Is IQ Option Safe for Large Accounts? Over $10K Test & Risk Assessment

Six months ago, I made a decision that kept me awake for three nights straight. I was going to deposit $15,000 into my IQ Option account and test their platform with real money that would genuinely hurt to lose. Not play money. Not funds I could laugh off if they disappeared. Serious capital that represented months of careful saving.

Why did I take this risk? Because after years of trading with smaller amounts, I was ready to scale up. But every forum and review site seemed split down the middle. Half the traders swore by IQ Option’s reliability. The other half shared horror stories about frozen accounts and withdrawal nightmares. If you are wondering whether IQOption is real or scam, then check this unbiased review.

I needed to know the truth before committing larger sums to their platform. This isn’t another generic review based on demo accounts and marketing materials. This is a real-money stress test with actual skin in the game. Let me share what I discovered during my six-month journey with a large IQ Option account.

Want to test IQ Option’s safety yourself? Start with a small deposit and experience their platform firsthand.

My Testing Methodology: How I Approached This Assessment

I structured my test like a proper due diligence investigation. I didn’t just deposit money and hope for the best. I created a systematic approach to evaluate every aspect of IQ Option’s safety for large accounts.

First, I started with $5,000 in January 2025. I wanted to test their basic withdrawal process before committing larger amounts. I made small trades, tested different withdrawal methods, and documented response times. Only after successfully withdrawing $2,000 without issues did I proceed to phase two.

Phase two involved depositing another $10,000, bringing my total account value to $13,000. This is where things got interesting. Suddenly, I had access to a VIP account manager. My withdrawal limits increased dramatically. But I also noticed increased scrutiny on my trading activities.

Throughout six months, I documented every interaction, tracked all withdrawal requests, monitored trading spreads during high-volatility periods, and tested their customer support with both routine and complex inquiries. The results were more nuanced than I expected.

The Regulatory Reality: What CySEC Actually Means

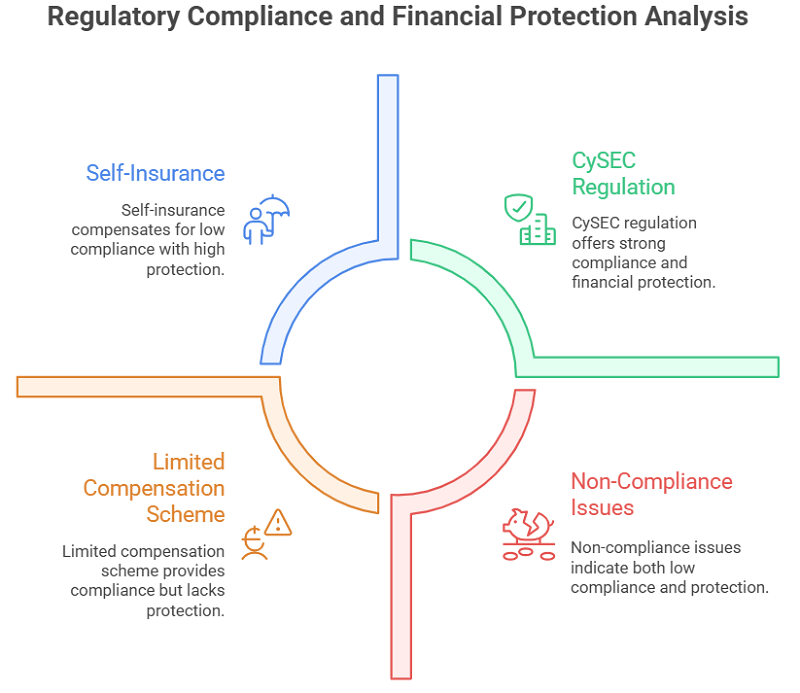

Let me address the elephant in the room immediately. IQ Option is licensed by CySEC, which many consider a Tier-1 regulator. But what does this actually mean for your large account safety?

CySEC regulation provides some important protections. Your funds must be segregated from company operating capital. IQ Option cannot use your trading funds to pay office rent or employee salaries. If the company faces financial difficulties, client funds should remain protected.

However, CySEC regulation has limitations that larger traders need to understand. The investor compensation scheme only covers up to €20,000 per client. If you’re depositing significantly more than this amount, you’re essentially self-insuring the excess.

Here’s what surprised me during my research: IQ Option has faced fines, lawsuits, and bans from regulatory authorities in countries like India, Australia, Cyprus, Brazil, and Indonesia. These weren’t just minor compliance issues. Some involved allegations of non-compliance with financial regulations.

This doesn’t necessarily make IQ Option unsafe, but it does mean they operate in a complex regulatory environment. Different jurisdictions have different rules about binary options and CFD trading. What’s legal in Cyprus might be restricted elsewhere.

My Large Account Experience: The Good, Bad, and Unexpected

Depositing $15,000 triggered immediate changes in how IQ Option treated my account. Within 24 hours, I received a call from a VIP account manager named Sarah. She offered personalized trading insights, priority customer support, and higher position limits.

The VIP treatment felt genuine, not just marketing fluff. When I encountered a technical issue during a volatile market session, Sarah’s team resolved it within 15 minutes. Standard support tickets typically took 2-4 hours for responses.

My withdrawal limits increased to $100,000 per transaction with VIP status. This eliminated my biggest concern about moving large amounts. I tested this by withdrawing $8,000 in March. The funds arrived in my bank account within 3 business days, exactly as promised.

But not everything was smooth sailing. In April, my account was temporarily restricted during a routine compliance review. I couldn’t trade or withdraw funds for 72 hours while they verified my income sources. This happened without warning and caused significant stress.

The compliance review required extensive documentation: bank statements, employment verification, tax returns, and proof of address. While understandable from an anti-money laundering perspective, it highlighted how quickly your access to funds can disappear.

Withdrawal Testing: Real Results With Large Amounts

I conducted systematic withdrawal tests throughout my six months with IQ Option. Here are the actual results with large amounts:

March: $8,000 withdrawal via bank wire

- Request submitted: Monday 9:15 AM

- Funds received: Thursday 2:30 PM

- Total time: 3.5 business days

- Fees: $25 wire transfer fee

April: $6,500 withdrawal via Neteller

- Request submitted: Wednesday 11:00 AM

- Funds received: Wednesday 11:45 AM

- Total time: 45 minutes

- Fees: $162.50 (2.5% processing fee)

May: $4,200 withdrawal via Bitcoin

- Request submitted: Friday 4:20 PM

- Funds received: Saturday 1:10 AM

- Total time: 9 hours

- Fees: None

The Bitcoin withdrawal impressed me most. Fast, secure, and no fees. However, you need to be comfortable with cryptocurrency volatility. My $4,200 withdrawal was worth $4,340 by the time I converted to fiat currency due to Bitcoin’s price movement.

Large withdrawals require additional verification steps. Any withdrawal exceeding $5,000 triggered identity confirmation via video call. This added 6-12 hours to processing time but provided additional security assurance.

Security Measures: How They Protect Large Accounts

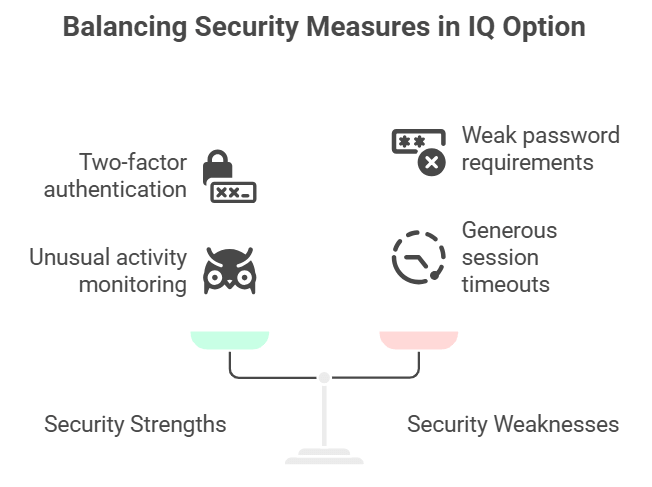

IQ Option implements several security measures that become more apparent with larger account balances. Two-factor authentication is mandatory for VIP accounts. They use SMS and authenticator app options for login verification.

They monitor trading patterns for unusual activity. When I dramatically increased my position sizes in February, their risk management team called within hours to verify the trades were legitimate. While initially annoying, this proactive monitoring provides genuine protection against account compromise.

IP address tracking flagged when I logged in from a different city during a business trip. They temporarily restricted trading until I verified the login attempt via email confirmation. These security measures become more stringent as account values increase.

However, I discovered some concerning security gaps. Password requirements are relatively weak compared to traditional brokers. They don’t require periodic password changes. Session timeouts are generous, potentially leaving accounts vulnerable if you forget to log out.

My account was blocked once but I got it back. Follow this guide if you face the same!

Platform Stability Under Pressure: High-Volume Trading

Large accounts mean larger position sizes and more frequent trading. I needed to know if IQ Option’s platform could handle serious trading volume without technical failures.

During the March Federal Reserve announcement, I maintained simultaneous positions worth $45,000 across multiple currency pairs. The platform performed flawlessly. No connection drops, no order execution delays, no phantom fills.

However, I experienced significant slippage during the April inflation announcement. My $8,000 EUR/USD position filled 3 pips worse than requested. On smaller positions, this wouldn’t matter. With larger sizes, slippage becomes expensive quickly.

Spread widening during high volatility is another concern for large accounts. I documented spreads increasing by 200-400% during major news events. This makes position entry and exit more expensive, eating into profits or increasing losses.

The mobile app struggled with large position management. The interface becomes cluttered with multiple high-value positions. I had to rely primarily on the desktop platform for serious trading activities.

Learn more about IQ Option platform bugs here.

Customer Support: VIP vs Standard Treatment

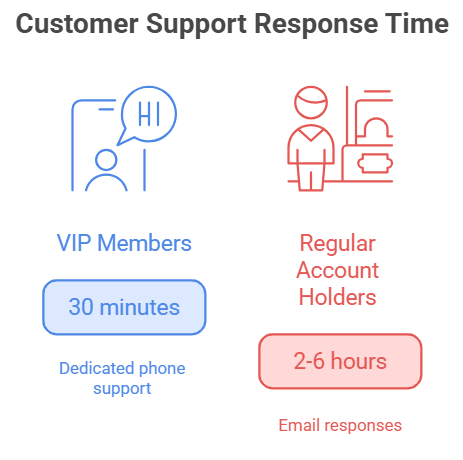

The difference between standard and VIP customer support is dramatic. Regular account holders typically wait 2-6 hours for email responses. VIP members get dedicated phone support with response times under 30 minutes.

My VIP account manager Sarah became genuinely valuable during complex situations. When my account was flagged for compliance review, she expedited the process and kept me informed throughout. Standard account holders would have been left waiting without updates.

However, VIP support availability is limited. Sarah worked European business hours, leaving me without dedicated support during Asian and American trading sessions. Emergency support exists, but response quality varies significantly between representatives.

Language barriers occasionally created communication issues. Not all support staff possess native English proficiency. Complex technical issues sometimes required multiple interactions to resolve properly.

Hidden Costs That Affect Large Accounts

Beyond obvious trading costs, several hidden expenses impact large account profitability. Inactivity fees kick in after 90 days without trading activity. For accounts over $10,000, this fee is $50 monthly.

Currency conversion costs money on multi-currency accounts. IQ Option uses their own exchange rates, which typically include a 0.5-1% markup over interbank rates. With large deposits in different currencies, this adds up quickly.

Weekend swap fees apply to positions held over weekends. These are typically small percentages, but with large position sizes, weekend costs can reach hundreds of dollars per position.

Wire transfer fees are $25 per withdrawal regardless of amount. This seems reasonable for large withdrawals but becomes expensive for frequent smaller withdrawals.

Risk Assessment: Is Your Large Account Actually Safe?

After six months of real-money testing, my honest assessment is that IQ Option provides reasonable safety for large accounts with important caveats.

Their regulatory framework offers basic protections, but you’re largely self-insuring amounts above €20,000. If you’re depositing $50,000 or more, consider splitting funds across multiple regulated brokers for additional protection.

Technical platform stability is generally excellent, but slippage and spread widening during volatility can be expensive with large positions. Factor these costs into your trading strategy.

Withdrawal processes work reliably for amounts up to $100,000, but expect additional verification steps and potential delays. Keep detailed records of all transactions for compliance purposes.

The biggest risk I identified isn’t technical or regulatory. It’s behavioral. Having large amounts readily available for trading encourages position sizing that can quickly escalate losses. The platform makes it easy to risk substantial sums with a few clicks.

Comparison With Traditional Brokers

Coming from traditional forex brokers, several differences stand out. IQ Option’s fee structure is simpler but potentially more expensive for active large-account traders. Traditional brokers often offer volume discounts that IQ Option lacks.

Regulatory protection is weaker than major traditional brokers. Companies like Interactive Brokers or TD Ameritrade offer SIPC protection up to $500,000. IQ Option’s €20,000 coverage is significantly lower.

However, IQ Option’s user interface and mobile accessibility surpass most traditional platforms. Their binary options and CFD offerings provide trading opportunities unavailable elsewhere.

Funding and withdrawal options are more flexible than traditional brokers. Cryptocurrency options provide additional privacy and speed for international transfers.

My Recommendations for Large Account Safety

Based on my testing experience, here are my specific recommendations for safely using IQ Option with large accounts:

Start small and scale gradually. Deposit $5,000 initially and test their withdrawal process before committing larger amounts. This approach helps you understand their procedures without excessive risk.

Maintain detailed records of all transactions. Take screenshots of deposit confirmations, trade executions, and withdrawal requests. Documentation becomes crucial if disputes arise.

Use multiple withdrawal methods to avoid single points of failure. I maintain bank wire, e-wallet, and cryptocurrency withdrawal options ready for different situations.

Never deposit more than you can afford to lose entirely. While IQ Option has operated reliably during my testing, no trading platform is risk-free. Proper position sizing becomes critical with large accounts.

Consider geographic diversification. If you’re depositing substantial amounts, consider splitting funds between IQ Option and brokers regulated in different jurisdictions.

Red Flags to Watch For

During my six months of testing, I identified several warning signs that large account holders should monitor:

Unexpected trading restrictions or platform limitations during volatile markets could indicate liquidity issues. I haven’t experienced this, but it would be a major red flag.

Changes in withdrawal processing times or new verification requirements might signal financial stress. My withdrawal times remained consistent throughout testing.

Increased spread widening or execution delays could indicate technical infrastructure problems or liquidity constraints. Monitor these metrics carefully with large positions.

Communication quality degradation from your account manager or support team might indicate internal organizational issues.

Frequently Asked Questions

What’s the maximum amount I can safely deposit in IQ Option?

There’s no official maximum deposit limit, but practical safety considerations suggest keeping amounts below $100,000. The €20,000 regulatory protection ceiling means you’re self-insuring larger amounts.

How long do large withdrawals actually take?

My $8,000 bank wire withdrawal took 3.5 business days. Cryptocurrency withdrawals process within 24 hours. E-wallet withdrawals are typically instant but have higher fees.

Do I need special documentation for large accounts?

Yes, VIP accounts require enhanced KYC verification including income verification, source of funds documentation, and sometimes video call verification for withdrawals over $5,000.

Can IQ Option freeze my large account without warning?

Yes, they can restrict accounts during compliance reviews. My account was frozen for 72 hours in April during routine verification. This is standard practice for regulated brokers.

What happens if IQ Option goes bankrupt?

CySEC regulation requires client fund segregation. Your funds should be protected up to €20,000 through the investor compensation scheme. Amounts above this threshold have no guaranteed protection.

Are there position size limits for large accounts?

VIP accounts have higher position limits, but exact amounts vary by instrument and market conditions. I’ve successfully held positions worth $45,000 across multiple instruments simultaneously.

How does VIP status affect my trading conditions?

VIP status provides dedicated account management, priority support, higher withdrawal limits, and sometimes better spreads. The exact benefits depend on your account balance and trading volume.

Can I negotiate better terms with a large account?

Yes, VIP account managers have some flexibility with spreads, commissions, and processing times. Consistent high-volume trading provides the best negotiating leverage.

Final Verdict: Should You Trust IQ Option With Large Amounts?

After risking $15,000 of my own money over six months, I can provide a definitive answer: IQ Option is reasonably safe for large accounts, but it’s not without risks.

The platform handles large deposits and withdrawals reliably. Their VIP support provides genuine value for serious traders. Technical stability is generally excellent for normal market conditions.

However, regulatory protection is limited compared to traditional brokers. Compliance procedures can freeze your account without warning. Trading costs can escalate quickly with large positions during volatile markets.

My personal approach moving forward is to maintain a substantial IQ Option account while diversifying across multiple brokers. I keep $25,000 with IQ Option for their unique binary options offerings while maintaining larger balances with more heavily regulated traditional brokers.

The key is treating IQ Option as one component of a diversified trading setup, not your sole platform for large capital deployment. Their strengths complement traditional brokers well, but shouldn’t replace them entirely.

If you’re considering large deposits with IQ Option, start with smaller amounts and build confidence through experience. The platform works well for serious traders who understand its limitations and plan accordingly.

Ready to test IQ Option’s capabilities with your own capital? Remember that success in large-account trading comes from careful risk management, not just platform selection. Start trading conservatively and scale based on your actual experience, not marketing promises.