5 Emotional Triggers That Killed My Trades on IQ Option

When I first opened an IQ Option account, I thought trading was about charts, signals, and strategies. I spent hours studying candlestick patterns, technical indicators, and news catalysts. But what no one told me was this: the real battle is not with the market, it’s with yourself.

Every time I blew an account or went on a losing streak, it wasn’t because my analysis was terrible. It was because emotions took control of my decisions. Fear, greed, overconfidence, and even anger disguised themselves as “logic.”

In this article, I’ll break down the five emotional triggers that repeatedly destroyed my trades on IQ Option. For each one, I’ll share a real example from my own journey, explain the psychology behind it, and outline the fixes I used to recover. If you’ve ever felt like you’re your own worst enemy in trading, this is for you.

👉 If you’re new, start with an IQ Option demo account. It lets you test your psychology in a safe space before risking real money.

Overconfidence: When Winning Streaks Turn Dangerous

My Overconfidence Story

I remember one week when I couldn’t seem to lose. I had five winning trades in a row on EUR/USD and Bitcoin. My account balance had jumped nearly 25%. Instead of being grateful, I felt invincible.

The very next day, I broke all my own rules. I entered a $500 trade on GBP/USD without a stop loss, thinking, “I can’t lose, I’ve figured this out.” Within 15 minutes, I watched the candle move against me. Instead of cutting the loss, I doubled down.

By the end of that session, my week’s profit, and more, was gone.

Why Overconfidence Happens in Trading

Psychologists call this the illusion of control. After a streak of wins, the brain convinces us that we’re more skilled than we are. On platforms like IQ Option, where trades can resolve in 1–5 minutes, the rush of quick profits tricks us into believing the outcome is predictable.

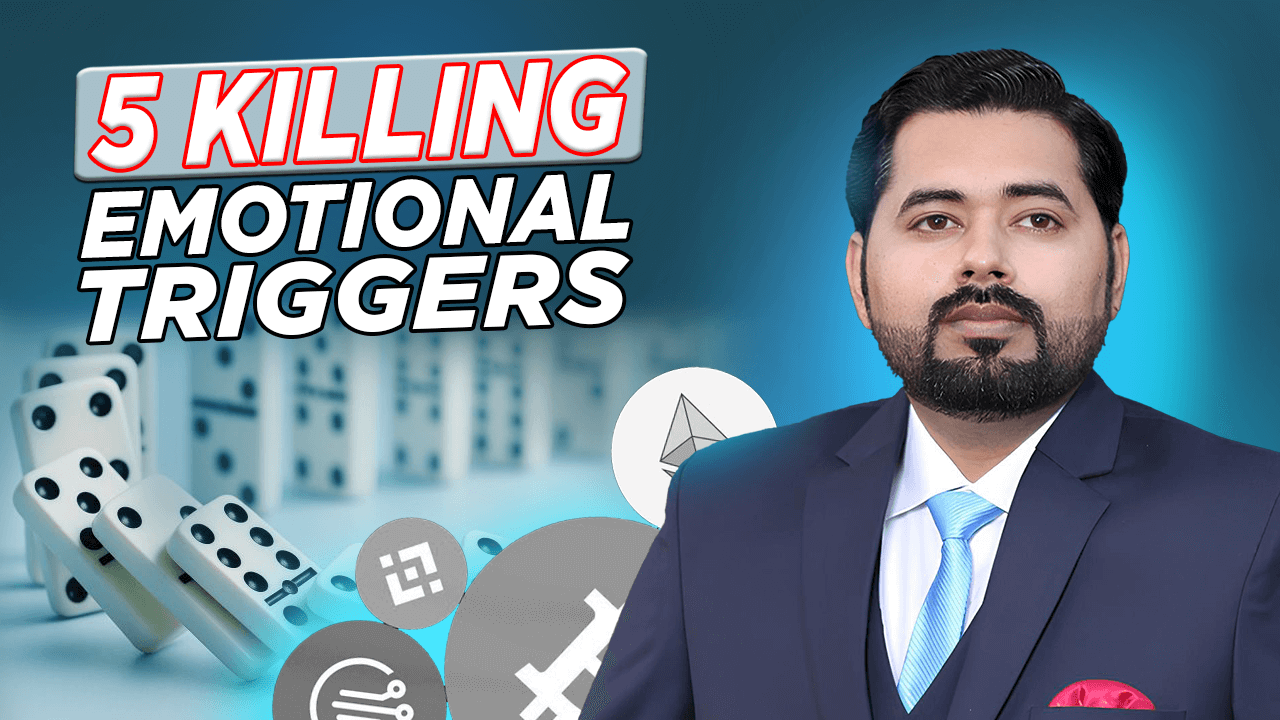

How I Recovered from Overconfidence

The fix wasn’t just “be humble.” I created practical safeguards:

- I capped my maximum position size to 2% of my account balance.

- I forced myself to take a day off after three consecutive wins.

- I started journaling not only losses but also wins to see if my wins were based on real setups or pure luck.

👉 Pro tip: Don’t confuse luck with skill. The market rewards discipline, not arrogance.

FOMO: Chasing Trades That Don’t Belong to Me

My FOMO Disaster

One night, I saw EUR/USD breaking out after a news release. I wasn’t at my desk during the start of the move, but when I opened my chart, I panicked. “If I don’t enter now, I’ll miss the big rally!”

I jumped in at the very top of the breakout. Within minutes, the price reversed. I had literally bought the peak. That single FOMO trade wiped out two days of slow, careful gains.

The Psychology of FOMO

FOMO is driven by loss aversion; the pain of missing an opportunity feels worse than the pain of losing money. On fast-moving platforms like IQ Option, where candles move quickly, FOMO feels even stronger.

How I Controlled FOMO

The only way I beat FOMO was by creating a trading checklist. I wasn’t allowed to trade unless two or more of my conditions were met, such as trend confirmation and candlestick setup.

I also stopped looking at social media groups during trading hours. Seeing other traders “boast” about their profits directly triggered my impulsive decisions. Each trigger ties back to loss psychology.

Greed: The Silent Account Killer

When Greed Took Over

After a winning trade on Tesla stock, I told myself, “Just one more, then I’ll stop.” That one more turned into five trades. At first, I was up even higher. But the sixth trade wiped out all my gains.

I learned the hard way that greed doesn’t look like greed at first; it feels like ambition.

Why Small Wins Don’t Feel Satisfying

Traders often underestimate the power of compounding. A 2% daily gain sounds small, but over a year, it can transform an account. The problem is, our brains crave big wins, not slow growth.

My Anti-Greed System

To fight greed, I built two rules:

- I set a daily profit target (3%–5%). Once I hit it, I logged out.

- I stopped trading in emotional states like excitement or boredom.

👉 Greed makes you stay longer than you should. The most successful IQ Option traders I know close their platforms while still ahead.

Revenge Trading: My Worst Habit on IQ Option

My Revenge Trading Spiral

One of my worst nights was after losing $200 in a single trade. Instead of walking away, I told myself, “I’ll get it back.” I entered another trade twice the size. It lost. I doubled again. Lost again.

In under an hour, I had burned 40% of my account. Not because my strategy was wrong, but because my ego was.

The Psychology of Revenge Trading

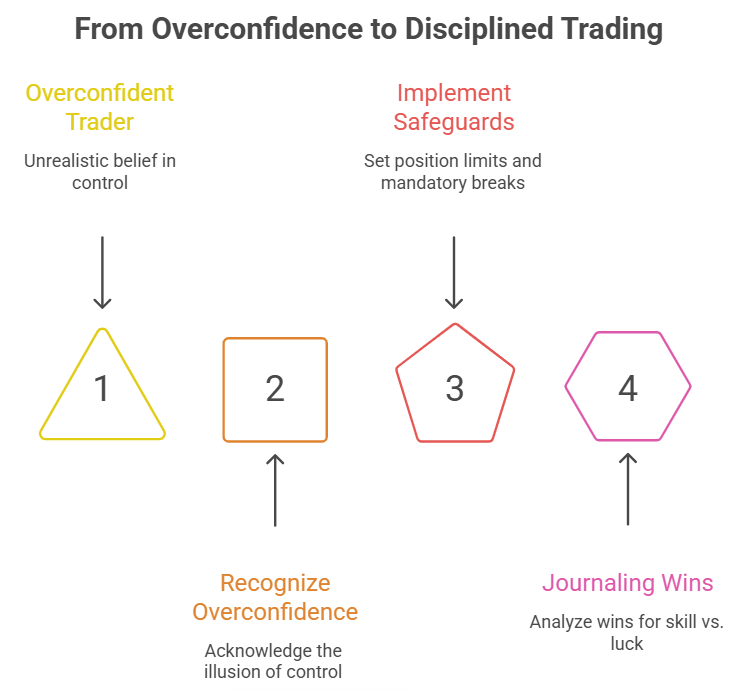

Revenge trading is fuelled by anger and ego. You feel personally insulted by the market and want to prove yourself right. But markets aren’t personal; they don’t care about you.

How I Stopped Revenge Trading

I wrote one strict rule in bold letters: Two consecutive losses = Stop trading for the day.

Even if I felt the urge, I shut down my laptop. This single habit prevented dozens of emotional blow-ups.

👉 Take control today: Open an IQ Option demo, test your discipline, and build the mindset that separates winners from losers.

Anxiety and Paralysis After Losses

The Hesitation Problem

After a string of losses, I developed the opposite problem of revenge trading; I became afraid to pull the trigger. Even when I spotted valid setups, I doubted myself. Sometimes, I’d exit early, only to see the trade go in my favour.

Why Anxiety Takes Over

This is the classic fight-or-flight response. The brain associates trading with pain and loss, so it tries to avoid future pain by hesitating. The problem is, hesitation itself leads to poor execution.

Regaining Confidence

I tackled this by journaling every trade. I rated my emotional state (calm, stressed, confident, anxious) before each entry. Over time, I realised most of my anxious decisions came late at night or after long workdays. By simply avoiding those hours, my hesitation dropped.

Sometimes, the best fix for anxiety is reducing trading frequency. Quality beats quantity every time.

Emotional Awareness as a Trading Tool

The most significant shift in my journey was treating emotions as indicators. Just like I wouldn’t trade against RSI or MACD, I stopped trading when I felt tired, angry, or rushed.

By making emotional awareness part of my strategy, I reduced impulsive trades by 70%.

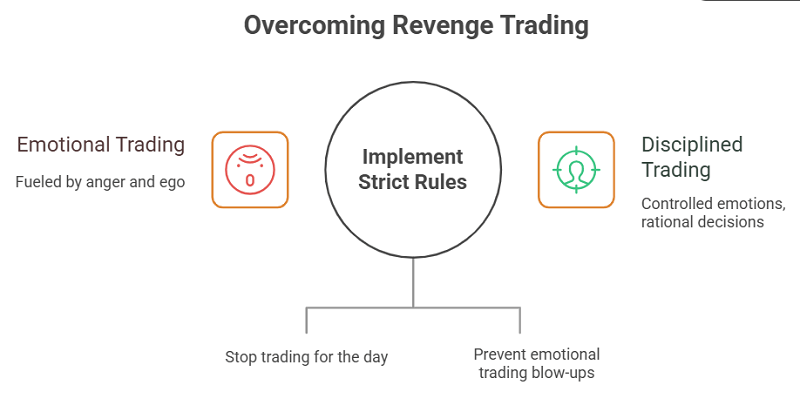

Building My Recovery Plan: From Chaos to Consistency

After months of trial and error, I built a system that blended strategy with psychology:

- Set rules in advance and never break them.

- Tracked emotions alongside entries and exits.

- Stopped trading after daily limits were hit, whether profit or loss.

- Practised in demo mode whenever I felt emotional instability.

This wasn’t a quick fix, but over time, my account stopped swinging wildly. I finally achieved consistency. I hit a breaking point with IQ Option addiction.

Final Thoughts: Why Controlling Yourself is the Real Edge

The truth is, IQ Option didn’t kill my trades; my emotions did. Overconfidence, FOMO, greed, revenge trading, and anxiety were all self-made traps. The moment I learned to master them, my results improved dramatically.

Trading success isn’t just about strategies or market analysis. It’s about mastering yourself.

Don’t let emotions control your trades. Open an IQ Option account today, test your strategies, and build discipline before risking real money.