How to Trade Forex on Quotex Like a Pro

Have you ever felt intimidated by the complexity of forex trading? You are not alone if you have been struggling to understand market dynamics.

But have you ever considered what risk management to use, how to enter trades, and how to set profit and spot exit levels? Many beginner traders don’t have a forex trading strategy. Most of the time, they get into the forex market without one. As a result, they get frustrated and lose, like I did as a noob trading on Quotex. The easy money lured me in, but the market showed no mercy since I had no trading plan.

This guide will equip you with the knowledge and tools to trade on the Quotex platform like a professional. It explores the best Quotex forex strategies and how to implement them.

Key Takeaways

- Major pairs to begin – when starting out, stick to dependable ones like EUR/USD or USD/JPY. They are less unpredictable, which is advantageous.

- Price action over indicator soup – avoid clutter using clear charts and support and resistance zones.

- The key to profitability is to practice discipline: don’t wing it, track news religiously, and test strategies in the demo account.

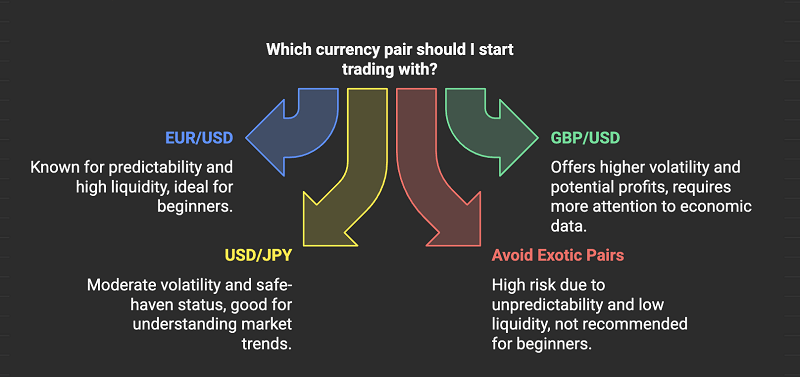

Top Quotex Forex Trading Currency Pairs for Beginners to Start With

EU/USD: The “Vanilla” of Forex, Predictable and Chill

The EUR/USD is the world’s most traded currency pair, known for its liquidity and relatively smooth movements. It is less “scary” for new traders, allowing them to predict direction better and use profitable Quotex forex trading strategies.

The fact that it is predictable somewhat depends on the stability of the US economy and the Eurozone, which gives starting traders a strong grounding to gain experience.

GBP/USD: A Bit More Action, but Still Manageable

Referred to as “Cable,” the GBP/USD pair has a volatility edge compared to the EUR/USD pair and can thus be more profitable. However, this higher mobility requires a more localized approach.

To make smart trading decisions, beginners need to pay attention to economic data from the US and UK, like employment figures and interest rate decisions.

USD/JPY: Moves at a Pace That’s Not Too Crazy

USD/JPY is another favored pair for newbies because of its moderate volatility and good liquidity. The Japanese yen is considered a safe-haven currency that may appreciate during periods of market illiquidity. Analyzing the economic ties between the US and Japan allows traders to understand the possible market trends, which is important for developing strategies.

Pairs to Avoid Initially: The Wild Ones

Even though exotic pairs like USD/TRY or USD/ZAR can offer high returns, novices should avoid them due to their unpredictability and low liquidity.

These pairs frequently experience abrupt and notable price fluctuations due to economic instability and geopolitical events. Before entering these erratic markets, obtaining experience with major pairs is best.

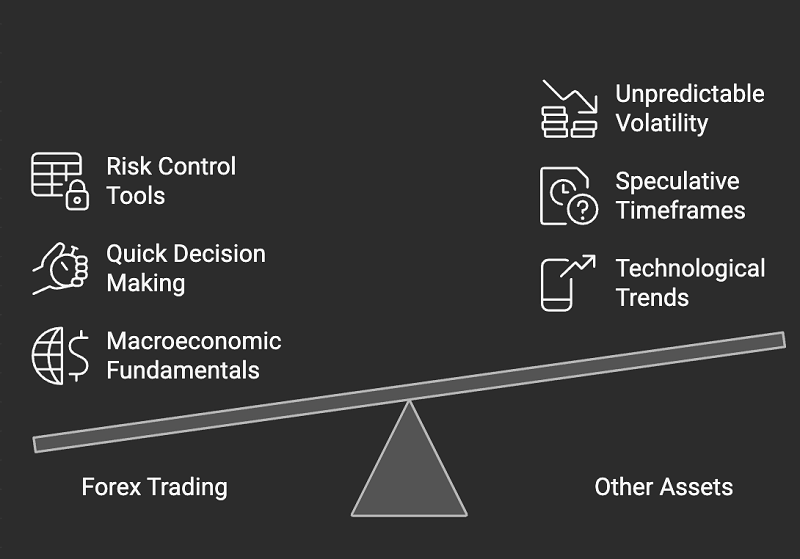

What Makes Forex on Quotex Different from Other Assets?

Not Like Crypto or Binary Options

Forex trading differs from other assets, such as cryptocurrencies or binary options, on our Quotex trading platform.

While crypto markets are open 24/7 and run on technological trends coupled with market sentiment, forex markets run on macroeconomic fundamentals and open and close on a set schedule within market hours.

Alternatively, binary options are speculation on an asset’s price movement within a specific timeframe and can result in a win or lose scenario. Forex trading also gives the option to have more control over the trades by stop-loss and take-profit levels.

Short Timeframes = Quicker Decisions

We support short-term forex trading with 1-minute, 5-minute, and other time frames. These smaller time frames necessitate quick decisions on the part of any trader involved and also place a premium on a defined plan and rapid reflexes. If not applied correctly, these can lead to swift profits and losses.

Movement Depends on Global Money Talk, Not Just Tech Trends

Global economic indicators, from interest rates to inflation data to employment statistics, play a major role in Forex markets.

Whereas social media fads or tech trends can influence cryptocurrencies, forex trading requires understanding macroeconomic fundamentals and how they apply to currency values. Keeping track of economic calendars and news releases is essential to preparing for market moves.

Volatility Hits Different Here

Forex market volatility presents opportunities as well as potential dangers. The major currency pairs are less volatile than exotic pairs, which makes them more suitable for beginners.

However, sudden price changes due to unforeseen economic occurrences or geopolitical conflicts are also a possibility. One way to help avoid losses during these volatile times is to employ risk controls such as stop losses and caps.

Quotex Forex Strategy Basics (That Don’t Suck)

Stick to One or Two Pairs Only at First

Limiting the number of currency pairs to trade allows the trader to study each pair’s behavior and the reasons behind its movement. The more concentrated scope allows for more insightful analysis of specific market movements and, ultimately, trading decisions.

Once they have gained confidence and experience, they may also want to add extra pairs to their portfolio.

Focus on Price Action, Not Shiny Indicators

Technical indicators are good, but they will result in analysis paralysis only if used as a guide and not as an isolated truth. Price action trading is the method of studying past prices to spot patterns in the market that may help predict future movements.

This practice allows the trader to focus on understanding market psychology and reacting to the actual price dynamic rather than following the signals generated by lagging indicators.

Use Support and Resistance Range Zones; Keep It Clean

Locating these critical support and resistance zones aids traders in locating possible entry and exit points.

Support levels show the price point at which the price will cease declining and begin to increase, and resistance levels point out the price that begins to stop increasing and starts to decrease. Identifying these ranges in charts allows traders to plan and trade more informedly, including setting stop-loss and take-profit levels.

Risk Only What You’re Fine Losing

Risk management is an important factor in forex trading. Risking small amounts of their trading capital on any given trade, generally between 1% and 2%. Our risk management tools will also assist in getting the right amounts to execute trades easily without risking the entire account.

In this way, the whole account is not risked on a streak of losing trades, which keeps traders in the game longer and allows them to learn from their experiences.

Trade Slow, Don’t Chase Wins

Patience is a virtue in forex trading. Chasing after quick profits or recovering losses rapidly can lead to impulsive decisions and increased risk. Developing a disciplined trading routine, sticking to a planned strategy, and avoiding overtrading are essential for long-term success.

Timing > Volume (Less Is More Here)

Forex traders need to be patient. Pursuing short-term gains or attempting to recoup losses quickly leads to rash decisions and higher risk. The keys to success are having a solid trading plan, being disciplined in following that plan, and not overtrading.

Pro Tips Most New Traders Miss

Don’t Switch Pairs Too Fast

One of the new trader’s biggest mistakes is regularly switching currency pairs, hoping to find the “perfect” one. The result is superficial understanding and suboptimal decisions.

The best practice on Quotex is to focus on one or two pairs and learn how these markets behave, and it will be easier to predict movement and work on your strategy as you go along.

Each pair has its own reaction to news, economic events, and technicals. Jumping around only diffuses a trader’s attention and causes a lot of unnecessary losses.

Consistency is an incredibly strong ally in trading. Staying with a familiar pair allows the trader to recognize repeating situations and be sensitive to changing circumstances. Discipline in picking partners is an underrated but essential quality for long-term success.

Always Check the News (Economic Calendar = Free Edge)

Forex trading is not only about technical charts but is also correlated with world economics. Currency prices can be substantially affected by inflation figures, interest rates, geopolitical developments, jobs reports, etc. Quotex traders who do not do this are basically trading in the dark.

The good news is that staying on top of economic news is easier now than ever. Free, live updates can be accessed via tools like Investing.com’s economic calendar or ForexFactory.

Knowing when/days the U.S. Fed has a rate decision or inflation figures for the Eurozone are coming out can make the difference between a clever trade and a gut-wrenching loss. Traders must plan to stay out of the volatility or use it to their advantage around high-impact events.

Don’t Trade Just Because the Market’s Open

The forex market is open almost 24 hours a day during the week, but that doesn’t mean every hour is a good time to trade. The best times to trade are when sessions overlap, like London/New York. On top of that, these periods present the most volume and reliable price action.

Trading during low-volume times, like the Asian session, if not trading JPY pairs, often results in choppy and unpredictable moves. Successful Quotex traders learn to wait for the market to present opportunities rather than forcing trades out of boredom or impatience.

Demo Trading Isn’t Just for Noobs; Use It to Test New Ideas

Our Quotex demo account is not only for newbies, as experienced traders can also use it to develop and test new strategies. Curious to see what a news-based strategy looks like? Wondering whether the new support-resistance method enhances the results? Try out our demo account.

Practicing on a demo minimizes real money losses from ideas that have never been tested. More importantly, it allows traders the space to experiment and develop without the stress of live market ramifications. Most professionals will often use demo accounts to enhance their edge.

Wrap-Up Cheat Sheet

- Choose slow, stable pairs such as EUR/USD or USD/JPY

- Use price action and clean charts; don’t clutter them with indicators

- Concentrate on a handful of trades per day at most

- Always check the news before trading

- Sample test all new tactics one going live

- Take the loss and run. Never pursue a win.

- Never risk what you wouldn’t be okay to lose.

- “Trade into the move. Stay out during the active hours.”

- Make habits, not hero trades

Conclusion: Make the Shift from Gambling to Strategic Trading

Forex trading on Quotex is not gambling but rather about preparation, discipline, and constant learning. Most traders fail not because the market is rigged but because they approach trading as gambling. They skip the basics, overlook risk, and pursue every shiny object.

This guide has provided a step-by-step path to calm currency pairs, respect price action, manage risk, and develop consistent habits. Demo trading is a zero-risk environment, so it can now be done for those willing to take this seriously.

To see real progress, try all your learning in a Quotex demo account now. Use the methods described above, modify them as necessary, and begin to develop the habits of a professional trader.

Ready to level up? Get 50% off on Quotex today!

Frequently Asked Questions (FAQs)

Is Quotex good for forex trading?

Yes, Quotex is beginner-friendly and offers an intuitive interface, quick trade execution, and multiple timeframes for forex trading.

What’s the best forex pair to trade on Quotex?

For most beginners, EUR/USD is the best starting point due to its stability and predictability.

How do I know when to trade on Quotex?

Trade during high-volume market sessions like the London-New York overlap, and check economic calendars for impactful events.

Do I need indicators to trade forex on Quotex?

No. Many successful traders use price action and simple support-resistance setups without relying heavily on indicators. Some successful indicator strategies include Bollinger Bands.

Can I trade Forex on Quotex using a mobile app?

Yes, Quotex offers a mobile platform that supports full forex trading functionality.