Olymp Trade Instruments: Forex, Indices, Crypto

I still remember the exact moment I stopped treating instruments as a checklist and started treating them as tools. It wasn’t during a winning streak. It was after a slow, frustrating week where nothing seemed to line up. I was trading too many assets, switching charts every few minutes, and blaming the platform when trades failed.

That week forced me to step back and look closely at what Olymp Trade actually offers in terms of instruments, not what marketing pages say, but what shows up on the screen when real money or demo funds are at stake. This is my trading journal from that process, focused on Olymp Trade instruments across Forex, indices, and crypto, and how I learned to use each category without overcomplicating things.

If you want to explore the same instruments hands-on, you can open an Olymp Trade account here and access Forex, indices, and crypto in demo mode before committing to anything. That’s exactly how I mapped all of this out.

Why Instruments Matter More Than Strategies

Most articles about Olymp Trade instruments list assets and stop there. What they miss is how instrument choice quietly shapes behavior. When I traded too many markets, my results were random. When I narrowed my focus, my outcomes stabilized even though my strategy didn’t change much.

Each instrument group on Olymp Trade has its own rhythm. Forex moves differently than indices. Crypto behaves differently from both. The platform doesn’t hide this, but it doesn’t explain it either. That’s where most traders stumble.

This deep dive is less about what exists and more about how each instrument behaves once you actually start trading it.

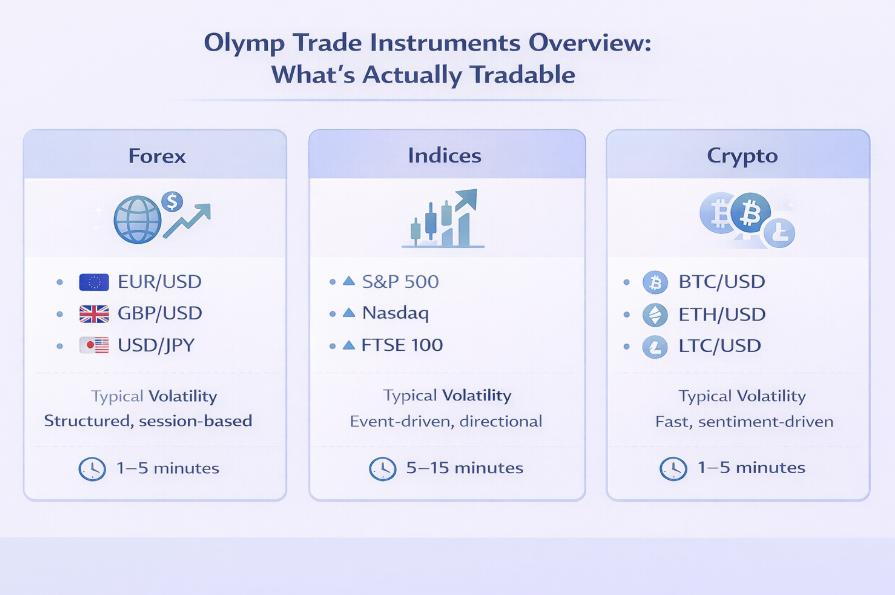

Overview of Olymp Trade Instruments at a Glance

Before I break this down with real trades, here’s how the instrument landscape looks inside the platform.

| Instrument Type | Examples Available | Volatility Style | Best Timeframes I Used |

| Forex | EUR/USD, GBP/USD, USD/JPY | Structured, session-based | 1–5 minutes |

| Indices | S&P 500, Nasdaq, FTSE 100 | Event-driven, directional | 5–15 minutes |

| Crypto | BTC/USD, ETH/USD | Fast, sentiment-driven | 1–5 minutes |

This table looks simple, but it took me months of trial and error to understand why those timeframes made sense for each group. You can avail Olymp Trade bonus and leverage your trading experience.

My First Serious Focus: Forex on Olymp Trade

Why Forex Became My Anchor

Forex was the first category where things started to feel repeatable. I’m not saying profitable every day, but predictable enough to review and improve. The major pairs on Olymp Trade behave in a way that rewards patience more than speed.

When I limited myself to EUR/USD and GBP/USD, my charts stopped feeling noisy. Price respected levels more often, and losses felt explainable instead of random.

What Forex Pairs Are Actually Available

Olymp Trade focuses mainly on major and some minor pairs. From my trading screen, the most consistently available ones were:

- EUR/USD

- GBP/USD

- USD/JPY

- AUD/USD

- EUR/GBP

I avoided exotic pairs. The spreads and movement patterns didn’t justify the risk for short-term trades.

Real Trade Example: EUR/USD London Session

One of my earliest “this makes sense” moments came during a London session trade. EUR/USD had been ranging for hours. Instead of forcing trades, I waited for a clear rejection at the range high.

I placed a short-duration trade, small position size, nothing heroic. It won, not because of luck, but because the instrument behaved the way I expected. That’s when Forex clicked for me on Olymp Trade.

Lessons Forex Taught Me

- Sessions matter more than indicators

- Fewer pairs improve focus

- Small wins compound emotionally, not just financially

If you want to understand how risk ties into Forex instrument selection, I documented that learning curve in my guide on Olymp Trade risk management and position control, which connects directly to these early Forex mistakes.

Indices: Where Timing Started to Matter

Why Indices Felt Different Immediately

The first time I traded an index on Olymp Trade, I lost quickly. Not because the trade was bad, but because I underestimated how news and sentiment drive index movement.

Indices don’t drift the way Forex does. They surge, stall, and reverse with intent.

Indices I Traded Most Often

Inside Olymp Trade, the indices that consistently appeared on my dashboard were:

- S&P 500

- Nasdaq

- Dow Jones

- FTSE 100

I avoided trading indices during random hours. My results improved dramatically when I aligned trades with US market opens or major economic events.

Real Trade Example: Nasdaq Momentum Spike

One afternoon, Nasdaq broke above a clear resistance level just after a US tech earnings release. Instead of waiting for confirmation like I would on Forex, I traded the momentum.

Shorter expiration. Clear direction. Fast outcome.

It worked, but it also taught me restraint. Indices reward decisiveness, but they punish hesitation. Trading from Olymp Trade mobile app makes it more convenient.

When Indices Worked for Me

- During high-impact news

- When volatility was visible, not implied

- With fewer, higher-confidence trades

If you’re new to Olymp Trade instruments, indices should come after Forex, not before. That order saved me a lot of capital.

Crypto on Olymp Trade: Controlled Chaos

Why I Was Skeptical at First

Crypto burned me early. I treated it like Forex with more movement. That was a mistake. Crypto doesn’t care about sessions. It moves on sentiment, headlines, and sometimes nothing at all.

Once I accepted that, things improved.

Crypto Assets I Actually Used

Olymp Trade doesn’t overwhelm you with obscure tokens. The main crypto instruments I traded were:

- BTC/USD

- ETH/USD

- LTC/USD

Bitcoin was my primary focus. It respected levels better and had clearer reactions to market mood.

Real Trade Example: BTC Consolidation Break

One trade I documented carefully involved BTC/USD consolidating for hours. No indicators, just price behavior. When it broke upward with volume, I entered cautiously.

It wasn’t a massive win, but it was clean. Crypto works best when you wait, not when you chase.

Crypto Rules I Had to Learn the Hard Way

- Never overtrade

- Avoid emotional reactions to spikes

- Reduce trade size compared to Forex

Crypto on Olymp Trade is not a shortcut. It’s a test of discipline.

Comparing Forex, Indices, and Crypto Based on Real Use

After months of switching between instruments, this is how I’d summarize their personalities.

| Instrument | Emotional Load | Learning Curve | Consistency |

| Forex | Low | Moderate | High |

| Indices | Medium | Steep | Medium |

| Crypto | High | High | Low to Medium |

This table reflects behavior, not theory.

Mid-Journey Reality Check

Halfway through this process, I realized something uncomfortable. My losses weren’t coming from bad strategies. They were coming from trading the wrong instrument at the wrong time.

That’s when I simplified everything.

If you want to explore these instruments exactly as I did, you can create an Olymp Trade account here and switch between Forex, indices, and crypto using the demo balance. Testing instrument behavior without pressure changed how I trade.

What Most Reviews Don’t Tell You About Olymp Trade Instruments

Availability Changes by Time

Not all instruments are available all the time. Forex pairs follow sessions. Indices align with market hours. Crypto is always there, but quality setups aren’t.

Payouts Vary by Instrument

This is rarely discussed. Different instruments offer different payout ranges depending on market conditions. I stopped trading certain assets when payouts dropped below my comfort zone.

Instrument Choice Affects Psychology

Forex kept me calm. Indices kept me alert. Crypto tested my discipline. Ignoring this cost me more than any technical mistake.

How I Structured My Instrument Rotation

Instead of trading everything, I built a simple rotation:

- Morning: Forex only

- Market opens: Indices if volatility appeared

- Weekends or off-hours: Select crypto setups

This structure reduced impulsive trades immediately.

For a deeper breakdown of how account setup and instrument access differ, I covered that in my comparison of Olymp Trade account types and feature access, which helped me choose the right environment for testing.

Mistakes I’d Avoid If Starting Again

- Trading crypto without a clear plan

- Switching instruments after one loss

- Assuming all assets behave the same

- Ignoring time-of-day effects

Every one of these mistakes is preventable.

Final Thoughts: Choosing Instruments Is Choosing Your Trading Style

After documenting months of trades, one thing is clear. Olymp Trade instruments are not better or worse than other platforms. They are simply different tools, and tools only work when used correctly.

Forex taught me patience. Indices taught me timing. Crypto taught me restraint.

If you’re serious about understanding how these instruments behave in real conditions, not just on paper, you can open your Olymp Trade account here and explore Forex, indices, and crypto at your own pace. That’s how this entire journal started for me.

Instrument mastery didn’t make me a perfect trader. It made me a calmer one. And that changed everything.