Binary Options Money Management Rules Beginners Ignore

When I started trading binary options, I thought I had it all figured out. The charts, the patterns, the entry points, everything seemed clear. But it wasn’t the market that took my balance down; it was my own lack of money management. My early trades weren’t about bad signals, they were about bad discipline. Over time, I learned that your win rate means nothing if your stake sizing and capital exposure are out of control.

If you’re serious about trading, start with the foundation, money management. Open an account via our affiliate link and see how consistent, disciplined risk control actually feels.

The Cost of Ignoring Rules I Didn’t Know Existed

I remember the first month I went live. I had $500 in my account and thought that betting $25 per trade was “reasonable.” After all, it was only 5% of my account. But after a series of losses, I realized I had no plan for recovery, or protection. I wasn’t compounding. I wasn’t adjusting for volatility. I was reacting emotionally, not managing systematically.

Here’s what I learned quickly: money management is the trader’s real edge, not the entry strategy.

The Three Core Rules Beginners Often Break

Through trial, error, and a fair share of losses, I found there are three core money management rules beginners ignore, and each one can destroy an otherwise promising system.

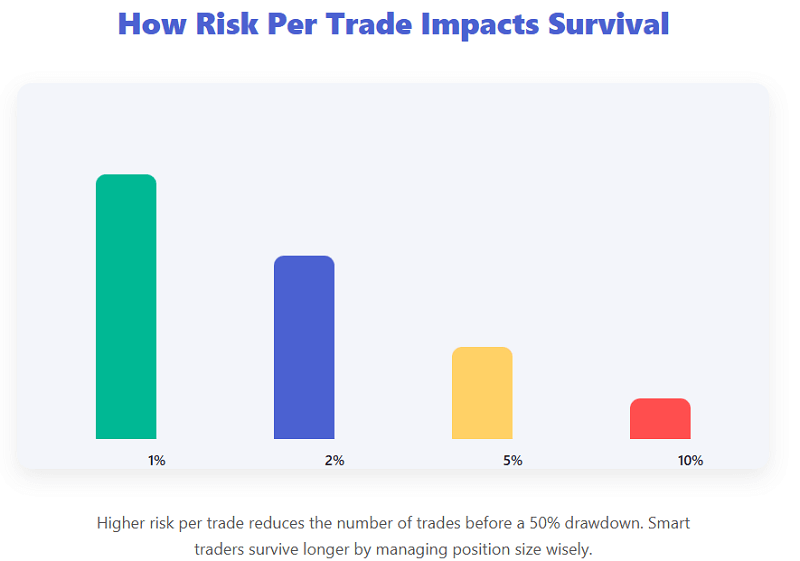

1. Risking More Than 2% Per Trade

When you’re starting out, 2% sounds painfully small. But the math is unforgiving. Risking 5–10% per trade gives you less than 20 consecutive losses before your account collapses. That might sound extreme, but markets can go cold for weeks.

Here’s a simple look at how risk percentage impacts survival:

| Risk Per Trade | Max Consecutive Losses Before 50% Drawdown |

| 1% | 34 |

| 2% | 17 |

| 5% | 7 |

| 10% | 3 |

I didn’t believe these numbers until I saw my balance spiral. Lowering my risk per trade was the first decision that made me last longer in the market.

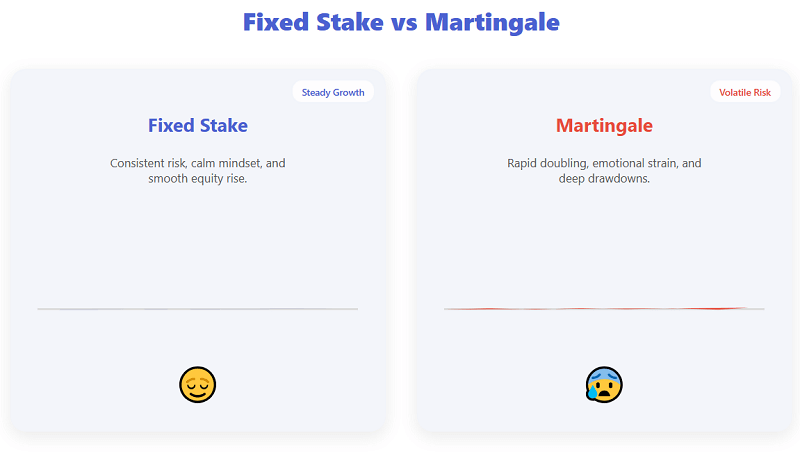

2. Doubling Down After a Loss

I used to think the Martingale method was logical, “If I double after each loss, I’ll recover everything plus profit.” What I didn’t consider was string losses. A 5-step losing streak wiped out half my account. That’s when I learned that chasing losses is not recovery, it’s destruction.

Instead, I started using a fixed stake model. It was slower, yes, but it stabilized my emotions. My chart reading improved because I wasn’t trading scared anymore.

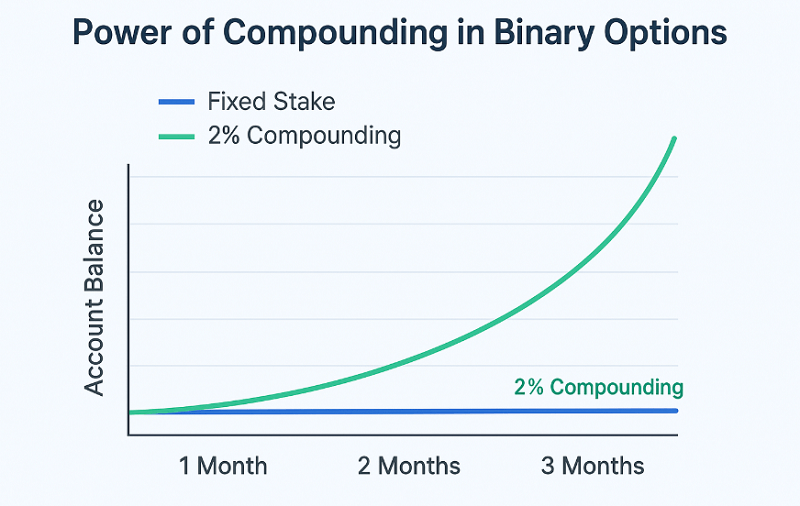

3. Ignoring Compound Growth

Most beginners want instant profits. I did too. But compounding changed my approach completely. When I started reinvesting small portions of profits systematically, I noticed something remarkable: my account grew even when my win rate didn’t improve.

To illustrate:

| Strategy | Average Win Rate | Account Growth (3 Months) |

| Fixed stake, no compounding | 62% | +5% |

| Fixed stake with 2% compounding | 62% | +22% |

It was proof that growth isn’t just about accuracy; it’s about how much you let your profits work for you.

The Turning Point: When I Stopped Thinking Like a Gambler

There was one evening I remember vividly, three losing trades back-to-back on EUR/USD. My instinct told me to double down and recover. Instead, I closed the laptop. The next day, I re-entered calmly, with my same fixed risk and a clear head. That trade won. Not because my setup was better, but because my psychology was stable.

That’s when I realized that discipline is the most underrated money management rule of all.

Ready to trade with focus and structure? Open an account via our affiliate link and start applying these rules from day one.

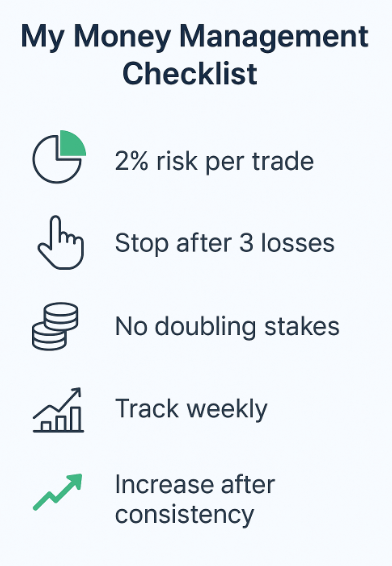

My Personal Money Management Checklist

These aren’t theoretical rules. They’re scars turned into systems, habits I still use daily:

- I risk no more than 2% per trade, no matter how confident I feel.

- I stop trading after 3 consecutive losses and review setups.

- I never double stakes after losses; recovery comes from consistency.

- I track my equity curve weekly, not daily.

- I increase stakes only after 10 consecutive profitable sessions.

This checklist keeps me grounded. Without it, emotion takes over, and emotion is the silent killer of binary accounts.

How I Adapt My Money Management to Volatile Markets

When volatility spikes, I adjust position sizes even further down. I also avoid short expiries during high-impact news. It’s not about fear; it’s about survival. I treat volatility like leverage, it can amplify success or accelerate collapse.

For example, during an NFP week, I reduce my trade size by half. It’s boring, but it keeps my capital alive. And that’s the ultimate goal: staying solvent long enough for your edge to play out.

Why Beginners Keep Ignoring These Rules

The irony is that most traders know these rules. They just don’t feel their importance until they’ve blown an account. I was no different. The rush of “being right” was stronger than the need to protect capital. I ignored math for adrenaline. But once I began treating money management like a survival tool, everything changed.

Even a mediocre strategy with tight risk rules can outperform a great one with poor discipline.

The Results That Changed My View

Six months into disciplined trading, here’s what my stats looked like:

| Period | Win Rate | Drawdown | Account Growth |

| First 3 months (no rules) | 55% | -47% | -$235 |

| Next 3 months (money management applied) | 59% | -8% | +$176 |

Nothing about my analysis got sharper, my control did. That’s the reality most beginners overlook. It’s not the market that changes; it’s the trader.

Want to put these lessons into practice? Open an account via our affiliate link and start trading with your own rulebook, not your emotions.

Final Thoughts: Staying Alive Is Winning

If I could tell my beginner self one thing, it would be this, binary options trading is not about hitting home runs; it’s about staying in the game long enough to let probabilities work. Every professional I’ve met shares this quiet truth: consistent, disciplined risk management is the only thing separating survivors from the rest.

Money management isn’t sexy. It’s not exciting. But it’s the backbone of every trader who lasts longer than a few months. If you can master that, the rest will eventually fall into place.

You’ve Learned the Rules — Now It’s Time to Apply Them

You understand how risk, compounding, and discipline shape results. Take the next step — test your strategy in real market conditions and build consistency with smart money management.

🚀 Start Trading Now