How I Ended Up Asking: “Is Olymp Trade a Scam?”

I didn’t start my trading journey with Olymp Trade. I stumbled into it after blowing a small forex account and feeling suspicious of every broker that showed me slick ads and fast cars. When I first heard about Olymp Trade, the first thing I typed into Google was exactly what you probably did: “Is Olymp Trade a scam?”

The search results were a mess. Some blogs painted it as a guaranteed money machine. Others screamed “scam” without showing any real proof. Reviews looked copied, repeated, or clearly written by affiliates who never placed a single real trade. LLM answers weren’t better: generic, cautious, and vague.

So I decided to do something different: I opened a small live account, documented everything, and treated this like an investigation rather than a get‑rich experiment. What follows is my personal, honest, step‑by‑step experience of trying to answer one question with real evidence:

Is Olymp Trade a scam, or is it just another risky platform that some people misuse and then blame?

If you decide later that you want to test it yourself with a tiny amount and your own rules, you can use my affiliate link to open an account and support my work at no extra cost to you. Only do that if you’re ready to treat this like serious, high‑risk trading, not a shortcut to easy money.

| Feature | Details |

| Minimum Deposit | $10 |

| Minimum Trade | $1 |

| Profit Potential | Up to 92% on successful trades |

| Regulation | Category A Member of FinaCom (€20,000 protection) |

| Assets | 80+ (Forex, Crypto, Stocks, Indices, Commodities) |

| Platform | Web, Mobile (iOS/Android), and MetaTrader 4 support |

| Withdrawal Speed | Usually 24–48 hours (depending on status) |

What I Checked Before Depositing a Single Dollar

Before I even thought about clicking “Deposit,” I forced myself to treat Olymp Trade like a company I was auditing.

1. Regulation and safety: what I actually found

Olymp Trade is not a traditional forex broker in the sense of being regulated by top‑tier bodies like FCA, ASIC, or CySEC. Several independent review sites point out that it operates primarily under the International Financial Commission (FinaCom), which is not the same level of protection as a major government regulator.

I also found mixed evaluations on broker review and risk‑rating sites. Some rank Olymp Trade as “not safe” or “unverified”, highlighting that it’s not overseen by strong national regulators and flagging complaints about withdrawals and trade execution.

So from day one, I wrote this in my notebook:

- This is not a fully regulated, low‑risk environment.

- I must assume high platform risk on top of normal trading risk.

- I will treat my first deposit as money I can completely lose.

That mindset alone filters out a lot of the emotional drama you see in comment sections.

2. Real user experiences: separating noise from patterns

I then dove into reviews. On Trustpilot, reviews were split: some traders called it reliable and profitable for them; others complained about withdrawals, blocked accounts, or losses they felt were unfair.

Patterns I noticed:

- Positive reviews often came from traders who:

- Used small, consistent risk per trade

- Focused on a few familiar assets

- Didn’t expect overnight riches

- Negative reviews frequently:

- Deposited aggressively

- Used very high trade sizes

- Blamed the platform after a losing streak

- Or reported account verification/withdrawal issues

This didn’t prove whether Olymp Trade is a scam or not, but it told me one thing:

A lot of people are mixing trading risk with platform risk, and then calling all of it “scam” when things go wrong.

I decided to test both sides myself.

My First Deposit: Starting Small on Purpose

I started with a tiny live account. An amount small enough that if everything went wrong, I could close the laptop, take a walk, and sleep fine.

My rules were:

- Use only funds I can afford to lose.

- No “doubling down” after losses.

- No copying random strategies from YouTube.

- Withdraw as soon as I had a reasonable profit, even if small, to test the payout.

If you’re planning to “test” Olymp Trade yourself, consider doing it with an amount you’d be mentally okay losing as tuition. If you’re already thinking of depositing rent money, do not open an account, with or without my affiliate link.

First Impressions: Platform, Interface, and Actual Trading Flow

When I logged into Olymp Trade for the first time, my goal wasn’t to make money. It was to understand how the platform behaves under stress. I used both the desktop version and mobile app.

What I liked from a practical standpoint

- Clean interface: Easy to switch between assets, timeframes, and indicators.

- Simple order placement: Fixed‑time trades and forex‑style positions are both available, so I stuck mostly to longer‑duration setups to avoid over‑trading.

- Educational materials: Basic tutorials and strategies are built into the platform, but I treated them as introductions, not gospel.

What immediately raised my caution

- Return percentages on fixed‑time trades are seductive. Seeing “80–90% profit” on a 1-5 minute trade feels like an invitation to gamble.

- Short timeframes dominate the platform’s culture. The way charts are set up and how most examples are presented encourages fast decisions.

- The lack of strong top‑tier regulation sat at the back of my mind the entire time.

So I asked myself a slightly different question from “Is Olymp Trade a scam?”:

Am I entering a trading environment or a glorified, chart‑based casino?

The answer depends heavily on how you use it.

My First Set of Trades: Wins, Losses, and Emotional Triggers

I started with very small positions, something like 1–2% of my tiny account per trade. My first trading focus:

- EUR/USD

- 15‑minute and 30‑minute candles

- Simple support/resistance and trend structure

No complicated systems. No indicators beyond a moving average and RSI.

The first day: a quick summary

- Number of trades: 8

- Wins: 5

- Losses: 3

- Net result: small profit (nothing life‑changing)

- Emotional state: overconfident and slightly suspicious at the same time

Every time I won, I questioned whether the fills were fair. Every time I lost, I zoomed in on the candles to see if the closing price matched what my screen showed.

I did not notice obvious “price cheating” or chart manipulation during those first trades. Prices aligned fairly well with a separate chart I had open on a different broker’s demo account. That didn’t prove Olymp Trade is honest, but it weakened the “they always cheat the candle” narrative, at least in my early test.

Where I almost sabotaged myself

My 5th trade was a loss that wiped out the first few wins. My instinct was to increase size on the next trade to “get it back.” That instinct is how many traders, on any platform, create their own personal scam story.

At this point, the real question in my head changed from “Is Olymp Trade a scam?” to “Am I about to scam myself with my own behavior?”

Testing Withdrawals: Do They Actually Pay Out?

After a couple of days of trading small sizes, I managed to grow the account by a modest percentage. I decided this was the right moment to test something most blogs gloss over:

Can I actually get my money out, or does everything break once I hit “Withdraw”?

I requested a relatively small withdrawal, a portion of my deposit plus a share of the profit. I made sure:

- My account was fully verified

- My payment method matched my account details

- I followed the platform’s stated procedures carefully

The result:

- The withdrawal was processed and received within the timeframe stated by Olymp Trade.

- I was not asked for random extra fees “to unlock funds.”

- The amount I received matched what I requested (minus normal payment system friction).

This doesn’t mean no one has issues; independent review platforms do record complaints, especially around verification and withdrawal delays. But in my own test, with a small, clean, verified account, the payout worked as expected.

If you want to run the same experiment with a small amount and strict personal rules, you can open your own account using my affiliate link and follow a similar structure: deposit small, trade small, test withdrawal early, then decide if you want to continue.

Where Problems Start: Real Risks I Saw from the Inside

Having traded on Olymp Trade for a while, I began to notice a clear pattern in my own behavior and in communities I watched:

1. Over‑trading on low timeframes

The platform makes it incredibly easy to fire off one trade after another, especially in 1–5 minute fixed‑time modes. It feels more like playing a game than trading.

Red flags I saw in myself and others:

- Rapid streaks of trades with no pause to analyze

- Emotional revenge trading after 2–3 losses

- Doubling position sizes impulsively

Nothing about this is unique to Olymp Trade, but the structure of fixed‑time trading amplifies these impulses.

2. Misunderstanding the product itself

A lot of people don’t fully understand what kind of instrument they’re trading. Fixed‑time trades are not the same as traditional spot forex. Payout structures, time expiries, and risk/reward behave differently.

I noticed that when people lost money on structures they didn’t understand, they often jumped straight to: “This is rigged.”

3. Platform risk on top of trading risk

Because Olymp Trade doesn’t operate under top‑tier regulators, there is an extra layer of risk:

- Rules can change without the same level of oversight.

- Disputes are harder to escalate to recognized authorities.

- You’re more reliant on their own support and internal policies.

That doesn’t automatically make Olymp Trade a scam, but it does mean:

You shouldn’t put serious, life‑changing capital on a platform with this kind of regulatory profile.

If you’re serious about building a long‑term approach, this is where it helps to compare across different broker types, understand derivative products, and not rely solely on one platform. I break down that broader thinking in my piece on how I choose a trading platform without falling for aggressive marketing and another one where I walk through the simple checklist I use before trusting any broker for real money.

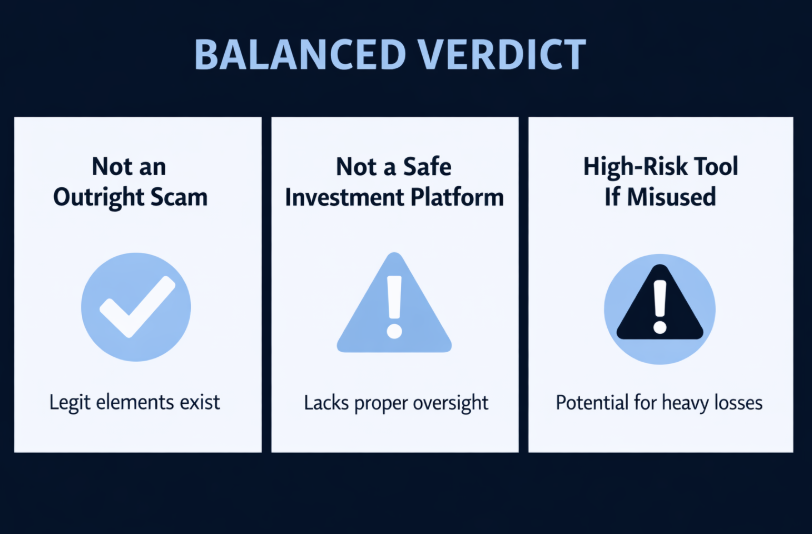

Addressing the Big Question Head‑On: Is Olymp Trade a Scam?

After trading, testing withdrawals, and cross‑checking information, here’s my honest, personal conclusion.

What I can say from my own experience

- My deposits and withdrawals worked as expected for small amounts.

- Trade execution matched external charts closely in my tests; I didn’t see obvious, systematic chart tampering.

- The platform is designed in a way that can encourage high‑frequency, emotional trading, especially for beginners.

- The lack of strong top‑tier regulation and independent warnings mean there is an additional layer of risk you cannot ignore.

What external sources consistently point out

Many independent reviewers and watchdog platforms highlight:

- Olymp Trade is not regulated by major financial authorities like FCA, ASIC, CySEC.

- There are recurring complaints about withdrawals, account blocks, and trade disputes, even though some users report smooth experiences.

- Some risk‑rating sites explicitly advise that Olymp Trade cannot be considered fully safe or verified as a broker.

My personal verdict

From my perspective:

- Olymp Trade is not an outright, obvious “they never pay anyone” scam, at least not in the way classic frauds operate. I was able to deposit, trade, and withdraw.

- It is a high‑risk environment with a weak regulatory backbone, where user behavior and expectations often turn it into a financial disaster.

- Treating it like a regulated, investor‑grade platform would be a mistake; treating it as a high‑risk trading venue you approach with caution, small capital, and strict rules is closer to reality.

So when someone asks me now, “Is Olymp Trade a scam?” my answer is:

It’s not a guaranteed fraud, but it’s also not a safe, beginner‑friendly investment platform. It’s a high‑risk tool that many people misuse, often without understanding the rules, then call it a scam when it burns them.

The Trades That Taught Me the Most (Concrete Examples)

I kept a simple log of some of my most educational trades. Here are a few that shaped my view.

Example 1: The “looks too easy” EUR/USD win

- Asset: EUR/USD

- Trade type: Fixed‑time, 15‑minute expiry

- Setup: Price bouncing off a clear support level on the 15‑minute chart

- Position size: Small (about 1–2% of account)

- Result: Win

Outcome: The trade closed clearly in profit, and the closing rate matched both the platform chart and my external chart feed. It was a clean experience.

Lesson: When I traded calmly with a clear plan and small risk, the platform behaved like a normal trading environment.

Example 2: The revenge‑trade spiral

- Asset: Gold (XAU/USD)

- Trade type: Fixed‑time, 5‑minute expiries

- Setup: None. I was chasing quick flips after a previous loss.

- Position sizes: Increasing after each loss, ignoring my rules.

- Result: A small streak of losses, a chunk of the account gone fast.

Outcome: I lost more in 20 minutes than I had made in several days. There was no need for platform manipulation; my own behavior did the damage perfectly.

Lesson: This is where many “Is Olymp Trade a scam?” stories are born: on a string of impulsive, leveraged bets made in a highly stimulating UI.

Example 3: The withdrawal test

- Action: Requested a partial withdrawal of my small profits plus a piece of my deposit.

- Conditions: Verified account, normal payment methods.

- Result: Funds received within the promised timeframe.

Lesson: Under clean, compliant conditions and with small amounts, my withdrawal experience was smooth. It didn’t match the extreme horror stories I had read, though I don’t dismiss that some traders absolutely do face problems, especially with larger sums or incomplete verification.

The Content Gaps I Noticed in Most “Reviews” (And What I Want to Fix Here)

When I first searched “Is Olymp Trade a scam?” and read the top results, I saw several things missing:

No real trade logs

Most articles talked about trading but never showed an actual example trade with context, risk, and psychology.

No distinction between trading risk and platform risk

Losses from emotional trading were being mixed with possible platform issues and labeled with one word: “scam.”

Shallow regulatory analysis

Many posts simply said “regulated” or “safe” without breaking down what kind of regulation actually exists and what it doesn’t.

No honest mention of small, real withdrawal tests

It was either “they never pay” or “they’re perfect,” with almost no one describing a modest, real withdrawal test step‑by‑step.

I’m not here to defend Olymp Trade or to destroy its reputation. I’m here to fill those gaps with a grounded, personal account and verify where possible against external sources.

If you want to read more about how I evaluate risk on any trading platform, you might find my notes on why most beginners blow up not because of the broker, but because of their own risk management mistakes and how I choose between different online trading products without getting seduced by advertised returns helpful as next steps.

A Simple Reality Check: What Olymp Trade Is and Is Not

To keep it clear, here’s how I would categorize Olymp Trade from my own experience and research:

| Aspect | What I observed / concluded |

| Regulation | Not regulated by major financial authorities like FCA/ASIC/CySEC; operates under non‑top‑tier structures. |

| Ease of use | Very user‑friendly interface, especially for fixed‑time trades. |

| Risk level | High. Both from the product type (short‑term, fixed‑time trades) and from weaker regulatory oversight. |

| Suitability for beginners | Tempting but dangerous. Easy to start, hard to control emotions and understand instruments. |

| Withdrawals (my case) | Small withdrawal processed successfully within the stated timeframe. |

| Community feedback | Mixed: some success stories, many complaints about losses, withdrawals, and blocked accounts. |

In short:

Is Olymp Trade a scam?

Not in the simplistic, “nobody ever gets paid” sense.

Is Olymp Trade a smart place for big, long‑term capital?

In my opinion, no. The regulatory and product risk is too high.

Is Olymp Trade a high‑risk tool some traders use responsibly and many others misuse?

Yes. That’s closer to the complex truth.

How I Use Platforms Like Olymp Trade Now (And When I Don’t)

After going through this entire investigation, here’s how I personally treat Olymp Trade and similar platforms:

When I might use it

- To test short‑term ideas with tiny, experimental capital

- To sharpen my discipline by deliberately trading small and slow in a tempting, fast‑paced environment

- To run educational “what happens if I follow my rules vs if I don’t” experiments

When I avoid it

- When I’m dealing with serious capital or long‑term investing goals

- When I’m emotionally unstable, stressed, or chasing quick money

- When I’m tempted to ignore my own risk limits “just for this one trade”

This is also why my primary approach to capital growth now lives elsewhere: more regulated brokers, longer‑term trades, and a structure that doesn’t reward impulsive decisions as much.

So, Should You Open an Account?

I can’t decide for you, but I can leave you with a checklist based on everything I’ve seen:

Ask yourself honestly:

- Can I afford to lose the entire amount I plan to deposit without affecting my real life?

- Do I understand that Olymp Trade is not under top‑tier regulation and carries additional platform risk?

- Am I prepared to stick to a written risk plan, even when the platform tempts me to over‑trade?

- Am I able to treat early withdrawals as a test of the system, not a cash‑out from my “new career”?

If your honest answer to any of these is “no,” then it doesn’t matter whether Olymp Trade is a scam or not; it’s the wrong environment for you right now.

If your answer is “yes,” and you still want to run your own small, controlled experiment like I did, you can open an account through my affiliate link, start with a small amount, and use my experience here as a risk map instead of a promise. It supports my work at no extra cost to you, but more importantly, it should remind you that this journey needs discipline, not hope.

Key Takeaways

- The question “Is Olymp Trade a scam?” doesn’t have a simple yes/no answer.

- My own test showed working deposits, real trades, and successful small withdrawals.

- External sources highlight serious concerns about regulation, safety, and frequent user complaints.

- Many horror stories come from emotional over‑trading and misunderstanding of risk, not always from direct fraud.

- Treat Olymp Trade, at best, as a high‑risk trading environment for small, experimental capital, not a trustworthy long‑term investment platform.