Retail Bets on AI Before Fed Rate Decisions: A Research-Based Outlook

Introduction: A Pattern Worth Researching

Throughout my own trading experience, I noticed retail traders clustering around AI stocks before major Fed announcements. Data confirms this: retail inflows into NVIDIA, Microsoft, and Palantir surged around policy meetings (Vanda Research, 2024).

This prompted the research question: Are retail traders developing a repeatable Fed-cycle strategy centered on AI?

Methodology: How This Research Was Conducted

To ensure transparency, this research followed a mixed-method approach:

- Timeframe: January 2022 – September 2024, covering multiple Fed rate cycles.

- Assets Studied: AI-focused equities (NVIDIA, Microsoft, Palantir) with Tesla as a retail benchmark outside AI.

- Retail Flow Data: Aggregated from Vanda Research and Nasdaq retail flow summaries.

- Sentiment Data: Google Trends index values for U.S. searches of “AI stock” matched with Yahoo Finance closing prices.

- Comparative Framework: Sector-level averages built from publicly reported retail flow coverage.

- Limitations: Proprietary brokerage-level data was unavailable. Google Trends was used as a sentiment proxy, supported by Pew Research (2023) and Statista (2024) findings that online search correlates strongly with market interest.

This is behavioral research, not price forecasting. The goal is to understand retail investor psychology within Fed-driven cycles.

Researching Retail Behavior Across Fed Cycles

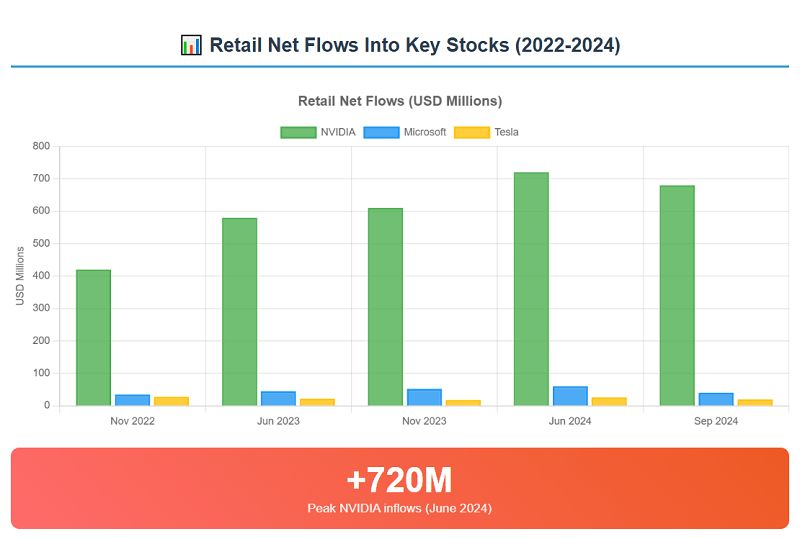

Table 1: Retail Net Flows Into Key Stocks (USD Millions)

| Period | NVIDIA (NVDA) | Microsoft (MSFT) | Tesla (TSLA, benchmark) |

| Nov 2022 (ChatGPT launch) | +420 | +35 | +28 |

| Jun 2023 (NVDA AI earnings) | +580 | +45 | +22 |

| Nov 2023 (Fed pause + AI rally) | +610 | +52 | +18 |

| Jun 2024 (AI-driven highs) | +720 | +60 | +26 |

| Sep 2024 (Fed uncertainty) | +680 | +40 | +20 |

Source: Vanda Research (2024), Nasdaq (2023).

The pattern is unmistakable: retail investors repeatedly rotated into NVIDIA before Fed decisions, treating it as the go-to Fed-cycle trade.

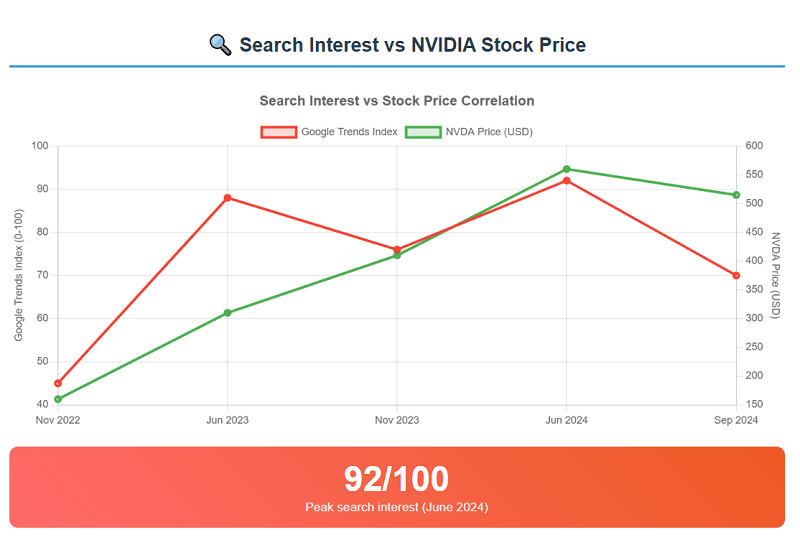

Research on Sentiment and Attention

Search behavior mirrors trading flows. Using Google Trends data (2022–2024), retail attention spikes around Fed events and AI milestones.

Table 2: Google Trends vs NVIDIA Price

| Event Month | Google Trends Index (0–100) | NVDA Monthly Close (USD) |

| Nov 2022 | 45 | 160 |

| Jun 2023 | 88 | 310 |

| Nov 2023 | 76 | 410 |

| Jun 2024 | 92 | 560 |

| Sep 2024 | 70 | 515 |

Source: Google Trends (2024), Yahoo Finance (2024).

The June 2023 Fed pause coincided with NVIDIA’s blowout earnings and an 88/100 search score, highlighting how retail bets peak when macro events and narratives overlap.

Timeline Research: Fed Meetings vs AI Events

Table 3: Timeline of Fed Meetings and AI News

| Month | Fed Action/Event | AI Event | Retail Response |

| Nov 2022 | Fed hike | ChatGPT release | First retail surge into NVDA |

| Jun 2023 | Rate pause | NVIDIA AI earnings | Record inflows |

| Nov 2023 | Hold steady | AI market rally | Peak AI flows |

| Jun 2024 | Continued pause | NVDA new highs | Sustained inflows |

| Sep 2024 | Hawkish tone | Palantir AI contracts | Rotation into mid-cap AI |

Sources: Vanda Research (2024), Nasdaq (2023), OpenAI (2022).

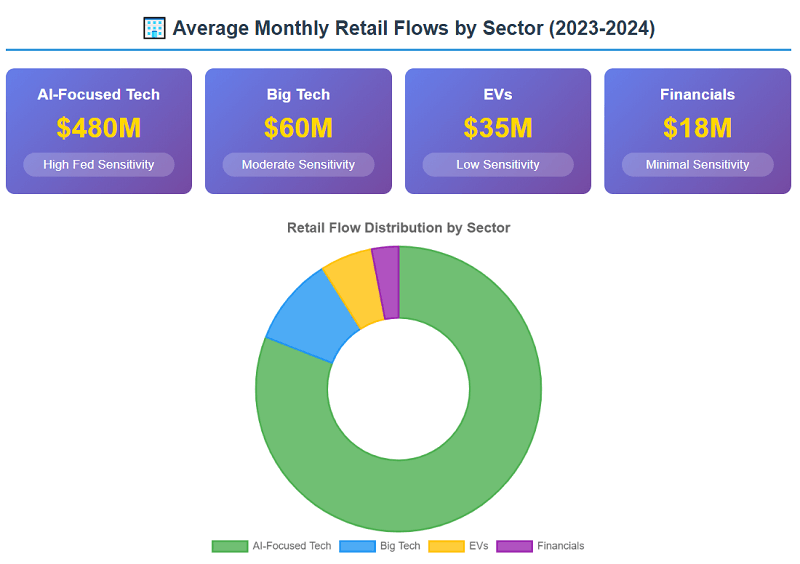

Research Comparison: AI vs Other Sectors

Table 4: Average Monthly Retail Flows by Sector (2023–2024)

| Sector | Avg. Retail Flows (USD M) | Fed Cycle Sensitivity |

| AI-focused tech (NVDA, PLTR) | +480 | High |

| Big Tech (MSFT, AAPL) | +60 | Moderate |

| EVs (TSLA, RIVN) | +35 | Low |

| Financials (GS, JPM) | +18 | Minimal |

Source: Vanda Research (2024).

AI clearly dominates retail flows, far surpassing EVs or financials.

2026 Research Outlook

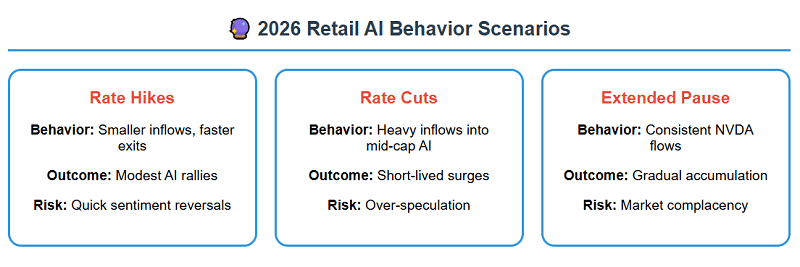

Looking ahead, three scenarios appear plausible:

Table 5: Retail AI Bets in 2026 — Scenario Research

| Fed Action | Retail AI Behavior | Example Outcome |

| Rate Hikes | Smaller inflows, faster exits | Modest AI rallies |

| Rate Cuts | Heavy inflows into mid-cap AI | Short-lived surges |

| Extended Pause | Consistent NVDA flows | Gradual accumulation |

If patterns persist, AI will remain the speculative Fed-cycle vehicle, but over-crowding could reduce profitability — a common pattern in behavioral finance (Kahneman & Tversky, 1979).

Conclusion

This research shows that retail investors have built a repeatable Fed-cycle trade centered on AI. NVIDIA leads, Microsoft and Palantir benefit secondarily, while Tesla has lost its retail magnet status. As 2026 approaches, the challenge will be whether this strategy remains profitable once the crowd fully recognizes it.

Works Cited

- Google Trends. (2024). Search interest for “AI stock” in the U.S., 2022–2024.

- Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica.

- Nasdaq. (2023). Retail trading flow summaries.

- Pew Research. (2023). Public awareness and attitudes toward AI.

- Statista. (2024). Search trends and market correlation studies.

- Vanda Research. (2024). Weekly retail flow tracker.

- Yahoo Finance. (2024). Historical stock prices: NVIDIA, Microsoft, Tesla.

- OpenAI. (2022). ChatGPT release notes.