Quotex One-Minute Trading Strategy: Does It Really Work?

I still remember my first 1-minute trade on Quotex. It felt like gambling. The candle barely moved, the timer was ticking fast, and my heart was racing. Win or lose, it was all over in 60 seconds. But was it just luck? Or could I actually build a solid strategy around these turbo trades?

I decided to dig deep, test out a few popular 1-minute strategies on Quotex, compare results, and find out what really works for short-term trading. In this post, I’ll walk you through each strategy I tried, how it performed, what I learned, and even show you a live trade example.

If you’re tired of vague advice and want honest, first-hand insights, this article is for you.

Looking to grow your account with short-term trades?

Start trading on Quotex now and get a 50% bonus on your first deposit

What Makes the 1-Minute Timeframe So Popular on Quotex?

Let’s be real. One-minute trades are tempting. Why?

- Fast results. You know if you’ve won or lost in a minute.

- High adrenaline. The speed keeps things exciting.

- Potential for stacking profits quickly.

But speed is a double-edged sword. These short windows are also highly unpredictable. Any strategy you use must account for quick reversals, slippage, and sudden spikes in volume. That’s why many traders either love or absolutely hate the 60-second game.

It was mostly luck until I started testing smarter.

My Quotex Trading Setup

Before jumping into the strategies, here’s how I prepared:

- Broker: Quotex

- Account Type: Real and Demo (I tested on demo first, then moved to real money)

- Chart Type: Candlestick

- Timeframe: 15-second candles (for 1-minute expiry)

- Indicators Used: Varies per strategy

- Assets: EUR/USD, GBP/USD, AUD/JPY (high payout, high volume)

- Trading Time: Between 9:30 AM – 11:30 AM and 1:30 PM – 3:00 PM (best volatility)

I avoided trading during news spikes and used the economic calendar religiously. Now, let’s get into the actual strategies I tested.

Strategy 1: RSI + Moving Average Pullback

How it works:

- Add RSI (period 14) and EMA (50)

- When price pulls back to EMA and RSI is between 40-60, enter a 1-minute trade in the direction of the trend

Example Trade:

- EUR/USD trending up

- Price pulls back and touches the EMA

- RSI at 55 (not overbought/oversold)

- I enter a 1-minute Call

Results:

- Tested 20 trades

- Win rate: 65%

- Risk: Low

- Comments: Very stable during trending sessions. Avoid sideways markets

Verdict:

Solid beginner-friendly strategy. Works best with confirmation from candle patterns, such as hammers or engulfing patterns.

Strategy 2: Bollinger Band Reversal

How it works:

- Add Bollinger Bands (20, 2)

- When the candle closes outside the upper or lower band, wait for a reversal candle

- Enter trade in the opposite direction

Example Trade:

- GBP/USD candle closes below the lower band

- The next candle is bullish

- I enter a 1-minute Call

Results:

- Tested 25 trades

- Win rate: 56%

- Risk: Medium

- Comments: Prone to losses during strong trends. Needs confirmation

Verdict:

Riskier but exciting. Best used with a news filter to avoid trading against momentum.

Strategy 3: M5 Support/Resistance with Price Action Entry

How it works:

- Draw support/resistance on the M5 timeframe

- Switch to 15-sec candles

- Wait for a pin bar or engulfing pattern on the level

- Trade 1-minute in the direction of the signal

Example Trade:

- AUD/JPY breaks M5 resistance

- 15-sec chart shows a weaker retest of broken resistance

- I enter a 1-minute Call

Results:

- Tested 18 trades

- Win rate: 72%

- Risk: Medium

- Comments: Needs patience. Entries are less frequent but of higher quality

Verdict:

Best performance so far. Feels more like trading, less like guessing.

👉 Want to try this strategy yourself? Sign up with Quotex now and claim your 50% deposit bonus

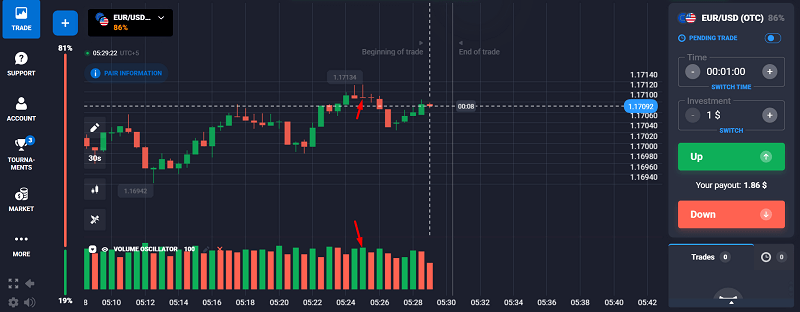

Strategy 4: Volume Spike Breakout

How it works:

- Add Volume indicator

- Watch for sudden volume spikes and breakout candles

- Enter trade in the direction of the breakout if no resistance is nearby

Example Trade:

- EUR/USD forms a strong bearish candle with a volume spike

- No resistance above

- I enter a 1-minute Put

Results:

- Tested 15 trades

- Win rate: 60%

- Risk: High

- Comments: Volatile. Works well on news or opening hours

Verdict:

Can be powerful, but inconsistent. Suitable for experienced eyes who can spot fakeouts.

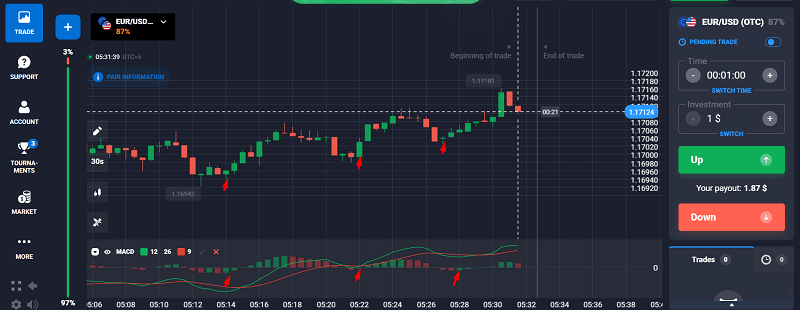

Strategy 5: MACD Crossover Confirmation

How it works:

- Add MACD (12,26,9)

- When the MACD line crosses the signal line, and the histogram confirms, enter a trade in that direction

Example Trade:

- GBP/USD MACD crossover bullish

- Histogram turning positive

- I enter a 1-minute Call

Results:

- Tested 20 trades

- Win rate: 58%

- Risk: Low

- Comments: Reliable but delayed signals. Works better with strong trends

Verdict:

Slower entries. Good as a confirmation tool rather than a standalone.

What I Learned After 100+ Trades

After going through 5 strategies and over 100 trades, some truths stood out:

- Not all 1-minute trades are created equal. You need clear entry criteria.

- Timing matters more than setup. A great setup at the wrong time is a failure.

- Price action beats indicators. Most winning trades originated from clean support and resistance levels, along with candlestick entries.

- Avoid overlap. Don’t use too many indicators. It clutters your judgment.

- Trade fewer, better setups. The more selective I got, the higher the win rate.

Does the 1-Minute Quotex Strategy Actually Work?

Yes, if you follow a transparent, disciplined approach and don’t trade unquestioningly. The best-performing method in my tests was using higher-timeframe zones with price action confirmation. It’s slower, but much more accurate.

If you’re just getting started, try the RSI + EMA method. If you’re more confident, consider using support and resistance, along with price action. Avoid over-trading. Limit to 5–10 solid setups a day.

Best Times to Use the 1-Minute Strategy on Quotex

- High volatility hours (when markets overlap)

- After a confirmed trend is established

- When the price approaches known zones (support/resistance)

Worst Times

- Just before major news events

- Asian session (unless trading JPY pairs)

- Low volume periods (lunchtime)

Common Myths Around Quotex 1-Minute Strategy

- “It’s just gambling.” Not true, if you plan your entries, manage risk, and avoid overtrading, it’s calculated.

- “Indicators alone can win you trades.” False. Context and candle patterns matter more.

- “Martingale fixes losses.” Nope. It often magnifies them.

FAQs

What is the safest 1-minute strategy on Quotex?

Using support and resistance levels from higher timeframes, along with price action confirmation, provides the safest entries in my experience.

How much can I earn daily with 1-minute trading?

It depends on your capital, risk per trade, and win rate. With a $100 account and a 2% risk per trade, you might make $5–$10 daily, provided you are consistent.

Do I need indicators for a 1-minute strategy?

No. Indicators can help, but aren’t necessary. Clean price action and market structure can outperform indicators alone.

Can I use this strategy on a mobile device?

Yes, but it’s harder to mark levels or read candles on smaller screens. I prefer a desktop for precision.

Is Quotex 1-minute trading suitable for beginners?

Only if you treat it like real trading, not gambling, stick to the demo first and track your trades.

Final Thoughts

Quotex 1-minute trading isn’t a shortcut to riches, but with discipline, structure, and the right strategy, it can be a profitable short-term method. Most traders lose money not because 1-minute trading is bad, but because they treat it like a slot machine.

Start by testing each strategy on a demo and tracking results. Find what suits your personality. Then go live with real money only when you’re consistent.

Ready to test these strategies on a clean, fast platform? Sign up for Quotex now and claim your 50% bonus.

Quick execution. High payouts. Beginner-friendly interface.