My Olymp Trade Platform Review 2026 (Tools, Indicators, UI)

I still remember the first time I opened the Olymp Trade platform in 2023. I was cautious but hopeful, curious whether the hype was real or just another trading mirage. Over the past three years, I’ve lived with this platform through small wins, frustrating losses, UI fights, and some very real lessons about markets and tools. This is my personal, in‑the‑trenches Olymp Trade Platform Review 2026, where I share not just features, but how they genuinely felt and worked as the markets moved.

If you’re thinking about opening an account here, make sure you understand both how Olymp Trade feels to trade on and how its tools behave in real conditions (many reviews online fail to address that). You can start cautiously by using a demo account first to explore the UI and indicators without risking your capital. If you’re ready to start trading and test the platform hands-on, you can open your Olymp Trade account here and explore it yourself.

How I Got Started

When I first signed up, the thing that attracted me most was the low entry barrier. You don’t need a huge capital to begin trading here, unlike many brokers that expect $500 or more. That made it easy to experiment without overwhelming risk. I also explored the platform’s bonus system and hidden conditions to see how it might affect my trading style.

The First Impressions: User Interface and Experience

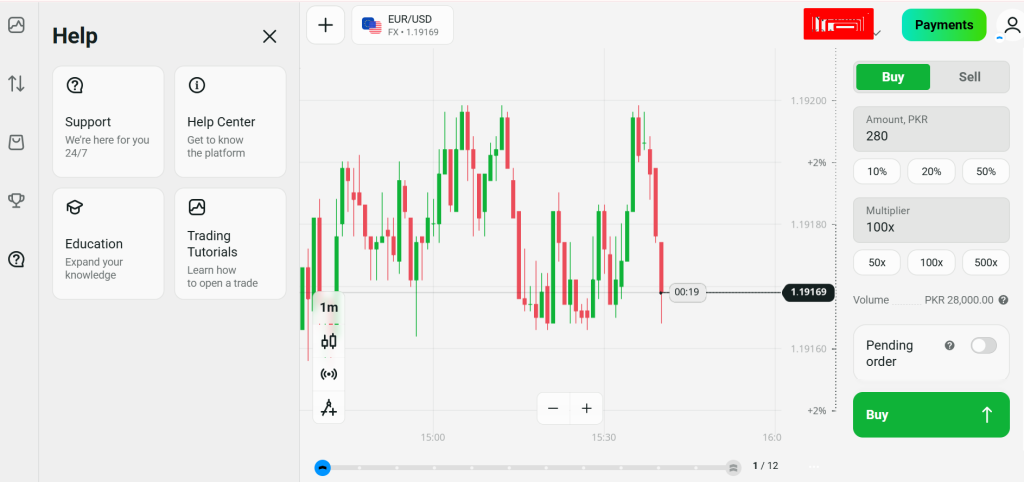

As soon as I logged in, the UI struck me as clean but minimalist. It wasn’t overwhelming, but it also didn’t feel like the powerful dashboards you see on advanced platforms.

What stood out first

- The home screen is simple, with a list of assets on one side and the main chart in the center.

- Switching between assets felt fast. The platform loaded quotes almost instantly during normal market conditions.

- On mobile, the interface stayed responsive and surprisingly complete compared to the web version. You can read my full mobile app deep dive to see how trading on iOS and Android compares.

What didn’t feel complete was the depth of analytical data. I quickly felt the limitations when I wanted to drill deeper into a trend or combine advanced indicators. More on that below.

If you want to explore the interface yourself and start placing trades, you can open your live Olymp Trade account here to test it firsthand.

Tools and Charting: Breaking Down What You Can and Can’t Do

This is where many Olymp Trade reviews gloss over details, but in practice it matters.

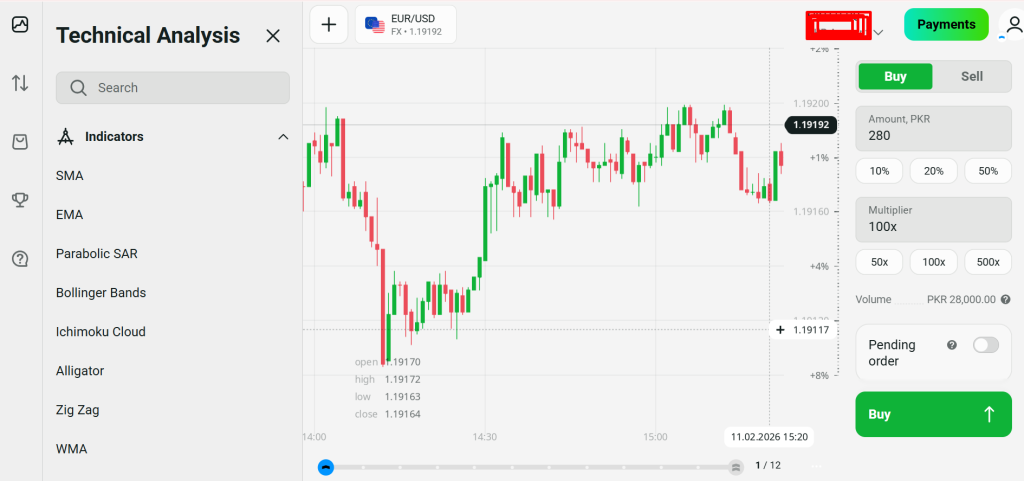

Indicators: What I Use Most

The platform offers the essentials:

- RSI

- MACD

- Moving Averages

- Bollinger Bands

- Trend lines and basic drawing tools

Here’s a quick snapshot of my go-to setup when I trade forex or major indices:

| Indicator | Purpose | How I Use It |

| RSI | Measure momentum | Spot overbought/oversold zones on 15‑min and 1‑hr charts |

| MACD | Trend direction + momentum | Entry confirmation with MACD crossovers |

| Moving Average | Trend smoothing | 50 EMA for trend bias, 200 EMA as dynamic support/resistance |

| Bollinger Bands | Volatility measure | Confirm breakout or contraction phases before taking impulse trades |

What’s missing is crucial: you can’t upload custom indicators or automated strategies like you would on MetaTrader. There’s also no way to script your own tools. For me, that meant that once I learned a strategy elsewhere, I still had to simplify it to fit within Olymp Trade’s built-in indicators. If you want tested approaches, check out my article on top working strategies backtested for 2025.

Charting Depth

The drag-and-drop drawing tools are intuitive. Trend lines and support/resistance marks stay anchored and can be removed with a click. I even liked how you can switch between chart types (candlestick, line) in one click. But there are limitations:

- No volume indicator

- No advanced oscillators beyond the basic suite

- You can’t collapse indicator names on the chart (it gets cluttered)

When I compared this to what I was used to on TradingView, it felt like a starter toolbox—not a professional kit.

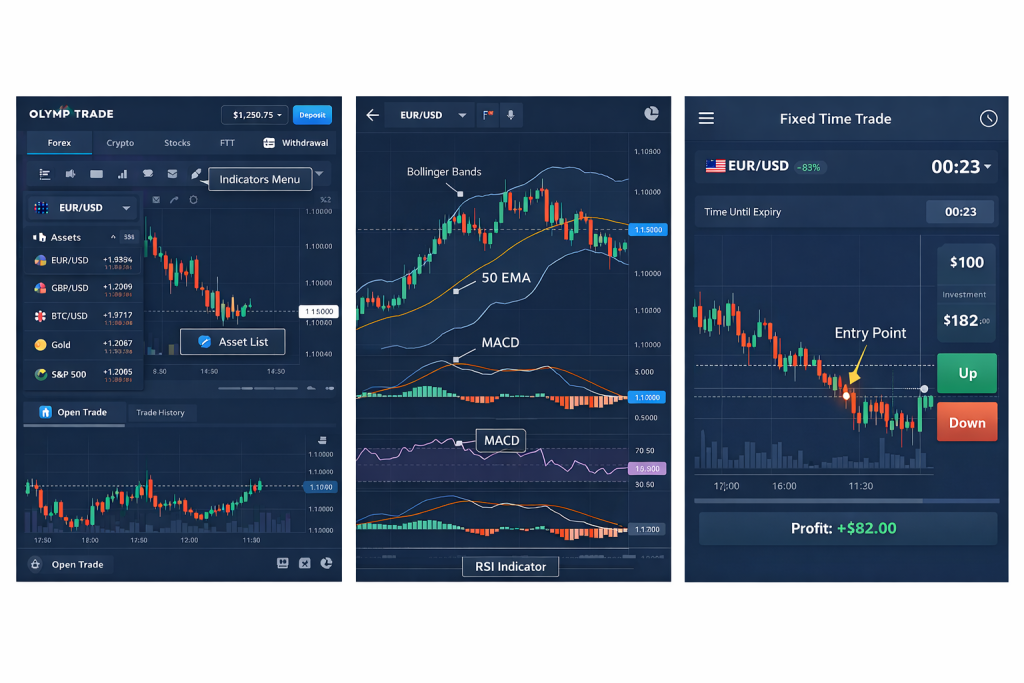

Navigating Fixed-Time Trades and Forex Instruments

One thing many traders want to know is whether Olymp Trade is better for short-term digital trades or forex/CFDs.

In my journey:

Fixed-Time Trades are straightforward and beginner-friendly. You choose a direction and time frame, and wait for expiry.

Forex, indices, and crypto trading felt closer to “real market” trading with stop-loss and take-profit controls. I explored all available instruments here.

I experienced moments where price movement on Olymp Trade’s chart deviated slightly from other platforms, especially in fast markets. While this wasn’t daily, it was noticeable enough that I started confirming price levels across tools before placing larger trades.

If you feel ready to try your own trades on live assets, you can start your Olymp Trade account here.

The UI That Shapes Decisions

While browsing charts and making decisions, UI responsiveness becomes a psychological factor.

On Web

- Fast chart refreshes in most conditions.

- Occasional lag during high volatility.

- Limitations on timeframe switching compared to professional platforms.

On Mobile

- Surprisingly reliable updates and push alerts.

- Quick order entries without diving deep into menus.

- Yet the lack of deep customization means mobile is best for quick checks or simple setups.

Tools I Wish Were Better

Here’s a short list of things I felt could improve:

- Volume analysis to confirm breakout strength (not available).

- Custom scripting for advanced traders.

- Fundamental feeds tied directly to economic news.

- More nuanced order types such as trailing stop.

At times when I was ready to take a trade based on confluence and market context, I had to mentally adjust for the platform’s limitations.

Real Trades and What They Taught Me

I want to share a few trades that truly shaped how I think about this broker and trading in general.

Trade 1: EUR/USD Breakout (Small Risk)

I placed a breakout trade after combining RSI oversold on 5-min, clean support at psychological level, and market sentiment leaning bullish. The entry felt textbook… and it worked. But the exit wasn’t as precise as I wanted because the platform doesn’t offer trailing stops for certain trade types.

Lesson: Recognize where the platform is precise and where it nudges you back to simplicity.

Trade 2: USD/JPY Fakeout

I got stopped out after the price whipped back unexpectedly. When I looked back, I realized I was reacting only to the chart on Olymp Trade, whereas a deeper view elsewhere showed a bigger consolidation zone I missed. Here, the limited chart depth cost me a better trade frame.

Lesson: Always confirm bias with additional tools if you’re doing deeper setups.

Trade 3: Gold Scalping Session

In fast gold movement, the price sometimes felt slightly delayed on Olymp Trade compared to raw interbank prices. Short-term scalping felt more “edge-dependent” here than on pro platforms.

Lesson: Use this platform’s strengths for strategy types that suit its speed and charting limits. If you like competitive trading, I’ve shared insights on Olymp Trade tournaments and how they influence decision-making.

Risk Realities and Regulation

The platform isn’t regulated by tier-1 authorities, meaning certain protections aren’t as strong. Licensing is with offshore entities and membership in bodies like the International Financial Commission, but that doesn’t replace stronger oversight. I also had friends experience delays in verification, highlighting the importance of compliance.

If you want a smoother gateway with lower capital but understand risk properly, try starting with a small live account or using a demo first.

Support: Helpful But Not Perfect

Customer support is available 24/7 and often helpful, especially for straightforward questions. But some complex issues, like verification, took longer than expected. Check my detailed notes on customer support reality vs claims before expecting instant resolution.

Summary: Tools, Indicators, UI, and Real-World Feel

| Aspect | How It Feels in Practice |

| UI | Clean and responsive, but not fully customizable |

| Indicators | Decent basics, but no custom scripting or deep analysis tools |

| Charting | Functional for simple setups, limited for nuanced moves |

| Trading Types | Good for FTT and basic forex/CFDs, limited for advanced systematic trading |

| Support & Security | Responsive support, but regulatory coverage is less robust |

Who I Think Olymp Trade Is For

- Beginners and intermediate traders exploring markets for the first time

- Those who prefer simplicity over full professional suites

- Traders with small capital who want low barriers

- People who reinforce their strategy with external tools

Wrapping Up…

My journey with Olymp Trade has been real and raw. I’ve learned to embrace its strengths while understanding its limitations. It’s not a “get rich quick” machine, nor a hidden scam, success here comes with discipline, solid risk management, and a clear understanding of its tools and realities.

If you’re curious and want to see how the UI feels in live conditions, consider opening a demo or live account and try out the charts, indicators, and trade execution yourself.

For more insights, check out how I built my first trading strategy from scratch and why keeping a trade journal transformed my results.

When you’re ready, start your Olymp Trade account today and explore trading tools, indicators, and tournaments firsthand. Trading is a journey, tool mastery is part of it.