Why Greed Destroys More Binary Accounts Than Strategy Mistakes

I started my binary options journey full of hope and excitement. My account balance was $1,000, and I felt confident I could turn small wins into steady growth. Very quickly, I discovered that what destroys more accounts than strategy mistakes is greed. Not technical errors or missed setups, but the urge to chase bigger wins, take larger risks, and bend rules because I “felt confident.”

If you want to trade with discipline and survive your early losses, it’s crucial to understand how greed manifests and how to manage it. I also recommend opening an account today to practice these lessons with real structure and limits — start here with IQ Option.

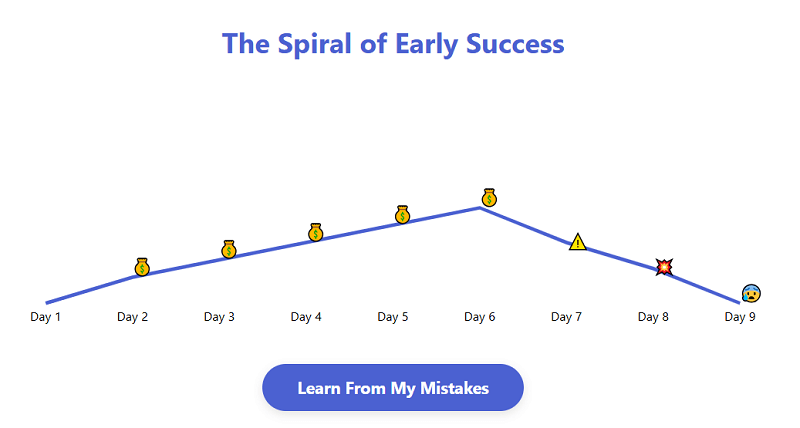

Early Wins That Fueled My Greed

In the beginning, my trading was simple. I focused on a few currency pairs, spotting short-term trends and placing Call or Put trades with 1–4 hour expiries. The first few wins felt effortless. That initial success was intoxicating. It made me believe I could predict the market and earn consistently.

The problem wasn’t my strategy. It was how I responded to success. After a small win, I immediately wanted a bigger stake in the next trade. After two consecutive wins, I increased the risk, thinking, “I’m on a roll; I can’t go wrong.” That feeling of invincibility made me trade impulsively, step outside my method, and ignore my limits.

The Day Greed Took Over

I still remember the Monday my account reached $1,300. A setup on EUR/USD appeared perfect. My method indicated a moderate stake, around 2% of my balance. Instead, I risked $100 — more than 7% of the account. Initially, the trade moved in my favor, and I felt elated. But I didn’t close it; I wanted more. The market reversed, wiping out the trade entirely.

I didn’t stop there. Driven by the desire to recover, I placed two more oversized trades that day. Both failed. By evening, my balance had fallen to $1,050. That single day cost me more than a full week of disciplined trading.

That day taught me a vital lesson: greed doesn’t just cost money, it erodes your rules, your discipline, and your confidence. I realized that the strategy wasn’t broken; I was.

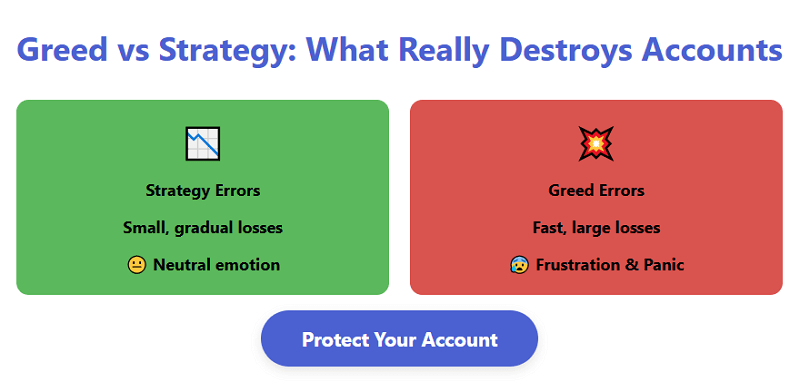

Understanding Why Greed is More Dangerous Than Strategy Mistakes

Strategy mistakes are visible. You can point to a wrong entry, a poor expiry, or a misread trend. Greed, however, operates invisibly. It disguises itself as confidence or intuition, luring you into overtrading, increasing stakes, or deviating from your plan.

In my case, greed triggered several destructive behaviors:

- Over-staking after wins.

- Chasing losses with bigger trades.

- Ignoring my method for “sure-win” setups.

- Disregarding daily or weekly stop limits.

Each behavior compounded the last. A small greedy decision might cost 2–3% of my account. Several in succession could wipe out 10–15% in a day. Unlike strategy mistakes, which can be corrected, greed amplifies losses quickly and often invisibly.

Psychologically, greed taps into the fear of missing out and the thrill of winning. In binary options, where the outcome is all or nothing, this emotional spike can be catastrophic. I learned this the hard way, watching my account swing wildly in the span of hours.

Real-Life Episodes of Greed Destroying Trades

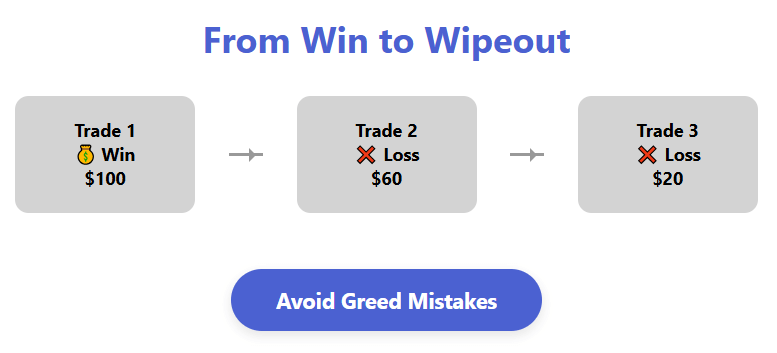

Looking back at my trade journal, I can identify three trades where greed cost me heavily.

| Trade Date | Asset | Stake % of Account | Greedy Behavior | Outcome | Lesson Learned |

| July 10 | EUR/JPY | 8% | Increased stake after prior win | Loss −8% | Risk too high after short-term success |

| July 11 | GBP/USD | 6% | Ignored method because “looked promising” | Loss −6% | Deviation from method = high risk |

| July 13 | AUD/USD | 10% | Chased loss with larger stake | Loss −10% | Chasing losses compounds damage |

The pattern was obvious: every time I deviated from my disciplined risk plan due to emotion, the results were disastrous.

Recognizing Greed Before It Destroys

The first step in regaining control was recognizing greed’s warning signs. I learned to notice my internal triggers:

- Win-chasing, thinking the next trade will be even bigger.

- Loss-chasing, believing I could recover instantly.

- Deviating from the method because “it looks good.”

- Ignoring stop-loss or stake limits because I felt lucky or “hot.”

Once I identified these behaviors, I could take conscious action to prevent them.

Rebuilding Discipline: My Anti-Greed Approach

I implemented a structured approach to prevent greed from controlling my trades.

Shrinking Risk

After my big losses, I reduced my stake to 1–2% of the account balance. Smaller risk reduced emotional pressure and prevented impulsive trades.

Journaling Every Trade

I logged each trade, noting: asset, stake, setup, emotion, and outcome. Writing down my feelings helped me see patterns I previously ignored.

Automating Guardrails

I imposed strict daily and weekly limits. No more than three live trades per day, no more than four percent drawdown per week, and a pause after consecutive losses.

Pausing on Deviations

Whenever a setup tempted me outside my method, I switched to demo mode. A cooling-off period prevented greedy impulses from dictating decisions.

Weekly Reviews

Every weekend, I reviewed my journal, identifying trades driven by greed and reinforcing those made with discipline. Over time, this built stronger habits.

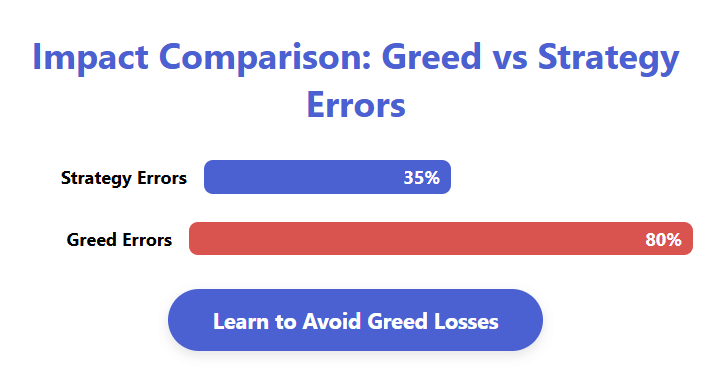

Comparing Greed Errors vs Strategy Errors

From my own logs, the difference between greed and strategy mistakes became clear.

| Error Type | Example | Impact | Recovery |

| Strategy Error | Wrong expiry on EUR/USD | −3% | Adjust method and expiry |

| Greed Error | Over-staking after win | −12% | Reduce stake size, pause trading |

| Strategy Error | Missed signal but normal risk | −4% | Refine entry timing |

| Greed Error | Chasing loss with larger trade | −15% | Demo mode, rebuild discipline |

Greed errors consistently caused higher, faster losses than strategy mistakes. Recognizing this fact changed my entire approach.

How My Account Stabilized

By controlling greed, my account slowly recovered over the next four months. I prioritized survival over instant profit. Monthly results illustrate this gradual but steady approach:

- Month 1: −3% (small drawdown)

- Month 2: +4% (consistent trades, small stakes)

- Month 3: +7% (method strictly followed)

- Month 4: +5% (steady growth, emotional control maintained)

Survival became the measure of success. The goal shifted from “big wins fast” to “consistent growth and longevity.”

If you want to trade with control and avoid greed destroying your account, open your IQ Option account here and start with proper limits and discipline from day one.

Recognizing Common Myths About Greed

Confidence Justifies Bigger Risk

After a few wins, I often felt I could safely increase stakes. Reality: confidence after a streak is when greed is strongest, and losses hit hardest.

One Big Trade to Recover Losses

Attempting to recover a loss with a bigger stake consistently failed. Instead of recovering, I deepened my drawdown.

Strategy Mistakes Are Costlier Than Stake Mistakes

In my experience, increasing stakes due to emotion costs more than wrong entries. Even a perfect setup can’t withstand oversized stakes driven by greed.

Rules Can Be Bent for “Sure Wins”

I once took trades outside my method because they “looked good.” Almost every time, I lost. Greed hides behind optimism, but it never pays off in the long run.

Building a Greed-Resistant Trading Plan

I now follow a blueprint to guard against greed:

- Stake size ≤ 2% of account balance (1% during recovery periods)

- Max three live trades per day, max five demo trades

- Weekly drawdown limit 6% → pause and demo if exceeded

- Trade only setups fully matching my method

- Pre-trade emotion checklist: “Am I chasing or feeling lucky?”

- Weekly review to spot and correct greed-driven trades

This structured approach protects my balance and my mindset.

The Emotional Cost of Greed

Beyond money, greed damages confidence, sleep, and focus. Big losses leave lingering anxiety and self-doubt. Accepting greed as a behavioral problem rather than a market problem allowed me to track patterns, rebuild discipline, and regain control.

Final Thoughts

Greed destroys more binary accounts than strategy mistakes because it hijacks risk management and emotional control. Survival, discipline, and consistency are more important than chasing instant profit.

If you want to trade safely and build long-term success, open your IQ Option account now and implement a greed-resistant plan from day one. Discipline beats strategy when greed is lurking.

Useful Links for Further Learning

- Learn how to keep emotional control in trading

- Read my guide on binary options risk management

- Explore insights on building your trading journal