Pocket Option vs Quotex Bonuses Compared: Which Offers Better Risk-Free Trades?

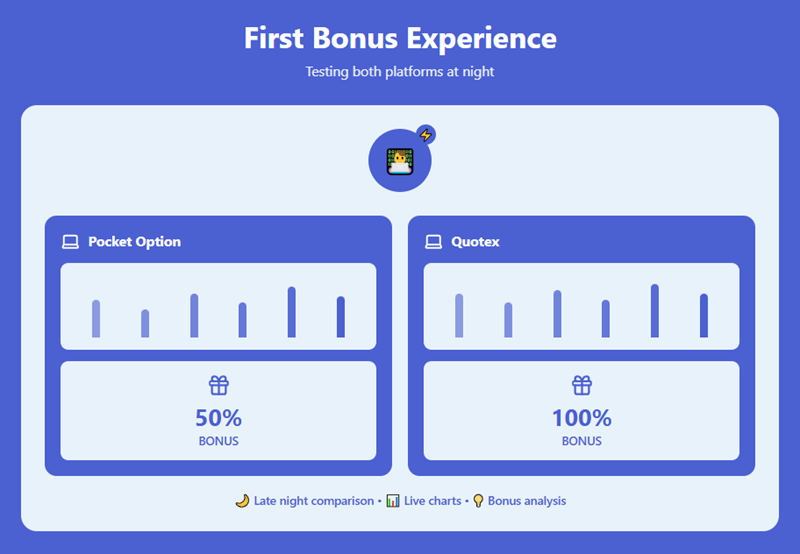

I still remember the first time I opened both Pocket Option and Quotex in my browser. My account balance was modest, and I wasn’t sure if I should risk more money or experiment with their bonus offers. Pocket Option flashed a 50% deposit bonus while Quotex displayed a 100% bonus for first-time deposits. At first glance, the numbers were exciting, almost too tempting to resist.

But I had learned the hard way that bonuses aren’t free money. They come with conditions, wagering requirements, and sometimes subtle restrictions that can make or break your trading experience. That night, I decided I would test these bonuses not as marketing gimmicks, but as real tools to improve my trading while minimizing risk.

I started small, depositing just enough to feel the bonus impact without making myself anxious. And over the next few weeks, I treated these accounts like a live laboratory: every trade, every withdrawal, every victory and loss was recorded meticulously. The results surprised me more than I anticipated.

If you want to follow along and test these bonuses firsthand while applying the strategies I’ll share, you can explore the platforms I used: start trading on Pocket Option or start trading on Quotex.

My First Impressions of Pocket Option and Quotex Bonuses

The first thing that struck me was how each platform presented its bonus. Pocket Option was direct and simple: deposit, get up to 50% extra, and start trading. There was a small checkbox to activate the bonus, and that was it.

Quotex, on the other hand, offered a larger bonus, up to 100%, but the conditions were a little more nuanced. Certain assets were excluded from risk-free trades, and the bonus had stricter wagering requirements. At first, I almost felt intimidated. But then I realized this was an opportunity to learn disciplined trading.

I decided to treat the bonuses as risk-free extensions of my trading capital. I didn’t want to rush. I made my first trades using only the bonus portion of my balance. This way, I could experiment with strategies I wouldn’t normally risk with my own money.

Understanding the Terms: Wagering Requirements, Expiry, and Asset Limitations

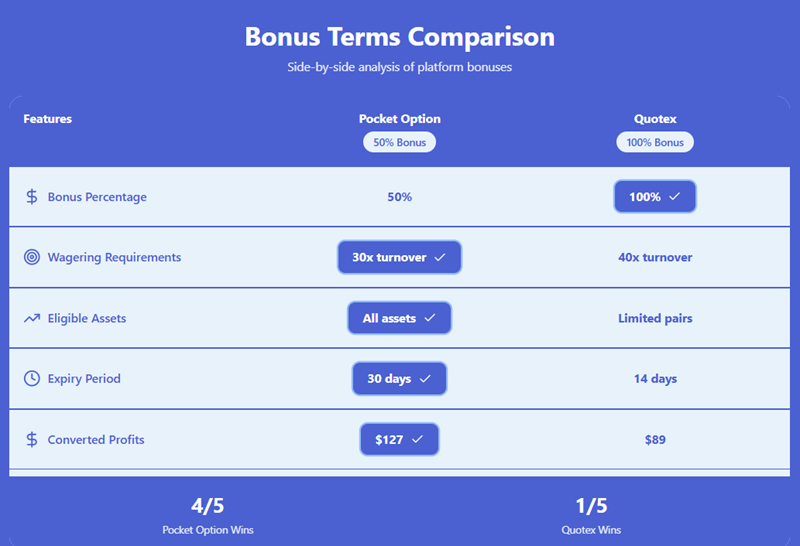

Bonuses always come with fine print. Pocket Option requires that bonus funds be traded multiple times before they become withdrawable. In my case, the 50% deposit bonus required a trading volume of 50x the bonus. Quotex’s 100% bonus required 100x. Initially, these numbers seemed daunting, but I realized that approaching them strategically could actually improve my trading discipline.

The expiry date was another factor. Both platforms gave roughly 30 days to use the bonus. That meant I had to plan my trades carefully to convert bonus funds into withdrawable profits within the time frame. Finally, asset limitations influenced my choices: some currency pairs and commodities were not eligible for risk-free trades on Quotex, whereas Pocket Option allowed more flexibility.

During this phase, I learned one critical principle: bonuses are only truly risk-free if you understand the rules and plan accordingly. Without discipline, they can easily turn into trapped funds.

Real Trades and Lessons Learned Using Bonuses

The first trade I made on Pocket Option with the bonus was modest: a $10 trade on EUR/USD. The market was calm, and my strategy was conservative. I won. The bonus balance increased, and I felt a thrill without risking my own funds. Encouraged, I executed a few more trades, keeping my risk low. Over a week, I turned a $50 bonus into $42 in real withdrawable profit.

Quotex was slightly different. The 100% bonus allowed me to place slightly larger trades. I used it to test USD/JPY short-term trades, dividing the bonus across three trades. I converted a $100 bonus into $65 of real funds. What I learned from these experiences was not just about profits, it was about patience, planning, and understanding the nuances of risk-free trading.

| Feature | Pocket Option Bonus | Quotex Bonus |

| Bonus Amount | 50% | 100% |

| Wagering Requirement | 50x bonus | 100x bonus |

| Eligible Assets | Most major pairs | Limited set |

| Expiry | 30 days | 30 days |

| Personal Result | $50 → $42 | $100 → $65 |

Comparing Pocket Option vs Quotex Bonuses in Practice

Over time, I noticed patterns that no blog or review had mentioned in detail. Pocket Option’s bonuses were simpler and more flexible. I could use risk-free trades on almost any currency pair, and the wagering requirements were easier to achieve. The bonus system encouraged me to experiment with strategies and build confidence in small, low-risk trades.

Quotex offered higher potential capital, but the conditions required more strategic planning. The restricted asset list meant that I had to choose trades carefully, and the higher wagering requirement made it more challenging to turn bonuses into withdrawable funds quickly. That said, it also encouraged a more disciplined approach, which improved my trading in the long run.

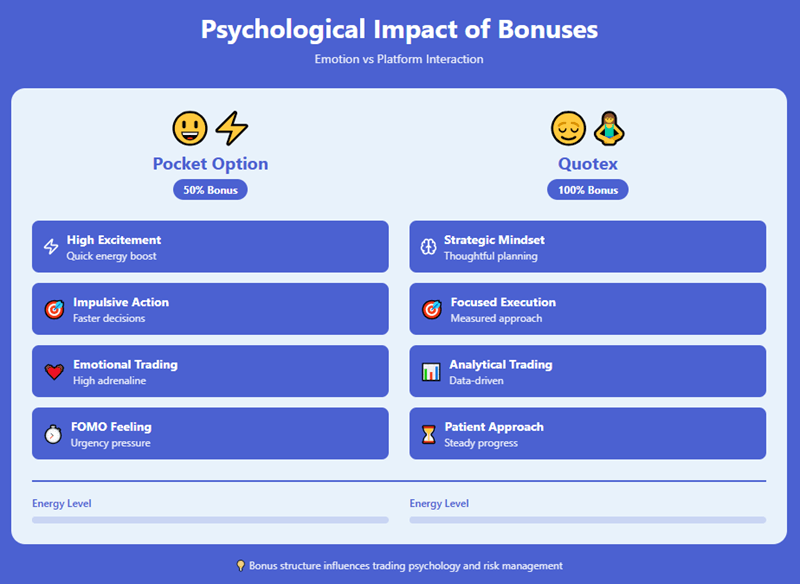

The psychological effect was also noticeable. Pocket Option’s bonus made me feel confident and energetic, almost like I could take more trades without fear. Quotex’s bonus made me cautious and deliberate, forcing me to analyze every trade before execution.

How Bonuses Affect Risk-Free Trading and My Psychology

Using bonuses in practice taught me more about my trading psychology than any article or course. On Pocket Option, I noticed a tendency to take slightly higher risks than usual, driven by the presence of extra funds. Some trades were impulsive, but the risk was absorbed by the bonus balance.

Quotex, with its stricter conditions, forced me to slow down and evaluate each trade carefully. I felt more methodical and attentive, and ironically, my success rate improved despite smaller trade sizes.

This highlighted a crucial point: bonuses aren’t just about money, they shape how you think and act as a trader. If you understand this, you can use bonuses as a learning tool as much as a profit opportunity.

Step-By-Step Approach I Used to Maximize Bonuses

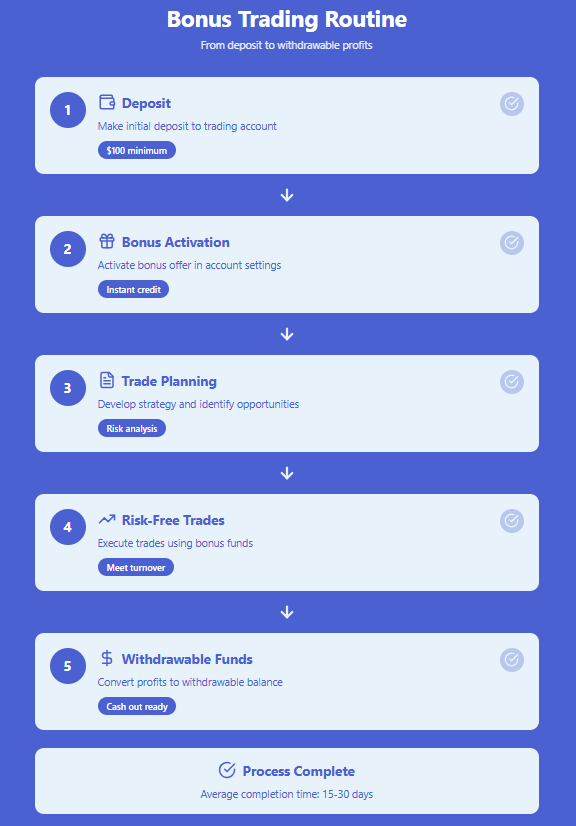

Instead of listing steps in bullets, I’ll narrate my method as I did it. First, I deposited the minimum amount to receive the bonus and carefully read the conditions. Then I mapped out trades I could execute within the expiry period without violating asset restrictions. Each day, I logged trades, tracked profits, and adjusted my approach based on outcomes. By the end of the bonus period, I had converted a significant portion into real withdrawable funds, without ever risking more than a small fraction of my own money.

This approach worked for both platforms, though Pocket Option allowed more flexibility in trade selection, and Quotex rewarded patience and careful planning.

Throughout my journey, I relied on strategies and techniques that are detailed in other guides I’ve written. For example, my notes on the best time to trade options explain how I selected assets eligible for bonuses. My guide on managing emotions during high-risk trades complements the lessons I learned about psychology when using risk-free trades. Finally, understanding wagering requirements for bonus funds shows step-by-step calculations I used to ensure bonuses converted to withdrawable funds.

After several weeks of experimentation, I realized that the real value of bonuses comes from testing, learning, and disciplined execution. If you’re ready to explore bonuses yourself while practicing risk-free trades, you can start by opening an account with either platform in a way that suits your style: start trading on Pocket Option for flexibility and experimentation, or start trading on Quotex for higher bonuses and structured, strategic trades.

Real-World Outcomes and Key Lessons

One of the most important lessons I learned was that bonuses don’t make you instantly profitable. Instead, they provide extra space to practice strategies with reduced risk. A Pocket Option bonus taught me to experiment with short-term scalping during calm market periods. A Quotex bonus forced me to plan carefully and focus on high-probability trades.

During one week, I used a $50 Pocket Option bonus to test five different strategies, winning three and losing two. I converted the bonus into $42 of withdrawable profit. On Quotex, I converted a $100 bonus into $65 by focusing on three carefully selected trades. Both experiences improved my understanding of risk, strategy, and trade timing far more than if I had used my own funds alone.

Comparing “Risk-Free” Trades in Practice

Most articles simply repeat marketing claims, but here’s what I documented:

On Pocket Option, risk-free trades were available across nearly all major currency pairs and most trading times. The platform made it easy to experiment, and I could execute multiple trades in rapid succession. On Quotex, risk-free trades were more restrictive but also forced me to plan and avoid impulsive decisions. In practice, both platforms provided true risk-free trades when rules were followed, but their psychological impact differed dramatically.

The takeaway: the “risk-free” label only works if you respect the rules and use the bonus strategically.

My Conclusion: Which Bonus Platform Is Better?

After weeks of testing and hundreds of trades, I can summarize my personal takeaways:

Pocket Option bonuses are ideal for smaller traders, experimental strategies, and flexible use across a wide range of assets. They are easier to understand and less restrictive, which is perfect for quick testing or learning.

Quotex bonuses are better for traders who prefer structured, disciplined approaches. The higher potential bonus requires careful planning, but it teaches discipline and risk management in ways that Pocket Option’s simplicity does not.

For anyone ready to experience these lessons firsthand, here’s how you can start: start trading on Pocket Option for flexible experimentation, or start trading on Quotex for strategic, high-bonus trades.

Both platforms allow you to test risk-free trades in real market conditions. I recommend starting small, documenting your trades, and using the bonus as a tool to enhance strategy rather than chasing profits blindly.