Quotex Compounding Strategy: How to Grow Your Account Fast

I still recall the first time I encountered the term “compounding” in trading. It sounded like some complicated Wall Street tactic. But over the years, it became my secret weapon. Especially on Quotex, where short-term trades can deliver quick returns, compounding helped me grow small accounts faster than I thought possible.

This guide is everything I wish someone had told me back when I started. I’ll walk you through what compounding really means in binary options, how to apply it on Quotex without blowing your account, and show you a real case study of how I scaled up $50 into $2,100 in just a few weeks. No hype, just what works.

Additionally, a free calculator is available to help you plan your journey.

If you’re new to Quotex, sign up using my link and start with a free $10 demo account or a real one with a minimum deposit of just $10. Start trading on Quotex now.

What Is Compounding in Quotex Trading?

Compounding in Quotex is simply reinvesting your profits to grow your trading capital. Instead of withdrawing every little win, you add it to your next trade. It’s like stacking your gains.

Let’s say you start with $10 and make a 90% win on a trade. That’s $19 now. If you reinvest the $19 and win again, you make $36.10. Do this consistently, and your account will snowball quickly.

But here’s the catch: doing it unquestioningly leads to disaster. Compounding works only if you:

- Have a consistent, high-probability strategy

- Control your emotions

- Stick to a fixed plan and know when to stop

Why Compounding Works Best on Quotex

Unlike forex or stock trading, Quotex gives fixed payouts. You know your reward and risk before you click “Trade.” That’s perfect for compounding because:

- Trade durations are short (60s to 5 mins)

- You can reinvest multiple times a day

- You don’t need 100 trades to see growth

- Losses are limited to your trade amount

It’s basically a fast lane for disciplined traders. But that’s the key word, “disciplined”.

My First Attempt at Quotex Compounding (And What I Got Wrong)

Back in early 2020, I deposited $100 into Quotex. My plan? Compound 100% of profits every single trade. No breaks. No rest. Just full send.

I turned $100 into $400 in one session. Felt like a genius. The next day, I lost it all on trade number one.

I didn’t understand risk tiers, didn’t know when to stop, and I was just chasing numbers. That failure taught me something huge:

“The goal isn’t to get rich overnight. The goal is to grow predictably.”

So I went back to the drawing board. Started slow. Introduced rules. Created a compounding table. And it changed everything.

The Smart Compounding Method I Use Now

Here’s the method that helped me scale consistently.

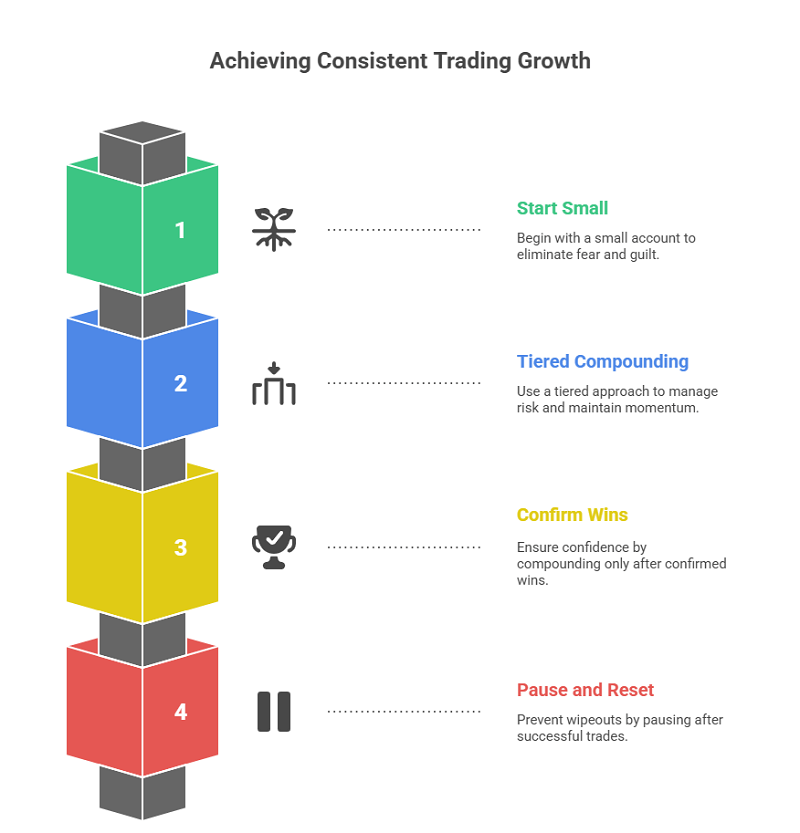

Step 1: Start with a Small Account

I usually begin with $50. Not because I’m broke, but because it removes fear. If I lose it, I walk away. No guilt. No revenge trading.

Step 2: Use a Tiered Compounding Plan

Instead of compounding 100% every time, I break it into tiers.

- Tier 1: Trade with 10% of capital (e.g. $5)

- Tier 2: Reinvest 50% of profits into the next trade

- Tier 3: Once the account grows 100%, withdraw 25% and restart

This method reduces risk while keeping momentum.

Step 3: Only Compound After 2-3 Confirmed Wins

This one’s underrated. I don’t start compounding unless I’ve had two wins using the same strategy in real-time. It builds confidence.

Step 4: Stop After 3-4 Compound Trades

You don’t need to compound endlessly. My rule: stack three successful trades, then pause. Withdraw or reset.

That pause saved me from countless wipeouts.

Real Case Study: $50 to $2,100 in 17 Trading Sessions

Here’s how one of my best runs went.

- Day 1: $50 → $72 (2 trades)

- Day 2: $72 → $105

- Day 3: No trade (market too choppy)

- Day 4: $105 → $160

- Day 5: $160 → $240

- Day 6: $240 → $360 (cashed out $60)

- Day 7: $300 → $450

- Day 8: Loss – back to $300 (reset compounding)

- Day 9-15: Gradual build from $300 → $1,050

- Day 16-17: Two high-conviction trades ($500 and $750)

- Final Balance: $2,100 (with $300 withdrawn earlier)

This wasn’t luck. It was structured. I treated it like a business.

Want to try the same structure? Use the Quotex Compounding Calculator to plan your goals. Set your start amount, daily return, and compounding frequency.

How to Manage Risks While Compounding

Let’s address the elephant in the room: Compounding is risky if done wrong. Here’s how I control it:

- Use 1-2 trusted strategies only (don’t jump between setups)

- Trade during optimal hours (avoid news and low-volume zones)

- Set daily stop loss (mine is 30% of current balance)

- Withdraw weekly (or when you hit a milestone)

- Don’t trade under pressure (skip days if feeling off)

Also, remember that no compounding plan works if your win rate is below 60%. Focus on building consistency first. Then compound.

Best Time to Use Quotex Compounding

Timing is everything. I’ve found the best windows for compounding on Quotex are:

- Morning Session (9 AM to 11 AM GMT+5) – European overlaps, solid volatility

- Evening Session (7 PM to 10 PM GMT+5) – US session winds down, cleaner trends

- Avoid weekends or OTC unless you’re testing.

I also avoid Mondays (due to unpredictable trends) and Fridays (the market cools down after midday).

Common Mistakes I See Traders Make

These killed my earlier attempts, and I still see others doing them:

- Over-trading after a loss to recover

- Compounding without a win streak

- No written plan or table

- Ignoring payout % – if it drops below 70%, skip the trade

- Using full balance each time – this is gambling, not compounding

If you avoid these, you’re already ahead of 90% of traders.

FAQs About Quotex Compounding Strategy

Is compounding more effective than fixed-stake trading on Quotex?

Yes, if you have a consistent win rate and a strict plan. A fixed stake is safer, but compounding yields exponential growth. You can even mix both methods.

How many trades should I compound per day?

Ideally 2–4 max. After that, market conditions change, and psychology gets fragile. Take your profit and reset.

What happens if I lose a compound trade?

You lose only the amount risked on that trade, not the whole chain. That’s why we use tiers and stop points. Never compound all-in.

Can I compound on a demo before trying real money?

Absolutely. You should test your compounding rules on the demo for at least a week. Quotex gives you a free demo account to practice.

What’s the best Quotex strategy to pair with compounding?

I employ a 1-minute trend-following strategy that utilises support and resistance levels, as well as RSI confirmation. Look for clean setups, no noise. Avoid indicators that lag.

Final Thoughts: Compounding Is a Tool, Not a Shortcut

If there’s one thing I’ve learned, it’s this: compounding multiplies your strengths and your weaknesses. If you’re consistent and disciplined, it works like magic. But if you’re emotional and impulsive, it burns fast.

Start small. Use a written plan. Withdraw profits often. And always trade when your mind is clear.

Quotex gives us a powerful platform. Fixed risk, fast trades, and flexible timing make it ideal for compounding. But only if you respect the process.

Ready to start your compounding journey?

Click here to create your Quotex account and get started

You can deposit as low as $10, test your strategy on a demo, and use the compounding calculator to project your goals.

Just remember, slow growth is still growth. Compounding is your engine. Discipline is the fuel. Let’s grow smart.