The Psychology of Binary Options: Why Demo Feels Easy and Live Hurts

The first time I opened a binary options demo account, I felt like I had discovered a secret portal. Everything seemed simple. I was placing trades quickly, experimenting with different expiry times, and watching my balance grow. That early phase felt almost unreal, like playing a trading simulator instead of dealing with financial markets.

But the day I switched to a real, funded account, everything inside me shifted. Suddenly my heart raced. My palms felt warm. The screen didn’t look like the same platform I used the week before. That single switch from demo to live revealed something I hadn’t seen coming: the psychology of binary options is the real battlefield, not the charts.

If you’re ready to face that psychological transition with real tools and real understanding, this is your starting point. And if you’re prepared to take the next step when the time is right, you can open a real account here and step into the market with clarity and structure.

How Demo Accounts Created a False Sense of Mastery

During my early weeks on demo, I kept pushing buttons without hesitation. I tested signals, expiry times, candlestick patterns, and trend breaks. Every trade felt light. Even when I lost, I treated the loss like a small inconvenience and moved on.

The absence of consequence created an inflated confidence. I told myself I was “learning,” but what I was really doing was avoiding the emotional reality of money risk. The more trades I took, the more I believed I had cracked the code. My demo performance looked flawless on some days. High win rates, growing balance, no stress.

But that environment did something dangerous to my mindset. It trained me to feel safe where risk didn’t exist. It rewarded me for being reckless because nothing was at stake. That false confidence would later hit me hard when I switched to live trading and felt the emotional punch of real loss.

If you want a deeper breakdown of the differences between the two environments, you may find my reflections in the guide on demo vs live binary options helpful.

The Shock of My First Live Trade

When I finally funded my account, I placed the first trade with careful analysis. It was a trend-following move on EUR/USD, a setup I had done dozens of times on demo. But this time, every second felt heavier. The chart moved more slowly. My chest tightened as the candle fluctuated.

When the price moved against me, my mind immediately tried to protect me. “It’s just temporary,” I thought. “Give it a few seconds.” But those few seconds came and went, and the loss felt like someone had pulled something out of my stomach.

It wasn’t about the amount I lost. It was about the realization that I wasn’t prepared for the emotional weight of real trading. This is where the psychology of binary options becomes very visible. A demo account shows you mechanics. A live account shows you yourself.

The Real Difference Between Demo and Live: It’s Not the Market, It’s You

A Different Relationship With Risk

In the demo, risk feels like a concept. On live, it feels like a sensation in your body. Even a small stake feels meaningful. I realized that I had never actually practiced risk tolerance on demo. I practiced chart-reading, not emotional control.

Overconfidence Crashes Under Real Pressure

When my demo win rate made me feel unstoppable, I didn’t notice how fragile that confidence was. Under real pressure, that confidence cracked instantly. Every hesitation and every doubt grew louder when money was involved.

Every Loss Becomes Personal

In the demo, I logged losing trades without emotion. In live mode, a single loss felt like a failure. I started questioning my method, my timing, and my judgment, even on setups that were perfectly valid.

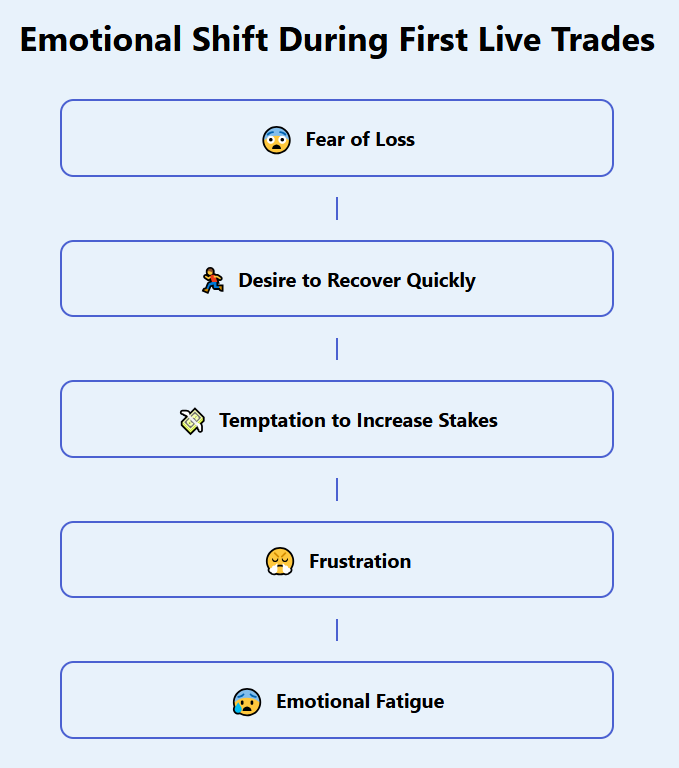

The Emotional Cost of Decision-Making

The moment real money enters the equation, you start experiencing new emotional layers: fear of loss, temptation to recover quickly, desire to increase stakes, and frustration when markets move unpredictably.

These reactions were never visible to me during demo trading. The market didn’t change. I did.

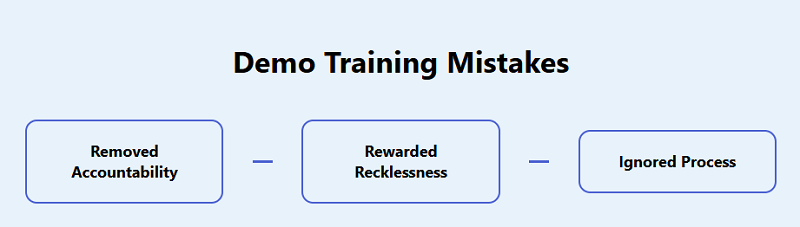

Why My Demo Training Failed Me

I didn’t fail because my strategy was weak. I failed because my demo habits had no discipline behind them. I had never practiced emotional consistency. I had never learned to stop trading after reaching a loss limit. I didn’t even realize how impulsive I was until real money made me feel the consequences.

Looking back, the root causes were simple:

Demo Removed Accountability

When I reset my demo balance after a bad streak, I was teaching myself that mistakes had no cost. The habit of “starting fresh” carried over into live trading, where that mindset becomes destructive. I explain this more deeply in my piece about why resetting demo accounts hurts discipline.

Demo Rewarded Recklessness

Large trades felt entertaining on demo. On live, they felt dangerous. But by then, I was already conditioned to think big stakes were normal.

Demo Made Me Ignore Process

Because wins came easily and losses barely mattered, I never built a decision-making framework. I never tracked emotions. I never practiced stopping when I felt tired or impatient.

So when I went live, I walked into the market emotionally untrained.

The Psychology of Binary Options Is Learned Through Emotions, Not Charts

Charts teach you patterns, but emotions teach you survival. Binary options amplify emotions because time is short, outcomes are binary, and feedback is instant. One minute changes everything.

Fear Alters Your Judgment

My first few live sessions taught me how fear enters through the smallest cracks. A single losing trade can shake the entire session, making you doubt the next setup even when the data is clear.

Greed Distorts Your Vision

When I had a streak of wins, my mind didn’t stay neutral. I started believing the market favored me, which was not true. That illusion pushed me to increase stakes, widen risk, and break my rules.

Impatience Leads to Overtrading

Binary options are fast-paced, which makes it tempting to “do one more.” On demo, this cycle felt harmless. In real life, it became exhausting.

Stress Shrinks Your Time Horizon

When losses hurt, the mind wants quick recovery. It narrows your thinking. Long-term discipline fades into short-term desperation.

This emotional spiral is why so many traders succeed on demo but struggle in live environments.

How I Rewired My Demo Habits to Train My Live Mindset

It took several weeks to understand that the demo should not be a playground. It should be a simulation. So I rebuilt my training approach from the ground up.

I Set Realistic Risk Rules

One of the first things I changed was how I sized my demo trades. Instead of placing random amounts, I capped everything at the same fixed percentage of a realistic balance. That kept me honest.

I Introduced Emotional Journaling

Before, I only recorded setups and outcomes. Now I write how I feel before I enter a position, what my thoughts are during the trade, and how the outcome affects my mindset. Over time, this journal revealed patterns in my behavior I wasn’t aware of.

I Trained With Stop-Loss Limits

I treated my demo sessions like live ones. If I had a losing streak, I stopped immediately. This built discipline and prevented emotional fatigue.

I Simulated Real Consequences

After each demo session, I asked myself how I would feel if the results were real. This quiet moment of reflection became one of my most important psychological tools.

I Practiced Slow Execution

Instead of firing trade after trade, I practiced waiting. I trained myself to see fewer setups but execute them better. It helped break the impulsive habits I had developed on demo.

These shifts made me a different trader not because my strategy changed, but because my mind finally caught up with the realities of live trading.

When My Live Trading Started To Stabilize

A few weeks after restructuring my demo training, I went back to my live account with a different mindset. I wasn’t perfect, but I felt grounded.

I placed a modest trade on a familiar setup. The chart dipped slightly, and I felt tension, but not panic. I accepted the possibility of loss before placing the trade, which made the outcome easier to process. The trade ended slightly negative, but I didn’t feel shaken. I moved on calmly.

That moment showed me that improvement in the psychology of binary options isn’t about removing emotions, it’s about managing them. When emotions stay within a controlled range, trading becomes clearer.

The Emotional Cost of Live Trading (And Why It’s Worth Facing)

Trading exposes parts of your personality you rarely confront in daily life. I discovered impatience, fear, and stubbornness I didn’t know I had. But I also found discipline, resilience, and clarity.

The emotional cost is real. But so is the emotional growth. If you handle the psychological side early, your trading becomes healthier and more sustainable. This has been one of the biggest lessons of my journey.

Why Many Traders Never Make It Past Demo

Through conversations and my own experience, I realized most traders fail for psychological reasons, not strategic ones.

Many stay stuck in the demo because the moment they switch to real funds, their confidence collapses. They are shocked by the emotional weight of real losses. Their strategy suddenly feels unreliable. Their patience evaporates.

The problem isn’t the strategy. The problem is that the demo never trained their emotional responses. That’s why I always encourage new traders to approach a demo with structure. If you want a practical guide to this transition, you may find value in the best way to use a demo accounts article.

My 30-Day Psychological Conditioning Plan

To fully bridge the gap between demo and live, I created a 30-day schedule focused entirely on discipline, emotion, and consistency. It is the most useful blueprint I ever built for myself.

Week 1: Emotional Awareness

I spent this week identifying how emotions influenced my decision-making. I wrote down feelings before and after trades. I practiced stopping when I felt stressed or bored.

Week 2: Controlled Risk and Patience Training

During this week, I enforced strict stake limits. I followed the session caps. I trained myself to wait for valid setups instead of reacting to noise.

Week 3: Simulated Stress Exposure

I intentionally took demo trades under more pressured conditions. I noted how I reacted when the session was going poorly. I trained myself to pause instead of forcing a recovery.

Week 4: Partial Transition to Live

I began placing small live trades not for profit, but for emotional conditioning. I continued journaling and reviewing every session. The improvement I saw in discipline and clarity convinced me I was moving in the right direction.

For a deeper step-by-step structure, the 30-day progression plan goes deeper into both emotional and technical habits.

The True Lesson: Psychology Shapes Your Performance

Today, when I place trades, I do so with a far stronger mindset. I still feel the tension of live trading, but it doesn’t derail me. I follow my rules. I allow losses. I maintain emotional distance from outcomes.

The biggest transformation wasn’t in how I read charts. It was in how I read myself. Understanding the psychology of binary options changed everything about how I trade.

If you’ve reached a point where a demo no longer teaches you anything new, and you want to experience the emotional clarity of real trading with structure, you can open your trading account here and begin the journey on solid ground.