ExpertOption Demo Account Full Guide (2025)

When I first opened an ExpertOption demo account back in early 2025, I wasn’t sure what to expect. I had tried other brokers before, but most demo accounts either felt too restrictive or too far removed from real trading conditions. What I found with ExpertOption was surprisingly different: a place where I could make mistakes, test strategies, and actually progress without risking a single dollar of my own.

This guide isn’t a generic walkthrough. It’s my own journey—how I set up my demo account, how I learned to reset it when things went sideways, and how I built a progression plan that made me feel more prepared for real trading. If you’re curious about whether the demo account is worth your time, I’ll share every lesson I picked up along the way.

👉 If you want to experience ExpertOption’s demo for yourself, you can open a free account here and follow along as you read.

Why I Started With the Demo Account

I’ve blown real accounts before. Anyone who has traded long enough knows that the early stage is usually more about losing money than making it. So this time, I made a conscious decision: before risking anything real, I’d master the demo.

What stood out immediately was that ExpertOption gives you $10,000 in virtual funds right away. No registration hassle, no bank details, just a one-click entry into the platform. That might sound small compared to some brokers that hand out $100,000 demos, but honestly, I prefer this, it’s closer to what I’d realistically fund in a live account.

I decided to treat this money as if it were my own. That mindset changed everything.

How I Set Up My ExpertOption Demo Account

The setup process was almost too simple. Within a minute, I was already looking at charts. Still, I had to customize a few things to make it “my space.”

Here’s what I did in the first 10 minutes:

- Chose the dark theme to reduce eye strain.

- Adjusted the chart type to candlesticks because that’s what I was comfortable with.

- Added a few key indicators I always rely on: RSI, MACD, and Bollinger Bands.

- Created a watchlist with my main assets: EUR/USD, BTC/USD, Apple, and Gold.

I even kept a small notebook on my desk. Every trade I took, I wrote down what I saw, what I felt, and what the outcome was. It felt like I was creating a personal trading diary that would guide me later.

The First Trades: Excitement and Reality

The first few trades on the demo account were pure adrenaline. I clicked “buy,” watched the candles move, and felt like a genius when I won the first one. But then I lost three trades back-to-back, and it reminded me: the demo account might not carry real risk, but it sure mirrors real emotions.

To keep myself grounded, I started applying risk management rules. I never risked more than 2% of my demo balance per trade. That way, I wasn’t just pressing buttons randomly, I was building habits that I could later use in my real account.

Here’s a quick snapshot of how my first week looked:

| Day | Trades Taken | Wins | Losses | Notes |

| 1 | 8 | 5 | 3 | Overconfident start |

| 2 | 6 | 2 | 4 | Forced trades, learned patience |

| 3 | 5 | 3 | 2 | Better entry timing |

| 4 | 7 | 4 | 3 | More consistent |

| 5 | 5 | 3 | 2 | Built a routine |

By the end of the week, I wasn’t chasing wins anymore. I was learning discipline.

Resetting the Demo Account: My Safety Net

The feature I found most useful was the reset option. Whenever my demo balance went too low or my testing became messy, I just reset it back to $10,000.

At first, I abused this feature. I’d blow half the account, reset it, and pretend nothing happened. But then I realized if I did that in real trading, I’d be bankrupt. So I started setting rules for when I was allowed to reset:

- If I dropped below $8,000, I forced myself to stop and analyze what went wrong.

- I only reset after completing a full 10-day trading cycle.

- Before resetting, I reviewed all my trades, highlighted patterns of mistakes, and adjusted my approach.

The reset button wasn’t just a convenience. It became my checkpoint, like restarting a level in a game but carrying forward the knowledge I gained.

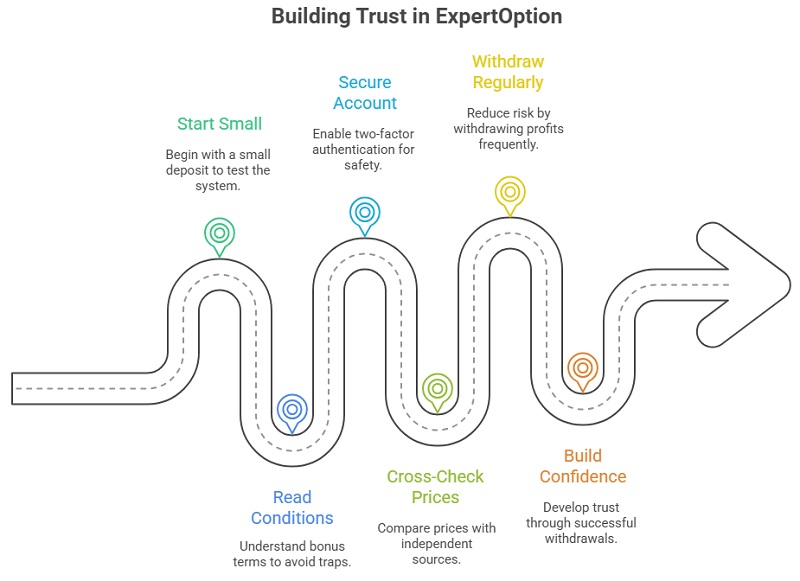

Building a Progression Plan

After two weeks, I realized I needed structure. The demo account was powerful, but without a plan, I could easily get lost. So I designed a progression roadmap:

Phase 1: Familiarization (Week 1–2)

- Focused on platform tools and order execution.

- Tested basic strategies like moving average crossovers.

Phase 2: Strategy Testing (Week 3–4)

- Tried candlestick setups like engulfing and pin bars.

- Kept track of win/loss ratios.

Phase 3: Risk Discipline (Week 5–6)

- Applied strict money management rules.

- Practiced trading smaller sizes consistently.

Phase 4: Realistic Simulation (Week 7–8)

- Treated the demo as if it were a $500 real account.

- Limited myself to the number of trades I’d realistically take in a day.

By the end of two months, I didn’t just know the platform. I had habits. I had strategies. I had confidence.

👉 If you’re ready to build your own progression, you can start your demo journey here.

Lessons I Learned From the Demo

Every trader will take away different lessons, but here are the ones that stuck with me:

- Don’t treat it like free money. The demo only works if you treat it as real.

- Keep a journal. Writing down trades helped me spot mistakes faster than anything else.

- Use resets wisely. It’s a learning tool, not a get-out-of-jail card.

- Simulate real conditions. Trade as if your family savings were on the line, even though they aren’t.

Frequently Asked Questions About ExpertOption Demo

1. Is the ExpertOption demo account free?

Yes, completely free. What surprised me was that I didn’t even have to provide payment details or commit to a deposit. I opened the platform, clicked “try free demo,” and instantly had $10,000 virtual funds waiting. That gave me peace of mind—it didn’t feel like a trap to push me into funding right away.

2. Can I reset my demo account balance?

Yes, you can reset it anytime, back to $10,000. I used this a lot in my first week, but eventually I disciplined myself. My rule became: only reset after a 10-day review cycle. That way, the reset became a checkpoint instead of a cheat code.

3. Does the demo account match real trading conditions?

In terms of price charts, assets, and order speed, it’s almost identical. But the real difference is psychological. When I trade with real money, my hands sometimes hesitate before clicking. On the demo, I never had that fear. So I had to artificially create discipline, like limiting myself to just 3 trades a day, so it would feel closer to reality.

4. How long can I use the demo account?

There’s no expiration. I used mine for two months straight before going live. Even today, I still switch back to demo whenever I want to test a new idea or indicator without pressure. I think of it as my permanent sandbox.

5. Should I switch to a real account right away?

Personally, I waited until I had at least 20 consecutive days of consistent results on demo before funding real money. I didn’t care if I won or lost a trade here and there; what mattered was that my risk management felt automatic. If you can’t resist going all-in on demo, you’re not ready for live.

6. Can I use the demo on mobile?

Yes, and I did often. ExpertOption’s app made it easy to sneak in practice during commutes or lunch breaks. But I noticed I was more careless on mobile, so I set myself a rule: analysis on desktop, quick execution or review on mobile.

7. What’s the best way to practice with the demo?

What worked for me was building scenarios. For example, one week I only traded EUR/USD during the London session. Another week, I focused only on crypto volatility. This gave structure instead of random button-clicking.

8. Does trading on demo improve psychology for live trading?

Yes and no. It definitely helped me build habits like risk sizing and patience but the emotional hit of losing real money still felt different. That said, by journaling my demo trades as if they were real, I trained my brain to treat them seriously. It softened the transition when I finally went live.

Final Thoughts: Why the Demo Was Worth It

Looking back, the ExpertOption demo account wasn’t just a playground, it was a classroom. It gave me the freedom to fail, the ability to reset, and the structure to build real trading discipline.

Would I recommend it? Absolutely. But only if you use it seriously, as if every dollar belongs to you. That’s how I turned a free tool into a stepping stone for real progress.

👉 If you want to start your own trading journey, you can open an ExpertOption demo account here today.