Quotex Candlestick Patterns Every Trader Must Know

Let me tell you about the day I discovered the real power of candlestick patterns on Quotex. I was staring at my screen, watching my account balance drop for the third consecutive day. The charts looked like random noise to me back then. Every trade felt like a coin flip. Sound familiar?

That’s when my mentor pulled me aside and said something that changed everything: “Stop looking at prices. Start reading the story that candles tell you.” Those words transformed my trading from guesswork into a calculated strategy.

Today, I’m sharing the exact candlestick patterns that helped me turn my trading around on Quotex. These aren’t just pretty pictures on a chart. They’re the market’s way of whispering its next move to those who know how to listen.

Ready to transform your trading? Start your Quotex journey today with crystal-clear charts designed for pattern recognition. Open your free demo account now.

The Hidden Language of Candlesticks

Before we dive into the patterns, let me paint you a picture. Imagine you’re at a poker table. The other players’ facial expressions, body language, and betting patterns tell you everything you need to know about their hands. Candlesticks work the same way in trading.

Each candlestick carries four pieces of information: opening price, closing price, highest price, and lowest price. But here’s what most traders miss. The real magic happens when you combine multiple candlesticks together. That’s when the market starts telling its story.

Candlestick patterns are great indicators of the continuation or reversal of a trend, and this information can be valuable when making trading decisions. This is especially true on Quotex, where timing is everything.

Why Quotex Traders Love Candlestick Patterns

Quotex offers clean, easy-to-read charts that make candlestick analysis a breeze. Unlike some platforms where you need to squint at tiny candles, Quotex provides crystal-clear visualization. The platform’s responsive design means you can spot patterns whether you’re on your phone during lunch break or analyzing on your desktop at home.

The beauty of using candlestick patterns on Quotex lies in their simplicity. You don’t need complex indicators or expensive software. Just your eyes and the knowledge I’m about to share with you.

Pattern 1: The Hammer – Your Reversal Signal

Picture this: you’re watching EUR/USD on Quotex, and it’s been falling for hours. Suddenly, you see a candle with a small body and a long lower shadow. That’s a hammer, and it’s telling you the bears are losing control.

I remember trading this pattern on gold during a particularly volatile session. The price had dropped 50 points in two hours. Then I spotted a perfect hammer forming on the 1-minute chart. The long lower shadow showed that sellers pushed prices down, but buyers stepped in and pushed it back up.

Here’s how to trade the hammer on Quotex: Wait for the hammer to form completely Look for it at the bottom of a downtrend Enter a call position on the next candle Set your expiry time to 2-3 candles ahead Use proper risk management – never risk more than 5% of your account

The hammer works because it shows a shift in sentiment. Sellers tried to push prices lower but failed. Smart money recognizes this failure and starts buying.

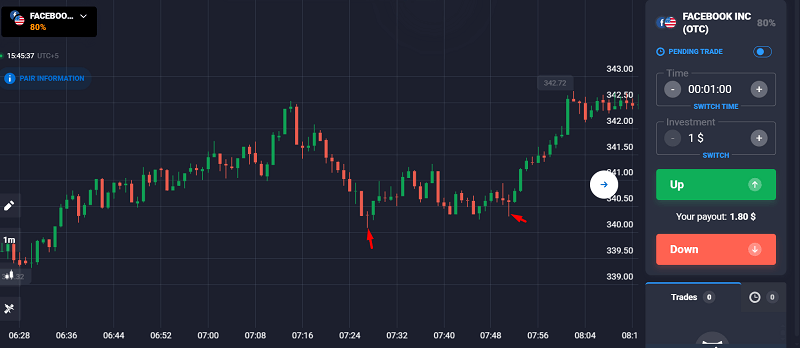

Pattern 2: The Hanging Man – When Bulls Get Tired

The hanging man looks identical to the hammer, but context is everything. When you see this pattern at the top of an uptrend, it’s a warning sign that buyers are exhausted.

I learned this lesson the hard way when I was trading Facebook stock on Quotex. The stock had been climbing for days, and I kept buying calls. Then I saw a hanging man form at a resistance level. I ignored it and placed another call. Big mistake. The stock dropped 3% the next day.

The hanging man tells you that during that trading period, sellers managed to push prices down significantly before buyers regained control. But the fact that they couldn’t maintain the gains is worrying for bulls.

Trading the hanging man: Spot it at the top of an uptrend Wait for confirmation with the next candle If the next candle closes lower, consider a put option Use tight stop losses as reversals can be swift

Pattern 3: The Doji – Market Indecision

The doji is like the market’s way of saying “I don’t know what to do next.” It forms when the opening and closing prices are virtually identical, creating a cross-like shape.

I’ve seen traders dismiss doji patterns as insignificant, but they’re making a huge mistake. The doji represents perfect balance between buyers and sellers. It’s a pause in the action, and what happens next often determines the market’s direction.

There are several types of doji: Standard doji with equal upper and lower shadows Gravestone doji with long upper shadow and no lower shadow Dragonfly doji with long lower shadow and no upper shadow Long-legged doji with very long shadows on both sides

The key to trading doji patterns on Quotex is patience. Don’t rush into a trade based on the doji alone. Wait for the next candle to show you the market’s decision.

Pattern 4: The Engulfing Patterns – Power Shifts

Engulfing patterns are like watching a bigger fish swallow a smaller one. They consist of two candles where the second candle completely engulfs the body of the first.

Bullish engulfing happens when a small red candle is followed by a large green candle that completely covers the red one. This shows bulls have taken control from bears.

Bearish engulfing is the opposite. A small green candle followed by a large red candle that engulfs it completely. Bears have wrestled control from bulls.

I use engulfing patterns as my primary reversal signals on Quotex. They’re reliable because they show a clear shift in market sentiment. The bigger the engulfing candle, the stronger the signal.

Real trade example: I was watching Bitcoin on Quotex when it formed a bearish engulfing pattern right near $110,000 resistance level. The first candle was a small green candle that barely pushed above resistance. The second candle was a massive red candle that not only erased the gains but closed well below the previous candle’s low. I immediately placed a put option with a 30-minute expiry. Bitcoin dropped $300 in the next 20 minutes.

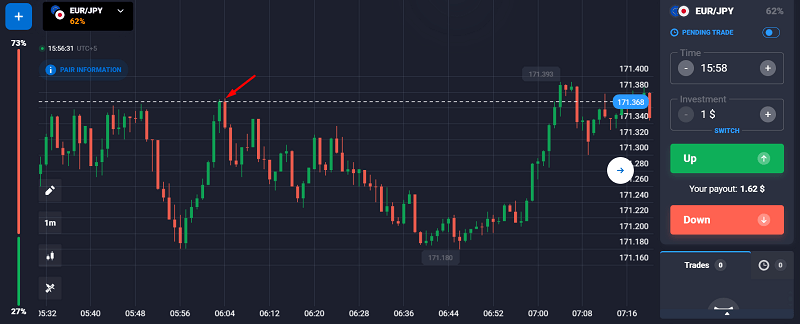

Pattern 5: The Shooting Star – Bulls Lose Steam

The shooting star is the opposite of the hammer. It has a small body with a long upper shadow, showing that buyers pushed prices higher but couldn’t maintain the advance.

This pattern works best when you spot it at resistance levels or at the top of uptrends. It’s the market’s way of saying “we tried to go higher, but there’s too much selling pressure up there.”

I remember trading the shooting star on EUR/JPY during a major news event. The pair had been climbing all morning, then formed a perfect shooting star right at a key resistance level. The long upper shadow showed that buyers had pushed the pair significantly higher, but sellers stepped in and pushed it back down.

Trading the shooting star: Look for it at resistance levels Ensure it has a long upper shadow (at least twice the body size) The body should be in the lower portion of the candle Enter put positions on the next candle Use the high of the shooting star as your stop loss level

Pattern 6: The Pin Bar – The Rejection Signal

Pin bars are like the market’s way of saying “not interested in these prices.” They have small bodies with long tails (shadows) that show rejection of certain price levels.

A bullish pin bar has a long lower tail showing sellers tried to push prices down but failed. A bearish pin bar has a long upper tail showing buyers tried to push prices up but were rejected.

The appearance of a pin bar on a moving average is particularly significant. When you see a pin bar forming at a key support or resistance level, or at a major moving average, it’s telling you that level is important.

I use pin bars as my go-to pattern for trading bounces on Quotex. They’re especially powerful when combined with other technical analysis tools like support and resistance levels.

Take your pattern trading to the next level. Join thousands of successful traders on Quotex and access professional-grade charting tools.

Pattern 7: The Inside Bar – Consolidation Signal

Inside bars represent consolidation. The entire range of the second candle fits within the range of the first candle. This shows the market is pausing, gathering energy for the next move.

Inside bars are frustrating for impatient traders, but they’re goldmines for those who know how to use them. They often precede explosive moves in either direction.

The key to trading inside bars is waiting for the breakout. Don’t try to predict which way the market will go. Instead, wait for the market to break above or below the inside bar range, then trade in that direction.

I’ve found that inside bars work exceptionally well on Quotex because the platform’s clear visualization makes it easy to spot when the price breaks out of the pattern.

Pattern 8: The Marubozu – Pure Momentum

The marubozu is a candle with no shadows. It opens at one extreme and closes at the other, showing pure buying or selling momentum.

A bullish marubozu opens at the low and closes at the high, showing relentless buying pressure. A bearish marubozu opens at the high and closes at the low, showing unstoppable selling pressure.

These patterns are rare, but when they appear, they’re powerful signals. I use them to identify the beginning of strong trending moves.

Real trade example: I was trading crude oil on Quotex when a major supply disruption was announced. The first candle after the news was a perfect bearish marubozu. I immediately placed a put option, and oil continued falling to $47 within next few minutes.

Pattern 9: The Harami Pattern

The harami pattern consists of a large candle followed by a smaller candle that’s completely contained within the first candle’s body. The Japanese word “harami” means pregnant, and the pattern does look like a pregnant woman.

This pattern shows indecision after a strong move. The large candle shows strong sentiment in one direction, but the small candle inside it shows that momentum is fading.

Harami patterns work best as warning signals. They don’t tell you exactly when a reversal will happen, but they warn you that the current trend might be losing steam.

Combining Patterns for Maximum Profit

Here’s where most traders go wrong. They try to trade every pattern they see. But the real money is made when you combine patterns with other technical analysis tools.

I always look for: Support and resistance levels Moving averages Volume patterns Market context

For example, a hammer pattern is much more reliable when it forms at a key support level. A shooting star is more powerful when it appears at resistance.

The Psychology Behind the Patterns

Understanding why these patterns work is crucial for consistent success. Each pattern represents a battle between buyers and sellers. The winners of these battles determine the market’s direction.

When you see a hammer, you’re witnessing sellers losing control. When you spot a shooting star, you’re seeing buyers getting exhausted. The patterns are psychological footprints left by market participants.

Risk Management with Candlestick Patterns

No pattern is 100% accurate. That’s why risk management is crucial. I never risk more than 2% of my account on any single trade, regardless of how confident I am in the pattern.

Here’s my risk management framework: Position sizing: Never risk more than 2% per trade Stop losses: Always use them, no exceptions Take profits: Don’t get greedy, take profits when available Diversification: Don’t put all your money in one asset

Common Mistakes to Avoid

After years of trading these patterns on Quotex, I’ve seen traders make the same mistakes repeatedly:

Trading every pattern without considering context Ignoring the overall trend Using patterns on timeframes that are too short Not waiting for confirmation Risking too much on single trades

The Best Timeframes for Pattern Trading

Different patterns work better on different timeframes. For Quotex trading, I recommend: 1-minute charts for scalping quick reversal patterns 5-minute charts for day trading momentum patterns 15-minute charts for swing trading major reversals 1-hour charts for identifying longer-term trends

Frequently Asked Questions

Which candlestick pattern is most reliable on Quotex?

The engulfing patterns tend to be the most reliable because they show a clear shift in market sentiment. However, no pattern is 100% accurate, so always use proper risk management.

How long should I wait for pattern confirmation?

Generally, wait for the next 1-2 candles to confirm the pattern. Don’t rush into trades based on incomplete patterns.

Can I use candlestick patterns on all assets on Quotex?

Yes, candlestick patterns work on all assets because they represent basic market psychology. However, some assets may be more volatile than others.

What’s the best time to trade candlestick patterns?

The best times are during high-volume periods when institutional traders are active. This typically includes the London and New York session overlaps.

How do I know if a pattern has failed?

A pattern fails when the price moves significantly in the opposite direction of what the pattern suggests. Always use stop losses to limit losses from failed patterns.

Should I use indicators with candlestick patterns?

Indicators can provide additional confirmation, but they’re not necessary. The patterns themselves are powerful enough when used correctly.

How many patterns should I focus on as a beginner?

Start with 2-3 patterns and master them before adding more. Quality over quantity is key in pattern trading.

Your Next Steps to Profitable Trading

Now that you understand these powerful candlestick patterns, it’s time to put them into practice. Start with a demo account to practice identifying and trading these patterns without risking real money.

Remember, becoming profitable with candlestick patterns takes time and practice. Don’t expect overnight success. Focus on learning one pattern at a time, understanding its psychology, and practicing proper risk management.

The market will always be there, but your trading capital won’t if you don’t protect it. Be patient, be disciplined, and let the patterns guide your trading decisions.

Start trading with confidence today. Open your Quotex account and access the most user-friendly platform for candlestick pattern analysis. Your profitable trading journey begins now.