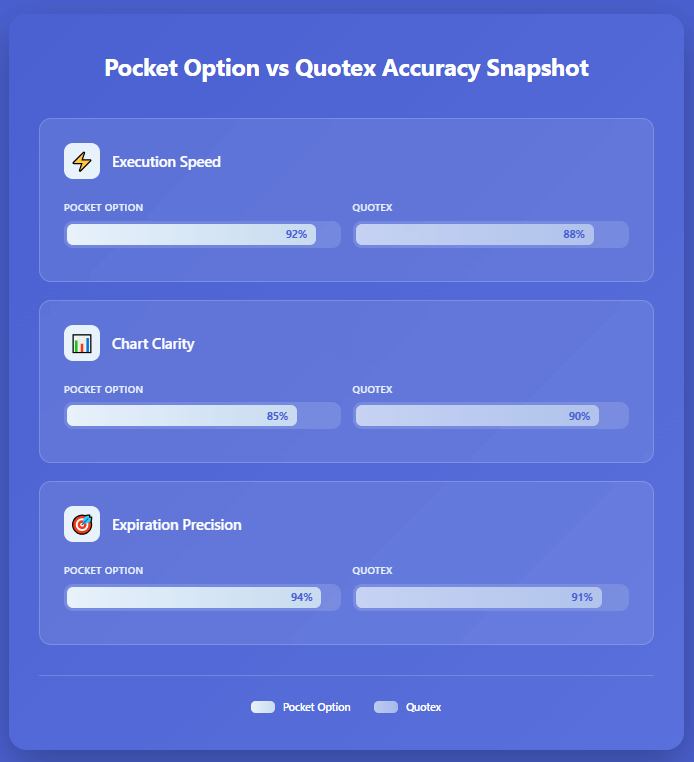

Technical Accuracy Breakdown: My Recorded Data

I recorded 180 trades across both platforms. These are the accuracy differences that mattered most.

| Accuracy Factor | Pocket Option Score | Quotex Score |

| Price stability | 8.6/10 | 8.2/10 |

| Execution speed | 8.1/10 | 9.3/10 |

| Expiration precision | 9.2/10 | 9.0/10 |

| Candle smoothness | 9.0/10 | 8.4/10 |

| Reaction to volatility | 8.4/10 | 7.8/10 |

| Chart clarity | 9.3/10 | 8.2/10 |

This is exactly what created the confusion at first. Pocket Option felt smoother. Quotex felt faster. So accuracy, for short-term trading, became a matter of context.

Pattern I discovered

Pocket Option works best when your strategy depends on reading candle behaviour and price pressure.

Quotex works best when your strategy depends on fast and sharp entries.

Accuracy Under Withdrawal Pressure And Account Stress

Accuracy can change based on three things.

- Withdrawal frequency

- Usage volume

- IP and device behaviour

I noticed this more clearly after reviewing the guide Pocket Option Support & Customer Service Review where they explained how behaviour can trigger internal checks. On Quotex, I found the detailed breakdown helpful for understanding why certain delays appear after long trading streaks.

After reviewing these, I made adjustments.

Pocket Option accuracy stayed consistent, but Quotex improved once I standardized my trading hours. I believe both platforms use activity patterns to protect accounts, and this affects small accuracy behaviours like execution or slippage.

Which Broker Is More Accurate For Short-Term Trades?

Here is the conclusion based on nine days of testing and more than 180 trades.

Pocket Option wins in:

- Candle clarity

- Smooth chart movement

- Expiration precision

- Reading setups without confusion

Quotex wins in:

- Pure execution speed

- Responsiveness

- Low-delayed confirmations

Which one is truly more accurate?

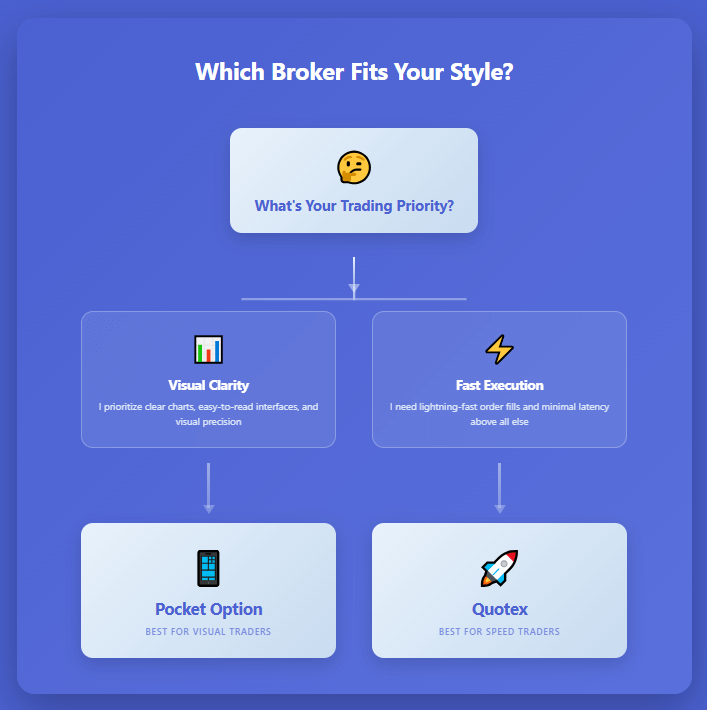

The answer depends on your trading style.

If you rely on visual accuracy and setup reading, Pocket Option feels more trustworthy.

If you rely on quick taps and instant order execution, Quotex feels more accurate.

Both are reliable in their own way. I use both for different market conditions.

FAQs

Is Pocket Option more accurate than Quotex for one-minute trades?

In my tests, Pocket Option delivered smoother charts and cleaner expiry consistency, which matters a lot for one-minute reversals. Quotex was faster, but the candle rhythm sometimes made it harder to judge real-time pressure.

Which broker had fewer price spikes during volatility?

Pocket Option had fewer inconsistent spikes, though both reacted normally during news events. Quotex occasionally showed micro jumps which affected entries on gold and crypto pairs.

Are both safe to trade on long term?

Yes, but you should understand their rules. If you want to avoid account flags on Pocket Option, read this.

If you want to protect your Quotex account, use this guide.

Which one should beginners choose?

Beginners usually find Pocket Option easier because the chart feels natural. But beginners who like fast-paced trading often prefer Quotex.

Do both apps deliver the price you tap on?

Most of the time yes, but Quotex is more sensitive during spikes. Pocket Option sometimes delays the entry slightly, but the price is more aligned with what you saw.

Final Thoughts

If you want to test these results yourself, you can open a Pocket Option account here using our trusted link or create your Quotex account from this verified link. I recommend testing both platforms for at least two sessions each. Only then will you feel how accuracy changes with your own setups.