Trading vs Gaming on IQ Option: Are You Treating It as a Casino?

When Trading Felt Like a Mobile Game…..

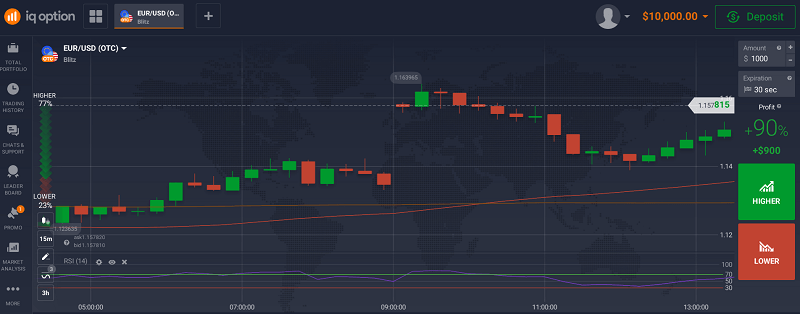

The first time I used IQ Option, I didn’t think I was doing anything wrong. I just opened the platform, clicked “Call” on EUR/USD, and watched the timer tick down. Thirty seconds later, I won. That rush, it hit like a dopamine shot.

I kept going. No chart analysis. No plan. Just button-pushing instinct. It felt exciting, like I was playing a strategy game on my phone. Fast, fun, and profitable… at first.

But that feeling didn’t last.

One evening, I opened a few trades back to back, lost them all, and doubled my trade size in frustration. Two more losses, and my $100 deposit was gone.

That’s when I realised: I wasn’t trading. I was gambling.

How the Line Between Trading and Gaming Gets Blurry

IQ Option is beautifully designed. That’s part of the problem. With its fast interface, smooth graphics, and one-click trades, it doesn’t feel like a traditional broker. You can go from signup to live trading in under five minutes. No friction.

There’s no complexity at the start; just assets, direction, amount, and boom, you’re in.

That simplicity is what pulls people in. But without a strategy, it’s easy to turn every trade into a coin toss.

Learn more about IQ Option addiction and overcoming it.

The Wake-Up Call I Needed

After blowing my second deposit chasing losses, I decided to pause. Not quit, just step back and figure out what I was doing wrong.

I opened a blank Google Sheet and started tracking my trades. For each one, I wrote down the asset, time, direction, expiry, result, and most importantly why I took it.

By the end of the week, the truth was staring back at me.

Almost every entry under “Why” said things like:

- “Felt like it would reverse”

- “Just trying this one quickly”

- “Trend looks strong (but didn’t check higher timeframes)”

Not a single one was based on a system. No confirmation. No consistency.

I had to admit it, I wasn’t trading. I was just playing with money.

Read out about 5 emotional triggers that could ruin your trading.

How I Rebuilt My Approach (And My Account)

I didn’t want to give up on IQ Option. The platform itself wasn’t the issue. The issue was me.

So I started fresh. This time, I treated it like a trading business.

First, I limited myself to one session a day, just 30 minutes during the London/New York overlap. I picked only two assets to focus on: EUR/USD and BTC/USD. I switched to 3-minute expiries instead of 60 seconds. And I only placed a trade when I had at least two reasons based on the chart like RSI divergence plus a support bounce.

I still lost trades. But now, they were controlled. Each loss was part of a system not a reaction.

Most importantly, I no longer felt triggered to “win it back.”

So… Are You Trading or Gaming?

Here’s the difference I started to see.

When I was gaming, I traded emotionally. I looked for excitement. Every click was a bet, not a decision. When I was trading, I slowed down. I waited for setups. I accepted losses calmly. And my results showed it.

You don’t need a dozen indicators to make this shift. You just need awareness.

Are you making decisions… or guesses?

Are you trading based on analysis… or boredom?

Are you reacting… or responding?

What Helped Me Stay Disciplined

After that reset, I followed three simple rules:

- Don’t trade without a reason I can explain in one sentence.

- Don’t increase trade size after a loss, ever.

- Journal everything, even the bad trades.

- Avoid martingale traps at all costs.

Those three things made more difference than any fancy strategy I’ve ever tried.

If you’re just starting out or feel like your trades are getting emotional, maybe it’s time for your own reset too. You can test your discipline on IQ Option’s demo account or start small here: Open your IQ Option account →

What IQ Option Does Right (And Why It’s Up to You)

I want to be clear, I never felt IQ Option was a scam. Every deposit and withdrawal worked. Support responded within 24 hours. The platform is well-made and fast.

But like any powerful tool, it can hurt if you don’t use it carefully.

IQ Option won’t stop you from overtrading. It won’t warn you when you’re being impulsive. That’s your job.

Treat it like a game, and it’ll behave like one. Treat it like a trading platform, and it’ll start rewarding you like one.

Final Thoughts

I started on IQ Option looking for quick profits. What I found was a mirror. Every bad habit, every emotional decision, it showed me exactly where I needed to grow.

Once I stopped gaming and started trading, everything changed.

If you’re using IQ Option, take a moment today. Ask yourself:

Are you trading with intention or are you just hoping to get lucky?

If you’re ready to approach it seriously, the tools are there. Start smart → get your free account here

FAQs

Can you treat IQ Option as a serious trading platform?

Absolutely. But only if you have a system and manage your risk. Without that, it becomes emotional and reactive, more like gambling.

Why do people compare binary options to gambling?

Because the fast outcomes and fixed payouts make it feel like betting. But with strategy and control, it becomes a legitimate way to trade short-term price movements.

What’s the biggest difference between a trader and a gambler?

A trader accepts risk and plans around it. A gambler ignores risk and chases results.

How can I tell if I’m gambling on IQ Option?

If you’re trading based on gut, increasing trade size after losses, and can’t explain your entries, you’re likely gambling.