Pocket Option Trading Hacks: Insider Secrets to More Wins

I’ll never forget the first week I started trading on Pocket Option. My balance would swing wildly. Fifty dollars up, seventy dollars down. It felt like I was in a casino, not a trading platform. I was guessing more than analyzing. That frustration pushed me to dig deep and discover what the pros were doing differently.

Spoiler alert: they weren’t using the basic stuff you find in most beginner guides. They were exploiting hidden features, optimizing their setups, and using smart psychological and technical hacks. Over the months, I compiled these into a personal playbook. A collection of hard-earned lessons, quick tricks, and secret tools I now use daily.

And I’m sharing them with you right here.

What No One Tells You About Pocket Option

Let’s get one thing straight. Most content out there repeats the same advice: use indicators, follow trends, don’t trade news. That’s fine, but basic. What if you want to move from average results to consistent profits?

That’s where the real trading hacks come in.

Let’s start with the hidden features.

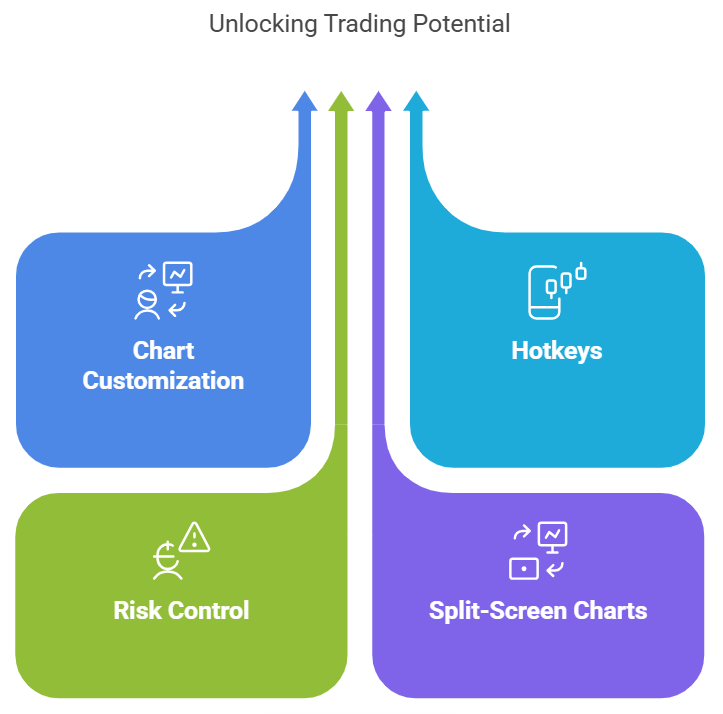

Hidden Pocket Option Features You’re Not Using

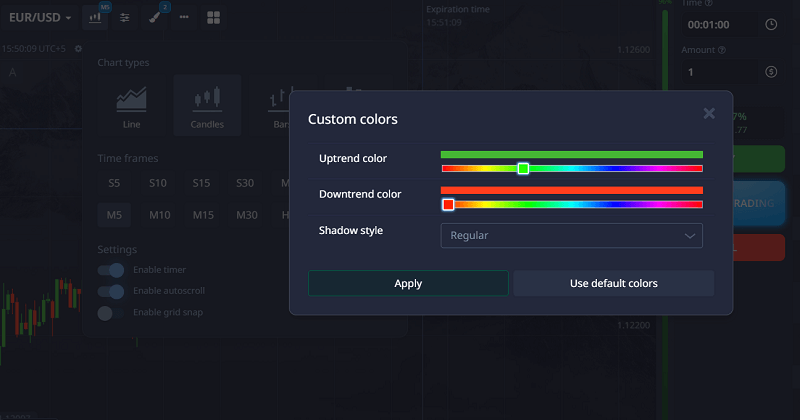

1. Chart Customization Tricks

Most traders stick with the default chart setup. But if you dig into the chart settings, there are a few gems:

- Change candlestick colors to reflect trend direction, like bright green for an uptrend and deep red for a downtrend. This makes it easier to spot reversals visually.

- Enable the time left on the candle countdown. It helps you enter trades at the perfect moment, especially useful in 30-second to 2-minute trades.

- Zoom out. It gives you context on higher-timeframe trends even if you’re scalping.

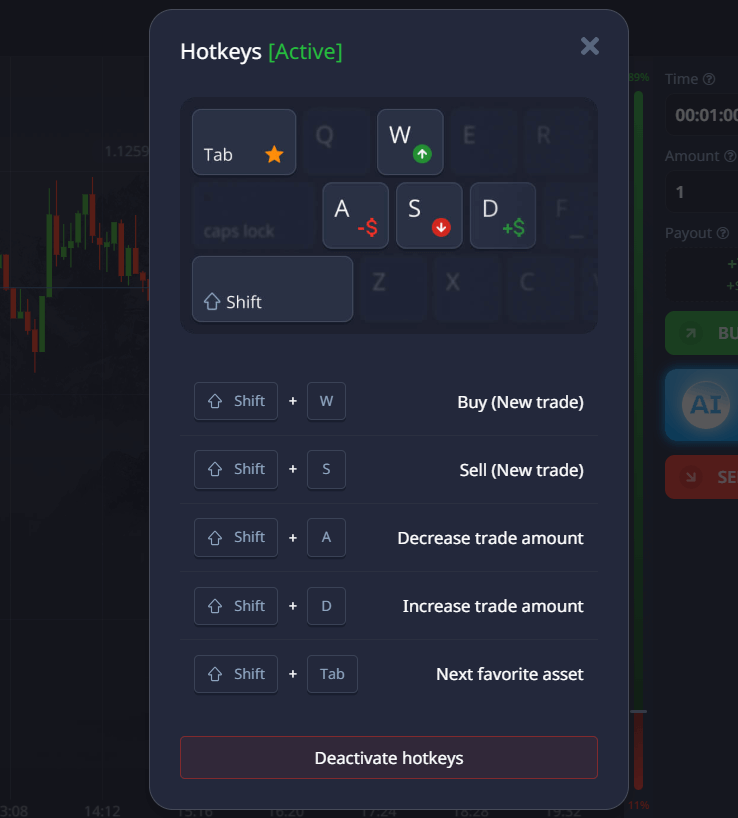

2. Hotkeys for Fast Execution

In the right hand vertical bar, click on Hotkeys, you can assign keys for Higher and Lower trades. I’ve mapped mine to the arrow keys. This way, I don’t hesitate. No mouse fumbling when I see a setup. I react instantly.

3. Risk Control Mode

This feature is buried in your account settings. You can activate a Loss Limit per day. Why is this a hack? Because once your brain knows there’s a cutoff, it trades more patiently. It’s like putting a leash on tilt mode.

4. Split-Screen Charts

Want to compare EUR/USD on 1-minute versus 5-minute timeframes? Use the split-screen view. It’s especially useful when double-confirming trend direction or identifying support and resistance across timeframes.

Lesser-Known Pocket Option Trading Techniques That Work

Now let’s talk about what’s not obvious. These are techniques I learned from spending late nights on Reddit threads, Telegram groups, and trading forums.

1. The Rejection Entry

Most people chase momentum. I do the opposite. I wait for the price to hit a key support or resistance level and fail to break it. That wick rejection is my entry cue. Combine it with RSI divergence or a doji candle, and it’s deadly accurate.

2. Box Trading Strategy

Draw a rectangle around the last ten candles’ high and low. If the price stays inside that box, wait. Once it breaks out, trade the retest of the broken level, not the breakout. This reduces false breakouts, especially in ranging markets.

3. Volume Hack Using Indicators

Pocket Option doesn’t show volume. But here’s a trick:

- Add the MACD indicator and focus on the histogram bars. When the bars spike sharply, it often mirrors volume surges.

- Combine that with candlestick breakouts or news releases for high-probability entries.

4. Indicator Stacking with Delay Offset

Most traders throw three or four indicators on the chart and look for overlap. I take it a step further. I offset each indicator slightly. For example, I use:

- RSI 14

- Stochastic 7,3,3

- Moving Average EMA 10 and EMA 20

But I’ll look for RSI confirmation first and then wait three to five candles for Stochastic to follow through. It increases confidence and filters out noise.

5. Psychological Stop Loss (Non-Monetary)

I track consecutive loss streaks, not just money. If I lose three trades back-to-back, I walk away. Even if it’s five dollars total. This small tweak reduced emotional spirals drastically.

You can also use Pocket Option mobile app for quicker access.

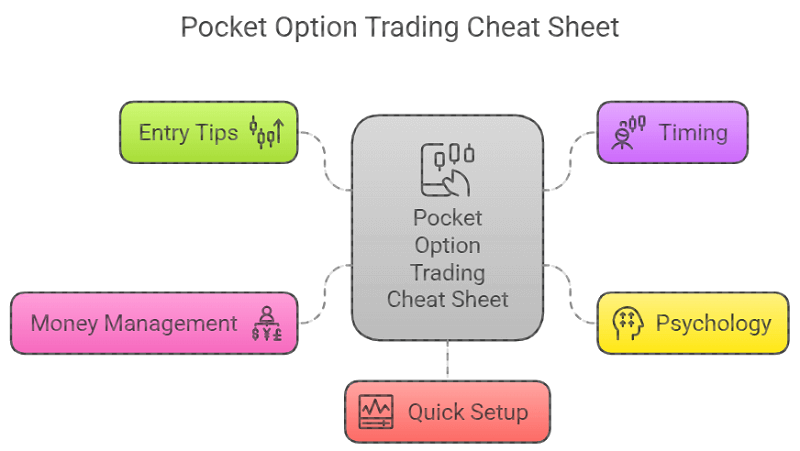

My Pocket Option Trading Cheat Sheet

Quick reference? Here you go.

Entry Tips:

- Trade only near key levels. Draw support and resistance lines daily.

- Enter on the candle open, not in the middle.

- Avoid the first and last five minutes of every hour due to high volatility.

Timing:

- Best trading windows are 9:30 AM to 11:30 AM EST and 2:00 PM to 4:00 PM EST.

- Avoid overlapping news events unless you’re trading volatility.

Psychology:

- Three wins? Take a break. Don’t get greedy.

- Three losses? Shut it down. Reset mentally.

- Never double stake after a loss. Pocket Option is not roulette.

Money Management:

- Use fixed percent model: two percent per trade.

- Don’t trade more than six percent of your balance per session.

- Compound profits weekly, not daily.

Quick Setup:

- Chart Type: Japanese Candles

- Timeframe: 1m or 2m

- Indicators: EMA 10, EMA 20, RSI 14, MACD for volume proxy

Secrets I Learned the Hard Way

The Platform Is Fast But Not Forgiving

Pocket Option’s execution is quick, but it punishes indecision. Ever notice how clicking Higher a second late ruins the whole trade? That’s why I use hotkeys and prepare my entries ahead of time.

Most Wins Come from Not Trading

Sounds weird, right? But seriously, I reviewed my trades and found sixty percent of my profits came from just twenty percent of the setups. Discipline beats screen time.

Pocket Option Signals Are Just Suggestions

Yes, the platform gives you signals. But don’t unthinkingly follow them. Use them as confirmation, not initiation. I only follow them when they align with my analysis.

FAQs About Pocket Option Trading Hacks

What’s the best strategy for Pocket Option?

The best strategies combine support and resistance, candlestick patterns, and momentum indicators like RSI or Stochastic. My go-to is the rejection entry on key levels.

Can you win consistently on Pocket Option?

Yes, but only with strict discipline, a proven method, and strong risk control. The platform is fair if you treat it like a business, not gambling.

How do I avoid fake signals?

Use multiple confirmations. Don’t rely on one indicator. Also, zoom out. Look at higher timeframes to avoid being tricked by short-term noise.

Are bots or auto-trading a good idea on Pocket Option?

They exist, but most are scams or unreliable. Manual trading with a clear edge is more sustainable long-term.

What time is best for binary trading on Pocket Option?

The best hours are when major markets overlap, such as the London and New York sessions between 8:00 AM and 11:00 AM EST.

Why do I win sometimes and then lose everything?

It’s usually due to emotional trading or a lack of structure. Winning is easy. Keeping the profits requires discipline and proper money management.

Can I use MT5 with Pocket Option for analysis?

Yes, and I highly recommend it. MT5 offers better tools, more indicators, and lets you do multi-timeframe analysis that you can’t fully replicate inside Pocket Option.

Should I use the demo account after going live?

Absolutely. The demo is perfect for testing new strategies or regaining confidence after a loss streak without risking real money.

Is Pocket Option good for beginners?

Yes, but only if they’re willing to learn. The platform is user-friendly, but beginners must avoid the temptation to overtrade and chase losses.

How can I track my performance effectively?

Use a trading journal. Log each trade, including time, pair, setup, result, and emotional state. Patterns will start to emerge that show you what works.

Final Thoughts

I used to think there was some magic secret the pros were hiding. But it turns out it’s not about one single trick. It’s about combining small edges, staying patient, and following a tight plan.

Pocket Option rewards discipline. The platform has everything you need to win if you treat it like a serious game.

I hope this guide saves you the months of trial and error I went through. If you want, I can even share my annotated screenshots or a video walkthrough of my setups. Just let me know.

Are you using any of these tricks already, or do you have one of your own?