Quotex Mobile App vs. Web Trading: Which One is Better?

I came across the Quotex platform for the first time as I scrolled through my phone during a late lunch break. An ad appeared that stated, “50% bonus on the first deposit.” I tapped it. In just ten minutes, I opened an account, added some money, and made my first trade.

I never thought this quick impulse would become a full-blown passion for online trading. Since then, I’ve been diving deep into the app and web versions. Initially, I used both alternately, not even giving it a second thought. However, I began to notice differences, some subtle and some striking, over time.

Here’s a down for you: the pros, the cons, and the bigger picture. You might be trying to determine which platform suits you best, or you’re like me and want to use both. This guide should give you all the info you need to decide.

New to Quotex? Get 50% extra on your first deposit here and start trading with an edge.

1. Interface and Ease of Use

When I first fired up the Quotex app, I entered a cozy little control room. The interface was smooth to use, with a quick response to my touch. All the buttons were right where my thumb could reach them, and I could move assets to the timeframe in no time. The app looked clean and simple, without any clutter to distract me from trading.

After about 15 or 20 minutes of looking for patterns and switching between tools, I felt slightly cramped. The small phone screen meant I had to keep things basic, which sometimes felt limiting. Even though I could still use the cues and tools, everything was packed into a tight space.

Then I opened the Quotex website on my laptop, and the experience changed instantly. The design looked great on the bigger screen, making good use of the space with a tidy dashboard that showed charts, assets, and tools in spacious ways.

Now, I can easily open several windows, move things around, and drag and drop symbols. Handling multiple assets is easy, and charting becomes a different ball game.

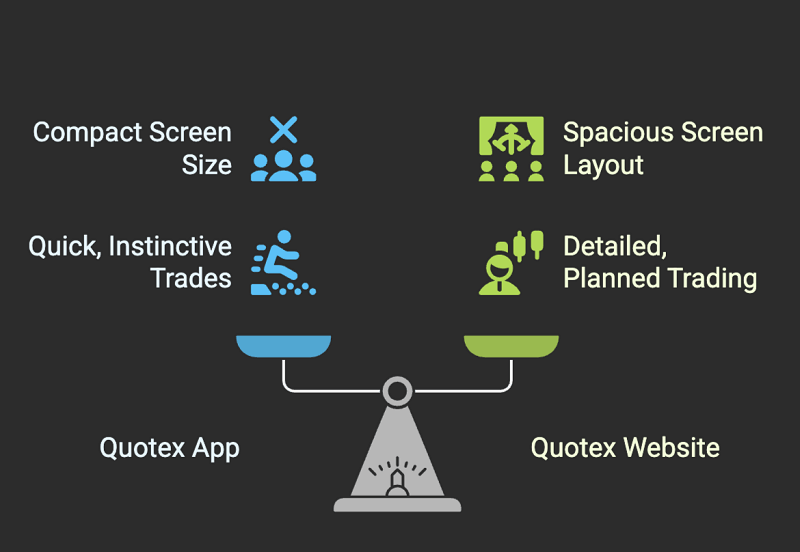

The difference in user interfaces affects your decision on where and how to trade. You can use the app to make quick trades during your lunch break or on your way to work. But when you want to spend more time trading or analyze the details, the website provides you with the room and setup you need to focus.

The app works best for quick, instinctive trades, while the website is better suited for careful planning and longer trading periods.

2. Speed and Performance

Time is of the essence when you’re trading. Wait too long, and a good trade turns into a lost opportunity. Speed and performance are more than luxuries. Simply, they’re necessary.

With the Quotex application, speed is a core feature from the get-go. Whether using a 4G, LTE, or unstable hotel Internet, I was surprised at how responsive the application remained. Quotex updates were in real time, and orders were filled close to instantaneously.

I marvelled at how nicely it ran under less-than-ideal conditions. It is designed to handle varying amounts of mobile data, making it highly reliable for traders who are often on the go.

On the other hand, the Quotex web platform offers a distinct performance. The web platform becomes a powerhouse when you’re hooked to a steady, fast internet connection through wired or fibre networks. It loads complete charts fast, supports multiple open tabs, and handles various data visualization layers without problems. However, it does depend on your browser and the quality of your connection. If your internet connection cuts out, the platform’s smoothness also drops.

While the app has an edge in consistency from one connection to another, the website is only in its element when your configuration is optimal for trading. The difference is crucial for traders in different locations or on other machines.

The application delivers consistent performance in every setting. The website performs best on steady, high-end connections.

3. Charting Tools and Technical Analysis

This is where you’ll start to see fundamental differences in what each platform can do. If you think of yourself as a trader who relies on strategy, how you read charts will influence many of your trading decisions.

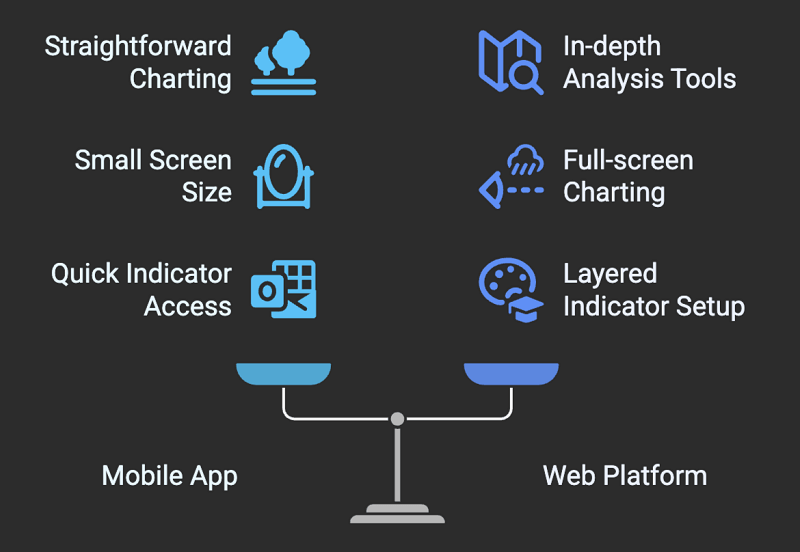

The mobile app provides a straightforward and practical charting experience. It lets you add indicators such as RSI, Bollinger Bands, and Moving Averages. You can zoom, scroll through price history, and change timeframes. To spot trends and get quick confirmations, it does the job well. But I found the mobile screen too small for someone who likes to dig deep, draw trend lines, compare several indicators, or look at long-term patterns. It doesn’t offer enough room to analyze things in depth.

Moving to the web platform transforms everything. The full-screen charting feature is perfect for technical traders. You can open multiple charts at once, add many indicators, use precise drawing tools, and watch how different assets move together. You can stretch a chart across the whole screen, which gives you a better view of market trends.

If you want to compare things, you can open two tabs next to each other and see how they relate in real-time.

Additionally, the web version allows you to layer indicators without compromising visibility. You can change settings, adjust colours, and save your setups, all of which help you improve your strategy.

The web platform has an edge in terms of in-depth charting and analysis. The app effectively provides glances and key indicators.

4. Execution Speed

A trading platform can look sleek and user-friendly, but what sets it apart is how effectively it executes trades.

Over the last few months, I’ve placed trades using the Quotex app and web platform in different situations during calm market conditions, through wild fluctuations, and when big news broke. What caught my eye is how both platforms adjust based on the strength of your connection, rather than what they can do based on their capabilities.

The mobile app, for example, runs fast even on a mobile data network. This is key when you’re trading from unpredictable places. On 4G, my market orders were processed almost immediately. At that moment, I knew the mobile app was smooth and reliable, where timing is key, as even slight delays can affect your outcome.

At the same time, the web platform works better when you have a solid, high-speed internet connection. There’s no lag, and trades happen without a hitch. However, if your connection drops, you may experience slowdowns or freezing, particularly when switching between charts or confirming orders.

Both platforms rely on external factors, such as network quality, but the app performs better in terms of mobility and responsiveness under various conditions. The web version excels when backed by robust infrastructure, enabling a more systematic and multifaceted trading process.

Both platforms execute trades, but the app has a slight edge in situations where mobile access is the only choice.

5. Alerts and Notifications

Nothing frustrates traders more than meticulously planning a trade only to miss the perfect entry point because they weren’t glued to their screens. Thankfully, alerts and notifications solve this problem.

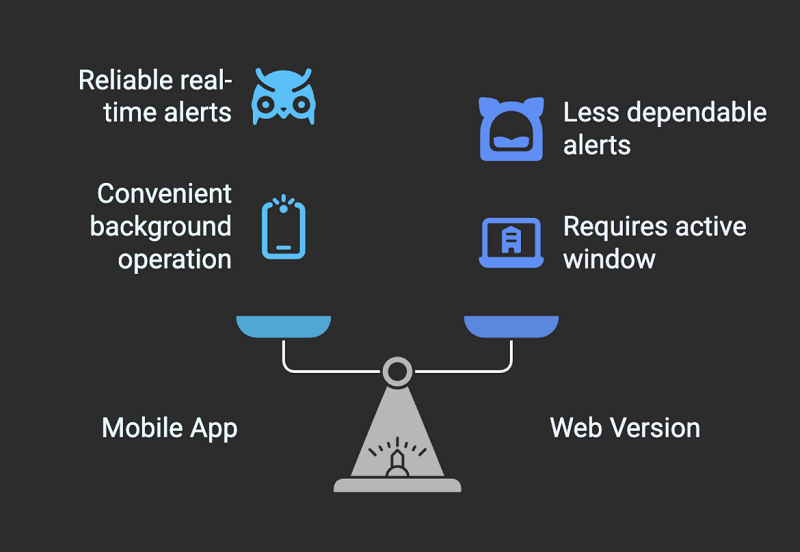

The mobile app comes with real-time push notifications. I count on these more than I thought I would. When a price hits a certain point or an indicator reaches a threshold, the alerts immediately appear, even when the app runs in the background. I’ve gotten alerts while walking, in meetings, or even cooking. Being able to act has helped me catch several profitable opportunities that I might have otherwise missed.

On the other hand, the web version does offer browser-based alerts, but you need to keep the tab open and turn on notifications. If your computer goes to sleep or you switch to a different window, you might not see them. It doesn’t feel as innovative or dependable as the app.

This impacts the mobile version’s reliability for real-time awareness if you’re watching trades throughout your day. It transforms your phone into a market pulse monitor, keeping you in the loop even when you’re not trading.

The mobile app offers quicker and more reliable alert systems. The web version is helpful but less steady when engaging in real-time.

Best Use Cases

I’ve spent a reasonable amount of time reviewing the Quotex phone application and the trading website. And both have their niche, depending on your trading style and where you are during the day.

Let’s start with the mobile app:

There is a sense of freedom in being able to trade from anywhere. The app is a window into the markets, whether you’re traveling, standing in line for coffee, or just lounging on the couch. It’s easy to use with your finger’s quick response and is always a tap away. For me, the mobile version stands out in situations where:

- You need to check charts or set up trades quickly.

- You must act quickly on market alerts or price changes.

- You don’t have access to a desktop or laptop.

- Quick and easy are more critical than in-depth analysis.

I use the app like a scanner. It keeps me informed when prices fluctuate and are likely to change. I can immediately make trades if I spot a promising setup or a quick signal. There’s no delay, no slow loading, and just smooth operation.

Let’s explore the web platform:

When I sit at my desk with a notebook nearby, a warm drink close, and my mind focused on the job, the Quotex web interface stands out. It’s spacious, detailed, and the hub for serious trading.

Here’s when I prefer to use the web version:

- When I need to examine several charts or conduct a thorough technical analysis.

- When I am experimenting with some new trading techniques that demand more screen space.

- I require an excellent overview when I have multiple trades running simultaneously.

- When I plan sessions, I deliberate rather than react in a rush.

The app focuses on providing fast responses, while the web version allows me to plan things. I strategize best when I can view everything laid out before me and take time to process it all.

I suggest using both platforms based on your specific situation and personal preferences regarding trading.

Here’s a quick summary of when each platform works best:

Top times to use the Quotex Mobile App:

- When you’re out and about or travelling.

- When you need to execute trades right away.

- To keep an eye on alerts and respond to quick signals.

Top times to use the Quotex Web Platform:

- When you sit down for a focused trading session.

- To analyze charts and test strategies.

- To handle multiple trades or accounts.

Trading is not necessarily bound to one space or setting. Knowing which platform is right at the right moment will allow you more consistency and flexibility in your trading.

Whichever method suits your style, claim your 50% first deposit bonus and try both platforms yourself.

Which One Should You Use?

You’ve seen the comparisons. You’ve looked at the scenarios. So what’s the bottom line?

Your lifestyle and goals will determine the answer. The mobile app will feel natural if you trade on the move and need quick, responsive tools and instant alerts. On the other hand, the web platform is better if you like to analyze, use big-screen charts, and plan your strategies.

But you don’t need to choose just one. The top traders I know of use both, just like I do. So, don’t limit yourself to just one platform. Instead, aim to make the most of each tool’s strengths.

Ready to experience Quotex on your terms? Sign up for a 50% bonus and start with your preferred platform.