Quotex Trading Tools: Hidden Features You Should Be Using

When I began trading on Quotex, I thought I had everything figured out. The layout looked neat, trades happened, and the profit potential seemed exciting. But after a few weeks of up-and-down results, I realized something important: I had touched the tip of the iceberg of what Quotex would do.

I wasn’t making bad trades. I just didn’t have the right tools. If you’re reading this, you might be facing the same problem. Luckily, I have the answers for you.

In this article, I will show you the hidden tools and features in Quotex that can boost your trading strategy. I’ll also explain how to use powerful external tools with Quotex. You’ll learn how one trader became exceptional by mastering these resources.

These insights will help you trade more effectively, whether you’re new to trading or looking to refine your approach.

Why You Need the Right Tools to Trade

Trading isn’t about guessing. It’s a process driven by data, and having the right tools makes a big difference. Tools don’t just give you data, but they change how you see things, improve your timing, and help you handle risk.

Quotex has many built-in tools that you can utilize. When you use them correctly, they give you an added advantage while trading. Besides what’s on the platform, other tools can back up your analysis and improve your entries and exits.

The key thing here is teamwork. You won’t always find the best tools for Quotex in the obvious spots. That’s why you need to know about both inside and outside resources.

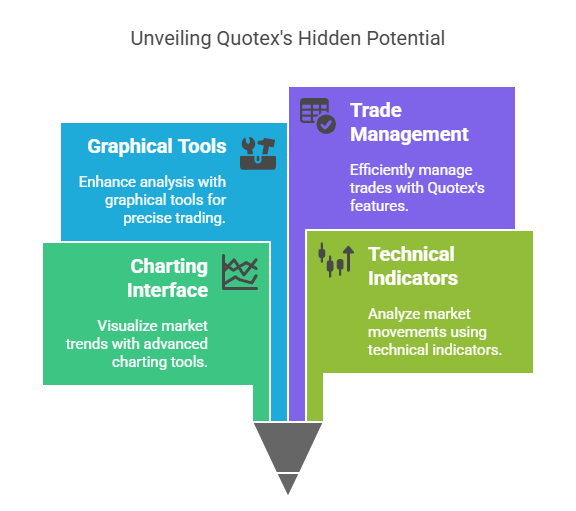

Overview of Quotex’s Built-in Tools

Many traders are unaware of the depth of Quotex’s features. It might seem simple at first, but upon closer examination, you’ll see that it has a strong and effective set of tools for analysis.

Let’s talk about the main tools you should consider:

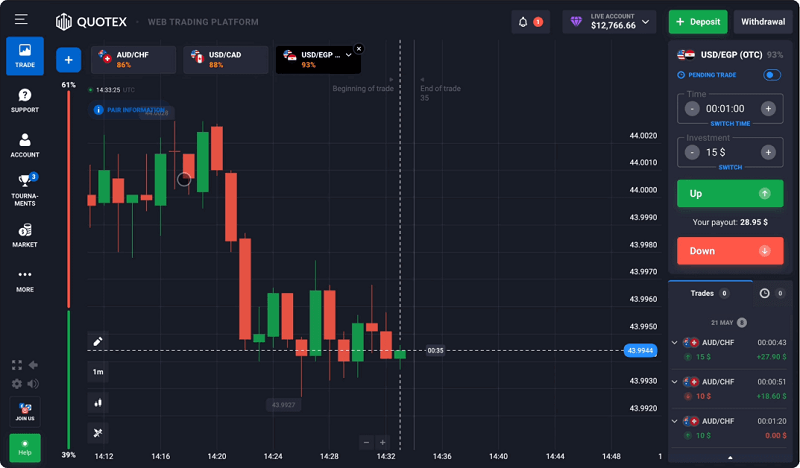

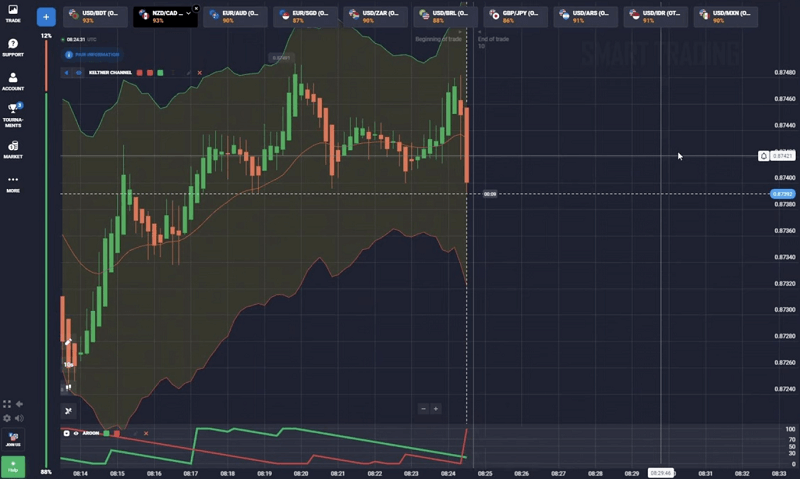

1. Charting Interface

One of the strongest aspects of Quotex is the charting system. Through this system, it is possible to choose from different types of charts on the system:

- Line charts

- Candlestick charts

- Bar charts

Line charts give you a quick picture, while candlestick charts show you more details about the market’s sentiments. Bar charts help when you want to track volume and price changes.

The time intervals vary from 5 seconds to 1 day. This range allows you to adjust your analysis to suit your trading approach. I have several charts side by side to track several timeframes for the same instrument myself. This broad view helps me avoid a narrow focus.

Options to customize color schemes, zoom levels, and multi-chart layouts add more clarity to your setups. If you haven’t checked out these features, you’re trading without complete information.

2. Technical Indicators

The core for making sound decisions is the awareness of market movements, and that’s where indicators come in. Quotex features a decent set of technical indicators that traders can apply directly to their charts without the need for external downloads.

Common indicators like:

- RSI (Relative Strength Index): Great at spotting when markets are too high or too low.

- MACD (Moving Average Convergence Divergence): Displays the direction of the trends and when it may shift.

- Bollinger Bands: Help you see how wild the market is and when it might break out.

These are good, but Quotex offers more. People often overlook some powerful tools, such as the Alligator, Parabolic SAR, and Fractals, which should not be the case. Here is why:

- The Alligator tool utilizes three smooth-moving averages to indicate whether the market is in a state of rest or in a state of awakening. I use it in trending environments to evade sideways traps.

- Parabolic SAR works well to adjust your stop-loss as the trend continues.

- Fractals help you find where prices might turn around based on past highs and lows.

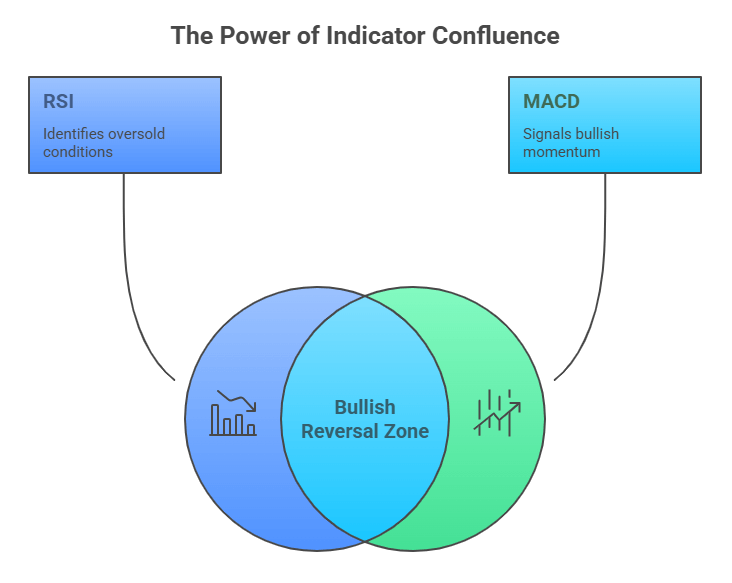

I prefer to use RSI in conjunction with MACD and Bollinger Bands. Suppose all three co-occur, for example. In that case, the RSI falls below 30, the MACD is bullish, and the Price touches the bottom of the Bollinger Band. I see a strong buy signal.

Here’s a piece of advice: keep your chart simple. Using two or three indicators beats a cluttered, over-analyzed setup.

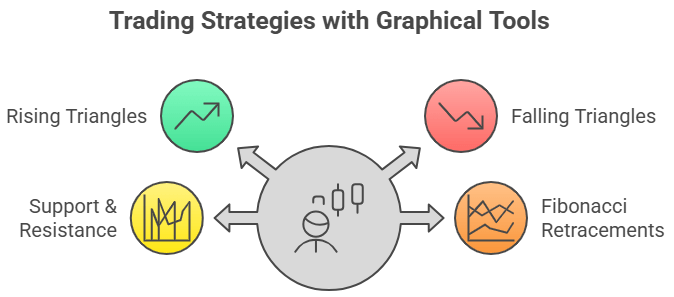

3. Graphical Tools

Rather than relying on indicators, Quotex offers graphical tools to help you draw your strategy. These include:

- Trend lines

- Support and resistance levels using horizontal lines

- Fibonacci retracement levels

I consistently draw rising and falling triangles that I anticipate breaking out with trend lines. This is a prevalent and straightforward setup for trading with tight stops and an acceptable risk-reward ratio.

Regarding support and resistance levels, they help determine psychological barriers to price movement. I prefer to do these manually on several timeframes to understand where the price may have difficulty penetrating.

Fibonacci retracements are very applicable in trending environments. I can project pullback points from swing highs to lows by taking a line from those, and I usually search for a confluence of a divergence in the RSI and the 61.8% retracement before I commit to a position.

Without using these graphical tools, you are trading without a roadmap. They provide perspective for the information that your indicators are communicating.

4. Trade Management Features

Even the best analysis won’t help if you can’t handle your trades well. This makes Quotex’s trade management options essential.

- Trading with one click allows you to act on your analysis almost immediately. This suits quick traders who need to move fast.

- Variable-length trading lets you fit your strategy for a brief 60-second transaction or a multi-minute position.

- Having the capacity to decide take-profit, loss-stop, and volume before filling the order enables you to remain in control of your risk.

Risk management plays a crucial role in long-term trading success. At first, I would wing it with my trades and skip setting exit points. This made things hectic and nerve-wracking. I felt more self-assured when I began using preset stop-loss and take-profit levels.

These days, each trade follows a clear strategy: the amount I can afford to lose, my profit target, and how long I plan to hold the position.

In addition, Quotex allows you to cancel trades during a grace period. This has saved me on numerous occasions from making mistakes.

Bottom line? The built-in tools on Quotex are not only helpful but also necessary. They provide an end-to-end analysis, implementation, and risk management toolkit. And when you use them correctly, you will have all you require for a repeatable data-driven trading strategy.

If you want a 50% bonus when depositing into Quotex, sign up using this link.

Outside Tools to Boost Your Quotex Strategy

Quotex is reasonably well-equipped, but accuracy can be enhanced by adding external tools to your trading routine.

1. Advanced Charting Platforms

Let us start with what I believe is a bare necessity: TradingView. Quotex charting is fine, but TradingView takes analysis to a completely different league. It’s like comparing driving a regular car to switching to a precision-tuned race car. The speed, the precision, the control, whatever, it is in a different league altogether.

Why is it preferable? It contains hundreds of custom indicators, drawing tools, and real-time alerts. I can build complex configurations using different indicators, change the aesthetic look of charts to suit my taste, and even use scripts developed by the community to execute specialized strategies.

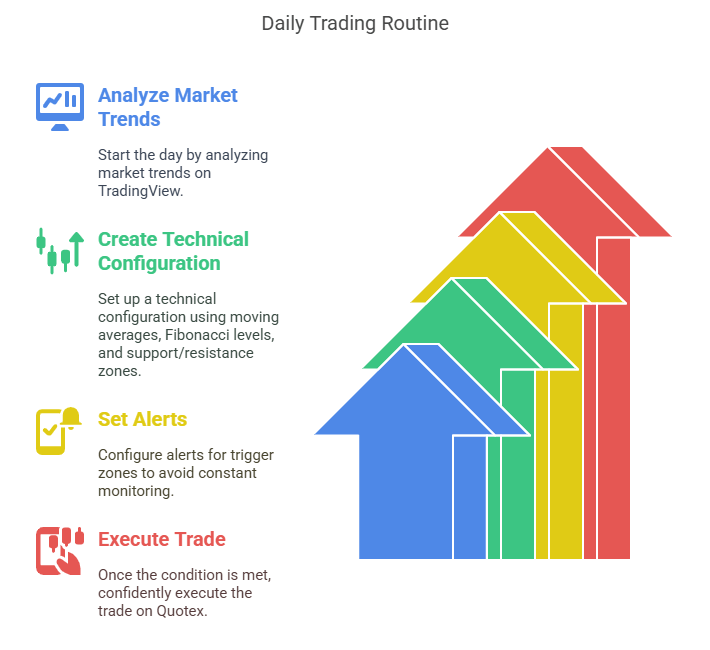

Here is the way I use it in my daily life:

- Every day, I start by analysing significant market trends on TradingView.

- I create a technical configuration that combines moving averages, Fibonacci levels, and support and resistance zones.

- I have alerts on my trigger zones, and I do not need to stare at the charts all the time.

- Once the condition is achieved, I will jump to Quotex and confidently execute the trade.

I stay more clear-headed by keeping my analysis (on TradingView) separate from my trades (on Quotex). This stops me from making trades without thinking, which I used to do a lot before.

It’s a game-changer for anybody wanting to make the most of Quotex analysis.

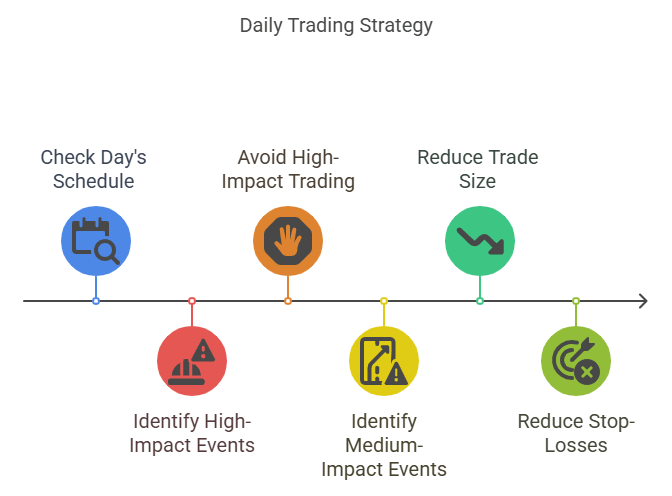

2. Economic Calendars & News Feed

Opting to trade without checking the news is like driving with a blindfold on. You may go, but you will not go far. Economic news, including interest rate decisions, GDP releases, and inflation reports, can lead to significant market movements.

I use ForexFactory and Investing.com regularly. Here’s what I do:

- I check the day’s schedule before every trading session.

- I look at the schedule for the day before each trading session.

- I point out events significantly impacting in red, which I do not trade with care.

- With medium-impact events, I decrease my trade size and move stop-losses closer.

An indelible memory: I unthinkingly entered what appeared to be a great trade right before a prominent Fed announcement. The price moved in seconds and hit my stop-loss. This error cost me dearly in my wallet; however, it also formed a habit in me to look at the calendar first.

Other traders depend on applications that alert them once news is published. It can save your account in case you are into short-term trading. In the market, time is money, and news usually provides the trigger.

3. Signal Services and Trading Bots

Signal services can help or hurt you. As a new trader, I followed signal providers. I didn’t get why they made specific trades. I won sometimes, but lost more often. Over time, I later recognized that signals need to be used to support, not substitute for, your place.

Today, I am subscribed to some reliable signal groups. I will only enter a signal when my analysis indicates that it is warranted. Follow signals as a suggestion, not a command. This change in mindset led me to change as a trader.

And in the case of trading bots, they are irresistible. Who would not wish to have a program doing things on their behalf? Bots, however, require frequent backtesting, maintenance, and monitoring. I have tried using bots, and they work in low-volatility environments but fail when the news triggers volatility.

If you opt to utilize bots:

- Start small. Never risk over 1-2 per cent of your capital.

- Put in place rigid manual overrides to allow you to intervene when necessary.

Automation can assist, but it is not a replacement for skill.

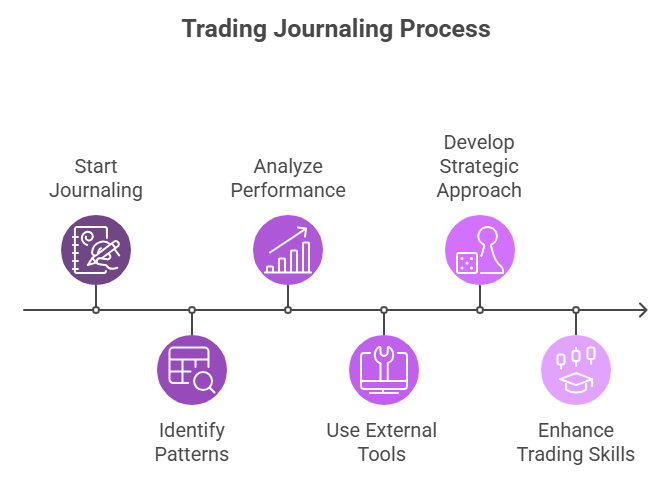

4. Trade Journaling & Analytics

If I had to give credit to one habit that enhanced my trading, it’s keeping a journal. At first, it seemed like a chore. Writing down every single trade? Who does that?

But once I stuck with it, the outcomes were eye-opening.

Here’s what I note after each trade:

- Asset and direction (Buy/Sell)

- Time and date

- Indicators used

- Setup confirmation

- Entry/Exit points

- Outcome (Win/Loss)

- Mistakes made (if any)

- How to improve next time

After 30 days, patterns appeared. I also discovered that I worked well in the market conditions, but not so well at particular times of the day. Trading became a scientific endeavor due to the advent of journaling.

I recommend such tools as Notion or Google Sheets. Other traders prefer journaling-specific apps that possess analytics dashboards. It’s not a platform’s issue; it’s a habit.

When you know your stats, trading becomes less emotional and more strategic. Journaling becomes your trading coach. It informs you of your strong points and your weak points.

Incorporating these external tools might look challenging initially, but it is deemed to result in a high-performance cockpit. Your radar, GPS, and co-pilot are those tools. Quotex is your control panel. Memorize them, and you will be good to fly.

Case Study: A Trader Who Realized the Full Potential of Quotex

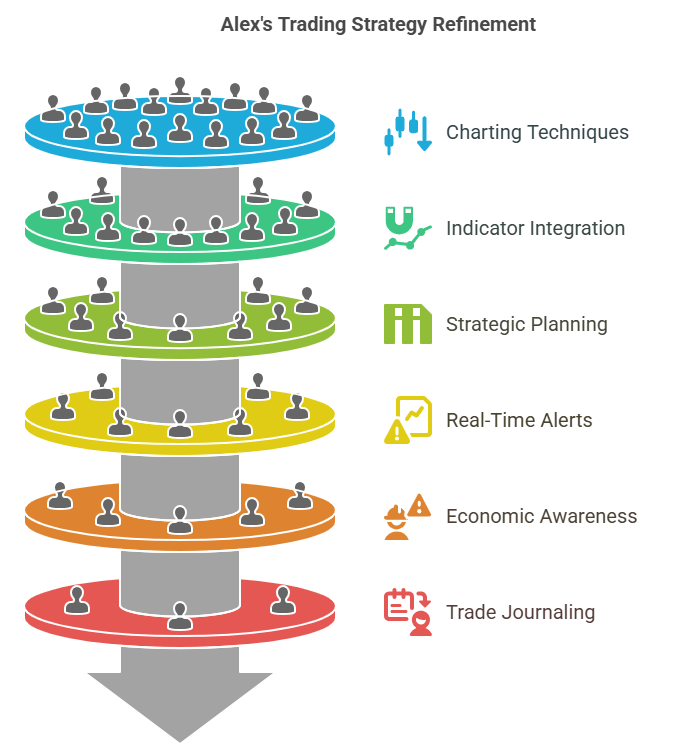

I’d like to tell you about Alex, one of the traders whose experience with Quotex demonstrates that utilizing all available tools can contribute to improved performance.

1. Profile of the Trader

Alex is 32 years old and works full-time as a computer consultant. As a hobby, he was interested in financial markets. Like the rest of us, he initially considered trading as a sideline and a source of extra money in his spare time. He discovered Quotex when a colleague introduced him to the website and demonstrated its simplicity and speed. Alex enjoyed the ease and registered almost immediately.

In his first month, Alex traded with a laid-back mindset. He would fire up the app, observe some candlestick patterns, and make trades on tips or instincts from social media. The result? He was fine on his good days and had some frustrating losses. What grated on him was the lack of consistency. To become a higher-performing trader, he realized he had to be disciplined.

2. Tool Set Used

At this point, Alex chose to give trading more attention. He changed the charts to candlesticks and used 5-minute and 15-minute intervals to observe more distinct patterns. He used RSI and MACD indicators to verify the trend’s market momentum and reversals.

He began to employ Fibonacci retracement levels to identify pullbacks and establish strategic entry points. He arranged real-time alerts on TradingView to intercept big breakouts. Another routine he adopted was visiting ForexFactory to stay informed about economic news and avoid high-volatility events.

He applied to a trade journal in Notion to track his progress and put down setups, rationale, emotions, and outcomes. The most significant choice was becoming a participant in the Quotex VIP Program. It significantly impacted his trading process, elevating it to a professional level due to exclusive learning materials, higher payout rates, and quicker withdrawals.

3. Results and Learnings

Six months later, the outcomes told the whole story. Alex’s success rate jumped from 48% to 65%, and more importantly, he lost less often and less. He quit overtrading, stuck to a firm plan, and learned to wait.

Alex developed a key approach: a reversal setup that used RSI divergences at primary Fibonacci retracement levels. This method provided him with steady signals, even when markets became choppy.

Looking back, Alex credits his wins to using tools rather than finding a “magic indicator.” In his view, waiting and self-control were the strongest assets.

His tips for traders just starting? “Don’t rush. Take some time to study every instrument Quotex offers before looking for further indications.”

Closing Thoughts

Trading on Quotex isn’t hard. But to be a successful trader at Quotex? That requires strategy, self-control, and the right tools.

The greatest traders aren’t the ones who use the flashiest methods. They’re those who know their instrument inside and out.

Take advantage of Quotex’s built-in charting functionality. Combine them with the indicators that best suit your trading style: graph levels and plot scenarios against them with graphing tools. Use pre-set risk parameters to control each trade.

Next, use serious technical analysis through TradingView. Keep track of economic calendars for volatility. Use signal services with caution and track your positions tirelessly.

Your next success may not be because of a new strategy. It may be because of implementing the tools you already possess.

If you want a 50% bonus when depositing into Quotex, sign up using this link.