High-Frequency vs. Longer-Expiry Trading Strategies in Binary Options

When I first started trading, I was addicted to speed. Watching the screen light up with constant price ticks gave me a rush. I believed that executing more trades meant earning more. That’s how I fell into what I now call my high-frequency phase quick, adrenaline-filled trades that taught me lessons the hard way. Over time, I realized not every move needs to be captured in seconds. Some setups needed days, even weeks, to mature. That’s when I began exploring longer-expiry strategies.

If you’ve been torn between these two approaches, this story is for you. It’s not theory, it’s how I learned, tested, and balanced both strategies in my own trading journey. And if you’re ready to test your style, you can open an account through our affiliate link to start experimenting yourself.

Two Roads in Trading: Fast vs Patient

High-Frequency

Fast-paced trades, quick decisions, instant reactions.

Longer-Expiry

Steady moves, patient entries, gradual growth.

How Expiry Became the Turning Point

Early on, I didn’t think about “time” as a variable in trading. I’d enter a setup expecting instant results. Sometimes it worked, but often, my timing was just a few hours off, and the opportunity slipped away. It wasn’t the strategy that was wrong; it was my holding period.

That realization pushed me to experiment. Should I keep chasing fast setups, or give trades more time to breathe? The answer wasn’t simple, and it definitely wasn’t in any trading book.

What I Mean by Each Strategy

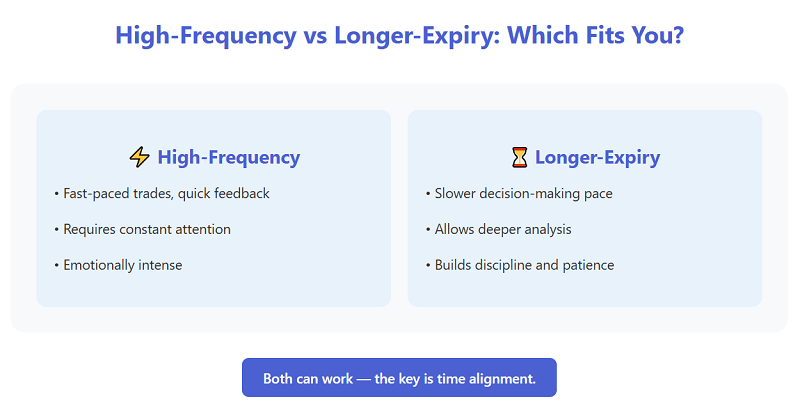

High-frequency trading, in my context, means multiple trades per day, fast entries and exits based on short-term momentum or breakouts. Positions last minutes to hours.

Longer-expiry trading, on the other hand, is about holding positions for several days or weeks. The focus shifts from instant reaction to patience and timing over a broader market cycle.

| Approach | Typical Hold | Style | Best Suited For |

| High-Frequency | Minutes to hours | Fast scalps, intraday momentum | Traders who can monitor the market closely |

| Longer-Expiry | Days to weeks | Swing or catalyst-driven setups | Traders who prefer a slower, strategic pace |

My High-Frequency Phase

When I first tried high-frequency strategies, the appeal was obvious: instant feedback. I could enter, manage, and exit trades before lunch. I remember a trade on a large-cap stock right after a news spike. Within 30 minutes, I made a small profit, and that rush was addictive.

But that speed came with costs I didn’t understand at first. Transaction fees added up. Emotional fatigue built fast. And false signals, especially during volatile sessions, burned my profits as quickly as I made them.

One trade stands out: I chased a breakout that reversed within an hour. Instead of cutting the loss, I waited for it to turn back. It didn’t. I took a hit. The move eventually came but after I’d already exited. The lesson was clear: if your time frame is short, your timing must be perfect.

The Burnout Loop of Overtrading

Break it by slowing down.

Pros and Cons from My Experience

| Pros | Cons |

| Fast feedback on performance | High mental and emotional demand |

| Minimal overnight exposure | Slippage and transaction costs add up |

| Many opportunities daily | Requires near-perfect timing |

| Keeps you engaged with the market | Easy to overtrade and make impulsive errors |

High-frequency trading can work, but only if you have the discipline to treat it like a process, not a thrill.

My Shift Toward Longer Expiry

After months of nonstop screen time, I felt drained. The constant need for action made me impatient. So, I decided to hold trades longer, sometimes a few days, sometimes a couple of weeks.

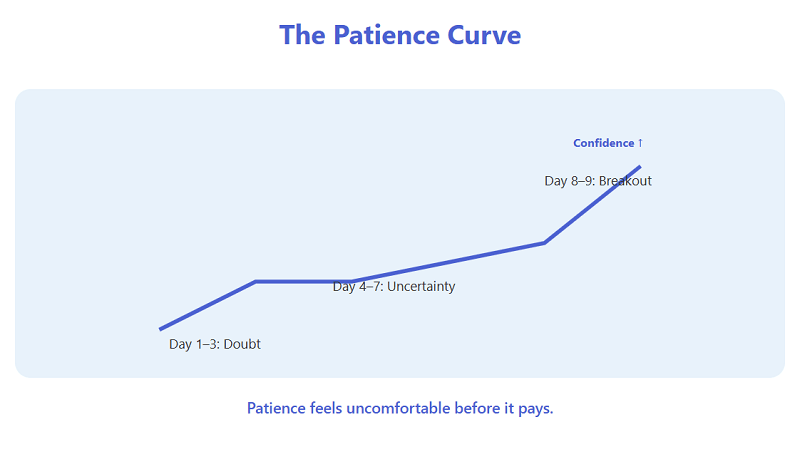

The first few attempts were uncomfortable. Prices would stagnate for days, and I’d question every decision. But one particular trade changed my mindset. I held a mid-cap stock through a consolidation period, expecting a breakout after upcoming earnings. Nothing happened for a week. On the ninth day, the stock rallied over 8%. That win wasn’t just financial, it was psychological.

I realized that patience could be just as powerful as speed, if applied to the right setup.

What I Learned

Holding trades longer forced me to plan more carefully. Stops had to be wider, risk had to be sized thoughtfully, and overnight exposure had to be accepted. It also made me more selective; every trade had to justify the time and capital it required.

| Pros | Cons |

| Potential for larger gains | Exposure to overnight and weekend risk |

| Less daily screen stress | Fewer trading opportunities |

| Allows trades to mature fully | Requires patience and conviction |

Comparing Both Styles

After testing both for months, I created a simple way to decide which one to use.

| Factor | High-Frequency | Longer-Expiry |

| Time Sensitivity | Very high | Moderate |

| Risk per Trade | Smaller, frequent | Larger, less frequent |

| Emotional Load | High (constant action) | Medium (requires patience) |

| Best Market Type | Volatile or reactive | Trending or catalyst-driven |

| Cost Impact | High from volume | Lower per trade |

| Suitable For | Active, screen-heavy traders | Strategic, patient traders |

When I look at a setup now, I ask: Does this move need minutes or days to play out? That single question keeps me aligned with the right approach.

Lessons from Real Trades

I’ve made every mistake you can imagine: exiting too early, holding too long, mixing strategies mid-trade, ignoring risk on weekends. The cost wasn’t just monetary, it was mental clutter.

Now, I separate both strategies clearly. I keep a smaller “fast” bucket for high-frequency setups and a larger “slow” bucket for swing trades. That separation helps me measure performance accurately and manage risk more calmly.

A quick example: A short-term index ETF trade gave me a neat 0.8% gain in under an hour. Later that week, a longer-expiry position on a tech stock ran 11% over nine days. The difference wasn’t just profit, it was the kind of effort and patience each required.

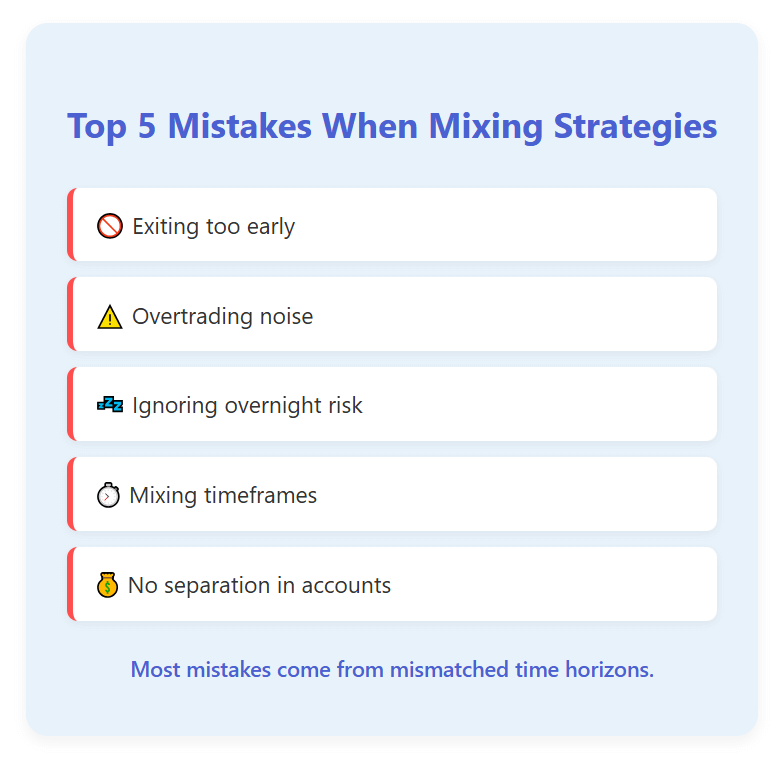

Common Mistakes Traders Make

- Treating a long-term setup like a day trade

- Trading too often when no clear signals exist

- Holding overnight without planning for event risk

- Mixing both strategies in one account without structure

- Underestimating the cost of mental fatigue

These are simple errors, but they compound fast. I learned to treat each style as its own discipline.

What Most Articles Miss

When you research “high-frequency vs long-term strategies,” you’ll find repetitive advice, “choose what fits your personality,” “manage risk,” “stay disciplined.” What’s usually missing is the real cost of execution, the fatigue, the waiting, the lost capital efficiency, and the operational drain.

High-frequency trading demands constant energy. Longer- expiry trading demands emotional endurance. Most traders underestimate both.

Finding Your Fit

If you’re unsure where to start, here’s how I’d approach it today:

- Decide how many hours per day you can actively trade.

- Be honest about your temperament, do you crave constant feedback or prefer to think in slow, deliberate moves?

- Start tracking your results by style. You might be surprised which one truly fits.

- Separate your accounts or at least your capital buckets for each strategy.

This structure helped me avoid cross-contamination between styles.

If you’re serious about testing both approaches, you can open an account via our affiliate link and dedicate a portion to each strategy to see which feels right in live conditions.

My Current Approach

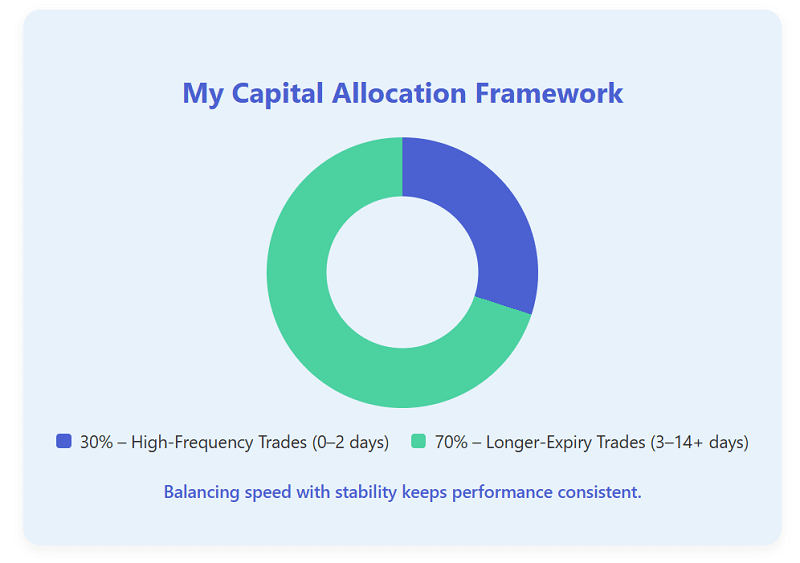

I now use a hybrid system:

- About 30% of my capital goes into fast, tactical trades that last less than a day.

- The remaining 70% is for slower, swing setups driven by fundamentals or catalysts.

This balance keeps me engaged but grounded. I get the satisfaction of activity without burning out.

Final Takeaways

Trading frequency is not just about style, it’s about self-awareness. Both high-frequency and longer-expiry strategies have their place, but each demands a different mindset. High-frequency rewards precision. Longer-expiry rewards patience. The best traders I’ve met excel because they know which one suits them best, and they don’t mix the two without purpose.

As for me, I lean toward longer-expiry setups now. They match my rhythm, reduce noise, and align with my broader market view. But I still enjoy the occasional fast trade, it keeps me sharp and connected to market flow.

If you’re ready to discover which approach fits you best, open your trading account here and start documenting your own journey. The lessons won’t come from reading, they’ll come from trading, reflecting, and adapting.

Choosing Your Trading Clock

(Precision)

(Patience)