Olymp Trade Deposit & Withdrawal Guide (Country-Specific)

Why I Started Looking Beyond My Own Trades

As a Pakistani trader, my first concern with Olymp Trade was simple: could I deposit easily, and more importantly, withdraw without stress? I had read stories of delays and restrictions, and I wanted to know the truth.

I began by testing deposits and withdrawals myself here in Pakistan. But I didn’t stop there. I also reached out to traders from India, Nigeria, Indonesia, and Brazil to understand how the process worked for them. These conversations gave me a country-specific perspective, which opened my eyes to how much geography really matters in trading.

👉 If you want to follow along and test your own country’s process, open your Olymp Trade account here.

Deposits: My Experience in Pakistan and Insights from Abroad

My own first deposit in Pakistan was with a Visa card. The transaction went through, but it didn’t feel instant. The bank flagged it as an “international purchase,” and I had to wait about an hour for clearance. Not terrible, but not instant either.

To compare, I asked other traders about their experiences. In India, one trader told me his $100 UPI deposit showed up instantly with no fees. A Nigerian trader said his local bank transfer took until the end of the day because it required OTP confirmation. Meanwhile, in Indonesia, e-wallets like DANA were credited instantly, while in Brazil, Boleto Bancário took one to two days but was still reliable.

Here’s a snapshot of the differences:

| Country | Deposit Method | Processing Time | Notes |

| Pakistan (my test) | Bank Card | 1 hour | Marked as foreign transaction |

| India (interview) | UPI | Instant | Smoothest method |

| Nigeria (interview) | Local Bank | Same day | OTP required |

| Indonesia (interview) | DANA | Instant | Very convenient |

| Brazil (interview) | Boleto | 1–2 days | Slower but dependable |

What I learned from these stories is that local wallets and payment rails usually outperform bank cards, which are often slowed down by international checks.

Withdrawals: My Real Test and What Traders Shared With Me

Withdrawals are the real test of trust. I began with a $100 bank transfer in Pakistan. The request was approved within a day, but the funds didn’t hit my account until Friday morning, nearly two days later. My bank treated it as a remittance, which explained the delay.

When I compared my experience with other traders, I saw the same theme repeated: local systems dictate speed. In India, UPI withdrawals were processed the same day, sometimes in just hours. A Nigerian trader told me his $75 withdrawal took just over a day, but he had to confirm with his bank using an OTP. Meanwhile, a Brazilian trader explained that Boleto withdrawals are always slow, usually taking three days to complete.

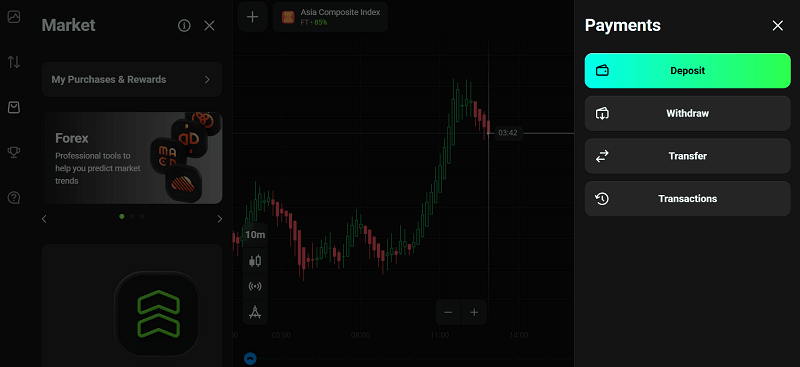

👉 To avoid delays like mine, it’s worth linking an e-wallet from the start. You can sign up here with my link and connect Skrill or Neteller for faster payouts.

Country-Specific Patterns I Noticed

After testing myself in Pakistan and listening to others abroad, I noticed a clear pattern: e-wallets are consistently the fastest across regions, while traditional bank transfers are slower but reliable.

| Region | Fastest Method | Avg. Withdrawal Time | My Rating |

| Pakistan | Bank Transfer (but slower) | 2 days | ⭐⭐⭐ |

| India | UPI / Paytm | Same day | ⭐⭐⭐⭐⭐ |

| Southeast Asia | E-wallets (DANA, OVO) | Same day | ⭐⭐⭐⭐ |

| Africa | Bank Transfer / M-Pesa | 1–2 days | ⭐⭐⭐ |

| Latin America | Boleto / Local Bank | 2–3 days | ⭐⭐⭐ |

| Europe | Skrill / Cards | 1 day | ⭐⭐⭐⭐ |

The details vary, but the principle stays the same: the closer the method is to a local, regulated payment rail, the faster it works.

Lessons I Took Away from Testing and Talking to Others

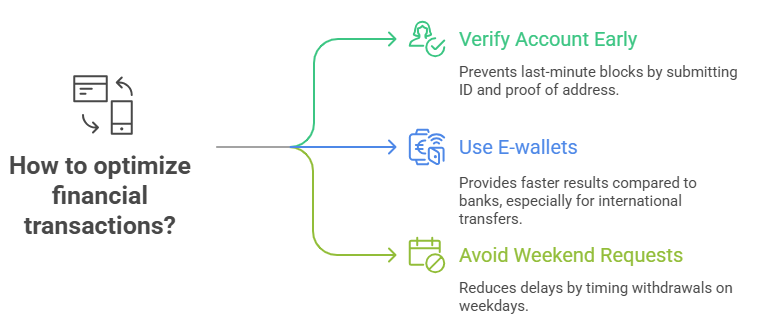

Through my own experience and the interviews I conducted, I came to a few simple conclusions. The most important step is to verify your account early by submitting ID and proof of address, because that prevents last-minute blocks. In Pakistan, I realized that banks will almost always review foreign-looking transfers, so patience is part of the process. E-wallets like Skrill and Neteller consistently gave traders the fastest results worldwide, and they’ve become my backup plan whenever banks slow things down.

Another thing I noticed is that weekend requests add unnecessary delays. If I withdrew on a Wednesday, the money usually came by Friday. But if I requested on a Saturday, the funds often sat pending until Monday or Tuesday. Understanding that helped me plan withdrawals more intelligently instead of worrying when the money didn’t show instantly.

How Deposits and Withdrawals Changed My Trading Psychology

In my early days, I hesitated to withdraw because I wasn’t sure how long it would take. Once I confirmed that Olymp Trade processed reliably, just with some local delays, I felt more confident scaling up.

For instance, when I experimented with my multi-chart layout guide, I withdrew small profits midweek just to see the speed. That boosted my confidence and encouraged me to stick with a disciplined approach instead of chasing losses. Similarly, when comparing my 1-minute strategy with longer trades, knowing my withdrawals were safe helped me stay patient.

Final Thoughts: My Olymp Trade Deposit and Withdrawal Guide

From Pakistan, deposits and withdrawals worked, though not instantly. Other traders I spoke with reported mixed experiences, but a clear pattern emerged: local methods and e-wallets are the real game changers.

For me, bank transfers worked, but they took time. If you want smoother access to your funds, especially if you’re outside of Pakistan, e-wallets like Skrill or Neteller are worth linking from day one.

👉 Ready to see how it works in your country? Open your Olymp Trade account today and test the deposit and withdrawal process with your local options.